When it comes to managing homeownership costs, one common expense many homeowners face is the payment of Homeowners Association (HOA) fees. These fees are essential for maintaining community amenities and common areas, but they can add up quickly, leading many to wonder, “Are HOA fees tax deductible?” Understanding the tax implications of HOA fees is crucial for homeowners looking to optimize their financial situation and potentially reduce their tax burden.

In this blog, we’ll explore the ins and outs of HOA fees, including when and how they might be tax-deductible. We’ll also provide practical guidance on maximizing the potential tax benefits associated with these fees, whether you use your home as a primary residence, rental property, or for business purposes. By the end, you’ll have a clearer understanding of whether HOA Fees are Tax Deductible and how to navigate the complexities of taxes related to your home.

What are HOA Fees?

A Homeowners Association (HOA) is a governing body that establishes and enforces rules for properties within a planned community, such as condominiums, gated communities, or apartment complexes. These associations typically charge HOA fees to cover the costs of maintaining common areas, landscaping, and the overall upkeep of the community.

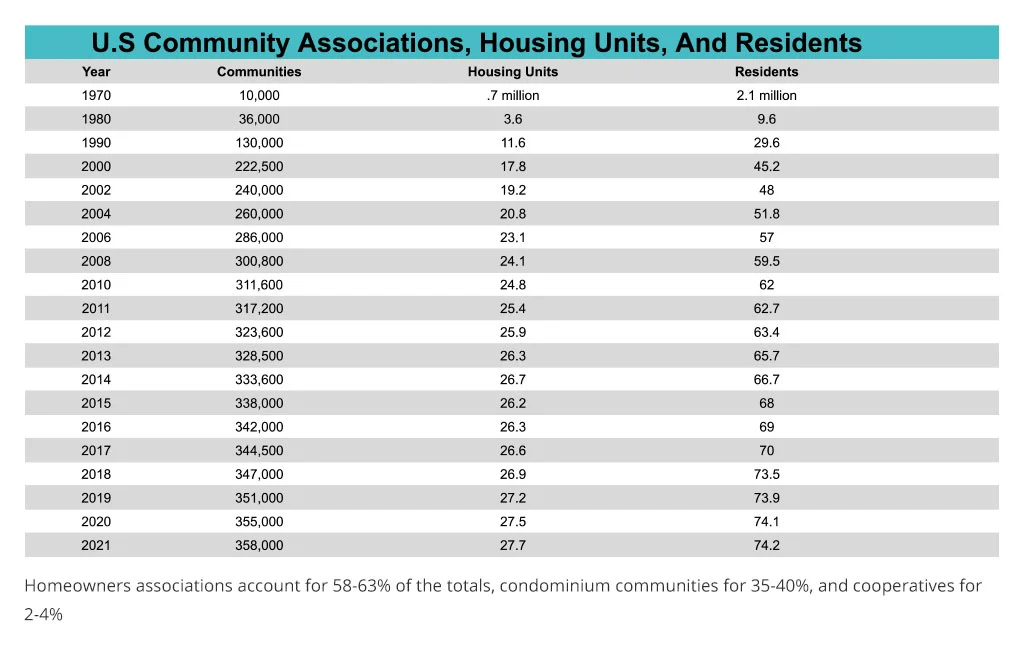

Approximately 74.2 million Americans, or 29 percent of the country’s population (as of 2021), lived in homeowners associations, condominium communities, or co-ops. This significant portion of the population highlights the importance of understanding how HOA fees impact your taxes and finances.

But what is HOA fee?

Simply put, it’s a mandatory payment made by homeowners to ensure that the shared spaces and amenities in their community are well-maintained and meet the standards set by the HOA.

Regarding taxes, the deductibility of HOA fees depends on how the property is used. If the property is used for rental purposes, the IRS considers HOA fees tax-deductible as a rental expense. This means that if you own a rental property, you can deduct the cost of the HOA fees from your rental income, reducing your overall tax liability. However, it’s important to note that if the HOA fee includes a special assessment for improvements, you may not be able to deduct this portion. Instead, you might need to account for these costs through depreciation over time.

On the other hand, if the property is your primary residence, HOA fees are not tax-deductible. Homeowners who live in their property and pay monthly, quarterly, or yearly HOA fees cannot claim these fees as a deduction on their tax return. The IRS views these fees as personal expenses, similar to utilities or home insurance, which are not taxable.

