What are Some Key Components of Successful Budgeting?

Money management is often seen as a complex puzzle, but one of the most reliable methods to navigate personal finances effectively is through budgeting. In fact, “What are Some Key Components of Successful Budgeting?” is a question that countless individuals

How Much Should I Contribute to My HSA?

In 2023 and 2024, healthcare costs surged more than initially projected, driven by unexpected trends in the utilization of GLP-1 drugs for diabetes and weight management. These medications, known for their effectiveness, have significantly impacted healthcare spending as more individuals

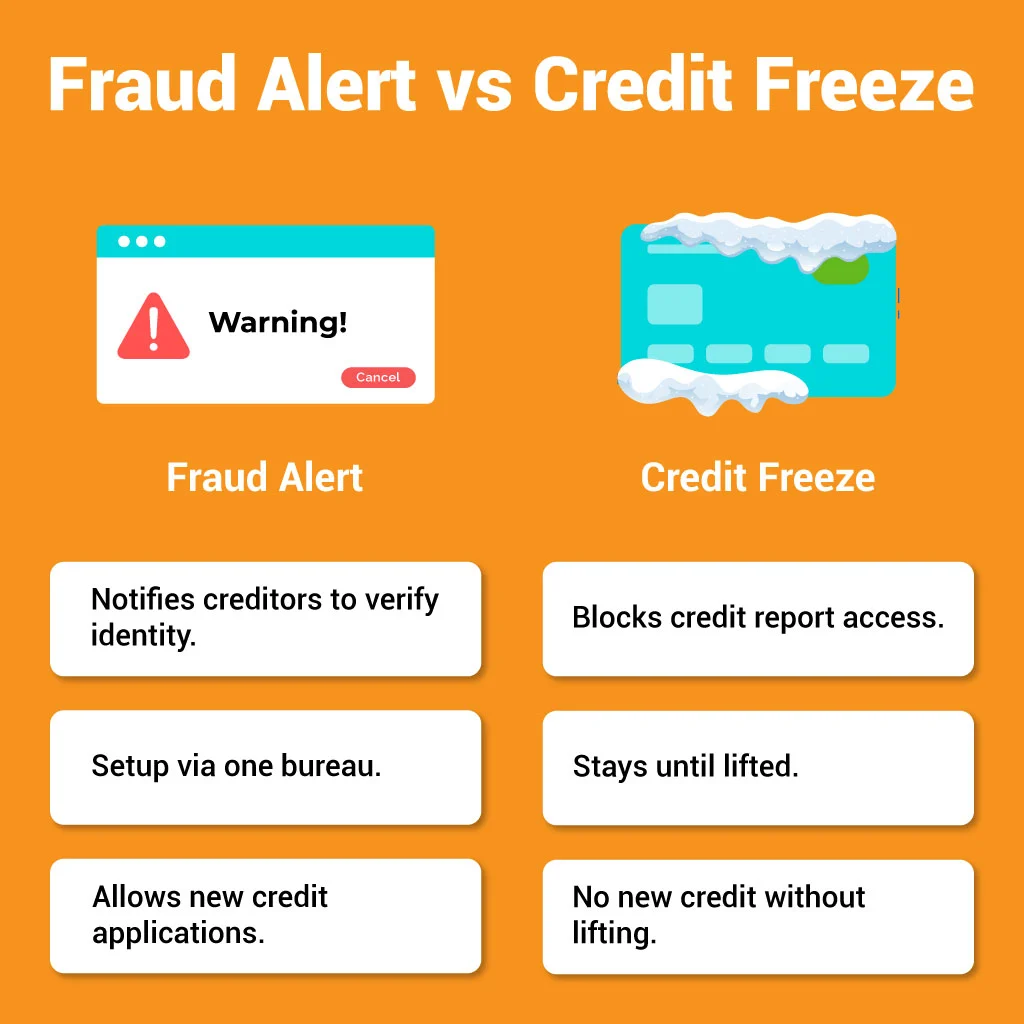

Fraud Alert vs Credit Freeze: Which is Better?

Identity theft and financial fraud are growing concerns in today’s digital age. To protect yourself, you have powerful tools: fraud alerts and credit freezes. While both are designed to safeguard your credit, they function differently. A fraud alert prompts creditors

Passive Income vs Residual Income: Understanding the Difference

Achieving financial freedom isn’t just about earning a high salary or pinching every penny—it’s about creating sustainable income streams that keep flowing, even when you’re not actively working. Imagine waking up to find that your investments, projects, or creative efforts

How Long Does It Take to Build Credit?

In 2023, the average Credit Score in the U.S. reached 715, a slight increase from 714 in Q3 2022, according to Experian. This marked the 10th consecutive year without an annual decline, emphasizing a steady decade of credit improvement since

What is a Secured Credit Card? How to Choose the Right One

Credit plays a vital role in our lives—it determines our ability to borrow money, rent apartments, buy cars, and even secure jobs. But what happens when you don’t have any credit history, or worse, a poor credit score? This is