Reducing your total loan cost means paying less in interest and fees over time. The good news is that you don’t always have to pay back your loan in full. You can save thousands of dollars by selecting the correct lender, making additional payments, refinancing at reduced rates, and staying clear of hidden fees. In order to keep your debt manageable, we’ll address the question, “How can You Reduce Your Total Loan Cost?” and provide you with helpful advice both before and after you borrow.

Making bigger or more frequent payments is also a good idea if you can do it. For example, if you pay every two weeks instead of every month, you make an extra payment every year, which shortens the loan term and cuts down on the interest you owe.

By the way, keeping your credit score in good shape can make a big difference. People who look less risky usually get better deals from lenders, which usually means a lower interest rate.

Now, fees can also add up without anyone noticing. Some loans have fees for starting them or penalties for paying them off early. You can avoid those traps by carefully reading the fine print.

And honestly, If rates go down or your financial situation gets better, refinancing could be another option. You take out a new loan with better terms to pay off the old one. This can sometimes make the whole deal cheaper over time.

How Can You Reduce Your Total Loan Cost? Explore 7 Smart Steps

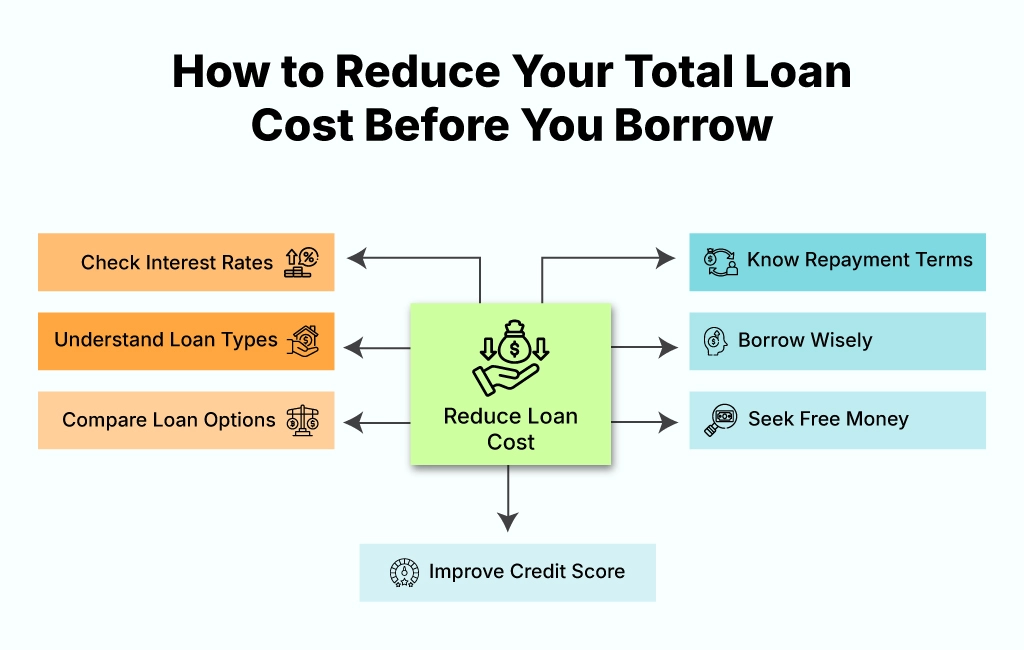

Before committing to a student loan, it’s essential to take proactive steps to minimize future costs. Decisions you make at this stage can impact your financial life for years. Here’s how you can keep those costs under control before you borrow a dime:

1. Understand What You’re Signing Up for

Student loans aren’t just numbers on a contract, they’re long-term commitments. Federal loans, such as Direct Subsidized and Unsubsidized Loans, are offered by the government and typically come with fixed interest rates, income-driven repayment options, and potential eligibility for forgiveness programs. Private loans, however, are issued by banks, credit unions, or online lenders and often have variable interest rates, less flexibility, and stricter repayment terms.

Understanding the type of loan you’re taking on is crucial. Don’t just skim over the paperwork, take time to research interest accrual policies, grace periods, deferment or forbearance conditions, and what happens if you miss a payment. The better you understand now, the fewer regrets you’ll have later.

