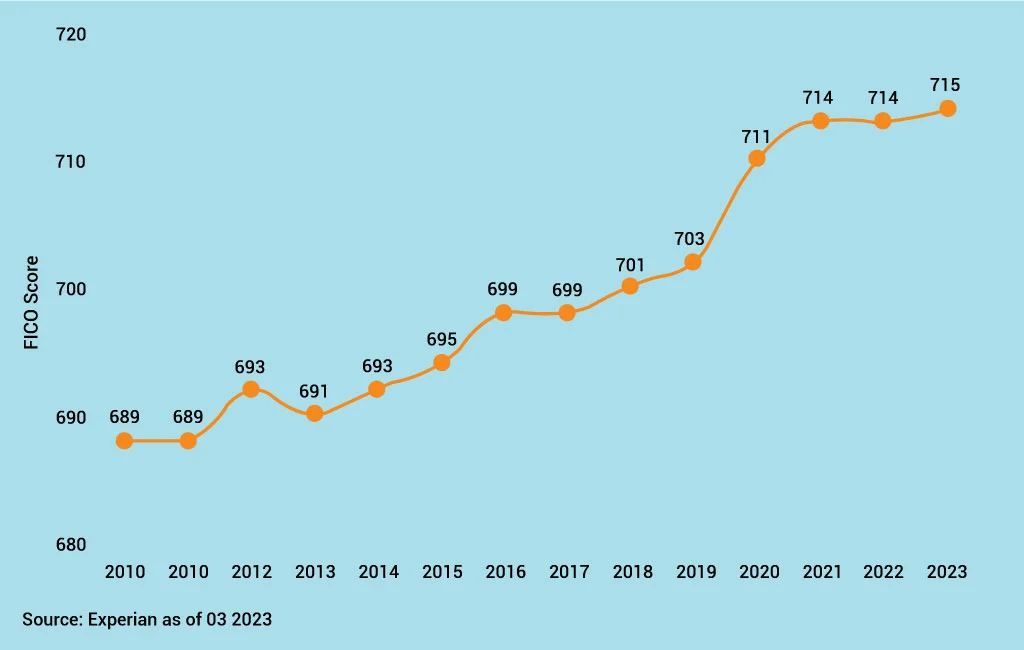

In 2023, the average Credit Score in the U.S. reached 715, a slight increase from 714 in Q3 2022, according to Experian. This marked the 10th consecutive year without an annual decline, emphasizing a steady decade of credit improvement since the last recorded dip in 2013.

Building a strong credit score is a critical step toward financial independence. Whether you’re just starting your credit journey or trying to improve an existing score, understanding how long does it take to build credit is essential. While the timeline varies depending on individual circumstances, the process can take months or even years of consistent effort.

What is Credit and Why Does It Matter?

What is a credit score? A credit score is a three-digit number reflecting your financial trustworthiness, helping lenders decide whether to approve or extend credit. Typically, credit scores range from 300 to 850, with higher scores signaling greater credit reliability. The FICO Score, developed by the Fair Isaac Corporation, is the most widely recognized credit scoring model, though other systems also exist.

Credit scores are calculated based on your credit history, which includes factors like repayment behavior, outstanding debts, the length of your credit history, and credit mix. Major credit bureaus—Equifax, Experian, and TransUnion—collect and analyze this information to generate your score. A good credit score can open doors to favorable interest rates and loan approvals, while lower scores may lead to denials or higher borrowing costs.

A strong credit score helps you qualify for financial products like mortgages, car loans, and credit cards and determines the interest rates you’ll pay. For instance, a score above 700 is often considered good, potentially leading to lower interest rates, while scores below 580 may signal financial risk to lenders. This three-digit number can significantly impact your financial well-being, influencing everything from renting an apartment to securing a job.

How Credit Scores are Calculated

Your credit score is calculated based on a combination of factors. These include payment history, credit utilization, length of credit history, types of credit, and new credit inquiries.

How is credit calculated? Understanding how credit is calculated can help you focus on areas that need improvement.

Payment history is the cornerstone of your credit score, contributing a significant 35% to the total calculation. This factor assesses whether you pay your bills on time and highlights any missed payments. It’s a primary measure lenders use to evaluate your reliability as a borrower. Regarding how long does it take to build credit, focusing on consistent, on-time payments is an essential starting point. Each timely payment adds to your credibility, gradually building a strong financial foundation over time.

Credit utilization accounts for 30% of your credit score and reflects how much credit you use relative to your total available limit. Maintaining a utilization rate below 30% demonstrates responsible credit management, signaling to lenders that you’re not over-relying on borrowed funds. This area offers a chance for quicker improvements. By paying down outstanding balances and keeping usage low, you show financial discipline—a critical step in addressing the question how long does it take to build credit.

