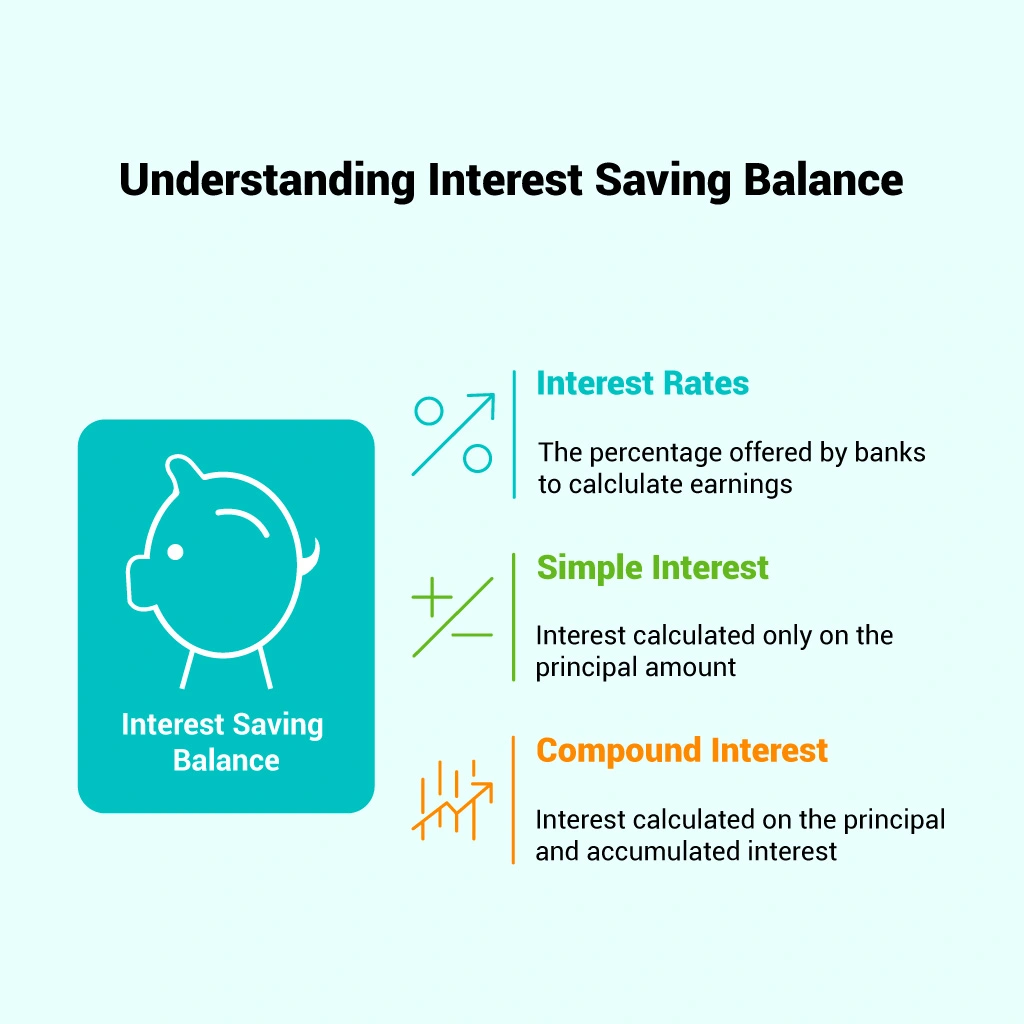

What is Interest Saving Balance? From Beginner to Pro

If you’ve ever tried to save money in a bank, you may have come across the term interest saving balance. It sounds technical, but in reality, it’s a simple concept that can help you grow your money over time. What

How Insurance Protects You from Financial Loss

Life is unpredictable. One moment, everything seems fine, then suddenly, disaster strikes. Whether it’s a house fire, a car accident, or an unexpected medical emergency, financial loss can happen in an instant. Without the right protection, you could find yourself

