Calculating your average tax rate is essential to managing your finances effectively. Understanding how to calculate average tax rate allows taxpayers to determine the overall percentage of their income that goes towards taxes, helping them plan and make informed financial decisions. Whether you are an individual or a business owner, knowing your average tax rate can provide valuable insights into your tax liabilities and aid in efficient financial planning.

In this comprehensive guide, we will explain the average tax rate, its importance, and provide step-by-step instructions on calculating it accurately. We will also explore additional factors to consider, common mistakes to avoid, and expert tips to ensure your calculations are precise. By the end of this article, you’ll be equipped with the knowledge and tools needed to navigate the complexities of tax calculations and improve your overall financial health.

What is the Tax Rate?

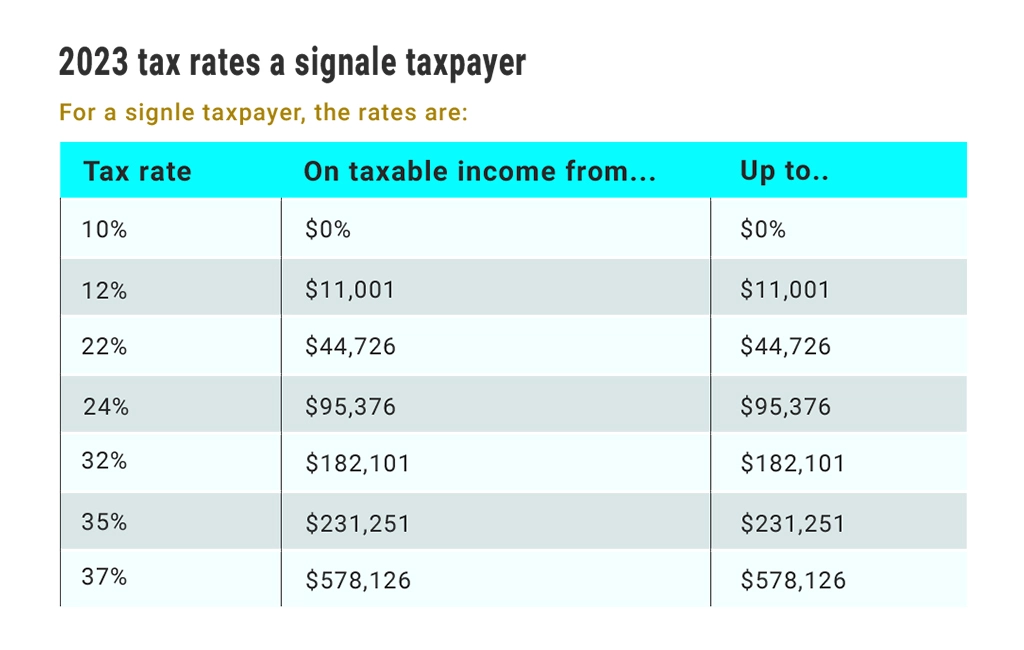

Tax rates are the percentage at which an individual or corporation is taxed. These rates can vary based on income level, type of income, and jurisdiction. In the United States, a progressive tax rate system is used, meaning the rate increases as the taxable income increases.

The federal income tax brackets for 2024 are set at 10%, 12%, 22%, 24%, 32%, 35%, and 37%. This system ensures that taxpayers with higher incomes pay a larger percentage of their income in taxes.

Progressive Tax System

The progressive tax system aims to collect more money from those who can afford to pay more. This system is designed to be fair, as it places a higher tax burden on individuals and corporations with higher incomes.

Taxing higher incomes at higher rates allows the government to generate more revenue to fund various public services and infrastructure projects.

Purpose of Tax Rates

Governments use tax revenue to build and maintain infrastructure and support social services. This includes everything from roads and schools to healthcare and public safety.

The tax rates applied to residents’ incomes are essential for the betterment of the nation and society as a whole. In the U.S., this revenue is crucial for sustaining the country’s development and providing services that benefit all citizens.

Types of Income Subject to Tax

Income that is subject to tax can come from various sources. This includes wages and salaries earned from employment, investment income such as dividends and interest, capital gains from investments, and profits from selling goods or services.

Both earned and unearned incomes are subject to tax rates, and a portion of these incomes is remitted to the government to support public services.

