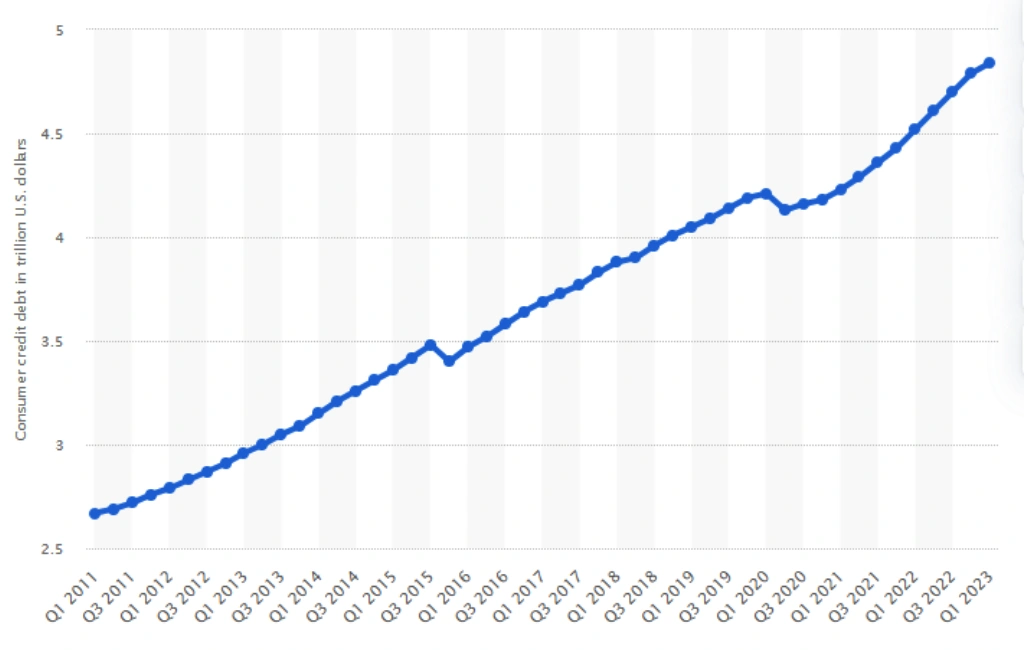

In the first quarter of 2023, a record was set in the United States: people borrowed more money than ever before, reaching a total of 4.84 trillion dollars. This isn’t just a one-time spike; it’s part of a trend that has been going on for the last ten years. More and more families and nonprofit groups are taking on debt, and it’s growing and growing. This means that understanding how to deal with this debt, especially how to handle the taxes on it, is becoming really important for a lot of people.

Debt settlement can offer a lifeline to those struggling with unmanageable debt. However, the tax implications of this relief can often be overlooked. This article will explore the essential facts about how to avoid paying taxes on debt settlement and provide valuable insights into this complex subject.

Understand the Tax Consequences

Navigating the waters of debt settlement is not merely about negotiating the amount you owe. The tax consequences play a crucial role, often determining how beneficial the settlement might be for your financial future. Understanding these implications is essential to avoid any unpleasant surprises at tax time.

When a part of your debt is forgiven or settled for less than the full amount, the IRS often views this forgiven amount as taxable income. Here’s what you need to know:

Forgiven Debt as Income

When a portion of your debt is forgiven or canceled by a creditor, the Internal Revenue Service (IRS) often considers this amount as income. This concept might seem counterintuitive since you didn’t actually receive money, but from a tax perspective, you’ve gained value equivalent to the forgiven amount.

Treating forgiven debt as income is based on the principle that you borrowed money without repaying the full amount. Essentially, the forgiven amount is seen as a benefit you’ve received and is treated as income.

The tax rate applied to the forgiven amount usually corresponds to your regular income tax bracket. If the forgiven debt is considered taxable, it could push you into a higher tax bracket, meaning you might owe more taxes.

Receiving a 1099-C Form

The 1099-C form, also known as the “Debt Cancellation” form, is a tax form that creditors must send to both you and the IRS if they forgive $600 or more of your debt during the tax year.

