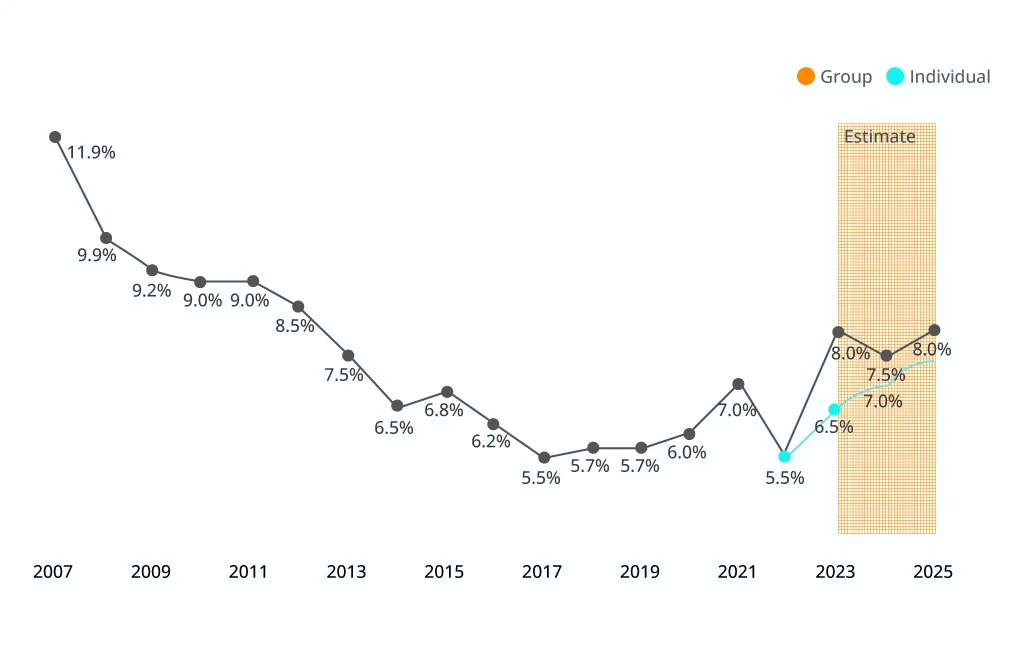

In 2023 and 2024, healthcare costs surged more than initially projected, driven by unexpected trends in the utilization of GLP-1 drugs for diabetes and weight management. These medications, known for their effectiveness, have significantly impacted healthcare spending as more individuals incorporate them into treatment plans. Simultaneously, higher acuity inpatient and outpatient care utilization has further strained financial resources, reflecting a growing need for comprehensive medical services.

Navigating these rising costs underscores the importance of financial planning tools like Health Savings Accounts (HSAs). If you’re wondering: how much should I contribute to my HSA, understanding your healthcare expenses and leveraging the tax advantages of an HSA can provide a much-needed safety net. This article explores the essentials of HSAs, contribution strategies, and how to optimize their benefits for both immediate and long-term healthcare needs.

What is an HSA, and How Does It Work?

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals with high-deductible health plans (HDHPs) save for qualified medical expenses. Understanding how HSA works is key to leveraging its full potential.

A Health Savings Account (HSA) is a specialized savings account designed to help individuals manage healthcare expenses efficiently. This account allows you to set aside pre-tax dollars to cover qualified medical expenses such as deductibles, copayments, and certain treatments. As long as the funds are used for eligible expenses, withdrawals remain tax-free, making HSAs a tax-advantaged way to manage out-of-pocket healthcare costs. However, general insurance premiums are not considered qualified expenses under HSA guidelines.

Eligibility for an HSA depends on being covered by a High Deductible Health Plan (HDHP). HDHPs typically have lower monthly premiums but require higher out-of-pocket spending before insurance coverage begins. Those enrolled in Medicare or plans that provide first-dollar coverage—where services are paid without deductibles or copayments—are not eligible to contribute to an HSA. This ensures that HSAs are specifically aligned with plans requiring significant individual responsibility for healthcare spending.