2. Only Borrow What You Truly Need

One of the easiest ways to reduce your total loan cost is to simply borrow less. While it might be tempting to pad your loan for extras, new gadgets, weekend getaways, or a cushy apartment, resist the urge. Loans are meant to cover essentials like tuition, fees, books, and living expenses. Take time to create a realistic budget and stick to it. The less you borrow, the less interest you’ll owe later. It sounds simple, because it is.

3. Look for Free Money First

Grants and scholarships are the financial equivalent of “free lunch.” They don’t require repayment and can significantly cut down how much you need to borrow. Start searching early, well before your school year begins. Use resources like Fastweb, College Board, and the U.S. Department of Labor’s scholarship search tool. Also, don’t underestimate local scholarships; even a few hundred dollars here and there can add up.

4. Compare Different Loan Options

Don’t accept the first loan offer you see. Whether federal or private, compare multiple options. Federal loans are generally more borrower-friendly, with fixed interest rates and government protections. But if you’re considering private loans, look closely at interest rates, repayment flexibility, and any hidden fees. Comparing student loans can help you identify the most cost-effective and manageable solution. Low-interest student loans are your friend—if you can qualify for one, take it.

5. Check the Interest Rate and Fees with Lenders

Interest is the silent killer of budgets. It accumulates quietly and compounds steadily. Federal loans have interest rates set annually by Congress, and they tend to be consistent. Private loan rates, however, can vary wildly depending on your credit score and market trends. Make sure to ask lenders about APRs, origination fees, and any penalties for early repayment. These small details can lead to big costs over time.

6. Know Your Repayment Terms

Repayment might seem like a problem for “future you,” but it’s a good idea to understand it now. Federal loans come with multiple repayment plans—including income-driven options that adjust based on what you earn. That’s a huge safety net. Private loans may not offer the same flexibility. Know when your repayment begins, how much your minimum monthly payment will be, and whether there’s a grace period after graduation. This knowledge helps you plan smarter.

7. Build or Improve Your Credit Score

If you need to borrow from private lenders, your credit score becomes a major factor in the interest rate they offer. A higher score means better terms and lower total cost. To build credit fast, start with a secured credit card or become an authorized user on someone else’s account. Pay all your bills on time, keep credit card balances low, and avoid unnecessary hard inquiries. Lenders love consistency, and that translates into savings for you.

With these seven steps, you’re not just preparing to borrow wisely—you’re actively shaping a more manageable financial future. These are small actions, but their impact adds up.

