Navigating the repayment of a reverse mortgage can seem complex, but understanding the process is essential for homeowners and their heirs. A reverse mortgage allows seniors to convert part of their home equity into cash, providing financial relief during retirement without the requirement of monthly mortgage payments. However, knowing how to pay back a reverse mortgage when the time comes, whether due to the homeowner’s death, a decision to move, or when selling the home, is crucial.

So, how do you pay back a reverse mortgage?

This article will explore the various methods and considerations of repaying a reverse mortgage. We’ll look into when repayment is required, the options available to homeowners and their heirs, and the financial implications of each choice. By understanding these aspects, you can make informed decisions that align with your financial planning and long-term estate management.

Understanding Reverse Mortgages

Understanding reverse mortgages is the first step in recognizing why they are popular for many older homeowners. Unlike traditional mortgages, where the homeowner makes monthly payments to a lender, a reverse mortgage provides the homeowner with payments based on their home’s equity. This arrangement continues until the borrower moves out, sells the home, or passes away.

A reverse mortgage offers a unique financial solution for older homeowners who wish to stay in their homes while accessing the equity they have built up over the years. This type of loan reverses the typical mortgage process; instead of the homeowner paying the lender, the lender pays the homeowner. This arrangement can provide a steady income stream or a lump sum crucial for covering living expenses, medical costs, or any other needs during retirement.

The structure of a reverse mortgage is designed to allow seniors to leverage their home’s value without the burden of monthly mortgage payments. The loan balance grows over time as interest accumulates and is due once the homeowner moves out, sells the home, or passes away. At that point, the home is typically sold, and the proceeds from the sale are used to pay off the reverse mortgage.

However, it’s important to understand that the funds from a reverse mortgage eventually need repayment. The loan balance increases over time as interest accumulates and is not required to be repaid until the homeowner no longer occupies the home due to moving, selling, or passing away.

Typically, the home is then sold, and the proceeds from the sale are used to settle the reverse mortgage, ensuring the loan is fully repaid, and any remaining equity is passed on to the heirs. This process highlights the need for careful future financial planning, particularly regarding how it affects estate management and the homeowner’s legacy.

How Does a Reverse Mortgage Work?

To comprehend how a reverse mortgage works, knowing that the loan amount is based on several factors, including the homeowner’s age, the home’s value, and the prevailing interest rates is essential. The homeowner retains the title to the home, and the responsibility for taxes and insurance, but no monthly mortgage payments are required.

Reverse mortgages are backed by the Federal Housing Administration (FHA) and overseen by the U.S. Department of Housing and Urban Development (HUD). They are crafted to allow older homeowners to borrow against their home equity without increasing their financial burdens during retirement.

The predominant form of reverse mortgage is the Home Equity Conversion Mortgage (HECM), though some financial institutions may offer proprietary reverse mortgages or larger, jumbo loans. These loans may feature either fixed or adjustable interest rates.

In practice, homeowners convert their home equity into cash, which is quite different from traditional home equity loans that require monthly repayments. Hence, the name ‘reverse mortgage’ suggests the lender makes payments to the homeowner, which is the opposite of the usual mortgage process. This reversal is what often raises questions about how do you pay back a reverse mortgage.

This unique financial arrangement is possible because FHA insurance provides protection and sets standards that benefit lenders and borrowers.

With a reverse mortgage, funds can be received in various forms: a single lump sum, structured installment payments, a flexible line of credit akin to a Home Equity Line of Credit (HELOC), or a mix of these methods. To be eligible for a reverse mortgage, homeowners must have substantial equity built up or own their homes outright. Any existing mortgage balance must be cleared using the reverse mortgage funds before the homeowner can access the remaining money.

If you are looking to answer the question of how do you pay back a reverse mortgage, here are some additional eligibility requirements:

- Being 62 years of age or older,

- Residing in the home as a primary residence and keeping up with its maintenance,

- Continuing to pay all related homeownership costs such as insurance, property taxes, and any applicable HOA fees,

- Completing a professional session with a HUD-certified housing counselor.

Homeowners can use the funds from a reverse mortgage as they see fit, including for home improvements. Under the installment payment option, borrowers can receive payments if they meet the reverse mortgage’s requirements. This setup might result in a loan balance surpassing the home’s market value.

Nevertheless, with FHA insurance, neither the borrower nor their heirs are responsible for paying back more than 95% of the home’s appraised value, as the FHA covers any excess amount owed to the lender.

When is a Reverse Mortgage Due?

