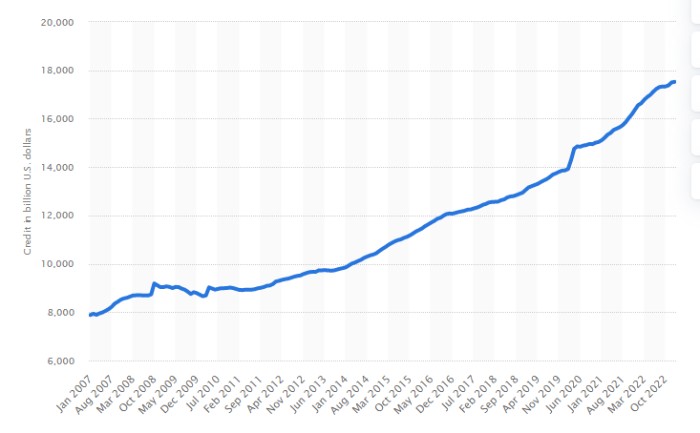

US commercial banks have steadily increased their loan portfolios since February 2020, with particularly impressive growth rates through April of that year. This trend has continued in the following months, and today (January 2023), we are witnessing a significant expansion in credit across all American banking institutions.

In today’s cutthroat business climate, maintaining a tight grip on your cash flow and credit is more critical than ever. To ensure you stay afloat in the wake of high-stakes competition from well-resourced opponents, reliable financing is just as vital as tracking expenses – neglecting either could have dire consequences for an organization.

If you’re looking for quality assistance with commercial loan management, Truerate services may provide useful support that suits your requirements! This blog post looks at what Truerate offers and shares some tips on maximizing the benefits of working with their services.

What are Commercial Loan Truerate Services?

Commercial Loan Truerate Services are specialized financial services that assist businesses in securing commercial loans. These services connect borrowers with lenders offering competitive rates and terms. They can also help businesses evaluate and negotiate loan terms, resulting in better loan options and lower interest rates.

With Truerate’s services, businesses can access various lenders and financial institutions. They advise on creditworthiness, repayment terms, and other factors affecting loan approvals. They also offer resources to help businesses obtain financing for expansion or investments in new projects.

Truerate services include everything from assessing the borrower’s creditworthiness to negotiating the loan terms. They also assist in structuring a commercial loan and help borrowers find the best loan package for their business needs. In addition, they offer pre-approval services, helping businesses identify which lenders may be most likely to approve the loan.

How do Truerate Commercial Loan Services work?

These Services work by matching borrowers with lenders that meet their specific needs. The process begins with an initial consultation, during which the service provider gathers information about the business and its financing requirements. This information is used to identify lenders that offer commercial loans that meet the borrower’s requirements.

Once potential lenders have been identified, the service provider works with the borrower to evaluate loan terms and negotiate rates. This can involve analyzing the borrower’s financials, developing a loan proposal, and presenting it to lenders. The goal is to secure the best loan terms possible, given the borrower’s financial situation and credit history.

What are the benefits of using Commercial Loan Truerate Services?

There are several benefits to using Truerate Service for Commercial Loans, including:

Access to a Broader Range of Lenders

Truerate Service works with a network of lenders, which means borrowers have access to a broader range of loan options than they would have on their own. This makes finding a loan package that meets their needs and budget easier. So, borrowers have the advantage of being able to shop around for the best loan terms.

Expertise

Commercial Loan Truerate Services have expertise in commercial lending, which means they can help businesses navigate the complex process of securing a commercial loan. They can provide valuable advice on creditworthiness, loan terms, and repayment options.

Cost Savings

Using Truerate Services often saves costs since they can negotiate better lending terms. This means businesses can save money on interest rates, fees, and other loan costs. Additionally, it gives businesses access to more competitive rates than they would get through traditional lenders.

Time Savings

Their service also can save businesses time by handling the loan application and negotiation process on their behalf. This can speed up loan approvals and enable businesses to access financing more quickly.

Comparable Offers

Businesses using a Truerate service can compare offers from multiple lenders at once. This makes it easier to identify the best loan option and decide which loan to choose. For example, if the borrower is offered two loans with similar terms, Truerate can help compare them and select the most advantageous option.