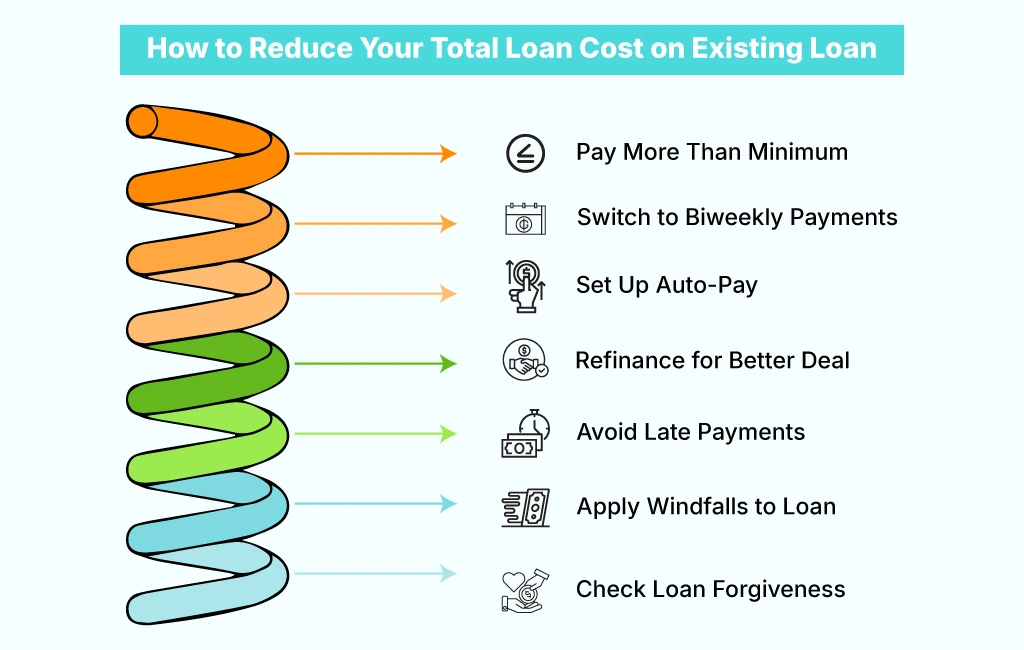

7 Steps to Reduce Your Total Loan Cost on Existing Loan

If you’ve already taken out a student loan, you’re not stuck with sky-high repayment costs, far from it. While you can’t erase your loan overnight, there are several practical ways to reduce what you ultimately pay. Here’s how to make the most of the situation and chip away at your debt with less stress and more savings.

1. Pay More Than the Minimum When You Can

This one’s straightforward but powerful. Your minimum payment is designed to stretch the loan over years, sometimes decades. By paying more than the minimum, even by a small amount, you cut directly into the principal, which in turn reduces the total interest you’ll pay over the life of the loan.

Let’s say your minimum payment is $250, but you pay $300 monthly instead. That extra $50 doesn’t just vanish, it trims your principal and compounds your savings month after month. It also shortens your repayment period, freeing you from debt sooner.

2. Switch to Biweekly Payments

Here’s a simple hack that pays off big: make half your monthly payment every two weeks instead of paying in one lump sum. You’ll end up making 26 half-payments, which equals 13 full payments annually, one extra payment every year without even noticing the change in cash flow.

This strategy keeps interest from accumulating as quickly, thanks to more frequent reductions in your principal balance. Over the long term, that small switch can shave months or even years off your repayment timeline.

3. Set Up Auto-Pay for a Discount

Most loan servicers offer a small discount, typically around 0.25%, if you set up automatic loan payments from your bank account. That may sound negligible, but over a decade-long loan term, it adds up. Plus, auto-pay ensures you never miss a payment, which is great for maintaining or improving your credit score.

4. Refinance for a Better Deal

If your credit score has improved since you first borrowed, refinancing could be a smart move. A lower interest rate means you’ll pay less in the long run, even if you stick to your current repayment schedule. Just be cautious: refinancing federal loans with a private lender means giving up benefits like income-driven repayment plans and potential forgiveness programs.

Only consider this route if you’re confident you won’t need those federal protections.

5. Avoid Late Payments

It might seem obvious, but timely payments are critical. Late payments often come with fees and can bump up your interest rate, not to mention the hit to your credit score. Set up reminders, calendar alerts, or automatic drafts to keep everything on track. A good payment history not only protects your credit but can open the door to better refinancing terms in the future.

6. Apply Windfalls to Your Loan

Did you get a tax refund, work bonus, or unexpected check from a relative? Instead of spending it all, apply a chunk to your loan balance. These occasional lump-sum payments go straight toward reducing the principal, resulting in less interest and a faster payoff.

Even applying half of a windfall can make a noticeable dent. You don’t have to be perfect, just consistent.

7. See If You Qualify for Forgiveness

Student loan forgiveness isn’t a myth, it’s just not automatic. Programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness can eliminate a significant portion of your balance if you meet the criteria. For PSLF, working full-time for a government or qualifying nonprofit and making 120 on-time payments could lead to full forgiveness of the remaining balance.

Other income-driven plans also offer forgiveness after 20 or 25 years, depending on the program. Explore these options with care, eligibility requirements are strict, but if you qualify, the savings are substantial.

With these strategies, reducing your total loan cost is not only possible, it’s completely within reach. It’s about making small, consistent decisions that add up to major financial wins over time.

How to Reduce Your Total Loan Cost: Common Mistakes and Ways to Avoid Them

Reducing your total loan cost isn’t only about what you do, it’s also about what you don’t do. Many borrowers unintentionally make choices that increase their overall debt burden. These aren’t necessarily dramatic blunders; more often, they’re small oversights or assumptions that quietly snowball into bigger problems. Here’s a closer look at the common missteps and how to sidestep them.