Understanding when a reverse mortgage is due highlights the conditions under which the loan must be repaid. This typically occurs when the last surviving borrower dies, sells the home, or fails to comply with the loan terms, such as maintaining the property or paying property taxes and insurance.

Passing of the Borrower

Repayment of a reverse mortgage typically becomes necessary when the last remaining borrower on the loan passes away. Upon death, the heirs are responsible for settling the loan, which usually involves paying off the remaining balance or selling the home to cover the debt, a critical part of understanding how do you pay back a reverse mortgage.

Home Sale

If the homeowner decides to sell the property, how do you pay back a reverse mortgage must be considered as the reverse mortgage must be repaid at the time of sale. The proceeds from the sale are first used to pay off the reverse mortgage balance, with any excess funds going to the homeowner or their estate.

Change in Primary Residence

How do you pay back a reverse mortgage? This question also becomes relevant if the homeowner no longer uses the property as their primary residence. This could be due to moving into a care facility, relocating for an extended period, or other similar circumstances. In such cases, the reverse mortgage must be settled, typically through refinancing or by selling the home.

When Do You Need to Repay a Reverse Mortgage?

Reverse mortgage repayment becomes necessary primarily when the borrower permanently moves out or passes away. Other conditions include the failure to meet the loan obligations like property upkeep, tax, and insurance payments or if the homeowner decides to sell the home.

Additionally, the loan may become due if the homeowner fails to comply with the reverse mortgage terms while still residing in the home. These terms often include maintaining the property and staying current on property taxes and homeowners insurance.

When repayment is triggered, the loan balance must be cleared if the borrower or heirs wish to keep the home. Importantly, heirs are not required to pay more than the home’s worth due to FHA insurance; this protects them from owing more than 95% of the appraised value.

If the heirs decide against keeping the property, the lender will likely sell the home to settle the reverse mortgage balance. Should the sale proceeds not cover the balance, FHA insurance will cover the shortfall, ensuring no additional financial burden falls on the heirs.

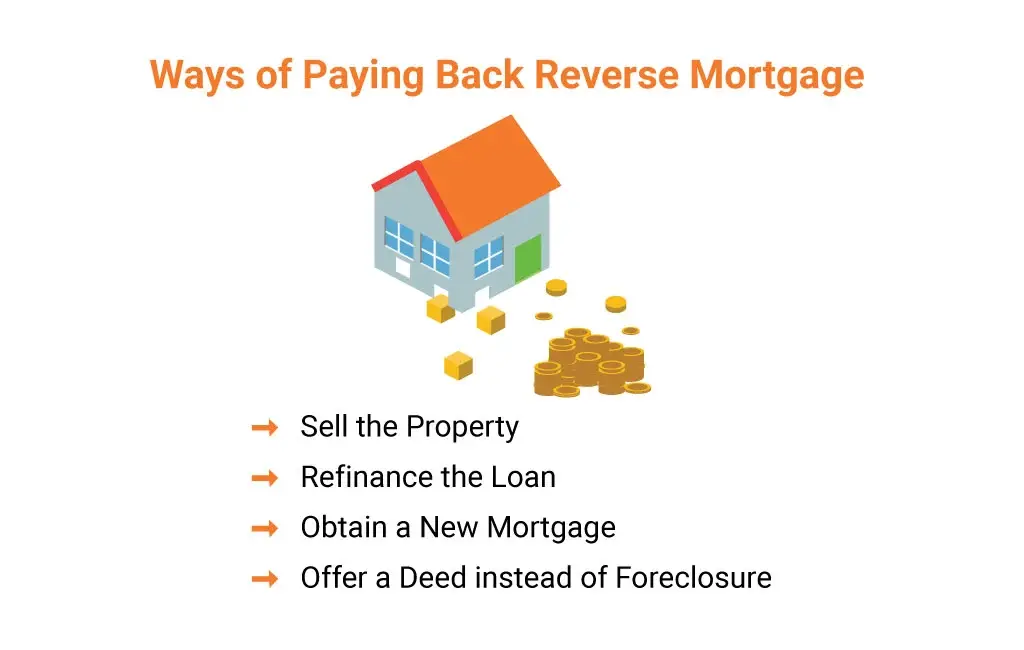

How Do You Pay Back a Reverse Mortgage? A Complete Guide

Repaying a reverse mortgage is a significant consideration for homeowners who have taken advantage of this financial tool. When the time comes to settle the debt, there are several options available, each with its own set of implications. Understanding these can help you choose the best course of action based on your circumstances or those of your heirs.

