Tax season: for some, it’s a well-oiled routine: gather the documents, plug in the numbers, submit the forms. For others, it’s a stress-fueled scramble, complete with coffee-fueled late nights and cryptic Google searches like “why is my W-2 different this year?” But here’s something a little less obvious, why might preparing taxes be different for people living in different states?

It’s easy to assume taxes are the same across the board. After all, everyone files a federal return, right? But the truth is, the state you call home can drastically change your experience when April rolls around. From income tax rates that swing from zero to double digits, to state-specific deductions that feel like insider secrets, the tax code isn’t just a national issue, it’s a deeply local one.

Some states are generous with tax credits for things like solar energy or education expenses. Others? Not so much. Some follow the federal tax system closely; others chart their own course entirely. And if you’ve recently moved, changed jobs across state lines, or worked remotely? Well, things get even more complicated.

This isn’t just about math, it’s about understanding a patchwork system that treats taxpayers very differently depending on geography. And that can affect not just what you owe, but how you prepare, how long it takes, and what kind of help you might need.

So, let’s unpack it. Let’s explore how where you live can change everything about your tax filing process.

Understanding the State-by-State Tax Landscape

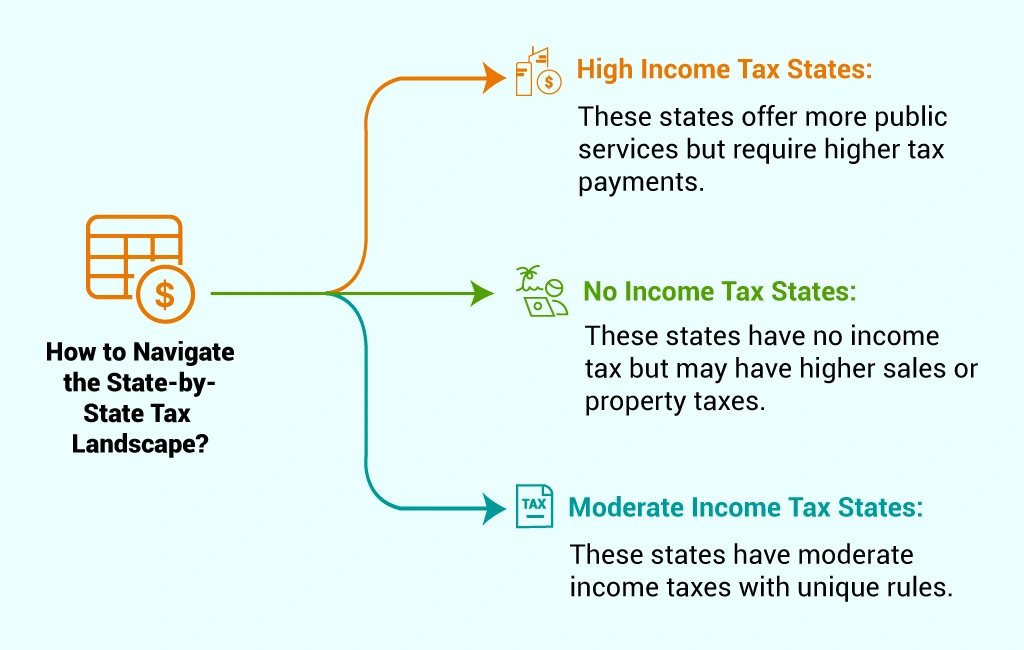

The United States operates under a federal system, an arrangement that gives states the freedom to design their own tax structures, independent of the federal government. On paper, that sounds like a reasonable way to reflect local priorities. In practice? It creates a tax landscape that can feel more like a maze than a map. Each state plays by its own rules, and as a taxpayer, you’re expected to know which game you’re in.

Some states, like California and New York, have relatively high income tax rates, and they apply them in a progressive fashion, meaning the more you earn, the more you pay. These states often pair higher taxes with a wider range of public services, but whether that trade-off feels fair is a matter of perspective. On the flip side, states like Texas, Florida, and Washington have no personal income tax at all. That might sound ideal until you realize those states often make up the revenue elsewhere, through higher sales taxes, property taxes, or fewer tax credits and deductions.

Then there are the in-betweeners: states that tax income moderately, but apply quirky rules that differ significantly from federal guidelines. For example, some don’t recognize certain deductions you’d expect to carry over from your federal return. Others require extra forms or calculations for local taxes.