Application of Tax Rates

For income tax, the tax rate is the percentage of an individual’s taxable income or a corporation’s earnings owed to state, federal, and sometimes municipal governments.

The specific rate applied to an individual’s income depends on their marginal tax bracket. These brackets are a key component of the progressive tax system, ensuring that those with higher incomes contribute more in taxes.

Marginal Tax Rate

The marginal tax rate used by the U.S. government reflects its progressive tax system. This rate applies to the last dollar of income earned and increases with higher income levels.

For example, if an individual moves into a higher tax bracket, only the income above the previous bracket’s threshold is taxed at a higher rate. This system helps to distribute the tax burden across different income levels equitably.

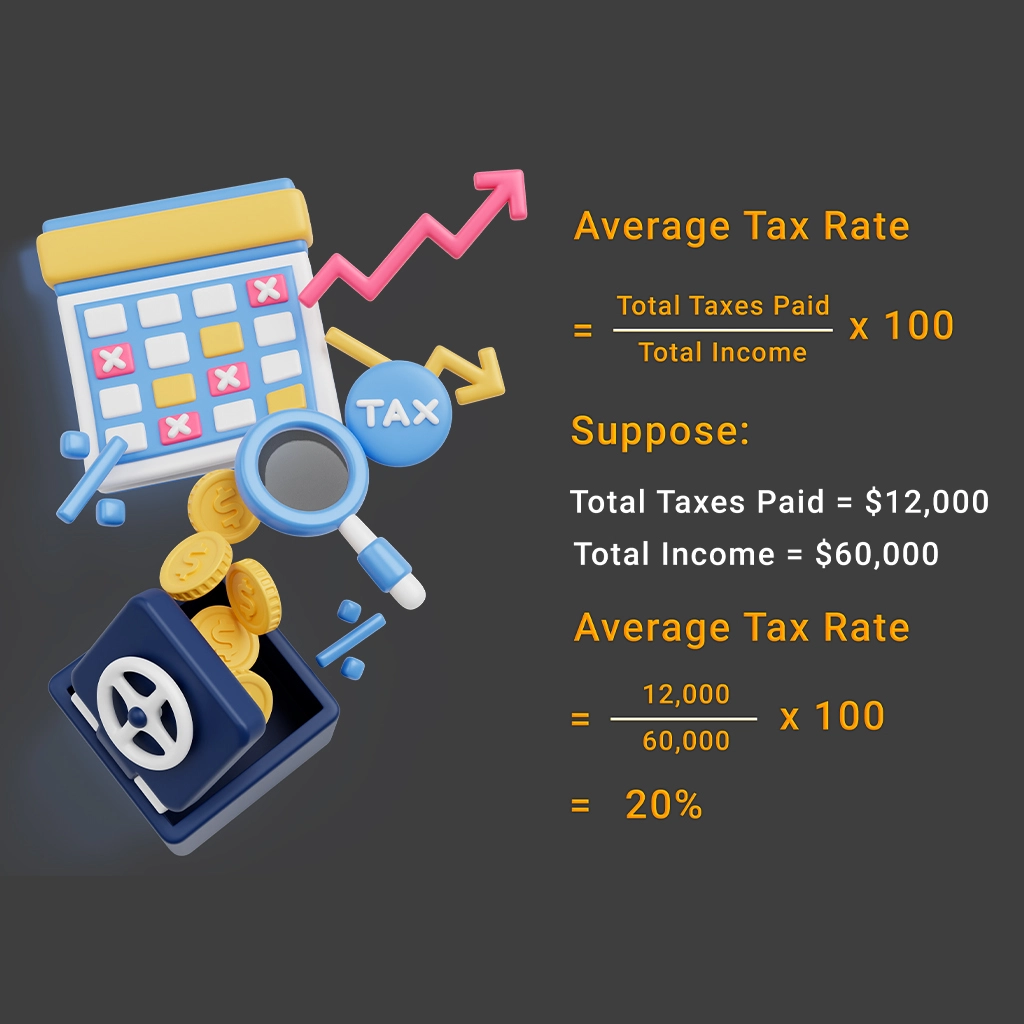

Understanding the Average Tax Rate

The average tax rate is a measure of the overall rate at which your income is taxed. It is calculated by dividing the total tax paid by the total income earned. This rate gives you an overview of how much of your income is going towards taxes, allowing for better financial planning and assessment of tax liability. The average tax rate differs from the marginal tax rate, which applies to the last dollar of income earned.