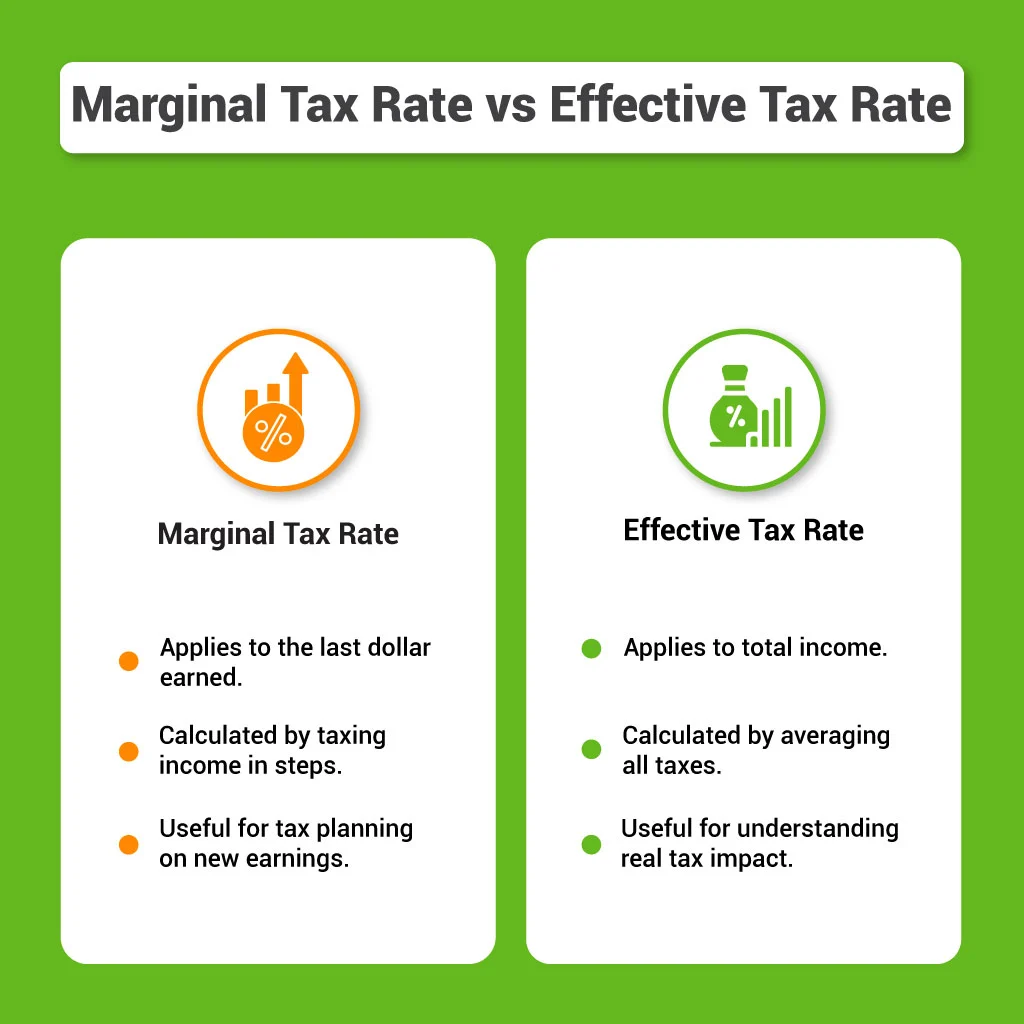

Marginal Tax Rate vs Effective Tax Rate: What Every Taxpayer Should Know

The United States operates under a progressive tax system, which splits your income into multiple tiers. Each tier, or bracket, applies a different tax rate solely to the portion of your income that lands within it. For instance, a single

What are Some Key Components of Successful Budgeting?

Money management is often seen as a complex puzzle, but one of the most reliable methods to navigate personal finances effectively is through budgeting. In fact, “What are Some Key Components of Successful Budgeting?” is a question that countless individuals

