In this blog post, we are going to talk about the 10 most common financial mistakes people make in their financial life. Making financial mistakes is easy, especially if you’re not used to handling money. However, even small mistakes can have big consequences down the road. Even if you make mistakes, don’t worry – we all do. It is important to learn from your mistakes, so you don’t repeat them.

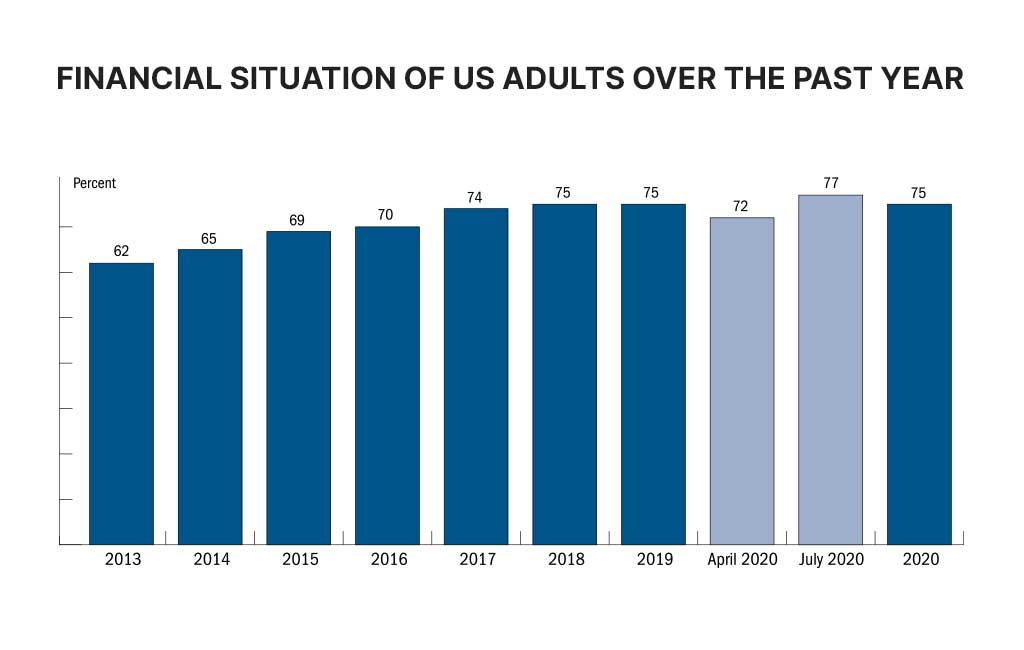

According to a survey from October 2022, 18-29-year-olds’ financial situations were the same as they were the year before, while 30-44-year-olds said they worsened.

As the survey shows, people struggle to manage their finances at different stages, which is alarming. This blog post will show you the 10 most common financial mistakes and how to avoid them so you can stay on top of your finances.

10 Most Common Money Mistakes and Ways to Avoid Them

If you have financial issues today. It is important to learn from your mistakes, so you don’t repeat them.

1. Spending more than you earn

This is the most common financial mistake people make. It’s easy to do, especially if you have a lot of expenses and a low income. You might not think it’s large if you spend a few dollars weekly on unnecessary food or clothing items, but that can add up to $150-200 of just “extras” annually!

For example, if you’re spending $100 a month on coffee, approximately 4-6 drinks a week (depending on where you go and what you get of course), this comes out to $1200/yr. Just on coffee! Thanks to credit card companies, it has become easier to spend more than you earn without realizing it.

There are a lot of common money mistakes to avoid, create a budget and track your spending. Make sure your expenses are lower than your income. You can do this by cutting unnecessary expenses, such as not eating out or buying new clothes monthly. Maybe brew your coffee at home? If you have debt, pay it off as soon as possible.

2. Living on a paycheck without investing in your future

While spending your entire paycheck buying things you want might be tempting, investing in your future is also important. Investing in your future includes saving for retirement, buying insurance, and investing in yourself (such as taking courses or learning new skills).

