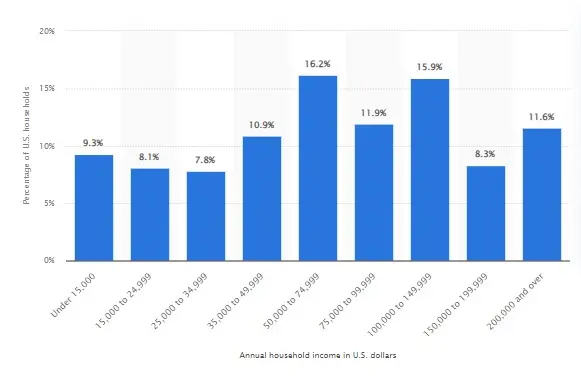

Despite the growing wealth in America, over half of the households still earned less than 75K in 2021- showing just how tough it can be for many families to make ends meet. If you’re living on a low income, budgeting your money is essential to ensure your bills are paid and you have enough left over for the necessities.

Budgeting is an essential skill everyone should learn regardless of income level. The good news is that it is possible to make a budget and save money on a limited income with some creativity and determination. In this article, we will discuss how to budget money on low income, how to budget and save money on a low income, and how to be financially stable with low income.

How to Make a Budget with Low Income: Assessing Your Income and Expenses

When it comes to achieving financial stability, one of the most important steps you can take is assessing your income and expenses. To make informed financial decisions and create a budget, it’s important to know the sources and destinations of your money.

Identifying All Sources of Income

The first step in budgeting is clearly understanding all your income sources. It’s more than just your regular paycheck; it could also be social security benefits, income from a part-time job, or any money you make from a side hustle.

Determining All Expenses, Both Fixed and Variable

The second step is identifying all your expenses. This refers to all costs, including fixed and variable ones. Fixed costs are included, which are expenses that don’t change monthly, like rent, utilities, mortgage, or car payments. These are usually the first things you should consider in your budget. Variable expenses include items like clothing, groceries, and entertainment. By understanding your fixed and variable costs, you can better manage your budget and identify areas where you might be overspending.

Tracking Daily Expenses

Keeping a close eye on your daily spending is crucial to budgeting. This might sound tedious, but it becomes much more manageable with the help of budgeting apps or a simple spreadsheet. Tracking your daily expenses helps you figure out how to budget money on low income.

Identifying Areas Where Expenses Can Be Reduced

After tracking and categorizing your expenses, the next step is identifying areas where you can reduce spending. Look for patterns in your spending habits. Maybe you’re eating out more often than you realized, or your cable bill is higher than expected.

How to Save Money on a Low-Income Budget: Budgeting Tips for Low-Income Families

Now that you better understand your income and expenses, you can start to create a budget that works for you. Please remember that a low-income budget example often includes one without a plan.

Reviewing Your Budget Regularly

A budget isn’t a set-it-and-forget-it tool. You should reevaluate your budget periodically to ensure you’re sticking to it, and you can adjust as needed. If you’re consistently overspending in certain areas, it might be time to reassess and adjust your budget.

Finding Ways to Increase Income

If you’re finding it hard to meet your expenses and don’t know how to budget money on low income, it might be the right time to consider ways to increase your income. This could be getting an additional job or starting a side business.

Avoiding Impulsive Purchases

Impulsive purchases can quickly derail a budget. It’s easy to make an unplanned purchase when something catches your eye, but these small expenses can add up over time. If you see something you want that’s not on the list, give yourself a day or two to think about it.

Seeking Help from Financial Advisors or Community Resources

How to budget money on low income can be challenging, and seeking help is okay. Many community resources offer free or low-cost financial counseling. Financial advisors can also be a great resource in creating a budget and understanding other aspects of personal finance.

Additional Ways to Save Money on Low Income: How to Save Money on Limited Income

While creating a budget plan is a great start, learning how to save money on a low-income budget can help you reach your financial goals even faster.

Cutting Back on Utilities

Utilities is a necessary expense, but that doesn’t mean you can’t try to reduce them. Look for ways to conserve energy, like switching to LED lightbulbs or air-drying your clothes. Consider switching providers to get a better rate.

Taking Advantage of Discounts or Coupons

Discounts and coupons can help you save on clothing, entertainment, groceries, and more. Look for discounts or coupons online, in newspapers, and at the local store. You can also look for buy-one-get-one deals or sales to get the most out of your budget.

Cooking at Home and Meal Planning

Eating out can be a nice treat, but it’s often much more expensive than cooking at home. By preparing your meals, you save money and have more control over your eating, which can benefit your health. To make cooking at home easier, try meal planning. At the start of each week, decide what meals you’re going to cook and make a shopping list of what you need.

Finding Affordable Entertainment Options

Entertainment is essential to life but doesn’t have to be expensive. Consider outdoor activities like hiking, biking, or visiting local parks. Look for free community events or free days at museums and galleries.

How to Budget Money for Beginners: 10 Tips on Financially Stability with Low Income

Living on a low income can be challenging, but it’s still possible to achieve financial stability by budgeting and saving money. We’ll share ten tips on budgeting money for beginners to help you maximize your income and reach your financial goals.