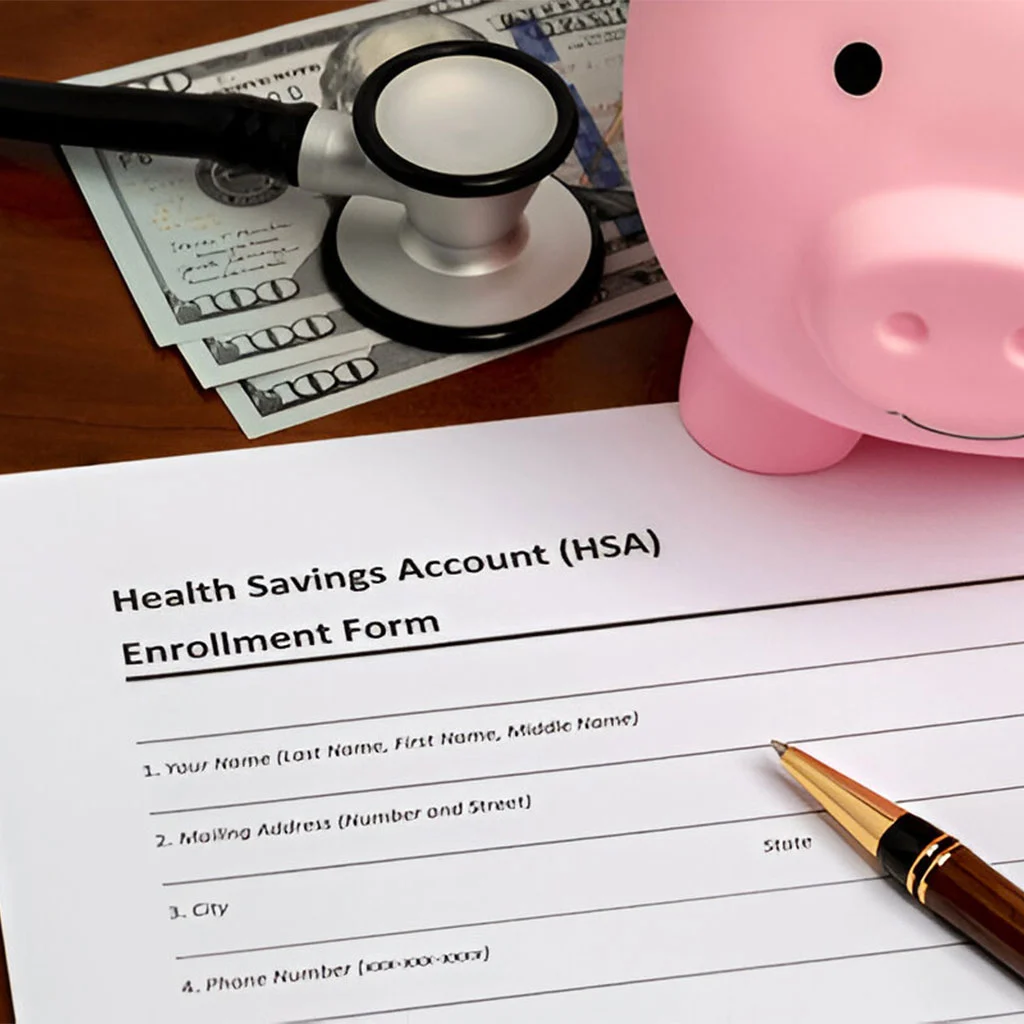

How Much Should I Contribute to My HSA?

In 2023 and 2024, healthcare costs surged more than initially projected, driven by unexpected trends in the utilization of GLP-1 drugs for diabetes and weight management. These medications, known for their effectiveness, have significantly impacted healthcare spending as more individuals

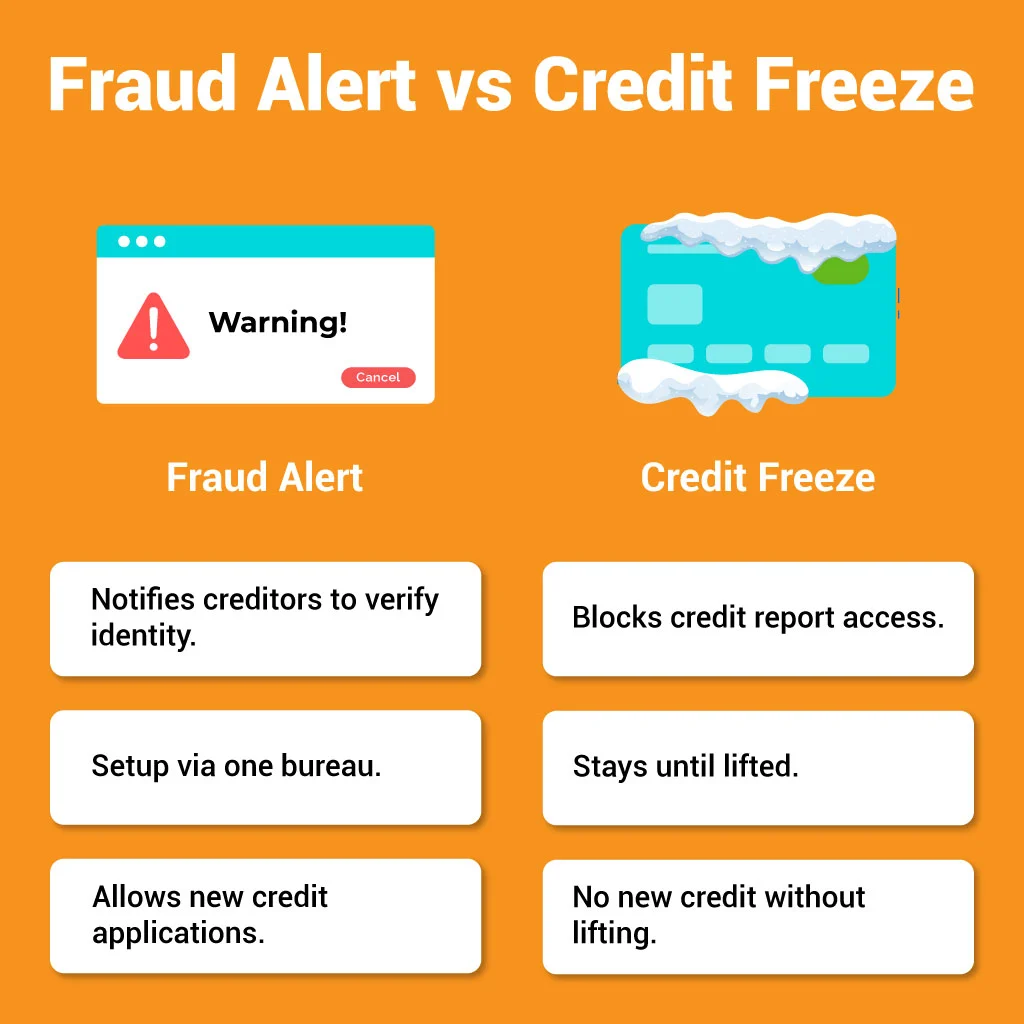

Fraud Alert vs Credit Freeze: Which is Better?

Identity theft and financial fraud are growing concerns in today’s digital age. To protect yourself, you have powerful tools: fraud alerts and credit freezes. While both are designed to safeguard your credit, they function differently. A fraud alert prompts creditors