The rate is the percentage of total income that is paid in taxes. It is calculated by dividing the total amount of taxes paid by the total income earned. This rate gives a more comprehensive picture of the taxpayer’s tax burden compared to marginal tax rates, which apply only to the last dollar of income earned. For example, if an individual earns $50,000 a year and pays $7,500 in taxes, their average tax rate would be 15%.

Understanding the average tax rate is important for financial planning and analysis. It helps individuals and businesses determine their overall tax burden and how much of their income is going toward taxes. This information is crucial for budgeting, saving, and making informed financial decisions. Knowing your average tax rate can also help you compare your tax situation to previous years or other taxpayers in similar income brackets.

How to Calculate Average Tax Rate Efficiently

Once you understand your average tax rate, calculate for effective financial planning. The average tax rate calculation involves a straightforward process that can be done efficiently with a few steps. Here, we will outline how to calculate the average tax rate and provide some tips to ensure accuracy. Average tax rate calculate

Step 1: Gather Financial Information

To start, collect all necessary financial documents, including your income statements, tax returns, and records of deductions and credits. This comprehensive collection will ensure that you have all the data needed for an accurate calculation.

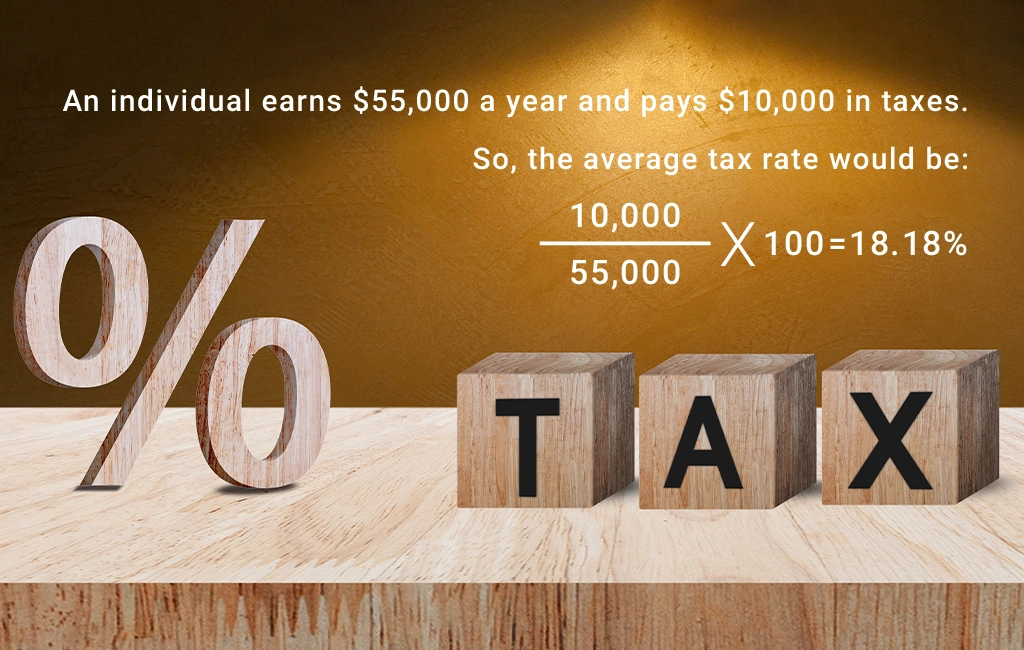

Step 2: Determine Total Income

Add up all sources of income for the year. This includes wages, dividends, interest, capital gains, and any other taxable income. For example, if you earned $50,000 from your job and received $5,000 in investment income, your total income would be $55,000.

Step 3: Calculate Total Taxes Paid

Refer to your tax return to find the total amount of taxes paid for the year. This includes federal, state, and local taxes. Suppose your tax return shows that you paid $8,000 in federal taxes and $2,000 in state taxes, your total taxes paid would be $10,000.

Step 4: Perform the Average Tax Rate Calculation

To calculate the average tax rate, divide the total taxes paid by the total income. The formula is as follows:

Average Tax Rate=Total Taxes Paid/Total Income

Using our example, the calculation would be:

Average Tax Rate=10,000/55,000≈18.18%

Additional Tax Calculation Considerations

When calculating your tax rate, it’s essential to consider various tax considerations that can affect the accuracy of your calculations. These considerations include deductions, tax credits, and any changes in tax laws that might impact your tax liability. Staying informed about these factors can help ensure your tax calculations are accurate and up-to-date.