Paying back a reverse mortgage loan can be managed through several methods:

1. Sell the Property

One common method to how do you pay back a reverse mortgage is by selling the home. The proceeds from the sale are used to clear the reverse mortgage balance. Once the loan is settled, any surplus funds are transferred to the homeowner or their heirs. This route is commonly taken when the homeowner is relocating or has passed away.

2. Refinance the Loan

Refinancing the reverse mortgage into a traditional mortgage is another viable option for how do you pay back a reverse mortgage. This is particularly beneficial for heirs who prefer to retain the property. By refinancing, they can pay off the reverse mortgage without selling the home, provided they meet the eligibility criteria for the new loan based on their financial standing.

3. Obtain a New Mortgage

Heirs or homeowners may opt to take out a new mortgage to how do you pay back a reverse mortgage. This allows the family to retain homeownership by resetting the mortgage under new terms, requiring regular monthly payments.

4. Offer a Deed Instead of Foreclosure

If the homeowner or heirs cannot pay off the reverse mortgage and do not want to sell the home, they might consider providing a deed in lieu of foreclosure as a way to how do you pay back a reverse mortgage. This means voluntarily transferring the property title to the lender to satisfy the loan, which helps avoid the ramifications of a foreclosure.

Early Repayment Considerations of Reverse Mortgage

Reverse mortgage early repayment may be considered if the homeowner’s financial situation improves significantly or if they decide to move. It’s important to consult with a financial advisor to understand any penalties or fees associated with early repayment.

No Longer Need the Funds

Sometimes, a homeowner’s financial situation may improve unexpectedly after obtaining a reverse mortgage. This could be due to receiving a large inheritance, better-than-expected retirement investments, or any significant positive change in financial circumstances.

In such cases, the homeowner might find that the additional cash flow from the reverse mortgage is no longer necessary. Repaying the reverse mortgage early in these situations can reduce the interest burden and preserve more home equity for future needs or heirs.

Desire to Leave a Debt-Free Home to Heirs

Many homeowners take out a reverse mortgage to enhance their retirement income without planning to move. However, they may still wish to leave their home as a legacy to their children or heirs without the attached debt of a reverse mortgage.

Early repayment can ensure that the home can be passed on free of liens, providing the borrower and their family peace of mind. This is particularly significant as it prevents the heirs from deciding between shouldering the debt or selling the family home to cover the reverse mortgage.

Change in Household Composition

Life circumstances change, sometimes, including who lives in the home. If a new occupant, such as a family member or a caretaker, moves into the home and is not on the reverse mortgage, it can complicate matters. Should the original borrower relocate, pass away, or even decide to move to assisted living, the non-borrowing resident could potentially lose their residence.

Early repayment of the reverse mortgage can avoid such issues, securing the housing situation for all occupants regardless of changes in the borrower’s life or status.

