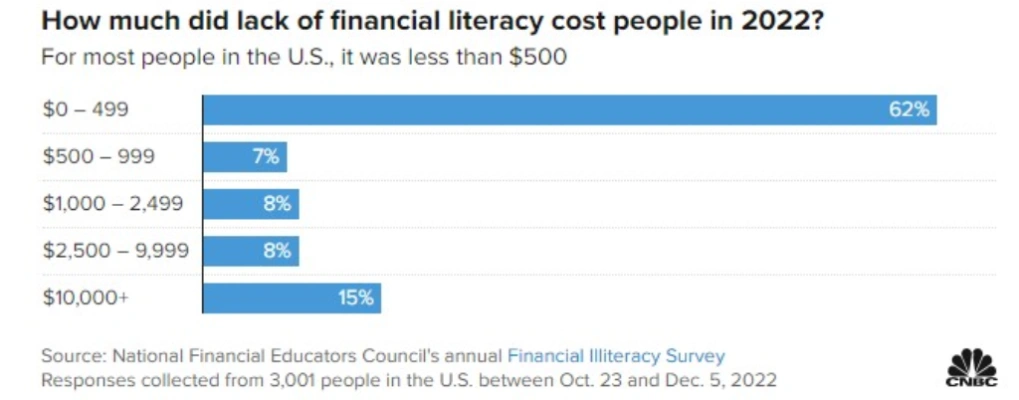

In 2022, the absence of financial literacy and the inability to handle personal finances came with a hefty price tag. The National Financial Educators Council (NFEC) undertook a study in which American adults were inquired about the estimated financial loss they suffered in the year owing to their deficit in financial acumen.

In today’s digital age, gaining financial literacy early is not just an advantage – it’s essential. With the wealth of online information, kids and teens have an unprecedented opportunity to learn about managing money. Among the various sources of financial education, “financial influencers” play a vital role. This article provides insights into the role of financial influencers and why they can be beneficial for kids and teens to follow.

The Role of Financial Influencers

Financial influencers have built a following on social media or other platforms by sharing information and insights on finance and money management. They come in all shapes and sizes – from investment experts to frugal living enthusiasts. For kids and teens, the right financial influencers can provide a foundation of knowledge that helps foster sound financial habits from a young age.

Benefits of Following Financial Influencers

Following reputable financial influencers can offer a plethora of advantages for young minds. These include education on financial concepts, exposure to real-world examples, motivation to save and invest, and guidance on practical money management strategies.

Getting an Early Start on Financial Literacy

Starting financial education early is key to cultivating good money habits. Kids and teens can learn the basics of money management, budgeting, saving, and investing by following financial influencers. This early exposure is crucial in setting them up for financial success in the future.

Relatable and Engaging Content

Financial influencers often present information in a relatable and engaging manner. Kids and teens are more likely to pay attention to someone they can identify with or speak their language. Many financial influencers use stories, animations, and interactive content to make financial concepts more accessible and fun.

Learning Real-World Applications

While traditional education systems might teach theoretical aspects of economics, they often lack real-world application. Financial influencers bridge this gap by sharing real-life examples, personal experiences, and practical advice. For instance, an influencer might share tips on saving money for a new video game or earning money through a summer job.

Encouragement of Financial Goals

Financial influencers often talk about setting and achieving financial goals. This can motivate kids and teens to think about their own goals. Whether saving for college, a car, or a trip, being goal-oriented with finances from a young age can lead to a more disciplined and thoughtful approach to money.

Awareness of Financial Risks and Opportunities

The financial world is filled with both risks and opportunities. Through financial influencers, young people can learn about different investment options, the risks involved, and how to make informed decisions. This awareness is crucial in a world where new financial products and investment platforms are constantly emerging.

Development of Critical Thinking

Not all advice shared by financial influencers will be applicable or even sound. Kids and teens can develop critical thinking skills by evaluating different viewpoints and information. They can learn to question information, research, and make decisions based on logic and reason.

Inspiration and Role Models

For some, a financial influencer might serve as a role model or a source of inspiration. Seeing someone successfully navigate the financial world can inspire kids and teens to take an active interest in their financial futures.