This patchwork of rules means that something as basic as moving across state lines, or earning freelance income in another state—can complicate your tax prep in unexpected ways.

Why Might Preparing Taxes Be Different for People Living in Different States? - Explained

Is tax different in different states? Without a doubt, yes. And if you’ve ever moved states mid-year or tried to reconcile freelance income earned in more than one place, you probably already know just how complicated it can get. While everyone files a federal return, each state has its own set of tax laws, forms, deductions, credits, and quirks. The difference isn’t just academic, it affects how you file, when you file, what you can deduct, and what you might owe.

Here are a few key ways state taxes can differ and why it matters:

Deductions & Exemptions

While the federal government offers a standard deduction (and itemized alternatives), many states have their own rules:

- Some mirror the federal deduction closely.

- Others reduce the amount significantly or offer a flat exemption instead.

- A few don’t allow certain federal deductions at all (like mortgage interest or student loan interest).

Tax Credits

States also choose what kinds of behaviors to reward. For example:

- California offers credits for electric vehicle purchases and clean energy home improvements.

- Other states may give credits for education expenses, childcare, or even staying employed (yes, really).

Filing Deadlines & Forms

- Most states stick with the federal April 15 deadline, but some, like Delaware or Hawaii—go rogue with their own schedules.

- Forms also differ wildly. While some states use intuitive, online-friendly systems, others require you to navigate paper-heavy or outdated portals.

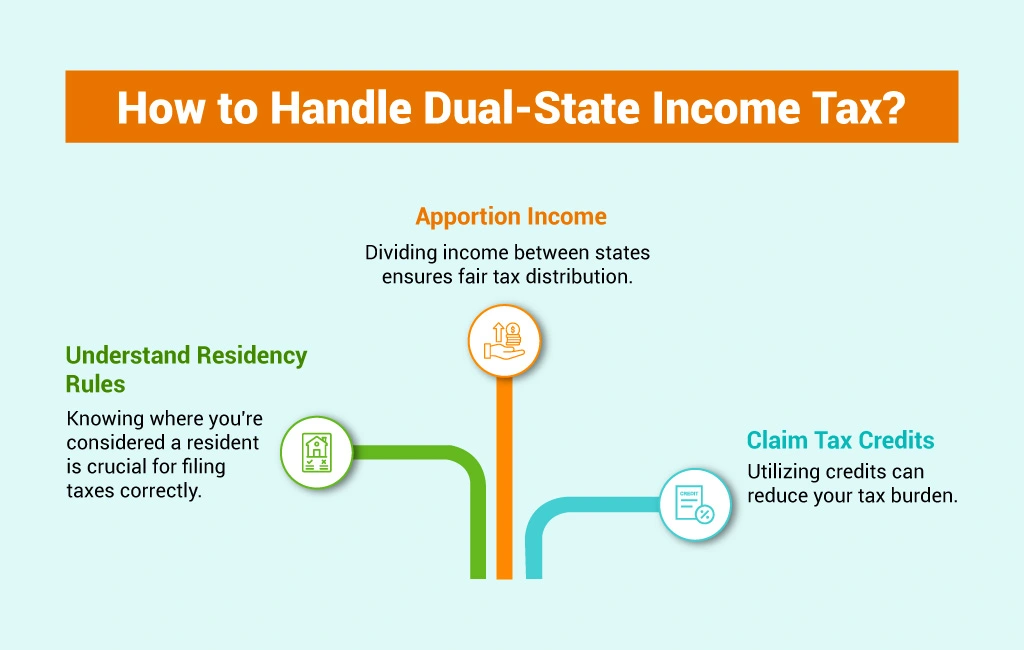

Dual-State Income

If you worked remotely from one state but your employer is based in another, or you moved states during the year, you’re likely on the hook for multiple state returns. That means understanding residency rules, apportioning income, and potentially dealing with tax credits for taxes paid to other states.

So yes, state lines may look like arbitrary borders on a map, but come tax time, they can completely change the game.

Residency Rules and Their Tax Implications

Where you live, and how long you live there, can have a huge impact on your tax bill. That’s because state residency rules are a foundational factor in determining where and how much you owe in state income taxes. But here’s the twist: residency isn’t always as straightforward as it seems.

In most cases, your state of residency is the place you consider your permanent home, where you sleep, vote, register your car, and return to after traveling. But if you move mid-year, split your time between two states, or work remotely, you might find yourself in a gray area. And that’s where things get messy.

