Every successful business eventually comes to a point where the small decisions aren’t just enough. This is where capital budgeting comes in!

They are the financial framework that companies depend on to analyze the major investments and decide which opportunities are worth trying to facilitate long-term growth. For example, there’s always this debate in a growing company about planning its upcoming big move. For example, it can include anything from investing in machinery to speed up production to opening a new branch; all these things play a crucial role in shaping the future.

That’s why, in the following discussion, we will be talking about what exactly defines capital budgeting, methods of capital budgeting in financial management, along with all the important topics to help you make the right call. Read on to find out!

What Is Capital Budgeting?

In short, the capital budgeting definition basically refers to the process that companies mainly use to evaluate and pick long-term investments that are expected to create greater returns in comparison to their expenses.

You can compare it to the financial roadmap that helps companies decide which major projects are worth opting for.

However, at the center of the capital budget is the capital expenditures (CapEx). They are long-term investments in the assets that benefit the companies year after year, such as buildings, equipment, vehicles, and so on.

On the other hand, there are the operational expenses (OpEx), which cover the daily expenses of running a business, like salaries, utilities, rent, and various office supplies. Simply put, OpEx keeps the organization functioning in the short term, whereas CapEx focuses on the long-term growth.

Why Capital Budgeting Matters

Capital budgeting plays a vital role in shaping an organization’s long-term goals. From financial analysis to strategic planning, the list goes on!

That is, they don’t rely on mere instincts; instead, they ensure that every major project delivers real value over time. Here’s why they matter so much:

- Helps companies select investments that support their future goals and strategy.

- Ensures that limited financial resources are invested in projects with the highest potential returns.

- Detects the potential risks early by analyzing the expenses, cash flows, and uncertainties.

- Prevents costly mistakes that might look promising at the beginning but fail to provide the desired results.

- Focuses on projects that support stable, long-term growth rather than short-term wins.

Types of Capital Budgeting Decisions

Capital budgeting decisions offer a wide range of long-term investment choices. Below are some of the most common ones:

- Expansion projects involve growing the business by opening new facilities, new markets, or launching new products.

- Replacement decisions help improve efficiency, reduce maintenance expenses, and keep operations running smoothly through upgrading equipment.

- Regulatory or safety investments may not directly increase profits, but they are important for avoiding penalties and maintaining the company’s reputation.

- Research and development initiatives help companies innovate, develop new products, and stay competitive in the industry.