1. How to Have Better Spending Habits: Monitor Your Expenses

The first step to financial stability is understanding where your money goes. This involves tracking all your income and expenses, no matter how small. To do this, you can use traditional methods like keeping a financial diary or ledger or modern methods like budgeting apps and online tools.

The process of tracking your spending not only promotes better money management but also encourages financial responsibility. It gives you a real-time view of your financial health and provides insights to guide your spending and saving decisions.

2. How to Budget Your Money on a Low Income: Set Achievable Goals

Goal setting is a vital part of realistic financial planning. A clear and achievable financial goal motivates and guides your budgeting process. To achieve your financial goals, such as saving for a down payment on a house, paying off credit card debt, or building an emergency fund, it is essential to set specific, measurable, achievable, relevant, and time-bound (SMART) objectives.

Setting realistic goals also means acknowledging your current financial situation and setting targets that you can realistically achieve. This approach helps to build confidence in your financial management skills and keeps you motivated to stick to your budget.

3. Prioritize Your Expenses

When budgeting on a low income, it’s essential to differentiate between needs and wants. Essential expenses like food, housing, and healthcare are needed for survival. Non-essential expenses that improve your lifestyle, such as entertainment and dining out, are wants. Prioritizing your expenses ensures that your basic needs are met before spending on non-essential items.

Understanding your expenses’ priority can help create a spending plan that reflects your values and goals. This doesn’t mean completely eliminating discretionary spending. Instead, it’s about balancing to meet your needs and enjoy your wants while staying within your income limits.

4. Reduce Your Debt

Carrying a lot of debt can significantly hinder financial stability. Paying off high-interest debt, like credit card debt, can significantly reduce your financial resources. Paying off these debts as soon as possible should be your top priority. If you can, pay more than the minimum payments and refrain from making new charges.

In addition, consider strategies like debt consolidation or negotiation for lower interest rates. Reducing your debt frees up money for other purposes and improves your credit score, which can benefit future financial goals.

5. Increase Your Income

While budgeting is often about cutting back, don’t overlook the potential of increasing your income. This can be accomplished through various methods, such as taking on a part-time job, freelancing, selling unused items, or even turning a hobby into a source of income.

Increasing your income can provide more financial flexibility and make it easier to meet your expenses and save for the future. Investing extra time and effort can yield significant financial stability benefits.

6. Cut Back on Non-Essential Expenses

Reducing non-essential expenses can free up funds for savings or essential costs. This might include opting for a cheaper cell phone plan, canceling unused subscriptions, dining at home instead of eating out, or using public transportation instead of owning a car.

Cutting back doesn’t mean you have to deprive yourself. It’s about making informed decisions on what to spend your money on. Remember, small savings can add up over time, and every dollar saved is a dollar that can be used towards reaching your financial goals.

7. Use Coupons and Discounts

One easy way to save money on your regular expenses is by using coupons and discounts. Many retailers offer digital coupons on their websites or apps, and various online platforms and apps are dedicated to providing coupons and discount codes.

However, be careful only to buy needed items, as it’s easy to overspend when items are on sale. Remember, it’s not a deal if you don’t need the thing in the first place.

8. Cook at Home and Meal Plan

Preparing your meals at home can be a cost-saving alternative to eating out or ordering in, which are usually pricier options. Additionally, cooking at home gives you more control over the ingredients you use, making your meals healthier.

To make cooking at home easier, consider meal planning. This can prevent impulse buys at the grocery store and ensure you have the ingredients to prepare meals, reducing the temptation to order takeout.

9. Save for Crises

An emergency fund means you have a safety net for unforeseen expenses like medical bills, car repairs, or unexpected job loss. This can prevent you from going into debt and give you peace of mind.

Start by aiming to save a small amount, such as $500, then gradually build up to three to six months’ worth of living expenses. Saving for an emergency fund might seem difficult when living on a low income, but even small contributions can add up over time.

10. Don't Hesitate to Ask for Help

If you find it difficult to meet your basic needs, do not hesitate to ask for help. Several government programs and community organizations provide aid with housing, food, healthcare, and other crucial services. Moreover, some non-profit organizations offer free or affordable financial counselling services.

Additionally, consider joining a local or online financial literacy group. These groups can assist you with support, resources, and education to enhance your financial situation. It’s important to remember that seeking help isn’t a weakness but a proactive step toward managing your finances.

Final Words: How to Budget Money on Low Income

Living on a low income is possible, although it can be difficult. With careful budgeting, a clear understanding of your income and expenses, and a commitment to making necessary adjustments, you can manage your finances effectively and achieve financial stability. Be patient and remember that even small steps towards improving your financial management can significantly impact the long term. Progress may be slow, but don’t get discouraged, and keep trying.

At EduCounting, we help you make the most of your income and learn how to save money with low income fast. Our online budgeting and financial literacy courses will teach you to track spending, set realistic goals, optimize cash flow, reduce debt, and save money. Enroll in one of our courses now to gain control over your finances!