For example, if you start saving $50 a month for retirement at age 25, you’ll have $75,000 by age 65 (assuming a 5% annual return). If you wait until you’re 35 to start saving, you’ll only have $40,000.

Investing in yourself is also important. By taking courses and learning new skills, you can make yourself more marketable and earn a higher salary.

3. Not having an emergency fund

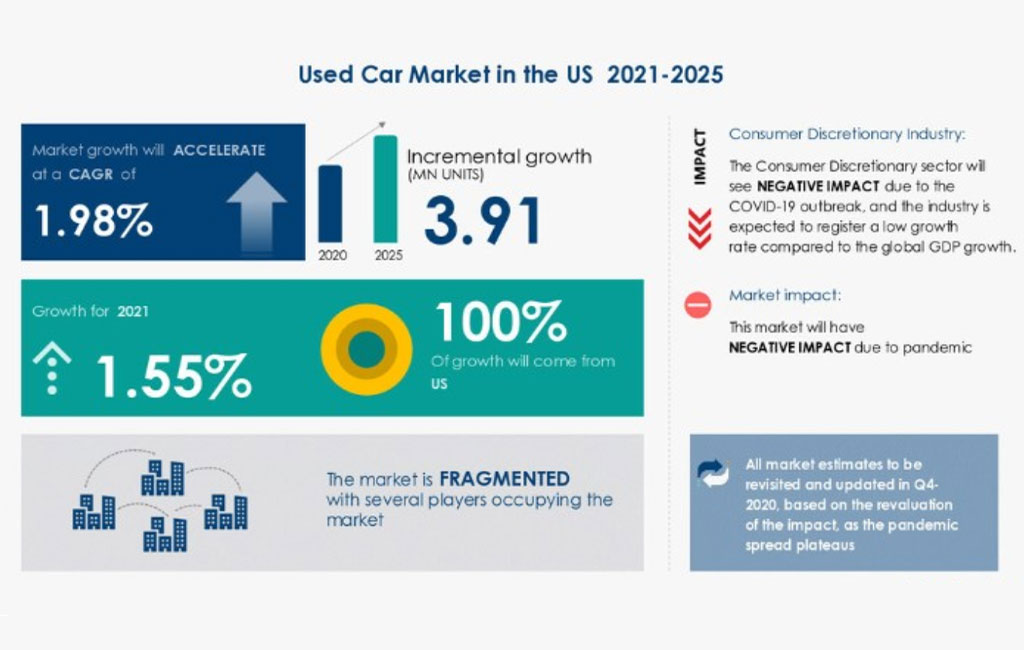

4. Investing in new cars without considering reconditioned/used options

Buying a new, luxurious car is always appealing. It is understandable that a car is essential, but it’s important to consider the long-term costs of a new car before making a purchase. While you have options for reconditioned and used cars, buying a new car can create a financial challenge because it will add a financial burden in the long term.

Buying an expensive, bigger, luxurious car is also a mistake because it will likely lose value quickly. A car is a depreciating asset that decreases in value over time. A new car can lose up to 20% of its value in the first year! Not to mention the costs of gas, insurance, and maintenance.

Always consider buying a car that serves your needs without being too extravagant. If you’re looking for a luxurious car, consider leasing one instead of buying it outright.

5. Rushing to buy a home

Buying a home is a big decision and taking your time is important. There are many things to consider, such as the location, size, type of home, and price. Many people rush into buying a home because they think it’s a good investment. While it can be, many risks are also involved in buying a home.

The most common mistake people make when buying a home is not considering the long-term costs. Just because you can afford the mortgage payments doesn’t mean you can afford the other costs of owning a home, such as repairs, maintenance, and property taxes.

The huge financial commitment can be a heavy financial burden, especially if you’re not planning on staying in the home for a long time. Consider renting instead if you need more time to be ready to commit to a long-term mortgage.

6. Overusing credit cards

Overspending with credit cards is one of the most common financial mistakes people make. It’s easy to do because you’re not using your own money, so it doesn’t feel like you’re spending anything. This can quickly lead to debt and high-interest rates.