Deductions

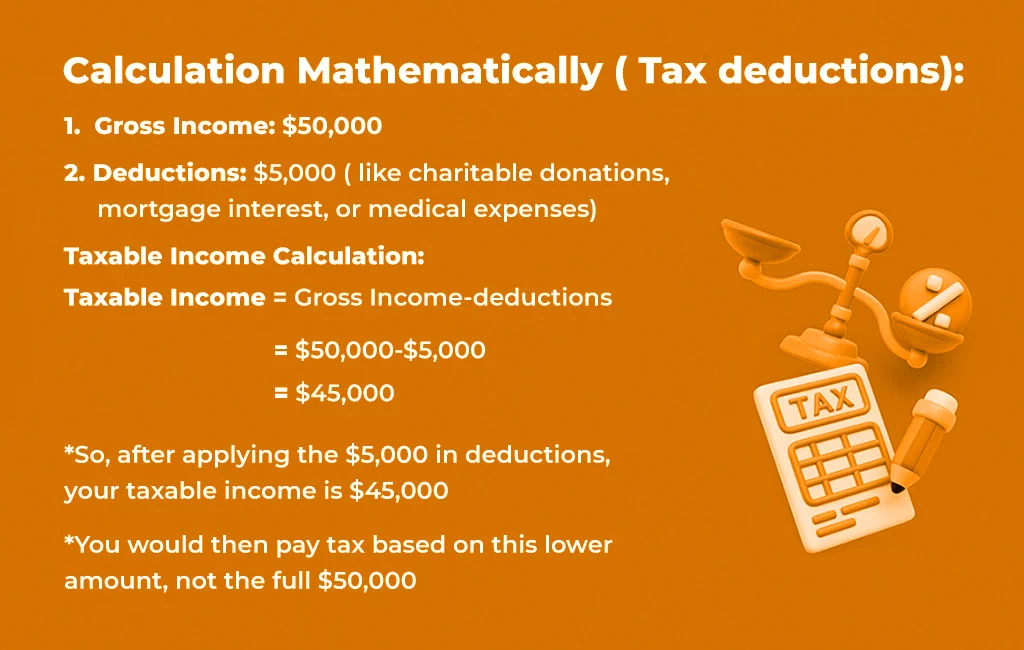

Deductions reduce the amount of your income that is subject to tax. They come in two forms: standard deductions and itemized deductions.

- Standard Deduction: This is a fixed dollar amount that reduces the income you’re taxed on. The amount varies depending on your filing status (single, married filing jointly, etc.). For example, for the tax year 2024, the standard deduction is $12,950 for single filers and $25,900 for married couples filing jointly.

- Itemized Deductions: If your allowable itemized deductions are greater than the standard deduction, you should itemize your deductions. Common itemized deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. Detailed records and receipts can help maximize deductions and reduce taxable income.

Tax Credits

Tax credits directly reduce the amount of tax you owe, dollar for dollar. Unlike deductions, which reduce the amount of income subject to tax, credits reduce your overall tax bill.

- Refundable Tax Credits: These can reduce your tax liability to below zero, resulting in a refund. Examples include the Earned Income Tax Credit (EITC) and the Child Tax Credit.

- Nonrefundable Tax Credits: These can reduce your tax liability to zero but cannot result in a refund. Examples include the Lifetime Learning Credit and the Adoption Credit.

Understanding and claiming all eligible tax credits can significantly lower your tax liability.

Changes in Tax Laws

Tax laws are subject to change, and these changes can impact your tax calculations. New tax laws can introduce new deductions and credits, eliminate existing ones, or change the tax rates and brackets.

- Annual Updates: The IRS updates tax rates, standard deductions, and other important figures annually to reflect inflation and legislative changes. Keeping abreast of these updates is crucial for accurate tax planning.

- Legislative Changes: Significant tax reforms can occur, affecting various aspects of the tax code. For instance, the Tax Cuts and Jobs Act (TCJA) of 2017 made substantial changes to individual and corporate tax rates, deductions, and credits.