This form includes crucial details such as the amount of debt forgiven, the date the debt was forgiven, and information about the creditor. It effectively serves as official documentation of the debt cancellation.

If you receive a 1099-C form, including it when you file your tax return is essential. The IRS will receive a copy and expect to see the corresponding information on your return.

Receiving a 1099-C can sometimes lead to confusion or even problems. The information might be incorrect, or you might disagree with the debt cancellation. In such cases, it’s wise to contact the creditor to clarify the information and consult a tax professional.

Insolvency Avoids Taxes on Canceled Debt

Navigating debt settlement often brings complex challenges, but there may be a silver lining for those who find themselves in a state of insolvency. Insolvency provides a unique opportunity to avoid taxes on cancelled or forgiven debt. Here’s how it works:

Debt Forgiven as a Gift, Inheritance, or Bequest: If debt cancellation occurs through a gift, inheritance, or bequest, it is exempt from taxation. This provision recognizes such transactions as non-commercial, removing typical tax obligations.

Forgiveness of Student Loans with Certain Employment Obligations: Some student loans may be forgiven if you work for a specified time with particular classes of employers. This helps incentivize careers in certain fields and can provide significant financial relief for qualifying individuals.

Specific Educational Loan Forgiveness Programs for Health Services: There are loan forgiveness programs aimed at those who provide health services in designated areas. These programs reward professionals who contribute to underserved communities and assist in meeting vital healthcare needs.

Student Loan Discharges from 2021 to 2025: A temporary provision exempts certain student loan discharges between 2021 and 2025 from taxable income. This policy aims to alleviate the burden on those benefiting from specific loan relief programs during this period.

Cancellation of Particular Student Loans: Some federal, private, or educational student loans may have cancellation provisions not subject to income taxes. Understanding the type of loan and its terms can clarify eligibility for this benefit.

Debts Qualifying as Deductible if Paid by Cash Basis Taxpayer: If a debt would have been deductible had it been paid by a cash basis taxpayer, its cancellation may be tax-exempt. This provision aligns the treatment of certain debts with the underlying economic realities of the transactions.

Price Reductions Granted by Property Seller: Qualified price reductions on purchase given by the seller of a property may be exempt from taxation. This recognizes the commercial nature of such concessions and avoids treating them as taxable income to the buyer.

Forgiveness of Debt During Chapter 11 Bankruptcy: Cancellation of debt as part of Chapter 11 bankruptcy proceedings is not included in gross income. This legal provision recognizes the unique circumstances of bankruptcy and avoids additional taxation during financial recovery.

Cancellation of Debt When Liabilities Surpass Assets: If the cancellation occurs when a debtor’s total liabilities exceed their assets, it may not be considered gross income. This recognizes the financial distress of insolvency and provides relief from additional tax burdens.

Debt Forgiveness Related to Qualified Farming Activities: Qualifying farm indebtedness that is cancelled may be excluded from gross income. This provision supports the agricultural sector by recognizing farmers’ unique financial challenges.

Relief from Qualified Real Estate Business Indebtedness: Qualified real estate cancellation business indebtedness may be tax-exempt. This exemption supports the real estate business by providing relief in specific, financially challenging circumstances.

Exemption for Primary Residence Indebtedness Before 2026: Indebtedness discharged on a primary residence before 2026 may be exempt from taxation. This provision supports homeowners facing financial difficulties, especially in the wake of housing market fluctuations.

Bankruptcy as a Tax-Free Alternative to Debt Settlement

Filing for bankruptcy can be a tax-free way to handle debts. Debts discharged through bankruptcy are usually not considered taxable income, thus offering a potential tax benefit. However, bankruptcy has consequences and legal complexities, so professional advice is essential.

Chapter 7 (Liquidation Bankruptcy): In a Chapter 7 bankruptcy, the assets of a business are liquidated to pay its creditors. Secured debts take precedence over unsecured debts in this process, often leading to the clearance of various outstanding obligations. This approach might result in a significant reduction of debt, but it involves the potential selling off of valuable assets.

