When investing in the stock market, understanding the key distinctions between preferred and common stock can significantly impact investment decisions. Each type of stock offers different benefits and risks, tailored to suit various investment goals and risk appetites. This blog aims to demystify preferred and common stock concepts, helping novice and experienced investors make informed choices.

Navigating the complex landscape of the stock market can be daunting. By breaking down the differences between preferred stock vs. common stock, we provide clarity and insight into how each type of stock functions and how they can align with your overall financial strategy. Whether you’re looking for steady income or the potential for significant growth, understanding these options is crucial in building a robust investment portfolio.

Preferred vs. Common Stock Overview

Preferred stock and common stock are two distinct types of equity in a company. Each type offers different rights and financial benefits to shareholders.

The primary distinction is in voting rights. Holders of preferred stock typically do not have voting rights. In contrast, common stock usually comes with the right to vote on corporate matters. This right is often allocated at one vote per share.

Interestingly, more investors are familiar with common stock than with preferred stock. This familiarity may influence their investment choices.

Despite these differences, both types of stock represent ownership in a company. Investors use them as tools to capitalize on a business’s potential growth and success. Each type serves a specific financial strategy and risk tolerance level, making it suitable for different investor profiles.

Benefits of Preferred Shares

Preferred shares offer unique advantages that can be crucial for certain investors. These benefits stem from their hybrid nature, combining equity and debt securities elements. Understanding these characteristics can help investors make informed choices about incorporating preferred shares into their portfolios.

Guaranteed Dividend Payments

One of the primary attractions of preferred stock is the provision of fixed dividends. Unlike common stock, where dividends fluctuate and are never guaranteed, preferred stock offers a consistent dividend. This fixed payout is similar to the regular interest payments received from bonds. It provides a reliable income stream, making preferred shares an appealing option for income-focused investors.

Priority in Dividend Payments and Asset Claims

In terms of financial hierarchy, preferred shareholders are in a more advantageous position than common shareholders, especially during financial distress or company liquidation. If a company goes bankrupt or is liquidated, preferred shareholders have a higher claim on assets and earnings compared to common shareholders. This priority also extends to dividend payments; if a company cannot pay all dividends, preferred dividends must be paid before any dividends can be paid to common shareholders.

Impact of Interest Rates on Valuation

Like bonds, the value of preferred stocks is influenced by changes in interest rates. Typically, the value of preferred shares decreases when interest rates rise and increases when interest rates fall. This inverse relationship with interest rates is an important consideration for investors, particularly in volatile economic climates.

Callability Feature

Preferred stocks often include a callability feature, which allows the issuing company to buy back the shares at a predetermined price after a set period. This can benefit the issuer, especially if the shares were issued during a period of high interest rates and the rates subsequently fall. For investors, the callability can offer a potential for the shares to be redeemed at a premium to their purchase price. However, it also introduces the risk of the shares being called away during favorable market conditions.

Benefits of Common Shares

Common stock is the most typical form of investment in the stock market. It represents ownership in a company. Most people who invest in stocks buy common stock. It’s the standard type when we talk about stocks.

Ownership and Voting Rights

Owning common stock means you own a part of the company. It also gives you a say in company matters. As a shareholder, you get voting rights. Usually, you get one vote per share to help choose the board of directors. These directors make big decisions about the company’s management and policies. This means you can influence how the company is run, unlike with preferred shares.

Potential for Growth

Common stock is known for its potential to increase in value. Over time, it tends to perform better than bonds or preferred shares. If a company succeeds, the value of its common stock can rise significantly. However, the value can also drop if the company does poorly. So, there’s a higher risk but also a higher potential for gains.

Dividends and Earnings Claims

The company’s board of directors decides if dividends will be paid to common stockholders. Dividends are not guaranteed with common stock. If the company doesn’t make enough profit, it might not pay dividends. Also, if there’s limited money for dividends, preferred shareholders get paid first. Common stockholders are second in line.

Common Stock vs. Preferred Stock: Key Differences

Each type has unique features and benefits, which can help you make better investment decisions. Here’s a breakdown of the key differences between common stock and preferred stock.

Share Price

The price of common stock is usually discussed in the news. It fluctuates frequently. When the price goes up, investors can make more money. However, they also risk losing more when the price drops. Preferred stock prices don’t change as quickly. They grow more slowly. The preferred stock price is determined by the number of dividends it pays in a year compared to the amount of money raised from selling those stocks.

Income

Preferred stock usually offers better income stability through fixed dividends. This makes it appealing to investors looking for steady earnings. Common stock does not guarantee dividends, and the payouts can vary based on the company’s profits and decisions by the board.

Dividends

Dividends are a major difference between these two types of stocks. Preferred stockholders receive set dividend payments, usually higher than common stock offers. These dividends are due before the dividends given to common stockholders. If a company has to reduce its dividend payments, common stockholders will likely feel the impact first.