However, there are specific scenarios where a portion of the HOA fees may still be deductible. For example, if you own a rental property that you also use for personal purposes for part of the year, you can only deduct the portion of the HOA fees that corresponds to the time the property was used as a rental. This prorated deduction allows you to claim a portion of the HOA fees on your tax return, reflecting the rental use of the property.

How to Know if a Property Has HOA Fees

When purchasing or owning a property, it’s crucial to understand whether HOA fees are involved. Not all properties have these fees, so it’s important to distinguish between property taxes and HOA fees. Property taxes are levied by local governments and are based on the assessed value of your home, while the Homeowner’s Association collects HOA fees to cover community-related expenses.

When purchasing a property, it’s crucial to understand all the costs involved, including any potential Homeowners Association (HOA) fees. These fees can impact your overall budget and are often used to maintain common areas and community amenities. Knowing whether a property has HOA fees is essential for accurate financial planning and ensuring you’re fully aware of all your obligations as a homeowner.

Here are some straightforward ways to determine if a property comes with HOA fees and how they might interact with property tax and HOA fees.

1. Simply Ask the Seller

One of the easiest and most direct ways to find out if a property has HOA fees is to ask the seller. The seller should be able to provide detailed information about any HOA fees, including how much they are, what they cover, and how often they are paid. By asking the seller directly, you can also inquire about any recent changes in fees or special assessments that may be later apparent.

2. Read the Legal Description

Another method to determine if a property has HOA fees is to read the legal description of the property carefully. The legal description is part of the property deed and typically includes details about any covenants, conditions, and restrictions (CC&Rs) associated with the property. These documents will outline whether the property is subject to HOA rules and fees.

3. Google It

In today’s digital age, a simple Google search can often yield valuable information about whether a property is subject to HOA fees. By entering the property address along with keywords like “HOA” or “Homeowners Association,” you can often find listings, forums, or community websites that mention any HOA involvement.

Additionally, many real estate websites now include HOA fee details in their property listings, making it easier to identify these costs upfront.

Are HOA Fees Tax Deductible?

The tax deduction for HOA fees depends on the specific use of the property and the nature of the fees. HOA fees are generally not tax-deductible when paid on a primary residence, but there are exceptions to this rule.

If your property meets certain conditions, you might be able to deduct HOA fees. For instance, if the property is used as a rental, a portion of the fees could be deductible as a business expense. Similarly, some HOA fees might be deductible under business expenses if you run a business from your home or have a dedicated home office.

It’s essential to keep detailed records of your HOA payments and consult with a tax professional to determine eligibility for deductions.

When Can I Claim HOA Fees on My Taxes?

Understanding when you can claim HOA fees on your taxes is crucial for maximizing your tax benefits. The key is determining how the property is used, which will dictate whether the fees are deductible. So, where can you claim hoa fees on taxes? Below are some scenarios that might apply:

Primary Residence Home

HOA fees are generally not tax-deductible if your home is your primary residence. However, if a portion of your home is used for business purposes, such as a home office, you can deduct a percentage of the HOA fees.

Home Office or Business Use

A portion of the HOA fees for homeowners using part of their home exclusively for business, such as home office HOA fees, may be deductible. The deduction is calculated based on the percentage of your home used for business purposes. For instance, if 10% of your home is used as an office, 10% of your HOA fees might be deductible.

Home Use as a Rental Property

If your home is used as HOA fees rental property, the HOA fees are generally deductible as a rental expense. This deduction is treated similarly to other rental property expenses, like maintenance, repairs, and property management fees. Maintaining meticulous records of all related expenses is crucial to claim the full deduction.

Using Home as a Part-Time Home or Vacation Property

If the property is used part-time as a rental or vacation home, the deductibility of HOA fees can get more complex. Typically, you can only deduct the portion of the fees corresponding to the time the property is rented out or used for income-generating purposes.

How to Deduct HOA Fees

If you qualify for a tax deduction HOA fees, you can report these fees on your Schedule E (Form 1040) when filing your tax return. Schedule E is used to report income or loss from various sources, including rental properties, partnerships, royalties, estates, S corporations, and trusts. This form is essential for those managing rental real estate, as it allows you to account for your HOA fees as part of your rental expenses.

According to the IRS, you can deduct up to $25,000 in losses against your income if you actively manage your rental property. If your losses exceed this amount, you can carry over the excess to future tax years. For instance, if you incur a loss of $45,000 in one year, you can deduct $25,000 for the current tax year and roll over the remaining $20,000 to the following year. This carryover helps maximize your deductions, ensuring you benefit from all eligible tax deductions.