Diversifying Information Sources

In the current era of information overload, it is pivotal for individuals, especially young ones, to diversify the sources from which they garner knowledge about finances. Relying on a single source or channel can lead to a narrow perspective and sometimes misinformation. By broadening the range of information sources, young individuals can gain a more comprehensive and well-rounded understanding of financial concepts and practices.

Expanding one’s information pool is not only about quantity but also quality. It is essential to ensure that the sources are credible and offer value. For instance, following financial influencers on social media can be complemented by reading books, watching documentaries, and taking online courses on financial management.

Furthermore, discussions with family members, teachers, or financial advisors can provide insights from personal experiences. This diversified approach helps build a strong foundation and enables kids and teens to make informed financial decisions, considering various viewpoints and expert opinions. Moreover, it empowers them to remain adaptable and receptive to new information and strategies in the ever-evolving world of finance.

Top 10 Financial Influencers for Kids and Teens

Here are 10 financial influencers that kids and teens should follow to stay informed on wealth wisdom:

1. Money With Mak and G

Money With Mak and G is an enlightening podcast where Ben’s twins, Makenna and Grant, break down financial topics into bite-sized pieces. Through these mini-episodes, young learners and their parents can delve into various money matters, such as the history of piggy banks and how to value and conserve money.

2. Stories Podcast

Stories Podcast is a free weekly podcast that delivers delightful stories for the whole family. It engages listeners with family-friendly stories read aloud, capturing imaginations and providing entertainment for all ages.

3. Greeking Out

Greeking Out is an enthralling podcast that brings stories from Ancient Greece and beyond to life. Perfect for families, this podcast offers a historical journey into the intriguing myths and tales of yesteryears.

4. Who, When, Wow!

Join Carly Q, an ambitious time travel detective and junior analyst at The Bureau of Universal Time Travel and Historical Exploration Department, as she embarks on time-traveling adventures to unravel historical mysteries, such as the Loch Ness Monster. Who, When, Wow! is an engaging podcast that combines history and adventure, taking listeners on a fact-finding mission through time.

5. Circle Round

Produced by parents, Circle Round adapts folktales from around the world into captivating radio plays for children between the ages of 4 and 10. With rich sound and music, each episode lasts 10 to 20 minutes and often revolves around valuable life lessons such as kindness, persistence, and generosity.

6. Story Pirates

Story Pirates is a creative media company that turns children’s imaginations into content. Best known for their family podcast, Story Pirates Podcast, they adapt kids’ stories into comedy sketches and songs. They have also published books and produced albums, all inspired by children’s ideas. The podcast features performances by well-known artists and celebrities.

7. Purple Rocket Podcast

Welcome aboard The Purple Rocket! The brainchild of Greg Webb, a storytelling enthusiast and father of four, the Purple Rocket Podcast is an exciting adventure for the ears. Here, Greg shares imaginative stories to take kids on thrilling journeys while educating them about the world. It’s an enjoyable escape from screens that stimulates children’s imaginations.

8. Story Seeds

Story Seeds is a podcast that puts creative power in the hands of young individuals. Through collaboration with renowned authors, kids contribute their own story ideas, which are then turned into original stories by the authors. This Webby Award-nominated podcast celebrates the creativity of young minds.

9. Fierce Girls

Fierce Girls is an inspiring podcast that shares stories of remarkable women from Australia who have dared to do things differently. From athletes and scientists to adventurers, Fierce Girls showcases stories of tenacious and spirited women, told by influential figures such as Amy Shark, Yael Stone, and Dame Quentin Bryce. This podcast aims to empower and inspire young girls by presenting them with real-life role models.

10. Planet Storytime

Planet Storytime Podcast offers children a captivating blend of stories and music, igniting their imaginations and inviting them to create mental images of what they hear. Believing in the power of storytelling as both entertaining and educational, Planet Storytime helps nurture creativity and cognitive development in children by transporting them to different worlds through stories.