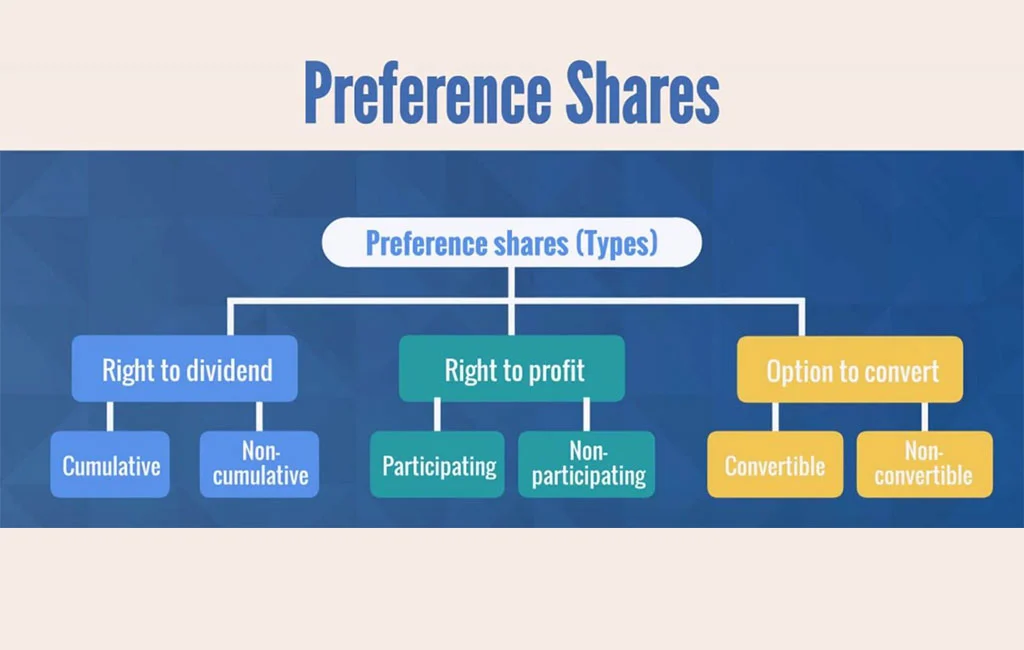

Stock Conversion

Preferred stock often comes with the option to convert into common stock under certain conditions, which can be advantageous if the common stock’s value rises sharply. Common stock does not offer a similar option for conversion into preferred stock.

Voting Rights

One of the biggest differences is in voting rights. Common stockholders usually have the right to vote at shareholder meetings, which can influence the company’s management and policies. Preferred stockholders generally do not have voting rights, giving them less control over corporate decisions.

Volatility

Common stock is typically more volatile than preferred stock. This means its price can go up and down more dramatically, which could lead to higher gains or greater losses. Preferred stock is less volatile, providing more stability but less chance for a significant price increase.

Returns

Over time, common stock tends to provide higher returns, especially if the company grows significantly. This is because common stock benefits directly from increased company value. Preferred stock offers returns mainly through dividends and is less affected by market price changes.

Purpose

Investors choose common stock for the potential for high returns and influence over company decisions through voting. Preferred stock is chosen for income stability and priority over dividends and during liquidation. Your choice depends on your value: potential growth or financial security.

Bankruptcy/Liquidation Preferences

In bankruptcy or liquidation, preferred stockholders have a higher claim on the company’s assets than common stockholders. This means they are more likely to get some money back if the company goes under. Common stockholders are last in line, making their investment riskier in troubled times.

How Do You Buy and Sell Preferred or Common Stocks?

If you’re looking to buy or sell preferred or common stocks, the most common way is through a brokerage account. This service is provided by companies that help you access the stock market. You can set up an account, deposit money, and start trading stocks through their platform.

In some cases, you can also buy preferred stocks directly from the company through a direct stock plan. This plan lets you buy stocks directly from the company without going through a broker. Another option for buying stocks is through a dividend reinvestment plan (DRIP). This allows you to use the dividends you receive from stocks to buy more shares, often without any commission.

Additionally, you can invest in stocks through a mutual fund or a stock fund. These funds pool money from many investors to buy various stocks, which helps spread out the risk.

Nowadays, various apps make buying and selling stocks very easy. These apps provide tools and resources that help you manage your investments from your phone or computer, making it convenient to trade stocks anytime.

Final Words

Understanding the differences between preferred and common stock is essential for investing in the stock market. By choosing the type of stock that aligns with their financial goals and risk preferences, investors can better manage their portfolios and potentially increase their returns. Knowing the nuances of preferred stock vs. common stock can empower you to make investment choices that best suit your financial objectives.

If you’re ready to start investing or want to learn more about how stocks can fit into your financial plan, visit us at EduCounting. We provide easy-to-understand resources and tools to help you make informed investment decisions. Whether you’re a beginner or looking to refine your investment strategy, we’re here to support your journey toward financial literacy and success.

FAQs

Why would a company convert preferred stock to common stock?

A company might convert preferred stock to common stock to simplify its capital structure or to satisfy the preferences of preferred shareholders who might want the opportunity to benefit from the voting rights and potential capital gains offered by common stocks.

Is preferred stock safer than common stock?

Generally, preferred stock is considered safer than common stock due to its fixed dividend payments and priority over common shares in asset liquidation. However, it usually offers less potential for price appreciation.

Can I convert preferred stock to common stock?

In some cases, preferred stock may be convertible into common stock at the shareholder’s discretion, depending on the specific terms set out by the company at the time of issuance.

Why do banks issue preferred stock?

Banks often issue preferred stock as a means to raise capital without diluting voting power, as preferred shares typically do not carry voting rights. This method allows banks to maintain control while meeting regulatory capital requirements.