HSAs are offered through banks, credit unions, and financial institutions, making them easily accessible to eligible individuals. Funds in these accounts can be used for a wide range of qualified expenses, such as acupuncture, ambulance costs, doctor visits, hearing aids, prescription drugs, and even psychiatric care. Additionally, HSA funds can sometimes be spent on similar medical costs for your spouse or dependents.

One of the standout features of HSAs is their ability to carry over unused funds year after year. This means you’re not under pressure to spend the money within a specific timeframe, unlike Flexible Spending Accounts (FSAs). Over time, this rollover capability can help build a robust financial cushion for future medical needs.

How Much Should I Contribute to My HSA? Explained

Determining how much should I contribute to my HSA involves analyzing my healthcare expenses, income, and future needs. The HSA contribution guide recommends considering your annual deductible, anticipated medical costs, and ability to maximize contributions.

Allocate Savings from Premium Reductions

High Deductible Health Plans (HDHPs), required for HSA eligibility, often come with lower monthly premiums but higher deductibles. The money saved from reduced premiums can be redirected into your HSA. This approach ensures that your savings align with your plan’s higher out-of-pocket costs while benefiting from the tax advantages of an HSA.

Additionally, preventative care services, such as annual check-ups, are usually covered even before meeting your deductible. By saving the difference in premiums, you’re building a financial cushion to handle unexpected healthcare expenses without disrupting your budget.

Budget for Regular Medical Costs

If you have consistent healthcare costs, such as prescription medications or regular doctor visits, estimating these expenses can guide your HSA contributions. Review past medical bills to determine a baseline for annual spending.

Contributing enough to cover these routine expenses ensures you maximize the HSA’s tax benefits while covering essential healthcare needs. For example, individuals in the 22% tax bracket could save nearly 30% in taxes on every dollar contributed via payroll deductions, making this a cost-effective strategy for managing healthcare expenses.

Cover Your Deductible or Out-of-Pocket Limits

A proactive way to use your HSA is by contributing an amount equal to your plan’s deductible or out-of-pocket maximum. These figures represent the most you’d pay annually for covered healthcare services, offering a clear savings goal.

However, reaching this goal within a single year might be challenging due to IRS contribution limits. Fortunately, HSA funds roll over each year, allowing you to save incrementally. In the meantime, you can use non-tax-advantaged funds for minor medical costs, helping your HSA balance grow for significant expenses.

Maximize Contributions for Future Benefits

Maximizing your HSA contributions is an effective way to prepare for both current and future medical needs. For 2024, the IRS limits are $4,150 for individual coverage and $8,300 for family coverage, with catch-up contributions of $1,000 available for individuals aged 55 and older.

By contributing the maximum, you can cover current healthcare expenses with tax-advantaged dollars and allow unused funds to grow over time. Treating your HSA as a long-term savings tool for retirement healthcare costs can significantly ease the financial burden in later years. For instance, a 65-year-old retiree may need approximately $165,000 in after-tax savings for medical expenses, making an HSA an invaluable asset.

HSA Contribution Limits

The IRS sets annual limits for HSA contributions, which vary based on individual and family coverage. Understanding these HSA IRS limits is essential to avoid over-contributing.

Health Savings Account (HSA) contribution limits are set annually by the IRS, ensuring account holders are aware of how much they can save within these tax-advantaged accounts. For 2024, individuals with HSA-eligible plans can contribute up to $4,150 for single coverage, while those with family plans can contribute up to $8,300. These limits include both employee and employer contributions, making it important to track the total amount deposited to avoid exceeding the limit.

For account holders aged 55 and older, the IRS permits an additional “catch-up” contribution of $1,000 annually. This provision allows older individuals to enhance their HSA savings as they approach retirement, preparing for potentially higher healthcare costs later. The limits increase slightly in 2025, with contributions capped at $4,300 for individuals and $8,550 for families, while the $1,000 catch-up contribution remains the same.

How much should I contribute to my HSA? These limits highlight the importance of strategic HSA planning. Whether you’re focused on covering immediate medical expenses or building a robust fund for retirement healthcare needs, adhering to the contribution guidelines ensures you make the most of this powerful financial tool.

Factors to Consider Before Deciding Your Contribution

So, how much should I contribute to my HSA?