How to Maximize Tax Benefits

Maximizing the benefits of HOA fees requires a strategic approach to property usage and tax planning. Here are some tips:

Mortgage Interest Deduction

The mortgage interest deduction allows you to reduce your taxable income by the amount of interest paid on your mortgage. However, if you’ve been wondering, “Are HOA Fees Tax Deductible?” in this context, the answer is usually no, unless the fees are directly related to home improvements that impact the interest. Accurately applying the mortgage interest deduction can still lead to significant tax savings.

Property Tax Deduction

The property tax deduction lets you deduct the state and local property taxes paid on your home from your federal taxable income. This deduction can result in substantial savings, but “Are HOA fees tax deductible?” under this category? Generally, HOA fees are not included in property tax deductions unless they pertain to a rental or business property. Understanding this distinction helps you maximize your overall tax benefits.

Home Office Deduction

For homeowners using part of their home for business, the home office deduction is a valuable tax benefit. It allows you to deduct a portion of your home-related expenses, including HOA fees, if they are tied to the business use of your home. So, “Are HOA fees tax deductible?” if you have a home office? Yes, a portion of them can be, making this deduction particularly useful for those working from home.

Energy Efficiency Tax Credits

Energy efficiency tax credits are available for homeowners who make qualifying energy improvements, such as installing solar panels. But “Are HOA fees tax deductible?” when claiming energy efficiency credits? Typically, they are not unless the HOA fees are part of a special assessment for energy-efficient upgrades. Properly leveraging these credits can help you reduce your overall tax liability.

Expert Tips for Homeowners

Homeownership comes with various opportunities and responsibilities, especially when it comes to maximizing the use and financial benefits of your property. Whether you’re using your home as a private residence, rental property, or business space, there are strategies to optimize your investment and potentially reduce your tax liability.

Here are expert tips for homeowners to make the most of their property.

1. Using as a Private or Personal Year-Round Home

When using your home as a private or personal residence year-round, focus on maintaining and improving the property to enhance its value over time. Regular maintenance and strategic home improvements not only increase comfort but can also add to your home’s resale value. While HOA fees in this scenario are typically not tax-deductible, investing in your home can still yield long-term financial benefits.

2. Using Your Home as a Rental Property

If you’re using your home as a rental property, there are several tax advantages to consider. Rental income must be reported, but you can deduct expenses like mortgage interest, property taxes, and even HOA fees associated with the rental. Keeping detailed records of all rental-related expenses is crucial to maximizing your tax deductions and ensuring compliance with tax laws.

3. Using Your Home for a Business

Running a business from home offers unique tax benefits, such as deducting a portion of your home-related expenses, including utilities, mortgage interest, and even HOA fees, if applicable. The key is to maintain a dedicated space exclusively for business use. This space can qualify for the home office deduction, helping to reduce your taxable income and increase your overall savings.

4. Using Your Home as a Vacation Property

Using your home as a vacation property, whether for personal use or short-term rentals, requires careful planning to maximize its benefits. If you rent it out, you can deduct expenses proportional to the rental period, including HOA fees. However, keep in mind that personal use can limit these deductions, so it’s important to understand the IRS rules regarding vacation property deductions.

5. Working from Home

With the rise of remote work, many homeowners use their properties as living spaces and workspaces. If you work from home, you might qualify for the home office deduction, which can include a portion of your HOA fees if they relate to the space used for work. This deduction can significantly reduce your taxable income, making it a valuable benefit for those working remotely.

Other Homeowner Tax Considerations

When managing homeownership, it’s essential to understand the tax implications that can affect your finances. From distinguishing between condo fees and HOA fees to identifying additional deductible expenses, being aware of these factors can significantly impact your tax filings. A key question is, “Are HOA Fees Tax Deductible?” Understanding this and other homeowner tax considerations is crucial.