If you use a credit card, only spend what you can afford to pay off at the end of the month. Also, try to find a credit card with a low-interest rate. And finally, don’t be afraid to negotiate with your credit card company for a lower interest rate.

Responsible use of your credit card can bring many benefits. But it’s not too late to turn things around if you start carrying big balances on your cards! You can use a personal loan to pay down the credit card debt. Then find a card with a solid rewards program and a reasonable interest rate for everyday purchases while paying it off monthly.

7. Taking a long time to pay off your high-interest debt

Numerous financial advisors will tell you that one of the smartest things you can do with your money is to pay off your high-interest debt as soon as possible. This is because the interest on these debts can add up quickly, and the longer it takes to pay them off, the more you’ll end up paying in interest.

If you have high-interest debt (for example, credit card), create a plan to pay it off quickly. The higher financial expense will only make it difficult to save money and achieve financial freedom. Make extra monthly debt payments, or consider transferring your balance to a lower-interest financial product. This way, more of your money will pay off the principal rather than the interest to offset the amortization schedule.

Getting control over expenses is like exploring new income opportunities because the free money in your bank account can hugely affect your financial future. It is always encouraging to save money and live within your means.

8. Not monitoring your credit scores and credit reports

Lenders use your credit score and credit report during lending money to determine whether you’re a good candidate for a loan. If you have a low credit score, you may not be approved for a loan or be charged a higher interest rate. Your credit score is based on your credit history, which is included in your credit report.

Your credit score doesn’t just impact when you are borrowing money to make up for your lacking of money; it can also affect things like getting approved for an apartment lease. So, monitoring your credit score and credit report regularly is important. You’re entitled to one free credit report from each of the three major credit bureaus annually. Check for errors and dispute any inaccuracies that you find.

A good credit score is important, but don’t obsess over it. Just make sure you’re monitoring it so you can make informed financial decisions in financial management.

9. Lacking an investment strategy or not sticking to one

Rome wasn’t built in a day, and neither is a solid investment portfolio. While starting investing as early as possible, it’s also important to have a plan. This means knowing what you’re trying to achieve with your financial planning from your financial planning guide.

Many people make the mistake of investing without a strategy or not sticking to their strategy. This can lead to impulsive decisions not based on sound reasoning. Instead, take the time to develop a well-thought-out investment strategy and stick to it. Review and adjust your strategy as needed, but don’t let emotions dictate your investment decisions.

Dividing investment strategy into short, medium, and long-term goals is a great way to maintain perspective and focus. Reviewing investments periodically is also key to maintaining an investment strategy. Doing so can help ensure your portfolio is on track and aligns with your goals.

10. Not pursuing financial education

Maintaining financial literacy is key to making sound decisions with your money. Unfortunately, many people are reluctant to pursue financial education. This can be for a variety of reasons, such as feeling like they don’t need it or that it’s too complicated. Because personal finance is not widely taught in public schools, many Americans rely on the financial knowledge of their parents or what they have learned through experience.

The truth is everyone can benefit from learning more about personal finance. And it doesn’t have to be complicated! Many resources are available to help you learn more about money management, investing, and other financial topics. Start with baby steps and gradually increase your knowledge over time. The more you know, the better equipped you’ll be to make informed decisions about your money.

EduCounting is dedicated to providing free financial literacy content for anyone who wants to learn. Our goal is to make complex topics like personal finance easy to understand so everyone can make better decisions with their money.

Final Words: 10 Most Common Financial Mistakes

Making sound financial decisions is key to achieving your long-term financial goals. Unfortunately, many people make some of the most common financial mistakes that can jeopardize their future.

Some of the most common financial mistakes include not saving enough money, not investing early enough, carrying too much debt, and lacking financial education. Avoid these worst money mistakes by being proactive about your finances. Make a budget, start saving for retirement early, and educate yourself on personal finance topics. Doing so can help you make informed decisions about your money and secure your financial future.

We hope this article has helped you identify some of the most common financial mistakes and provided some useful tips for avoiding them. If you found this article helpful, please share it with your friends and family!