Overall, Commercial Loan Truerate Services provide businesses with access to competitive loan terms and the expertise needed to secure a loan. They can help businesses save time, money, and resources, making obtaining financing for business needs easier.

Types of Loans Through Truerate Services

Truerate knows that finding the perfect loan for your business is no simple task. That’s why they have put a unique process in place to ensure you get the best deal available on mortgage services – whether you’re looking at short-term or long-term options.

With two interest rate types – fixed and variable – to choose from, there are plenty of ways to customize it just right!

Equity Placement

Equity placement and market capitalization offer a desirable opportunity for investors looking to use their money best. Unlike debt, with no repayment obligations, this investment strategy can bring great rewards with minimal risk – making it one of the wisest options!

Debt Financing

Debt financing is an excellent way for businesses to expand or invest in new projects. Businesses can borrow money from lenders at affordable interest rates and repayment terms through debt financing. This is the most common type of loan businesses apply for and is often used to purchase long-term assets or investments. While using commercial loan truerate services, prioritize simpler terms over lower interest rates.

Commercial Mortgage Truerate Services

Commercial mortgage truerate services provide businesses with access to competitive commercial mortgage rates. They can also help them negotiate better terms for the loan. This is especially beneficial for businesses looking to purchase property, as it can reduce their overall borrowing costs.

Investment Sales

As a commercial real estate owner, you have the power to turn market volatility into an asset. By staying on top of fluctuations in your property’s value, you’ll better understand its true worth and capitalize when conditions are favorable!

Process for Obtaining a Loan through a Commercial Loan Truerate Service

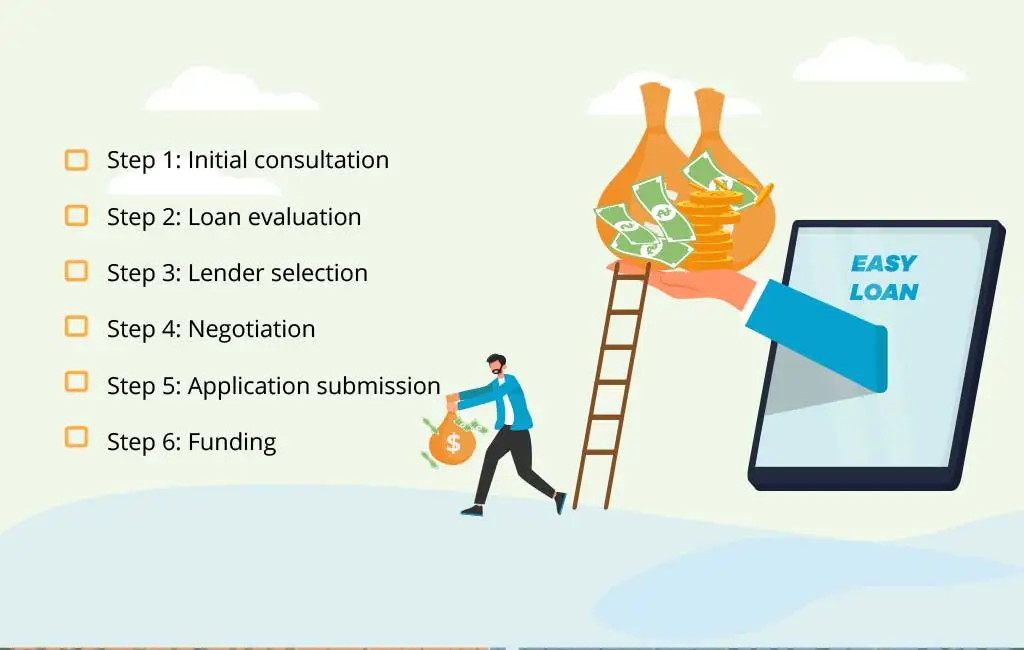

The process for obtaining a commercial loan through a Commercial Loan Truerate Service typically involves the following steps:

Step 1: Initial Consultation

The process begins with an initial consultation, during which the service provider gathers information about the business and its financing needs.

Step 2: Loan Evaluation

The service provider evaluates borrowers’ financials and develops a loan proposal tailored to their needs.

Step 3: Lender Selection

The service provider identifies potential lenders that offer loan terms that meet the borrower’s requirements.