Ignoring Interest Accrual

One of the most frequent and costly mistakes is underestimating how quickly interest adds up, especially during periods of deferment or forbearance. While these options provide temporary relief, they don’t stop your loan from growing. Interest keeps accruing, and if it’s capitalized (added to your principal), you’ll end up paying interest on that interest. To avoid this, make interest-only payments if possible during these pauses.

Not Understanding Loan Terms

Loan contracts are dense and full of fine print, but brushing past them can lead to missed opportunities. For example, some loans penalize early repayment, while others have hidden fees. Misunderstanding your repayment timeline, grace period, or deferment rules can also lead to budget mismanagement. Take the time to read and ask questions. It’s worth it.

Failing to Reevaluate Repayment Plans

Your income and expenses aren’t static, so your repayment plan shouldn’t be either. As your financial situation evolves, it’s important to reassess your repayment strategy. You might be eligible for an income-driven plan that lowers your monthly payments, or better yet, you might be in a position to pay more aggressively and save on interest.

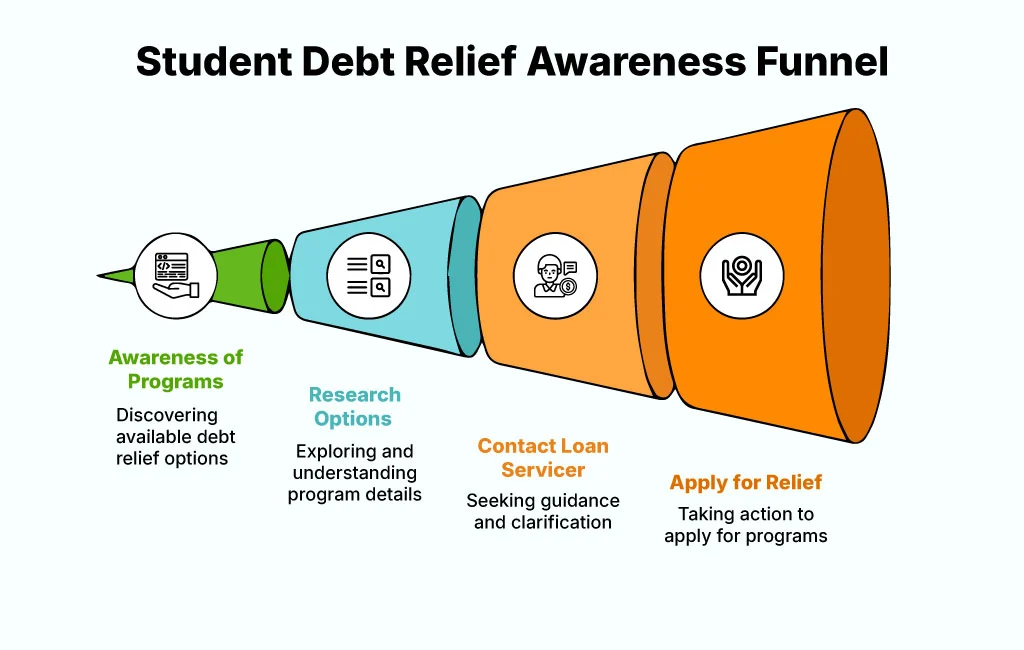

Overlooking Student Debt Relief Options

There are numerous federal and state programs designed to ease student debt—but many borrowers never apply simply because they don’t know these programs exist. Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and income-driven repayment forgiveness are just a few. Take time to research or speak with your loan servicer. The potential savings can be substantial.

Avoiding these mistakes is just as crucial as implementing smart repayment strategies. Sometimes, not taking the wrong step is half the battle won.

Conclusion

Managing student loans isn’t just about making monthly payments, it’s about making smart, strategic decisions from the moment you consider borrowing until the day your balance hits zero. While it might feel overwhelming, especially with terms like “capitalized interest” and “refinancing” floating around, the truth is: you have more control than you think.

Start with awareness. Know what you’re signing up for, borrow only what’s necessary, and seek out grants and scholarships to fill gaps. These initial steps might not feel urgent, but they’re the foundation for a healthier financial future.