What is the First-Time Homebuyer Tax Credit?

In 2023, first-time homebuyers made up 32% of all home purchases, a noticeable increase from 26% in 2022. This shift reflects a growing trend among younger buyers, with the median

In 2023, first-time homebuyers made up 32% of all home purchases, a noticeable increase from 26% in 2022. This shift reflects a growing trend among younger buyers, with the median

When it comes to managing homeownership costs, one common expense many homeowners face is the payment of Homeowners Association (HOA) fees. These fees are essential for maintaining community amenities and

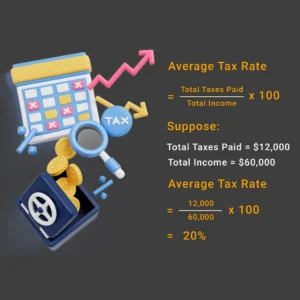

Calculating your average tax rate is essential to managing your finances effectively. Understanding how to calculate average tax rate allows taxpayers to determine the overall percentage of their income that

When evaluating the average cost of tax preparation by CPA, it’s crucial to consider the relief it can bring during the often stressful tax season for both individuals and businesses.

Choosing a private school for your child’s education can provide numerous benefits, but it often comes with high costs. Many parents wonder, “Is private school tuition tax deductible?” Understanding private

Owning property in California comes with many financial responsibilities, including property taxes. A common question among homeowners is: Are property taxes deductible? Understanding the rules around property tax deductions in