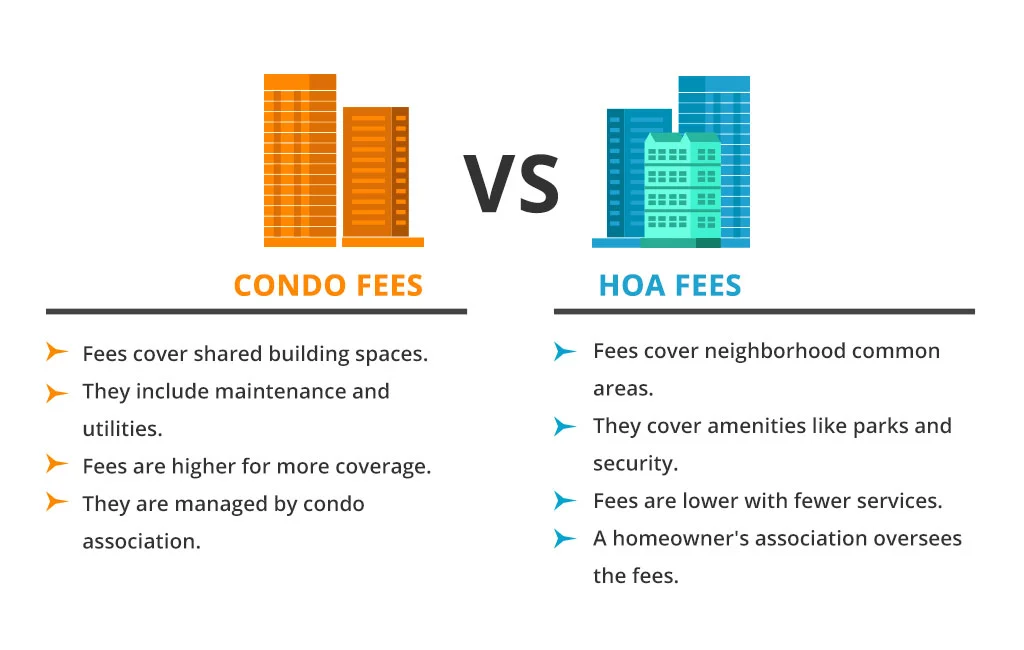

Condo Fees vs. HOA Fees

A common confusion for homeowners is the difference between a condo fee vs HOA. Condo fees typically cover the maintenance of the building’s exterior, common areas, and shared facilities in a condominium complex. HOA fees, on the other hand, are associated with single-family homes in planned communities, covering landscaping, community security, and recreational amenities.

The question, “Are HOA fees tax deductible?” arises often. Generally, neither condo fees nor HOA fees are deductible for a primary residence. However, if the property is used as a rental or for business purposes, some or all of these fees might be deductible.

Additional Deductible Expenses

Beyond HOA and condo fees, homeowners should explore other potential deductible expenses. Mortgage interest and property taxes are common deductions, but energy-efficient home improvements may also qualify for tax credits.

Additionally, if you use part of your home for business, some of your utilities, home insurance, and even HOA fees could be deductible. Again, “Are HOA fees tax deductible?” If you use your home for business, the answer could be yes. Proper documentation and understanding of eligible expenses can maximize your tax benefits.

Conclusion

The question, “Are HOA Fees Tax Deductible?”, ultimately depends on how you use your property. Generally, HOA fees are not deductible for a primary residence. However, exceptions exist if the property is used for business purposes, as a rental, or for part-time income generation. In these cases, depending on the specific circumstances, you can deduct a portion or even all of your HOA fees.

To fully benefit from any potential deductions, it’s crucial to understand the applicable tax rules and keep detailed records of your expenses. By staying informed and organized, you can maximize any possible deductions related to your HOA fees and optimize your overall tax situation.

For more insights on managing your finances and understanding the complexities of tax deductions, visit our blog at EduCounting. We provide a wealth of resources to help you make informed decisions and take control of your financial future.

Frequently Ask Questions

Can You Write Off HOA Fees If You Work from Home?

Yes, if you have a dedicated home office, you can write off a portion of your HOA fees as a business expense. The deduction is usually based on the percentage of your home used for business purposes.

Are HOA Fees Tax Deductible for Rental Property?

Yes, HOA fees are generally deductible for rental properties as they are considered necessary rental expenses. These fees can be deducted from your rental income, reducing your overall taxable income.

What Expenses are Part of the HOA Fees?

HOA fees typically cover the maintenance of common areas, security services, landscaping, and sometimes utilities or special assessments. These fees ensure the upkeep and management of shared community spaces.

Can You Write Off the HOA Fees for the Rental Property?

Yes, HOA fees for rental properties are tax-deductible as they are necessary expenses for maintaining the property. This deduction can help lower your taxable rental income.