What to Look for in a Financial Influencer for Kids and Teens

In an increasingly interconnected world, financial literacy is no longer just an essential skill for adults. Kids and teens must also develop financial acumen to make informed decisions as they grow. As parents and guardians, it is crucial to guide them in selecting the right financial influencers.

Age-Appropriate Content

When looking for a financial influencer for kids and teens, it’s essential to ensure that the content is age-appropriate. The influencer should be able to break down complex financial concepts into simpler terms that are easy for young minds to grasp. Moreover, the content should be engaging and relatable to maintain their interest.

Educational Credentials or Experience

Check whether the financial influencer has relevant educational credentials or experience in finance and education. Those with a background in both finance and education may be better equipped to create content that is not only informative but also pedagogically sound for young audiences.

Positive Role Modeling

Kids and teens are impressionable, and it’s important that the financial influencers they follow model positive financial behaviors and ethics. Ensure the influencer promotes responsible money management, savings, and smart financial decisions, rather than risky investments or get-rich-quick schemes.

Interactive and Fun Learning

For kids and teens, learning is more effective when it’s interactive and fun. Look for financial influencers who use creative methods such as games, quizzes, storytelling, and animations to make financial education enjoyable and engaging.

Focus on Core Financial Principles

The influencer should focus on core financial principles such as saving, budgeting, understanding the value of money, and basic investment concepts. These foundational skills will serve kids and teens well throughout their lives.

Parental Involvement

Look for financial influencers who encourage parental involvement. Parents and guardians must be actively involved in their kids’ education. Some influencers might provide guides, discussion points, or activities that parents and kids can do together.

Positive Reviews from Parents and Educators

Research the influencer’s reputation among parents and educators. Positive reviews and endorsements from these groups can be a good indicator that the influencer’s content is respected and trusted.

Avoiding the Promotion of Financial Products

Be cautious of influencers who heavily promote specific financial products or services, especially to a young audience. Kids and teens should be learning the basics of financial management rather than being encouraged to engage in transactions or investments.

Relatability

Finally, it’s important that kids and teens can relate to the influencer. An influencer who understands the world of young people and can connect with them on their level will be more effective in conveying financial concepts.

Final Words

In a world where financial knowledge is power, imparting this wisdom to kids and teens is crucial. Financial influencers can play a significant role in this education. By following the right influencers, such as Money With Mak and G, Stories Podcast, and others mentioned above, young individuals can embark on a path of financial literacy and sound money management.

However, it is important to remember that while financial influencers can be a valuable resource, they should not be the only source of information. Encouraging critical thinking, diversifying information sources, and fostering an environment of learning and discussion around finances will equip the younger generation for a future of financial success.

Remember, the realm of “financial influencers” is vast and ever-evolving. Always approach critically and ensure that the information consumed is balanced with other forms of financial education.

At EduCounting, we are passionate about helping young people attain financial literacy and money management skills. Our online platform is purpose-built to provide a comprehensive suite of tools for kids, teens, and young adults to become financially confident.

Join our course today and learn the basics of financial literacy with EduCounting! We look forward to helping you on your journey toward financial success.

Financial Influencers FAQs

What are some recommended kids' financial influencers and platforms?

Some recommended financial influencers for kids, and teens include Money With Mak and G, Stories Podcast, Greeking Out, Who, When, Wow!, Circle Round, Story Pirates, Purple Rocket Podcast, Story Seeds, Fierce Girls, and Planet Storytime.

Can kids' financial influencers influence children's spending behavior?

Yes, they can. By educating kids on money management and savings, financial influencers can help shape a child’s spending behavior positively.

Can financial influencers guarantee investment success?

No, financial influencers cannot guarantee investment success. It’s essential to remember that all investments carry risks. However, an informed decision can help reduce the risk of undesired losses.

How can I determine if a financial influencer is trustworthy?

Look for financial influencers with credentials, experience, and a track record of providing reliable information. Additionally, cross-verifying the information with other credible sources can be helpful.

Should I solely rely on financial influencers for investment decisions?

No, relying solely on financial influencers for investment decisions is not advisable. Diversifying information sources, consulting with a financial advisor, and conducting personal research are essential.