Chapter 11 (Reorganization Bankruptcy): Unlike Chapter 7, Chapter 11 bankruptcy allows the company to continue operating while restructuring under a court-appointed trustee’s supervision. The goal of Chapter 11 is to emerge from bankruptcy as a viable business, adjusting debts and obligations to create a more sustainable financial structure. This option offers more flexibility and control but requires a detailed plan and ongoing court oversight.

The Value of a Tax Professional in Navigating Debt Settlement

Navigating the world of debt settlement is a complex endeavor filled with potential pitfalls. Collaborating with a licensed tax professional rather than relying on generic online services can mean the difference between success and costly mistakes.

Guiding You Through Debt Settlement

An experienced, licensed tax professional specializes in interpreting the often-confusing laws surrounding debt settlement. They can help you understand your options, take advantage of any available exemptions, and guide you through the process in a way that minimizes your tax liabilities. Debt settlement has unique tax implications, and handling the situation incorrectly can lead to penalties and unexpected expenses. A tax professional can prevent these by ensuring that you follow the correct procedures.

Avoiding Mistakes in Debt Settlement

In the realm of debt settlement, errors can be costly. Completing forms incorrectly or failing to understand the specific tax codes related to debt cancellation can lead to unnecessary financial burdens. A skilled tax professional can help you avoid these mistakes, employing their expertise to guide you through the process and ensure that your debt settlement is handled in the most tax-efficient manner possible.

Selecting the Right Debt Settlement Expert

The expertise among tax preparers varies widely. While some may claim to specialize in debt settlement, they may need more training, experience, or certifications to provide the guidance you need. Others may only dabble in the field with the qualifications to navigate the complexities of debt settlement. Therefore, conducting your research is paramount to finding someone who can truly assist you.

How Much Is the Debt Settlement Tax?

The consequence of debt forgiveness often leads to owing additional money to the IRS. In scenarios where this extra tax liability becomes more than you can reasonably manage, there may be avenues to pursue tax debt relief, potentially reducing the burden. This aspect underlines the importance of understanding the tax consequences of debt forgiveness and exploring options if you find yourself in a situation where the tax liability becomes unmanageable.

When a debt of $600 or more is forgiven or wiped out, tax implications follow, and you must pay taxes on the sum that has been cancelled. It becomes a requirement to declare this forgiven debt when you file your taxes and to help with this, your lender or creditor will furnish a Form 1099-C, which outlines the amount that has been wiped clean and the date on which it was done.

The IRS views debt forgiveness as a form of income, meaning the amount must be recorded under “other income” when filing your tax return. This amount is subject to regular income tax rates. To illustrate, if you have an annual salary of $50,000 and a debt of $10,000 is forgiven, a tax rate of 22% would apply to that $10,000, resulting in a tax bill of $2,200 specifically related to the cancelled debt.

Can I Avoid Paying Taxes on a Debt Settlement?

Avoiding taxes on debt settlement is possible under certain conditions, such as insolvency or bankruptcy. It may also depend on the type of debt being settled. Consulting with a tax professional can provide personalized advice tailored to your situation.

Final Words

Understanding how to avoid paying taxes on debt settlement is critical to managing personal finances, particularly for those struggling with significant debt. From insolvency to bankruptcy, and with the help of tax professionals, strategies are available to minimize or even eliminate the tax burden associated with debt settlement. With careful planning and expert guidance, navigating this complicated financial landscape is possible.

At EduCounting, we’re committed to empowering young people with the financial literacy and money management skills they need to thrive. With our educational resources and tools, we guide you every step of the way to making informed, confident decisions about your money. Don’t wait to become a master of money management – join the course today and start your journey toward financial success!

FAQs

A. Are Tax Debts Settled Through an Offer in Compromise Taxable?

An Offer in Compromise is an agreement with the IRS to settle tax debts for less than the full amount. Generally, this is not considered taxable income, but specific circumstances can vary.

B. Are Debts Canceled in Bankruptcy Taxable?

Typically, debts cancelled in bankruptcy are not taxable. This is one reason why bankruptcy might be considered over debt settlement in some situations.

C. What Happens When Debt Relief Companies Negotiate Settlements?

Debt relief companies negotiate with creditors to reduce the amount you owe. While this can lead to substantial savings, the forgiven debt may be considered taxable income, subject to the aforementioned exceptions.