As businesses navigate the ever-evolving landscape of asset management and acquisition strategies, the decision between Capital Lease and Operating Lease emerges as a critical juncture. This pivotal choice transcends simple preference, diving deep into the essence of financial structuring, aligning with organizational objectives, and seizing tax efficiencies. The distinction between capital and operating leases is paramount for entities across the board, influencing the optics of financial statements, liquidity management, and broader strategic financial positioning.

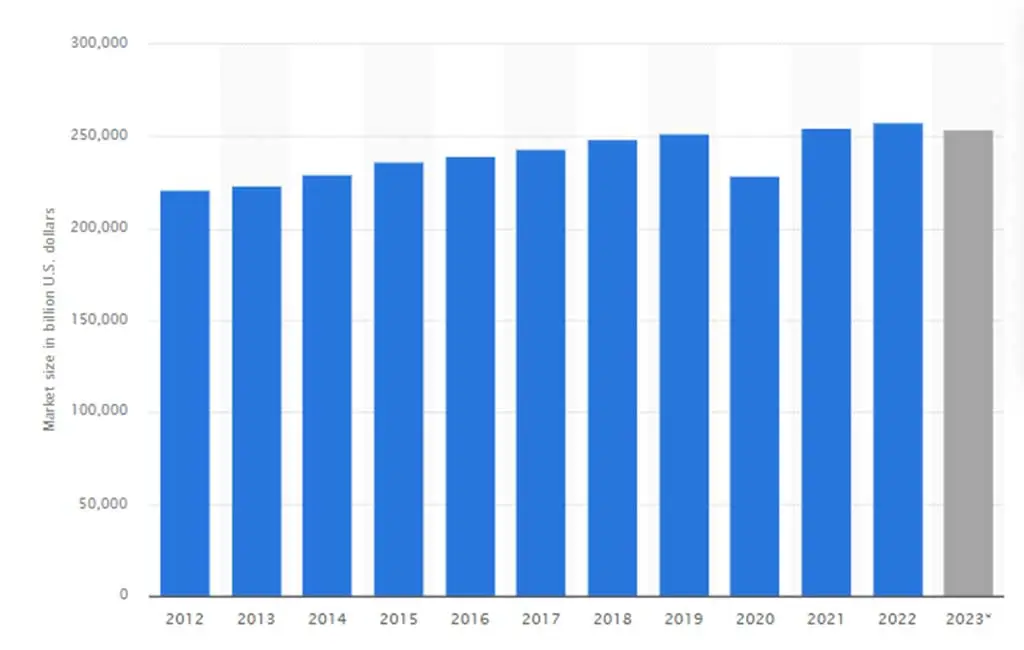

The commercial real estate leasing market in the United States is rebounding robustly from the initial shocks of the coronavirus pandemic in 2020, showing remarkable resilience and growth in 2021 and 2022. The market is reaching a size of approximately 257.6 billion U.S. dollars in 2022, so the relevance of making an informed lease decision has never been more pronounced.

This resurgence underscores the importance of Capital Lease vs. Operating Lease decisions in today’s business environment, where choosing the right lease option can significantly impact a company’s operational agility and financial health. As the market recovers and expands, businesses have unique opportunities and challenges in leveraging real estate and other assets for sustainable growth.

This blog aims to demystify the differences between capital and operating leases, offering insights into how each can cater to varying strategic needs and financial goals. With a deeper understanding of these leasing options, businesses are better positioned to navigate the complexities of the current economic climate, ensuring their leasing strategies are both prudent and aligned with their long-term vision.

What is Capital Leasing?

A capital lease is pivotal for entities seeking to utilize assets without immediately procuring them outright. This type of lease arrangement bestows upon the lessee— the party renting the asset— certain attributes akin to ownership, thereby mandating the financial treatment of the leased fixed asset (property, plant, and equipment – PP&E) as though the lessee were the bona fide owner.

This financial arrangement is characterized by its ability to transfer the economic benefits and burdens associated with the asset from the lessor—the rightful owner—to the lessee. As such, although the legal title may remain with the lessor for the lease term, the lessee enjoys functional use and benefits akin to ownership.

The US GAAP has outlined specific criteria to classify a lease as a capital lease. The fulfillment of any of these conditions necessitates the capital lease accounting treatment:

- Ownership Transfer: A fundamental criterion is the eventual transfer of ownership from the lessor to the lessee upon the lease’s expiration. This criterion ensures that the lessee will become the outright owner of the asset at the end of the lease term, mirroring a purchase scenario.

- Bargain Purchase Option: This condition allows the lessee the option to acquire the leased asset at a price significantly lower than its fair market value when the lease concludes. Such an option implies a pre-determined purchase decision, making the lease akin to a financing agreement to purchase the asset.