Common Scenarios that Trigger Multistate Tax Filing

- You moved from one state to another during the tax year (you may need to file part-year resident returns in both).

- You live in one state but work in another (this typically means filing a nonresident return in your work state, and a resident return where you live).

- You maintain a second home in a different state and spend a significant portion of the year there.

- You’re a digital nomad or remote worker bouncing between states throughout the year.

This often leads to multistate tax filing, and yes, it can mean filing multiple state tax returns.

To stay compliant and avoid overpaying (or underpaying), you need to:

- Understand the residency rules in each state involved.

- Track your days in each location.

- Maintain clear records of income earned in each state.

A tax advisor can be a lifesaver here, especially when residency status isn’t cut-and-dried.

State-Specific Deductions and Tax Credits

When it comes to deductions and credits, many people think only in terms of federal tax breaks. But here’s what often flies under the radar: states can, and frequently do, offer their own unique set of incentives. These can dramatically affect your bottom line, sometimes in ways that catch even seasoned taxpayers off guard.

Unlike the one-size-fits-all approach of federal taxes, state deductions and credits are designed to reflect local economic priorities, political leanings, and budget constraints. That means the savings you might unlock in one state could be completely unavailable in another.

For example:

- Education-based deductions: Some states let you deduct contributions to a 529 college savings plan—even if you don’t itemize deductions on your federal return.

- Green energy credits: States like New York or California may offer credits for installing solar panels, buying electric vehicles, or upgrading to energy-efficient appliances.

- Retirement income exclusions: A few states exclude certain types of retirement income, like pensions or Social Security, which can drastically reduce your taxable income if you’re retired.

- Earned income and child care credits: These often mirror the federal credits but at a different rate—or come with additional eligibility rules.

- Health savings accounts and medical expenses: Some states treat HSAs differently, limiting or expanding deductions based on their own criteria

If you’re filing multiple state tax returns due to a move, remote work, or owning property in more than one state, it’s essential to understand which of these apply, and where. Being unaware of them means potentially leaving money on the table.

In short, knowing your state’s incentives isn’t just good housekeeping. It’s smart tax planning. And it can make a real difference when it’s time to tally up what you owe, or what you’re owed.

Sales and Property Taxes — The Often Overlooked Costs

When we think of taxes, income tax usually grabs the spotlight. It’s what we plan for, dread, and (hopefully) prepare early. But tucked in the wings—quiet yet impactful, are sales and property taxes, often underestimated in how they affect our financial picture.

Sales taxes are applied at the point of purchase and can vary significantly:

- California leads with one of the highest combined state and local sales tax rates, which can top 10% in some areas.

- Oregon, by contrast, doesn’t collect any state sales tax, making it a haven for big-ticket shopping.

- Local jurisdictions (cities, counties) can tack on their own sales taxes, which means the rate can change just by crossing a city limit.

These differences don’t just affect your shopping habits, they can influence where you choose to live or even where you take that new job.

Property taxes, meanwhile, are based on the value of your home and are determined by local governments:

- New Jersey and Illinois have notoriously high property tax rates, often cited as a burden by homeowners.

- Hawaii and Alabama boast some of the lowest, though this often reflects lower funding for local services.

Now, add complexity: what if you own property in one state but live in another? Or moved mid-year? These situations may trigger filing taxes in two states, or at the very least, a deeper dive into how property and sales taxes interact with your income tax liability.

They’re often overlooked, but these taxes quietly shape our budgets and our lives.

Filing Deadlines, Forms, and Requirements by State

When it comes to taxes, timing and paperwork matter. And depending on your state, both can look surprisingly different.

While the IRS sets a consistent federal deadline, usually April 15, states have the freedom to choose their own. That means your filing schedule may shift depending on where you live or where you earned income. A few examples:

- Delaware gives you until April 30 to file state taxes.

- Hawaii expects returns by April 21.

- Iowa often pushes the deadline to the end of April.

It might seem like a small difference, but if you’re juggling federal and multiple state returns, that extra time (or lack of it) can make a difference.

On top of timing, there’s the matter of forms and requirements. Some states mirror federal returns fairly closely, simplifying the process. Others? Not so much.

- Some require additional forms for credits or deductions not recognized federally.

- Others may not conform to IRS rule changes right away, creating discrepancies.

- If you’re filing in two states, the forms can become even more layered, part-year and non-resident forms, income allocation worksheets, and so on.

Bottom line: knowing how to file taxes in two states, or even just one unfamiliar one, means being proactive. Don’t assume every state plays by the same rules. Most don’t.

