What is it like to grow up with money? Honestly, I wouldn’t know from personal experience.

But, what I do know from paying attention to those with money is that it’s different. My parents came from small towns in Indiana and neither had money. My dad was right off the farm and his understanding of many things outside of having a pet cow and raising corn was lacking.

He tried but didn’t have the experience. I asked him if I should take the job offer made by Ernst & Young after graduating college. He didn’t ask me if it was a good offer. He knew it was a good company and he immediately said “yes”, because “it was a job”.

My mother had the influence of a father who was clearly focused on education and making something better of himself, and that included gaining more financial education and experience. So my mother had much more knowledge about money than my father ever did. He told me on several occasions: “If I would have listened to your mother about investing, we’d be in a much better place than we are now.”

Some of my earliest recollections were differences in the financial status of people. Indianapolis is a mid-sized city at best. There are clearly pockets of wealth, but nothing to the levels I saw during my travels to large cities such as New York, London or Paris, for instance.

I often thought about how my life could’ve been different if I was born into another family and how that would’ve changed who I am today. But, it could’ve also gone the other way too!

I’m not angry or bitter about where I’ve come from. But, I have been envious. I’m grateful for many things my parents have done for me because life would be very different if I was still on a 40-acre farm in southern Indiana.

I’ve frequently asked myself about the differences between having money versus not having money. I have to admit that there have been times when I’ve felt left behind by others.

Though not angry, I believe I understand the feelings that sometimes come to people who get frustrated to the point of anger when not even given the insight of how to find and take advantage of an opportunity.

Even though I’ve experienced so much and been successful, I believe I missed a lot because I didn’t have one key aspect necessary to take anything to the next level: A role model or someone to show the way to a better life.

Everyone has different experiences and these are my own. I think you might find some common threads that could be useful when teaching YOUR children about money.

You Need a Mentor

Many of the learnings I had came from home. In total, there were eight of us in one house. Six kids and mom and dad. So, when you do the math, MORE clearly means LESS in a house when money isn’t free-flowing and grown on a tree. More kids means less space, less disposable income, less clothes, less food, and less quality time with mom and dad. Simply LESS.

For most of my younger life, I started to embrace a certain view of the world, which was clearly not healthy. Those with more money were more WORTHY. I wish that wasn’t the false truth that became my reality and one I hope no child ever picks up. I hope I might help to change this line of thinking.

I believe that my hope in writing an honest piece about myself is to first show others that feelings about money are complicated. They come from your own experiences, and I believe it’s ok to realize they may have messed you up a bit. However, since none of us are perfect, we can work to change them and make strides to make them better.

Even with an immense amount of formal education and knowledge, I personally continue to make stupid decisions about money, because I feel like they were built into me from a young age. But, they don’t defeat me, as I keep my goal in mind (GOAL: Have enough money to be comfortable and have a great deal of flexibility to enjoy my life.)

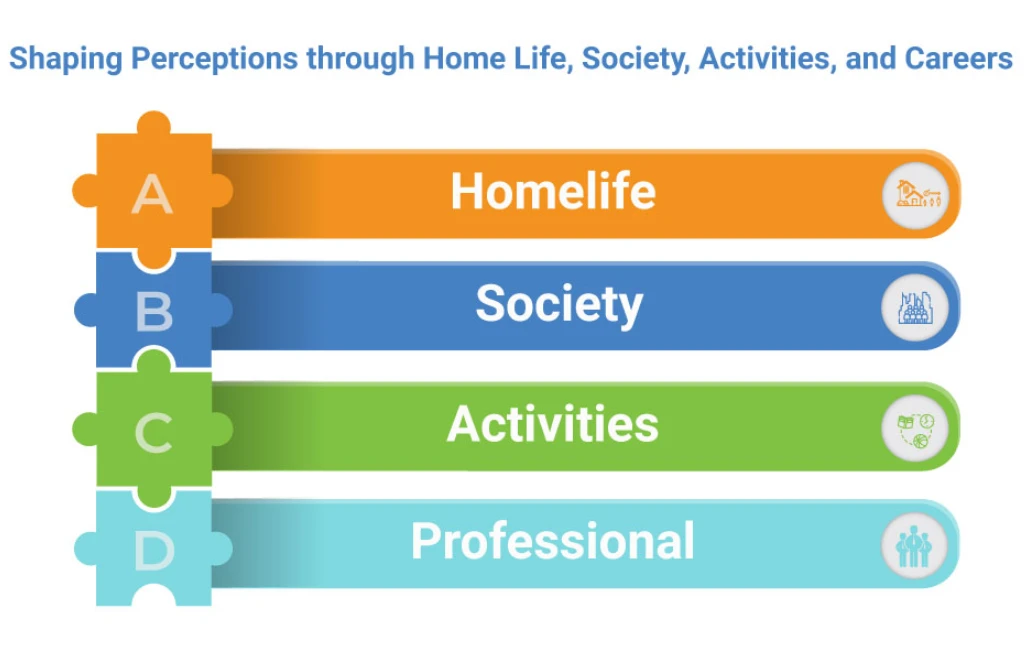

Ok, so where did these ideas come from? I think it’s easy to see that our perception tends to be reality and those perceptions are formed through experiences that I have classified as being from home life, society, activities, and careers. Depending on your age, they can be very different. For instance:

Homelife:

As a kid, if we are raised by a stay-at-home parent, we spend a tremendous amount of time around our parents/family and much less time out in society. A lot of foundational information is laid early by those near us because we generally rely upon and trust them. Therefore, this seems to be VERY important for our money journey.