- Lease Term: The lease’s duration is crucial; if it amounts to 75% or more of the asset’s estimated useful life, it is considered a capital lease. This criterion reflects the lessee’s substantial asset utilization throughout its functional life.

- Present Value of Lease Payments: When the present value of all lease payments equals or surpasses 90% of the total fair market value of the asset at the lease’s commencement, the lease is treated as a capital lease. This threshold signifies the lessee’s significant financial commitment, akin to purchasing the asset on credit.

Capital leases, therefore, represent a unique financial instrument that allows businesses to leverage assets for their operational needs while accounting for them in a manner that reflects both the benefits and responsibilities of ownership. This classification impacts the lessee’s balance sheet by adding both the asset and corresponding liability and affects the lessee’s financial strategy and planning.

What is Operating Leasing?

An operating arrangement is tailored for short-term equipment rental, often extending for less than a year. It is especially suitable for assets subject to rapid technological advancements or changes in business needs, such as computer technology, software, and electronic equipment.

The defining characteristic of an operating lease is its treatment of the lessee’s financial records. Unlike capital leases, where the lessee assumes ownership-like rights and responsibilities for the asset, an operating lease is recognized purely as an operating expense. This distinction underscores the lessee’s lack of ownership over the leased property, aligning with the principle that the lessee borrows the asset temporarily without any intention or obligation to purchase it.

Operating leases offer several distinct advantages and features for businesses:

- Operating Expense Recognition: Lease payments under an operating lease are recorded as operating expenses on the income statement. This accounting treatment provides the benefit of reducing the reported earnings before interest and taxes (EBIT), potentially leading to tax savings.

- Off-Balance Sheet Financing: A key attribute of operating leases is their exclusion from the balance sheet. Since the lessee does not assume ownership of the asset, both the asset and the corresponding lease liability remain off the lessee’s balance sheet. This can lead to a more favorable appearance of the company’s financial leverage and debt-to-equity ratios, as it does not inflate its total assets and liabilities.

- No Depreciation Claims: As the lessee does not own the asset, it cannot claim depreciation expenses for tax purposes. While this may seem like a drawback compared to capital leases, it simplifies the accounting process and aligns with the temporary usage model of operating leases.

Operating leases thus present a compelling option for companies that prioritize operational flexibility over asset ownership. By opting for an operating lease, businesses can ensure access to the latest technology and equipment without the long-term financial commitments and accounting complexities associated with purchasing or capital leasing. This leasing option is particularly beneficial for companies that frequently update or replace their equipment to stay competitive in fast-evolving industries.

Capital Leases Vs. Operating Leases

When navigating the complex business financing and asset management landscape, understanding the distinctions between capital leases and operating leases is crucial. These leasing options offer different pathways for businesses to access and use assets, each with unique financial, tax, and accounting implications. Through a detailed examination of their differences, businesses can strategically choose the lease type that aligns with their operational needs, financial goals, and risk management strategies.

Ownership

In a capital lease arrangement, the lessee essentially obtains ownership rights of the asset, even if the legal title might only transfer at the end of the lease term. This ownership comes with the benefits and responsibilities typical of owning an asset, such as the right to claim depreciation and to sell or modify the asset.

Operating leases do not confer any ownership rights to the lessee. The lessor retains ownership throughout the lease term, allowing the lessee to return the asset at the end of the lease without further obligations, thus avoiding the risks associated with asset depreciation and obsolescence.

Accounting

Capital leases require the lessee to record the leased asset as a tangible asset on the balance sheet, reflecting a corresponding liability for lease payments. This method affects the balance sheet’s asset and liability side, impacting financial ratios and the company’s perceived financial health.

Operating leases were not required to be listed on the balance sheet until recent changes in accounting standards, allowing businesses to keep their debt-to-equity ratios low. However, with new accounting standards, operating leases now need to be recorded. However, they still offer different financial statement impacts compared to capital leases, primarily through their treatment as operating expenses.

Tax

Capital leases can provide tax advantages, as the lessee can claim depreciation on the asset and interest on the lease payments as business expenses, potentially reducing taxable income.

For operating leases, the entire lease payment is deductible as a business expense in the period it’s paid, providing a straightforward way to reduce taxable income without the complexity of calculating depreciation and interest deductions.

Expenses

The initial financial burden of a capital lease can be higher than an operating lease, given the asset’s inclusion on the balance sheet and the need to account for depreciation and interest expenses.

Operating leases typically result in lower initial expenses, reflected directly as operating expenses. This can make operating leases more attractive for short-term asset needs or assets that a company prefers not to own.

Risk of Obsolescence

With capital leases, the lessee bears the risk of obsolescence, as they effectively own the asset. This can be a significant downside for technology or equipment rapidly becoming outdated.