Local Taxes and Additional Surcharges

State taxes are only part of the picture. In many areas, local governments add their own layer of taxation, which can catch people off guard, especially if they’ve recently moved or worked in different cities throughout the year.

Here’s what to watch for:

- City or County Income Taxes – Common in places like New York City or some Ohio municipalities.

- Local Sales Taxes – On top of state rates, many cities and counties tack on their own percentages.

- Special Surcharges – These may fund things like public transit, emergency services, or school districts.

For example, New York City residents pay a separate city income tax in addition to state and federal taxes. That’s not just a line item—it’s a whole other calculation.

If you’re filing taxes for different states, don’t forget to check for local obligations too. Skipping them, intentionally or not, can lead to fines, interest, or a very unwelcome surprise later.

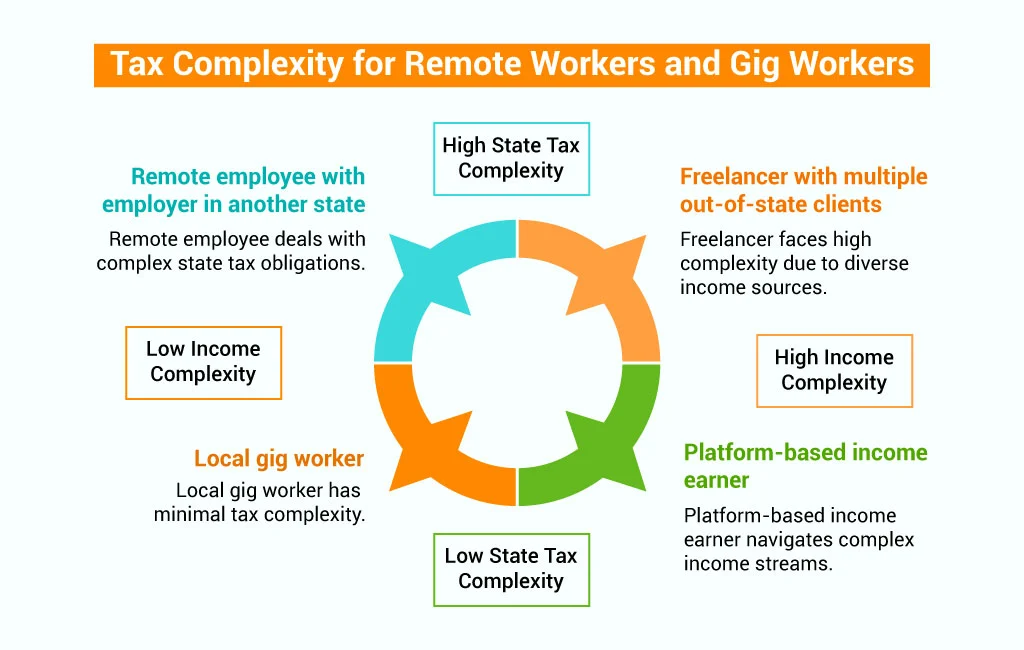

Remote Work, Business Income, and Side Gig Tax Challenges

The shift toward remote work and the explosion of side gigs have made tax season a lot trickier—especially when it comes to state filings. Earning income across state lines now isn’t just for traveling consultants or sales reps. It’s a reality for freelancers, remote employees, and anyone with a side hustle.

Here’s where it gets complex:

- Remote employees may owe taxes in both the state they live in and the state where their employer is based.

- Freelancers or gig workers might need to file in multiple states if they earn income from clients across borders.

- Platform-based income (like from Etsy, Uber, or Upwork) can be taxed differently depending on the state..

To stay ahead:

- Track income sources by state.

- Keep receipts and client records organized.

- Understand each state’s tax thresholds and filing rules.

Getting ahead of these details can save you headaches—and possibly money—down the line.

Final Thoughts

Navigating the complexities of state taxes can be daunting, but understanding the nuances of each state’s tax laws is crucial for accurate and efficient tax preparation. Whether it’s recognizing the differences in deductions and credits, understanding residency rules, or being aware of local taxes and surcharges, being informed can lead to significant savings and ensure compliance.

Remember, tax laws are subject to change, and staying updated with the latest information is essential. Consulting with a tax professional or utilizing reputable tax software can provide guidance tailored to your specific circumstances. Ultimately, being proactive and informed is the key to navigating the diverse tax landscapes across different states.