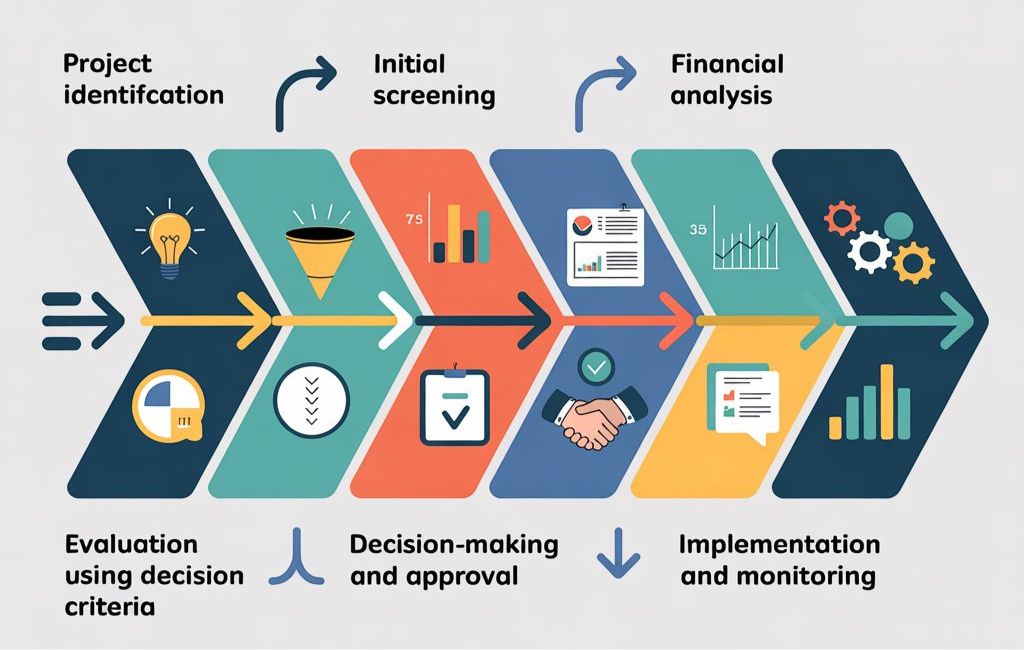

The Capital Budgeting Process

The capital budgeting process ensures that every project is assessed properly and is aligned with the long-term business goals.

This is how it works:

Step 1: Project Identification

The first and foremost thing that companies do is identify the potential investment opportunities, like new tools and equipment, technology upgrades, and so on. That is, the goal is to collect the ideas that support growth.

Step 2: Initial Screening

As always, not every idea moves forward; companies perform a quick preliminary review to eliminate the ones that don’t align with the goals. In short, only the most promising ones move forward.

Step 3: Financial Analysis

The most crucial one, indeed. Here, the companies estimate and take into account everything, such as the expenses, expected cash flows, risks, and potential returns. Tools like forecasting, cost estimation, and risk assessment help determine whether it is financially viable or not.

Step 4: Evaluation Using Decision Criteria

Once the financial data is ready, the companies begin applying capital budgeting techniques, like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index for the comparison.

Step 5: Decision-Making and Approval

In this phase, the senior management or the board decides whether to accept, modify, or reject, depending on the company’s goals, financial capacity, and risk tolerance.

Step 6: Implementation and Monitoring

Lastly, if approved, the project moves into execution. The companies begin tracking the progress, monitoring expenses, and comparing the actual performance against the initial projections.

Capital Budgeting Methods and Techniques

To make the right decisions, companies often depend on several capital budgeting methods, such as the following:

Net Present Value (NPV)

Net present value measures the project value, which is basically created through comparison of the present value of the future cash inflows to the initial investment. For instance, a positive one refers to the project will add value, while a negative one might decrease the value.

Internal Rate of Return (IRR)

IRR is the discounted rate at which a project’s net present value becomes equivalent to zero. Meaning, a project is typically accepted if the IRR is high compared to the organization’s required rate of return.

Payback Period

This calculates how long it will take for a project to recover its initial investment. Short ones are generally preferred as they are simple and easy to use.

Discounted Payback Period

This method improved on the traditional payback period by discounting through future cash flows. It shows how long it will take to recover the investment, along with offering a more accurate scenario of the risk and cash flow timing.

Profitability Index (PI)

PI measures the value created per unit of investment by dividing the present value of future cash inflows by the initial expense. That is, a PI greater than 1.0 indicates a potentially profitable project and is useful for comparisons of multiple projects with varied investment sizes.

Accounting Rate of Return (ARR)

ARR calculates the expected return based on the accounting profits instead of the cash flows by dividing the average annual profit by the initial investment.

Key Concepts in Capital Budgeting

As always, there are some core ideas in capital budgeting that are designed to help companies to opt for a project that provides the strongest financial return. They are:

Time Value of Money

This concept means that the money today is worth more than the same quantity in the future.

It happens when money can earn interest, be invested, or grow with time. NPV and IRR depend heavily on it to evaluate future cash flows precisely.

Discount Rate and Cost of Capital

This represents the company’s required rate of return, essentially the minimum return required to justify an investment.

Here, a high rate means the project is expected to generate stronger returns to be considered worthwhile.

Cash Flow Estimation

Precise cash flow forecasting is at the core of the capital budgeting. Businesses estimate all the expected inflows and outflows over the project’s lifespan. The good one helps determine whether the project will generate enough value or not.