Operating leases mitigate the lessee’s obsolescence risk, making them ideal for high-tech or rapidly evolving assets. The flexibility to upgrade or change assets at the end of the lease term without residual value concerns is a clear benefit.

Use

Capital leases are often utilized for long-term asset needs where the lessee intends to use the asset for a significant portion of its useful life, benefiting from the sense of ownership without immediate large capital expenditure.

Operating leases are suitable for short-term needs or for accessing frequently updated or replaced assets. This option allows businesses to respond to market changes and technological advancements.

Advantages

The advantages of capital leases include the ability to claim ownership benefits such as depreciation, making them suitable for long-term asset financing. They also allow businesses to leverage assets without significant upfront costs.

Operating leases offer flexibility and lower upfront costs, making them ideal for temporary or seasonal needs. They also provide a simple way to manage expenses and avoid the risks of owning rapidly depreciating assets.

Pros and Cons of Capital Lease Vs. Operating Lease

Choosing between a capital lease and an operating lease can significantly impact a company’s financial statements, tax obligations, and balance sheet. Each type of lease has advantages and disadvantages that can influence a company’s financial strategy and operational flexibility. Here’s a comparison of the key financial implications of capital leases versus operating leases:

Accounting Treatment and Reporting

- Capital Lease: Capital leases are treated like purchased assets financed with debt. Consequently, they are registered as both an asset and a corresponding liability on the balance sheet. This accounting treatment acknowledges the lessee’s control over the asset and the obligation to make future payments.

- Operating Lease: Operating leases are simpler in terms of accounting and reporting. Only the lease payments are recorded as expenses in the income statement, making them a more straightforward option for businesses looking to streamline their balance sheets.

Impact on the Balance Sheet and Liability

- Capital Lease: Capital leases increase both assets and liabilities on the balance sheet. This dual effect can influence a company’s financial ratios, such as its debt-to-equity ratio, which may affect how investors and lenders view its financial health.

- Operating Lease: Operating leases generally have a smaller impact on the balance sheet, primarily because they do not result in the recording of an asset or a liability. This can benefit businesses with a cleaner balance sheet and better financial ratios.

Maintenance and Risk Responsibility

- Capital Lease: With capital leases, the lessee is responsible for maintenance and the risk associated with the asset. This can mean additional costs and obligations for the lessee but offers more control over the asset’s use and maintenance.

- Operating Lease: With operating leases, the lessor often retains responsibility for maintenance. This can relieve the lessee from the burden of upkeep and repair, making operating leases an attractive option for assets requiring high maintenance or prone to obsolescence.

Tax Implications

- Capital Lease: Capital leases offer tax advantages, including claiming asset depreciation and deducting interest expenses on lease payments. These benefits can reduce taxable income, providing a significant advantage for businesses looking to maximize their tax efficiency.

- Operating Lease: While lease payments under an operating lease are tax-deductible as operating expenses, no depreciation benefits exist. However, the straightforward deduction of lease payments can still offer tax advantages, particularly for businesses that prefer a simpler tax reporting process.

Final Words

Grasping the nuances between a Capital Lease and an Operating Lease is pivotal for companies aiming to navigate the intricate world of leasing with astuteness. This understanding is not merely academic; it has real-world implications that touch upon diverse facets of business operations, including tax ramifications and the portrayal of assets and liabilities on financial statements. By meticulously analyzing the benefits and drawbacks associated with each leasing type, businesses are better positioned to make informed choices that resonate with their overarching financial strategies and objectives.

As you delve deeper into the complexities of Capital Lease vs. Operating Lease, we invite you to explore more insights and resources available on our blog at EduCounting. Our platform empowers business owners, financial officers, and entrepreneurs with the knowledge they need to thrive in today’s dynamic economic landscape.

FAQs

What is a capital lease under IFRS?

Under IFRS, a capital lease is a lease that substantially transfers all the risks and rewards incidental to owning an asset. This is similar to a finance lease under IFRS standards, where such transactions are recorded on the balance sheet as assets and liabilities

Why choose a capital lease?

A capital lease is often chosen for the long-term use of an asset when the lessee wants to benefit from ownership rights such as depreciation and potential tax deductions. It’s suitable when a company intends to keep the asset beyond the lease term.

Why are operating leases capitalized?

Operating leases are capitalized to provide a more accurate picture of a company’s financial obligations. This approach, mandated by recent accounting standards, ensures that long-term rental commitments are reflected on the balance sheet, offering transparency to investors and creditors.

What is the disadvantage of operating lease?

The primary disadvantage of an operating lease is the lack of ownership benefits, such as depreciation, and the potential to capitalize on the asset’s residual value. It can also be more costly over the long term if the asset is essential to the business for an extended period.