When deciding how much to contribute to your Health Savings Account (HSA), several HSA contribution factors should guide your decision to ensure you’re optimizing its benefits.

Your Health Insurance Plan

Your HSA contributions are closely tied to the type of high-deductible health plan (HDHP) you’re enrolled in. Understanding your plan’s deductible, out-of-pocket maximum, and overall coverage will help you estimate potential medical expenses and decide how much to contribute. For example, if your plan has a high deductible, consider contributing enough to cover that amount to ensure financial security in case of unexpected medical costs.

Current Healthcare Needs

Evaluate your current medical expenses, including routine doctor visits, prescriptions, and ongoing treatments. If your healthcare spending is consistent year over year, using past expenses as a baseline can help determine an appropriate contribution. Contributing enough to cover these anticipated costs ensures you can take full advantage of the tax benefits while managing medical expenses effectively.

Future Medical Costs

Planning for future healthcare needs is equally important. Adjust your contributions accordingly if you foresee higher expenses due to planned procedures or family healthcare needs in the coming years. Additionally, consider contributing the maximum allowed if you aim to build a substantial fund for healthcare costs in retirement.

Your Financial Goals

Balancing your HSA contributions with other financial priorities is critical. While maximizing your HSA contributions provides tax benefits and long-term savings potential, ensure it doesn’t compromise your ability to meet other goals like retirement or managing daily expenses.

Maximizing the Benefits of Your HSA

Utilize HSA savings strategies to maximize the benefits of your account. To fully leverage your HSA, adopting strategic approaches that maximize its financial benefits is essential. Below are some effective ways to make the most of your HSA. So, how much should I contribute to my HSA?

Contribute the Maximum Amount Each Year

One of the most effective ways to maximize your HSA is by contributing the maximum amount the IRS allows annually. For 2024, the contribution limits are $4,150 for individuals and $8,300 for families. If you’re 55 or older, you can also make an additional $1,000 catch-up contribution. Contributing the maximum ensures you take full advantage of the account’s triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified expenses.

Invest Your HSA Funds

Many think of HSAs as only a tool for paying immediate healthcare expenses. However, investing your HSA funds can significantly grow your savings over time. Many HSA providers offer investment options, including mutual funds and ETFs, allowing you to build a healthcare nest egg for the future. By treating your HSA like a retirement account and investing funds you don’t need for current expenses, you can benefit from tax-deferred growth and potentially cover significant healthcare costs in retirement.

Focus on Qualified Medical Expenses

To maintain the tax-free withdrawal benefits of your HSA, it’s crucial to use the funds exclusively for qualified medical expenses. These include doctor visits, prescription medications, dental work, and vision care. Misusing HSA funds for non-qualified expenses before age 65 can lead to penalties and taxes. After 65, you can use HSA funds for non-medical expenses without penalties, though they will be taxed as regular income.

Save for Future Healthcare Costs

Consider your HSA as a long-term savings tool. Refraining from using your HSA for small, out-of-pocket expenses today allows your contributions to grow over time. This strategy is particularly beneficial given the rising costs of healthcare in retirement, which can amount to hundreds of thousands of dollars. Building a substantial HSA balance can provide peace of mind and financial security for future medical needs.

Track and Document Your Expenses

Keep detailed records of all medical expenses paid with your HSA. This ensures you can reimburse yourself later, even years after the expense, as long as it was incurred after opening the HSA. Maintaining good documentation helps you maximize your HSA’s flexibility while complying with IRS rules.

Qualified vs. Non-Qualified HSA Expenses

Understanding HSA-eligible expenses helps you use your funds wisely. Qualified expenses include doctor visits, prescription medications, and dental care. Non-qualified expenses, like cosmetic procedures, incur a 20% penalty if withdrawn before age 65.

Qualified HSA Expenses

Qualified HSA expenses are those directly tied to medical care, treatments, or related necessities. For instance, expenses like acupuncture, birth control, and fertility treatments are eligible for reimbursement. Special medical equipment installed in your home or car due to a diagnosed disability also qualifies, though you must file the appropriate capital expense forms.

