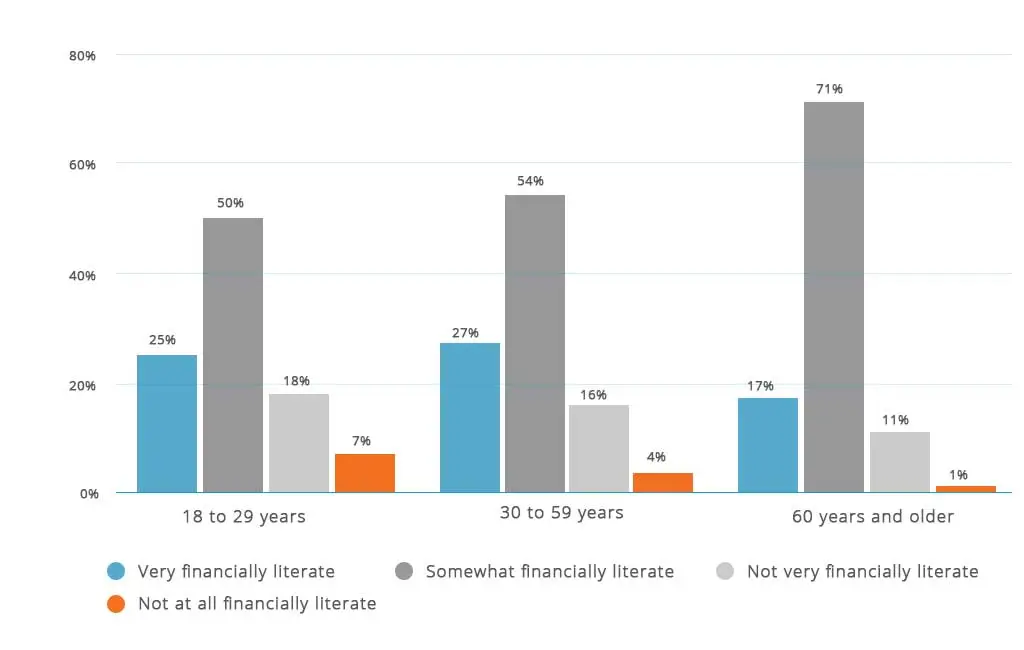

Why is this financial guide so important? 50% of Americans aged 18-29 admitted to having at least some knowledge about money management, a Statista 2017 survey revealed- a significant step in understanding the basics and creating more financial security.

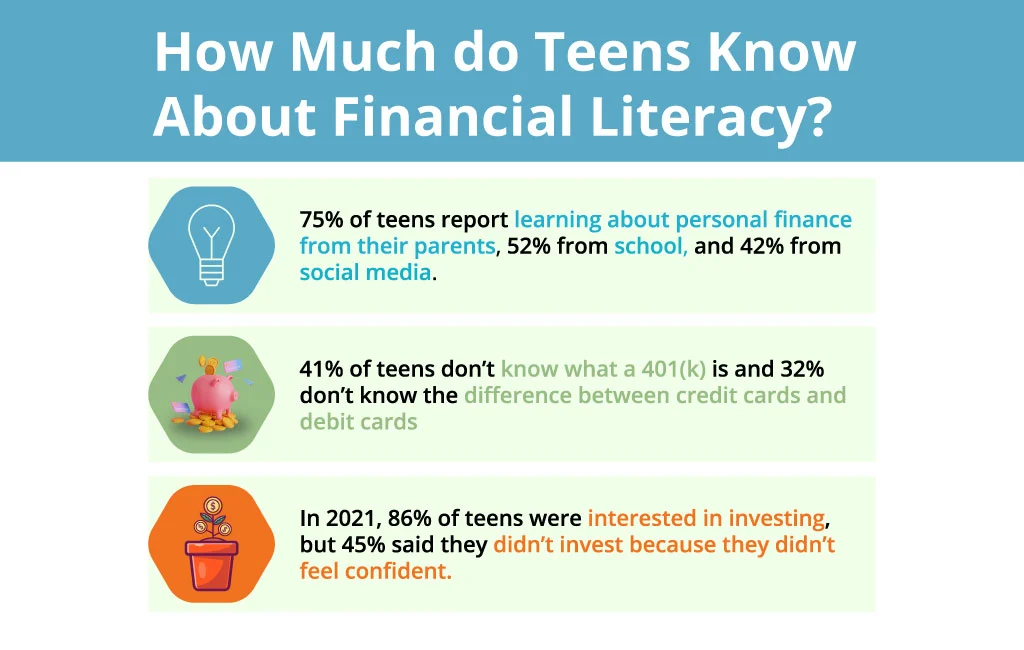

Many teens lack financial guidance despite being eager to learn about money management. This leaves them unprepared for the road ahead – though not without hope! Schools can equip students with concrete knowledge and valuable skills, so they have a leg up when taking on their monetary futures.

As the financial education gap increases, so do the benefits of having a quality financial guide. A comprehensive introduction to money management is essential for any individual or family looking to take charge of their finances. This blog post will cover the most powerful benefits of having a financial life.

A Beginner's Guide to Financial Literacy

As a starting point and according to beginners guide to financial literacy, financial guides provide a solid foundation of understanding regarding key money management topics such as budgeting, saving, investing, and expenses. A comprehensive guide offers an easy-to-follow plan that explains the basics of each topic in simple terms. This content is especially helpful for teens and young adults who may not have had any prior exposure to complex finances.

Income

Income means money earned from various sources, including employment, investments, and other activities. Understanding the concept of income is essential for financial planning, as it helps to determine how much money can be allocated towards savings and expenses.