Risk and Uncertainty

Every long-term investment contains some level of risk associated with it. Such as market changes, cost overruns, competition, and economic conditions, all can affect the overall performance.

Capital budgeting involves risk analysis to better understand the outcomes and make more informed decisions.

Capital Rationing

Sometimes companies have more opportunities than available funds. As a result, this rationing helps companies prioritize the ones when resources are limited to make sure the most valuable ones are chosen first.

Practical Applications and Examples

Capital budgeting is a tool companies use every day to make the right decisions. Below is a list of a few practical examples to show how they work in real life:

Small Business Example

Let’s say there’s a local bakery deciding whether to purchase a new commercial oven or not. The owner estimates the overall expense, the rise in production capacity, and the extra revenue it might generate.

They also compare the upfront investment with the expected cash flows, and using the NPV or payback period, they can find out whether it will pay for itself and bring long-term profits.

This simple application shows how even small companies depend on capital budgeting to prevent unwanted spending.

Corporate Example

A large manufacturing company might consider creating a new production facility to meet the rising demand. As a result, the finance team predicts the construction expense, operating costs, and future cash inflows.

They even evaluate using NPV, IRR, and profitability index to compare with other potential investments. Afterwards, senior management decides whether it aligns with the goals or not.

Common Pitfalls to Avoid

Even with the most structured process, companies can make mistakes. Some common ones to avoid are:

- Overestimating future cash flows

- Ignoring the time value of money

- Underestimating project risks

- Focusing only on short‑term profits

- Not comparing alternatives

- Lack of proper post‑implementation monitoring

Best Practices for Effective Capital Budgeting

The best practices for effective capital budgeting are about using the proper tools and making the right decisions that support long-term successful budgeting.

Here’s how:

Use Multiple Evaluation Methods

Depending on a single technique can often give an incomplete picture. Hence, make sure to combine methods, like NPV, IRR, payback period, and profitability index. Also, cross-checking results helps confirm whether a project is financially sound or not.

Conduct Thorough Cash Flow Analysis

Accurate cash flow forecasting is the foundation of good decision-making. So, it is better to estimate all inflows and outflows, multiple scenarios, along with avoiding overly optimistic assumptions.

Incorporate Risk Assessment

Every investment contains uncertainty; hence, evaluate market risks, cost overruns, and economic conditions. Plus, use sensitivity analysis to test how various changes affect the overall performance.

Align with Strategic Goals

A project can seem promising, but still might not be the right one. That’s why, make sure every investment supports the company’s long-term goals to keep the resources focused where they matter most.

Post-Implementation Reviews

The process doesn’t end with the approval of the project only. Instead, you have to compare the actual outcomes with initial projections to calculate performance, find out which worked well, and could be further improved.

Conclusion

Capital budgeting is the thing that ideally sits at the core of every smart business strategy. From turning uncertain calls into strong ones, they let organizations take charge and invest confidently in projects that will help to shape their future.

After all, by using tools like NPV, IRR, and payback period, companies will be able to figure out which opportunities will provide long-term value and which might fall behind in the race.

Capital budgeting is the process businesses use to evaluate and select long-term investments, such as new projects, equipment, or expansions, to ensure they generate profitable returns over time.

The seven commonly used capital budgeting techniques are:

Payback Period

Discounted Payback Period

Net Present Value (NPV)

Internal Rate of Return (IRR)

Profitability Index (PI)

Accounting Rate of Return (ARR)

Modified Internal Rate of Return (MIRR)

A capital budgeting method is a financial evaluation technique used to compare investment options by analyzing cash flows, risk, and expected returns to decide whether a project is financially viable.

The seven steps of the capital budgeting process are:

Identifying investment opportunities

Estimating project cash flows

Assessing project risk

Selecting an appropriate evaluation method

Evaluating and ranking projects

Making the investment decision

Monitoring and reviewing project performance