Step 4: Negotiation

The service provider works with the borrower to negotiate loan terms and rates with the lender.

Step 5: Application Submission

Once loan terms have been agreed upon, the service provider assists the borrower in submitting their loan application to the lender.

Step 6: Funding

If the loan is approved, the lender will provide funding to the borrower, typically through an electronic transfer of funds.

What Makes Commercial Loan Truerate Services Stand Out?

TrueRate Service makes the loan process easier for business owners by providing critical assistance throughout each process step. They help borrowers obtain competitive rates and terms, provide personalized advice, and negotiate with lenders on behalf of their clients.

By utilizing Commercial Loan Truerate Services, businesses can take advantage of competitive loan terms, access financing quickly, and get the advice they need from experienced professionals. With a trusted partner, businesses have the confidence to make informed decisions and secure the best financial solution for their unique circumstances.

Commercial Loans vs. Traditional Loans

Commercial and traditional loans have some things in common but also key differences. Commercial loan terms are more appealing than traditional ones – so let’s dive into what makes these two financing options distinct!

LTV Ratio

The Loan-to-Value (LTV) ratio is the most distinctive difference between commercial and traditional loans. While a traditional loan may require an LTV of 80%, commercial loans may offer more flexible terms with lower LTVs, allowing businesses to borrow more money without needing extra equity.

Debt-to-Income Ratio (DTI)

Another key difference between commercial and traditional loans is the Debt-to-Income (DTI) ratio. Commercial loan providers often require a lower DTI than traditional lenders, making it easier for businesses to qualify for larger amounts of financing.

Credit Scores

When it comes to commercial real estate loans, you’ll need a top-notch credit score – usually in the 200s. However, don’t forget that your credit history can also be considered and substantially affect your business’s overall rating!

Collateral

When you take out a traditional real estate loan, your property can be used as security to guarantee that the funds will be repaid. On the other hand, commercial lenders may require additional forms of collateral to approve a loan – such as cash reserves or additional assets.

Expert Advice Before You Go for Commercial Loan Truerate Services

Before committing to any loan provider, it’s always important to research and get expert advice. TrueRate Services for Commercial Loans are a great way to ensure you get the best deal possible on your financing needs, but it’s essential to understand all the details first.

Discover the Period of the Loan

It’s always important to consider the loan period and understand its terms. Commercial loans typically have shorter repayment periods than traditional ones, so ensure you are comfortable with their timeframe before signing the dotted line. Loans with shorter time end up with higher installment payments, so make sure you know this and that it fits your budget.

Know the Types of Interest Rates

Commercial loans can have fixed, variable or hybrid interest rates. It’s essential to understand what each means and how they might affect your repayments down the line. Many lenders offer Truerate Services to help you compare different kinds of loans and decide the best option.

Research Lender Reputation and Reliability

Not all lenders are created equal, so it’s important to ensure you research their reputation and reliability before signing any loan documents. Read online reviews, ask about their past performance, and do your due diligence before committing to any lender.

Calculate the Portion of Your Income that Goes Towards Loan Repayment

When taking out a commercial loan, it’s essential to consider how much of your income will go toward the loan repayment. If you’re not careful, you may have more debt and insufficient money for other expenses. To get the green light from lenders regarding borrowing, ensure your debt-to-income ratio is lower than 43% – any amount above this could put them off. Taking steps like paying down existing loan amounts can help you streamline and significantly reduce that percentage for a smoother approval process.

Weigh Your Outgoings and Evaluate Your Finances

Before you even reach out to lenders for commercial loan Truerate Services, getting a clear picture of your finances is important. Track your spending and evaluate what money goes in and out each month. It’s also essential to create a budget that you can stick to so that you don’t overextend yourself in the future.

By researching and understanding the above, you can ensure that getting a commercial loan from Truerate Service is the best option for your business and that you get the most competitive rate possible.

Final Words

Never be afraid to ask questions before signing any agreement. A good lender will be transparent and honest about their loan terms and services. With some research, you can ensure that the commercial loan Truerate Services you choose fits your business needs best.

At EduCounting, we are enthusiastic about helping everyone learn how to handle their finances effortlessly and confidently! We take complex financial concepts and break them down into easily digestible bits so that anybody can comprehend the basics of intelligent money decisions. Head to our website for more helpful articles and tools!