Other approved expenses include Medicare premiums for Parts A, B, and D, mental health treatments, and weight-loss programs for medical conditions. Transportation costs for attending medical appointments, such as taxis, buses, or flights, are also reimbursable. Additionally, everyday items like bandages for post-care and menstrual products fall under qualified expenses, along with over-the-counter medications, even without a doctor’s recommendation.

Non-Qualified HSA Expenses

Not every medical-related purchase is eligible for HSA reimbursement. For example, controlled substances like marijuana are not approved, even if state laws permit their use for medical purposes. Similarly, voluntary cosmetic surgeries and teeth whitening treatments are excluded unless necessary due to a medical condition.

Other non-qualified expenses include medications from foreign countries (unless FDA-approved) and veterinary costs for guide or service animals. If an unapproved expense is inadvertently paid using HSA funds, it must be corrected within the same tax year to avoid a 20% penalty.

HSA Strategies for Different Life Stages

How much should I contribute to my HSA? An HSA adapts to your needs at every life stage, providing tax benefits and financial security for healthcare expenses. Tailor your contributions and withdrawals with HSA life stage planning:

Early Career: Building Savings

Start contributing consistently to your HSA, even in small amounts, to build a foundation. With fewer immediate medical costs, invest unused funds for long-term growth and enjoy tax-free compounding over time.

Family Years: Covering Growing Expenses

During family years, contribute enough to cover annual deductibles and out-of-pocket maximums. Use your HSA for routine healthcare costs while saving for future needs whenever possible.

Pre-Retirement: Maximizing Contributions

As healthcare costs rise, maximize contributions, including catch-up contributions if you’re 55 or older. Build a robust balance to cover anticipated retirement healthcare expenses, such as long-term care and Medicare premiums.

Retirement: Strategic Use of Funds

In retirement, use your HSA tax-free for qualified medical expenses like Medicare premiums and dental care. Surplus funds can be withdrawn for non-medical needs without penalties after age 65, offering additional flexibility.

What Happens if You Over-Contribute or Under-Contribute?

Exceeding the IRS limits leads to penalties, while HSA underfunding impact leaves you unprepared for healthcare costs. Stay within limits and reassess your contributions annually.

Tips for Making the Most of Your HSA

How much should I contribute to my HSA? Health Savings Accounts (HSAs) are powerful tools for managing healthcare expenses while enjoying tax benefits. Here’s how you can optimize your HSA contributions and usage effectively.

1. Maximize Contributions When Possible

If your financial situation allows, contribute up to the IRS annual limit. For 2024, individuals can contribute $4,150, while families can save up to $8,300. Those aged 55 or older can add an extra $1,000 in catch-up contributions. Maxing out contributions ensures you take full advantage of the tax benefits and grow your savings.

2. Leverage Savings from Lower Premiums

High-deductible health plans (HDHPs) typically come with lower monthly premiums. Consider channeling the difference between premiums into your HSA. This approach not only builds your account balance but also ensures you’re prepared for medical costs without impacting your budget.

3. Cover Your Deductible Amount

At a minimum, aim to save enough to cover your plan’s deductible. This ensures you have immediate funds for essential healthcare expenses. Over time, you can grow your balance to cover additional costs like out-of-pocket maximums or unexpected medical emergencies.

4. Plan Contributions in Your Monthly Budget

Incorporate your HSA contributions into your regular budget. Setting up automatic payroll deductions or monthly transfers makes saving seamless and consistent. This habit ensures you steadily grow your HSA without disrupting other financial goals.

5. Tailor Contributions to Your Needs

Analyze your healthcare costs and financial goals to determine the ideal contribution amount. Whether saving for routine care or future medical needs, aligning contributions with your personal circumstances ensures your HSA works effectively for you.

Final Words

So, how much should I contribute to my HSA? Understanding this is vital for achieving financial security and managing healthcare expenses effectively. By aligning contributions with your needs and utilizing your HSA strategically, you can enjoy its tax advantages and ensure you’re prepared for medical costs at every stage of life.

Head over to the comprehensive blog to dive deeper into optimizing your contributions and fully leveraging your HSA. It’s your guide to making smarter financial decisions and maximizing your healthcare savings.