The length of your credit history, making up 15% of your score, reveals your experience with managing credit. Lenders value longer histories as they reflect stability and reliability. Keeping older accounts open and active is key to maintaining a strong credit profile. Similarly, your credit mix, accounting for 10%, showcases your ability to manage various credit types, from credit cards to loans.

Factors That Influence How Long It Takes to Build Credit

Understanding how long to build credit history depends on various elements that shape your credit score. Each factor uniquely demonstrates your financial responsibility, from how consistently you pay bills to the diversity of your credit accounts. These factors affect your credit score and influence how quickly you can establish or rebuild credit.

Payment History (35%)

Payment history carries the most weight in your credit score, accounting for 35%. It reflects whether you pay your bills on time and how often you miss payments. Lenders prioritize this factor because it shows your reliability as a borrower. If you want to understand How Long Does It Take to Build Credit, this is one area you should focus on first!

To improve this aspect, establish a habit of paying bills promptly. Over time, consistent payments help build credit and show lenders that you can manage your obligations responsibly.

Credit Utilization (30%)

Credit utilization measures how much credit you use compared to your total credit limit. A lower utilization ratio, ideally below 30%, indicates responsible credit management.

This factor offers opportunities for quick improvement and answers the question of How Long Does It Take to Build Credit. Paying down balances and keeping credit usage low over time demonstrates financial discipline and helps build credit effectively.

Length of Credit History (15%)

The length of your credit history accounts for 15% of your score and reflects how long you’ve been managing credit. Lenders prefer a longer history as it indicates experience and stability.

Keeping older accounts open and active is crucial for this factor and increases your chance of How Long Does It Take to Build Credit. Although it takes time to build, a well-maintained credit history strengthens your overall profile.

Credit Mix (10%)

A diverse credit mix, including credit cards, mortgages, and loans, contributes 10% to your credit score. This variety shows lenders that you can handle different credit responsibly.

While you shouldn’t open unnecessary accounts, maintaining a balanced mix over time can boost your credit score and highlight your ability to manage various debts.

New Inquiries (10%)

Every time you apply for new credit, a hard inquiry is added to your credit report. Too many inquiries in a short period can temporarily lower your score.

Avoid excessive applications and focus on growing your existing accounts. Managing inquiries wisely helps protect your score and reinforces good financial habits.

How Long Does It Take to Build Credit From Scratch?

Building credit from zero is a journey that requires patience and consistent effort. Credit bureaus typically need at least six months of financial activity to generate your initial credit score. During this period, it’s important to focus on creating positive credit behaviors, such as making timely payments and lowering your credit utilization. These habits lay the foundation for establishing a solid credit profile and demonstrate your reliability to lenders.

So, how long does it take to build credit from scratch?

However, reaching a “good” or “excellent” credit score can take significantly longer—often one to two years of consistent and responsible credit use. Opening a secured credit card or becoming an authorized user on someone else’s account can help speed up the process. These strategies provide opportunities to showcase your financial discipline while steadily building your credit history. Regularly monitoring your progress also ensures you stay on track toward your credit goals.

While the timeline for building credit may seem long, the benefits are well worth the effort. A strong credit score opens doors to favorable loan terms, lower interest rates, and greater financial opportunities. By understanding how long it takes to build credit from scratch and maintaining responsible habits, you can create a credit profile supporting your financial success for years.

Tips for Building Credit Effectively

Building credit effectively requires consistent effort and smart financial habits. Whether you’re starting from scratch or improving an existing score, focus on these fastest credit-building tips:

1. Pay Your Bills on Time

Payment history is the most critical factor in your credit score. Lenders view consistent on-time payments as a sign of financial reliability. Missing payments, on the other hand, can hurt your score and take months to recover from. To build credit effectively, prioritize paying all bills—credit cards, loans, or even utilities—by their due dates. Setting up automatic payments or calendar reminders can help ensure you never miss a deadline.

2. Use Your Card Carefully

Using your credit card wisely is another key to building credit. Try to keep your credit utilization ratio—the amount of credit used compared to your total limit—below 30%. For example, if your card has a $1,000 limit, try not to carry a balance higher than $300. Low utilization shows lenders you can manage credit responsibly. Paying your balances in full monthly also avoids charged interest and keeps your financial health intact.

3. Pursue Variety

A diverse credit mix can positively impact your credit score. Credit scoring models favor a combination of revolving credit (like credit cards) and installment credit (such as auto loans or mortgages). While taking on debt solely to improve your credit is unnecessary, responsibly managing multiple types of credit over time demonstrates your ability to handle different financial obligations.

4. Apply Carefully

Every credit application results in a hard inquiry on your credit report, which can temporarily lower your score. To avoid unnecessary hits, apply for credit only when needed. Before applying, research the eligibility criteria to ensure you meet the requirements. Careful planning reduces the risk of rejection and keeps your credit profile in good standing.