Society:

As we begin to go to school, I call this being exposed to society. We begin to see differences up close. We see the way people live, behave, spend money, and more. School builds our view of the outside world very quickly.

Activities:

Activities as kids usually are attached to school such as sports, music, and other activities (dances, birthday parties, etc.). As we grow older, these activities change and aren’t generally tied to a school (bars, vacations, etc.).

Professional:

As an adult who is working, we spend more time performing our job than we do at home. Our view of the world is related more to our experiences at work. These continue to affect our view of the world both from seeing and watching others as well as how we are treated (pay, promotions, responsibilities given, etc.).

My Home Life

My homelife was interesting in several ways. I had a big family, and money seemed to sit like a blanket over most conversations. It was heavy, and it could never be ignored. I became very familiar with the word “No” because we couldn’t afford most things.

I started to grow angry about never being able to afford things that other kids in the neighborhood could, like a new bike, clothes, video games, vacations and more. I started to really hate the “B” word. It wasn’t my name, but it was the dreaded Budget.

It’s funny what we remember as kids. I can remember being denied going on the church ski trip in 6th, 7th and 8th grade. If I remember correctly, it was going to cost $60, but it wasn’t in the budget. I could give up birthday presents and possibly some Christmas as well to get it. But, it was just way too much of a sacrifice.

During my younger years, us kids weren’t included in money conversations. So, I wasn’t aware we needed money later in life, and there was something called “retirement”. But, I WAS told that college was something expensive and we had to save for that. Putting away money now, for a bigger payoff later was a common mantra.

I didn’t clearly understand what that meant. My mother often said, “when you get older you will be able to buy whatever you want.” But how do you believe something that hasn’t been true your entire young life?

There was a common thread throughout my entire childhood, and that was scarcity. Money was scarce, space was scarce, food was scarce, and much more. I couldn’t figure out why other families had a lot more. I know hindsight is 20/20 and I wished I would have had more time to talk about these things with my mother.

But, time was scarce too, because we didn’t have enough money to cover our bills and she traded her time for money for a nursing graveyard shift.

I remember that there were always broken arms, ripped clothes, flat tires, and other things that all cost money. It just meant we rarely got to go out to eat, a vacation or something else fun.

If you asked for something not on the grocery list, you’d get an automatic “No”. Ask for a luxury of any kind, like name-brand cereal (i.e.-Apple Jacks), then you got a “No”. It was the way we lived. I started to form my thoughts about what it meant to be rich. Ready? Here goes:

- You didn’t share a room or bed with your brother

- Your house had a sprinkler system (and you paid someone to cut your lawn)

- You took vacations by plane and didn’t stay with your family (you stayed in a hotel!)

- You got your own clothes (with your initials on them, so no one could take them)

That’s about it. I wonder what your belief of what “rich” meant from when you were a kid. Shoot me an email, as I’d love to hear about it.

Here are some very interesting things I learned along the way when growing up in a large family with little cash:

- The early bird gets the WARM (that’s not a misprint, get up early and you get the warm water to take a shower because the water heater had a small tank). Once the shower started, it didn’t stop, one body jumped out, and another jumped in.

- When the money’s gone it’s gone. Mom would NEVER think about going into debt with a credit card. If you can’t make it work, too bad because no one’s coming to rescue you.

- Cornflakes aren’t only for breakfast. They’re good as an economical dry snack, in meatloaf to make it more filling, or even for dinner as a two-course meal (milk AND cornflakes).

- “Take me downs”and “hand me downs” were normal, sometimes you were handed clothes that an older sibling wasn’t wearing. Other times you had to go and get them, so when you needed them… Take ‘em!

- I didn’t know girls’ shirts buttoned on the other side until I got one handed down to me, and someone at school made fun of me. Wrong move for them, but there you go.

- No such thing as something that was yours. It was communal. To this day I love putting my name on stuff… a tag, a Sharpie, embroidered, etc. There was no sense of ownership. It was a socialist society.

- People had to be taught to share, and that was always a weird concept to us. Sharing was whoever was strongest, got it, or whoever mom said, got it.

- “No” means “no”.We didn’t have the money. Things were scarce. We couldn’t buy stuff that wasn’t on the list.

- It literally took me until I was in high school to understand that almost everyone else gets their bread from a regular store, not the “day old store” which had all the expired stuff from the “real stores”.

- Twinkies (and other stuff) that were gently beaten up, like a crushed box, was the only way mom would buy those treats because they were cheaper and “tasted the same” (which they did).

- When we saw leftover food at an event, we’d ask if we could take some home.

I think I could go on for a very long time. But, the point I’m trying to drill home is we learn from our childhood — in ways I never realized until really digging into it.

So what about society? Let’s save that for a future post. Just remember we have emotions tied to our experiences and sometimes it takes a little time to understand it, so you can move forward.

Until next time, enjoy your non-expired bread and realize you are already rich!