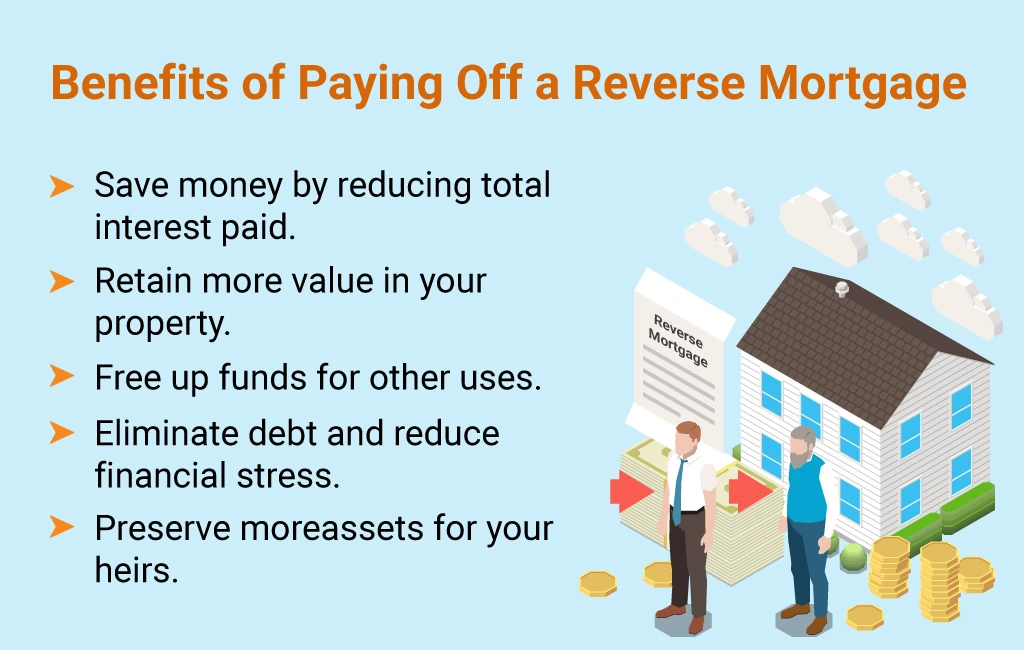

Benefits of Paying Off a Reverse Mortgage Early

One of the benefits of reverse mortgage early repayment is the potential for significant interest savings. Unlike traditional loans, where interest is front-loaded, reverse mortgages accumulate interest over time, which can grow the loan balance substantially. By paying off the loan early, homeowners can minimize the amount of interest that accrues, thereby preserving more of their home’s equity.

Additionally, early repayment of a reverse mortgage helps maintain a higher level of equity in the home. This is particularly beneficial for those who wish to leave their property to their heirs. With less of the home’s value being used to repay the reverse mortgage debt, more of the home’s actual equity remains, thereby increasing the value of the inheritance passed on to the next generation.

From an estate planning perspective, early repayment also simplifies settling the homeowner’s estate. When a reverse mortgage is still in place at the homeowner’s death, the heirs must handle the repayment either by refinancing, selling the home, or paying off the debt to retain the property. This situation can be complex and stressful. Clearing the reverse mortgage beforehand eliminates these complications and allows for a smoother estate transition.

Moreover, paying off a reverse mortgage early can give homeowners greater peace of mind. Knowing that their home is fully paid off and that they are not accruing additional debt can offer substantial emotional and financial relief. This is especially significant as homeowners advance in age and prioritize stability and security in their financial affairs.

Tips for Pay Back Reverse Mortgage

Paying back a reverse mortgage involves understanding your options and preparing effectively for when the loan becomes due. Here are some reverse mortgage tips for repayment:

Stay Informed About Loan Balances and Home Values

Check the balance of the reverse mortgage regularly and compare it with the current market value of your home. This will help you understand your property’s equity status and plan repayment or estate management accordingly.

Consult with Financial Advisors

Seek advice from financial advisors or counselors who specialize in reverse mortgages. They can provide insights on the best strategies for repayment based on your financial situation and future goals.

Plan for Future Changes

Anticipate and prepare for potential life changes that could affect your repayment strategy, such as moving to assisted living or changes in your financial status. Planning ahead can reduce stress and financial strain when the loan eventually needs to be repaid.

Understand Repayment Options

Familiarize yourself with the various methods for repaying a reverse mortgage, such as selling the home, refinancing the loan, or using savings or other assets. Each option has different implications for your financial health and estate planning.

Communicate with Heirs

Discuss the reverse mortgage and its implications with your heirs. Clear communication can help ensure that they understand their responsibilities and options for repayment upon inheriting the property.

Maintain the Property

Keep your home in good condition to preserve its value and remain a viable asset for loan repayment. Regular maintenance can prevent larger issues that might complicate home selling or refinancing.

Challenges and Implications of Repayment

The challenges of reverse mortgage repayment include the potential for decreasing home values, which might not cover the total amount owed on the mortgage at the time of repayment. Additionally, heirs may find the process of selling the home or refinancing a loan to be complex and time-consuming.

Heirs and Reverse Mortgage Repayment Role

The role of reverse mortgage heirs is pivotal when it comes to repayment. Heirs should be informed about the details and conditions of the reverse mortgage to prepare appropriately for future repayment responsibilities.

How to Exit a Reverse Mortgage Agreement

Exiting a reverse mortgage may be necessary if the homeowner or their heirs decide to pay off the loan early or sell the property. This involves contacting the lender to obtain the current loan balance and understanding the steps required to clear the loan.

Conclusion

Repaying a reverse mortgage involves a nuanced understanding of when and how repayment should occur and its impact on both the homeowner and their heirs. So, how do you pay back a reverse mortgage?

Navigating the various strategies available is vital for effectively managing this type of loan. Considering all aspects of repayment helps homeowners ensure that their financial security and estate planning goals are met, maintaining peace of mind about their future and that of their family.

For a deeper dive into the specifics of reverse mortgage repayment and to explore detailed strategies that could benefit your particular situation, we invite you to read more on our blog. Our comprehensive guide provides all the information you need to effectively make informed decisions about managing your reverse mortgage. Visit our blog today to ensure you are fully prepared for the financial implications of your reverse mortgage.