Expenses

An important component of any financial planning, expenses are money spent on various items each month. Common examples include rent, groceries, utilities, and entertainment. A financial guide can help individuals understand which expenses are essential and which can be cut back to save money.

Financial Goals

Creating a plan for utilizing money is key to achieving financial security. A comprehensive guide will help individuals set achievable goals, as well as provide tips on how to reach these milestones. This could include guidance on budgeting, saving and investing for retirement, or creating a plan for paying off debt. A smart financial goal must be realistic and should be tailored to the individual’s current financial situation.

With the help of proper financial guides, you can increase your savings, improve your financial security and stability, and get ahead financially.

Investment

There are various investment opportunities and associated risks for those interested in building wealth, so individuals can make informed decisions about where to allocate their capital. This could include stocks, bonds, mutual funds, real estate, etc.

Taxes

Understanding tax regulations is critical for effective financial planning. A guide can provide an overview of income tax and estate tax regulations and insight into how to manage these obligations best.

Retirement Planning

Creating a purposeful retirement plan is one of the most critical elements of any financial strategy. A comprehensive guide will guide how to save for retirement, invest strategically, and manage necessary paperwork.

Insurance

Individuals can protect their finances and loved ones through various insurance policies. A financial guide will provide tips on choosing the right policy for personal needs and budget.

Basic Guide for Financial Decision Making

Once you understand the fundamentals of money management, it’s time to implement them. A financial guide can help individuals take the next step by guiding them to make informed decisions about the future. This could include advice on when to buy or sell investments, how to manage debt, and other essential details necessary for effective long-term planning.

Calculate Net Income

Net income is the total amount of money an individual earns minus taxes and other financial obligations. A smart way is to calculate net income and use it for financial decision-making.

Cut Your Coat According to Your Cloth

This phrase, “spend within your means,” is essential for financial health. Always consider your expenses within your earnings.

Start Savings Early

Saving money is key to achieving financial security. A smart person always focuses on creating effective savings goals and strategies for reaching them. This could include setting up a separate bank account for an emergency fund or investing in relevant markets.

Invest to Secure Your Future

Investing is a great way to build wealth over time. This could include investing in stocks, bonds, mutual funds, real estate, etc.

Review Finances Regularly

Regularly reviewing your finances and goals is essential for staying on track. A periodic review will ensure that investments and financial decisions align with long-term goals.

Keep an Eye on Your Credit Score

Your credit history is important in financial decision-making, so it’s essential to monitor it regularly. A bad credit card debt can lead to higher interest rates and other financial burdens.

Work With a Financial Advisor

The goal of a financial advisor is to help individuals make smart decisions with their finances. A financial advisor can help individuals reach their goals faster and provide additional guidance regarding investments, taxes, retirement planning, and more.

Family Financial Guide

Securing your family’s financial future is a critical element for any individual. A comprehensive guide will help individuals understand how to manage their finances, develop effective strategies for wealth building and protect what’s most important – their loved ones.

Make It a “Family” Budget

Creating a family budget is important for managing expenses, saving money, and reaching financial goals. A budget should include a breakdown of income and expenses and a plan for managing the money. To get started, it’s important to have honest conversations about money between spouses or other family members. Openly discussing financial goals, current spending habits, and how to save best is essential to creating an effective family budget.

Keep the Future Your Focus

It’s important to plan for your future by creating an emergency fund and a retirement savings plan. Emergency funds should cover three to six months of expenses, so you can protect your family from unexpected costs. Retirement is another way to safeguard your family’s financial future – start now to take advantage of compounding interest.

Invest in Education

Education pays off in the long run. Higher education brings higher earning potential and better job opportunities, making it a critical component of any family’s financial future. Investing in your children’s education early on is a great way to ensure their success down the road.

Don't Ignore Your Debt

Debt can be a huge financial burden on any family. It’s essential to stay aware of the total amount owed on personal loans and focus on paying it off in a timely manner. To minimize debt, find ways to reduce spending and use extra money to pay down loans.

Educate Your Kids about Financial Literacy

Financial literacy helps prepare kids for adulthood by teaching them how to manage their finances. Teaching kids to save, budget, and invest will give them the tools they need for a secure financial future. Many books, websites, and workshops can help parents teach their kids about personal finance.

At EduCounting, we understand the importance of family financial planning. Our goal is to provide individuals and families with the knowledge and resources they need to create a secure, prosperous future for their loved ones.

Basic Financial Analysis Guide

Understanding the basics of financial analysis is a significant first step in investment planning. Knowing how to read and interpret financial statements, calculate key ratios and estimates, and use other analytical tools can help you make informed investment decisions.

Income Statement

The income statement, or profit and loss statement (P&L), is a financial report that outlines the revenues, costs, and expenses associated with a particular period of time. The primary goal of an income statement is to determine how much money was earned versus how much was spent during a specific period.

Balance Sheet

A balance sheet is one of the most critical financial statements to understand, as it outlines a company’s assets and liabilities. It also provides insight into the equity position of the business. The balance sheet is also often referred to as a statement of financial position or statement of affairs.

Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash into the business. It provides important insight into a company’s ability to generate and manage cash and its liquidity position.

A Guide to Financial Statements of Not-for-Profit Organizations

Not-for-profit organizations have different financial statements than for-profit businesses. For example, instead of a balance sheet and an income statement, these organizations have a statement of financial position (like a balance sheet) and a statement of activities (like an income statement). Not-for-profits also typically have additional statements such as a statement of functional expenses, cash flows, and changes in net assets.

Final Words

A financial guide can help you make better decisions and enhance your financial literacy. With this knowledge, you can ensure a secure future for yourself and your family. When planning ahead, remember to save for retirement, invest in education, manage debt wisely, and teach kids good financial habits.

Good luck on your financial journey!