5. Use a Secured Credit Card

If you’re just starting out or have poor credit, a secured credit card is an excellent tool for building credit. Secured cards require a refundable deposit that acts as your credit limit. Using the card responsibly—making small purchases and paying off the balance in full—shows lenders that you can handle credit responsibly. Over time, consistent use of a secured card can help you qualify for traditional, unsecured credit options.

Challenges and Mistakes to Avoid

Building and maintaining a strong credit score is essential, but certain challenges and common mistakes can hinder your progress. So, how long does it take to build credit with these challenges? Avoiding these pitfalls is key to effective credit management. Here are some common credit mistakes to avoid:

1. Falling Behind

Late or missed payments can severely damage your credit score. Payment history accounts for a significant portion of your credit score, so falling behind on bills can take months or even years to recover from. To avoid this mistake, set up instructions for automatic payments or use reminders to ensure you never miss a due date.

2. Overcharging

Exceeding your credit limit or maintaining high balances on your credit cards can hurt your credit utilization ratio. Lenders prefer to see utilization rates below 30%, so overcharging can make you appear financially irresponsible. Regularly monitor your credit card balances and aim to pay off your statement in full each month to avoid interest and keep utilization low.

3. Closing Accounts

Closing old credit accounts might seem like a good idea, but it can negatively impact your credit score. Older accounts contribute to the length of your credit history, which is a factor in your overall creditworthiness. Instead of closing unused accounts, consider keeping them open with occasional small purchases to maintain their positive impact on your credit profile.

4. Applying Indiscriminately

Submitting multiple credit applications within a short period results in hard inquiries on your credit report, which can lower your score temporarily. Applying indiscriminately not only affects your credit score but also increases the likelihood of rejection. Be selective and strategic when applying for credit, ensuring you meet eligibility criteria before submitting applications.

Long-Term Strategies for Building and Maintaining Good Credit

Achieving and maintaining good credit requires consistent effort and strategic planning. Implementing these long-term strategies will help you sustain a strong credit score while enhancing your financial stability. Follow these strategies for maintaining good credit:

Hold Old Credit Accounts

One of the most effective ways to maintain good credit is by keeping old credit accounts open. The length of your credit history plays a significant role in your overall score. Closing older accounts can reduce your average account age, which may lower your score. Instead, keep these accounts active by making small purchases and paying them off promptly. This approach demonstrates financial responsibility and boosts your credit profile over time.

Remove Incorrect or Negative Information from Your Credit Reports

Errors in your credit report can unfairly lower your score, making it crucial to review your reports regularly. Negative items like outdated debts or inaccurate late payments can stay on your report for years, affecting your creditworthiness. Dispute any incorrect information with the credit bureaus to ensure your report accurately reflects your financial behavior. This proactive approach can significantly improve your credit over time.

Report Rent and Utility Payments

Adding rent and utility payments to your credit history can be a game-changer, especially for those with limited credit accounts. Some credit reporting agencies allow you to include these payments, demonstrating consistent financial responsibility. While not all lenders consider these accounts, reporting them can diversify your credit profile and provide a small but meaningful boost to your score.

How Long Does It Take to Improve an Existing Credit Score?

Improving a credit score depends on the severity of past issues. Minor improvements can happen within a few months, but significant increases may take a year or more. Consistently applying good practices can show steady progress.

How long does it take to build credit? Different credit events have varying impacts on your score and require different recovery periods. For instance, severe financial setbacks like bankruptcy can take over six years to recover fully, while smaller issues like closing or maxing out a credit card may only take around three months. Similarly, a home foreclosure may take about three years, and a missed or defaulted payment often requires 18 months to bounce back. Even a late mortgage payment (30 to 90 days) typically impacts your credit for nine months.

Your financial habits play a crucial role in how quickly your score improves. Consistently paying bills on time, reducing outstanding debts, and avoiding unnecessary credit inquiries can significantly speed up recovery. Moreover, your starting point matters—those with higher initial credit scores may see slower improvements, while those with poor credit might experience faster gains with responsible behavior.

Focus on strategies tailored to your specific situation to improve your credit effectively. If you’ve maxed out a credit card, aim to lower your credit utilization ratio by paying down balances. If missed payments are the issue, prioritize building a record of timely payments. While improving your credit score takes time and effort, consistent and disciplined actions will lead to steady progress.

Final Words

So, how long does it take to build credit? The answer depends on your starting point and the consistency of your efforts. Whether starting from scratch or improving an existing score, patience and discipline are key. By following the tips outlined here and avoiding common pitfalls, you’re well on your way to achieving and maintaining a strong credit score.

Looking for more financial insights? At Educounting, we believe financial literacy is key to success. Dive into our resources to learn, grow, and master your finances. Let’s make smart money decisions together!