Staying informed about these changes can help you adapt your tax strategy and ensure compliance with current laws.

Timing of Income and Deductions

The timing of income and deductions can also affect your tax liability. Consider strategies like income deferral and accelerating deductions to manage your tax burden.

- Income Deferral: Delaying income to the next tax year can be beneficial if you expect to be in a lower tax bracket. For example, if you’re close to retirement, deferring income might reduce your tax rate.

- Accelerating Deductions: If you expect your tax rate to be higher in the current year, accelerating deductions into this year can reduce your taxable income. This is particularly useful for medical expenses or charitable donations.

Retirement Contributions

Contributions to retirement accounts like 401(k)s and IRAs can also impact your tax calculations. These contributions are often tax-deductible, reducing taxable income and tax liability.

401(k) Contributions: Contributions to a traditional 401(k) are made with pre-tax dollars, reducing your taxable income. For 2024, the contribution limit is $20,500, with an additional catch-up contribution of $6,500 for those aged 50 and older.

IRA Contributions: Contributions to a traditional IRA may be tax-deductible depending on your income and whether a retirement plan at work covers you or your spouse. The contribution limit for 2024 is $6,000, with an additional catch-up contribution of $1,000 for those aged 50 and older.

Factors Affecting Average Tax Rate

Several factors will be coming into play and affecting the tax rate. These include your income level, filing status, deductions, credits, and other tax policies. Understanding the effective tax rate factored by these elements can provide a clearer picture of your overall tax situation and help in effective tax planning. Affecting tax rate

1. Taxable Income

Taxable income is the portion of your income that is subject to taxation after all deductions and exemptions. Higher taxable income generally leads to a higher average tax rate.

To understand how to calculate average tax rate, you need to first determine your total taxable income, which forms the basis for calculating your tax liability.

2. Filing Status

Your filing status significantly impacts your tax rate. Whether you file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with a dependent child, your status determines the tax brackets and rates that apply to you.

When learning how to calculate average tax rate, it’s important to consider how your filing status affects your taxable income and tax liability.

3. Adjustments

Adjustments to income, such as contributions to retirement accounts, student loan interest, and health savings account contributions, can reduce your taxable income.

These adjustments play a crucial role in determining how to calculate average tax rate by lowering the amount of income subject to tax, thereby reducing your overall tax rate.

4. Exemptions

Exemptions reduce your taxable income, which can lower your average tax rate. While personal exemptions have been suspended until 2025, understanding their previous impact can be helpful.

Knowing how to calculate average tax rate involves factoring in applicable exemptions to measure your tax liability accurately.

5. Tax Deductions

Tax deductions are expenses that can be subtracted from your gross income to reduce your taxable income. These include itemized deductions such as mortgage interest, charitable contributions, and medical expenses.

To understand how to calculate average tax rate accurately, it’s essential to account for all applicable deductions, which can significantly lower your taxable income.

6. Tax Credits

Tax credits directly reduce the amount of tax you owe, providing a dollar-for-dollar reduction in your tax liability. Unlike deductions, which lower your taxable income, credits reduce your overall tax bill.

When figuring out how to calculate average tax rate, incorporating all eligible tax credits is crucial, as they can substantially lower your effective tax rate.

Average Tax Rate vs. Marginal Tax Rate

The distinction between the average tax rate vs marginal tax rate is crucial. While the average tax rate represents the overall rate at which your income is taxed, the marginal tax rate applies to the last dollar earned.

Knowing the difference between marginal vs average tax rates can help you understand how additional income will be taxed and plan accordingly.

Definition and Calculation

The average tax rate is the total amount of taxes paid divided by the total income earned. For example, if a household earns $100,000 and pays $15,000 in taxes, their average tax rate is 15%. This rate represents the overall tax burden on the household’s income, reflecting how much of their income is dedicated to taxes.

In contrast, the marginal tax rate is the rate applied to the next dollar of income earned. It measures the incremental tax paid as a percentage of additional income. For instance, if a household earns an additional $10,000 and pays $3,030 in taxes on that income, their marginal tax rate is 30.3%. This rate indicates the tax impact of earning more income.

Tax Burden vs. Economic Incentives

The average tax rate broadly measures a household’s tax burden, indicating how much of their total income goes towards taxes. This rate helps households understand their overall tax liability and how it affects their ability to consume and save. It is a useful metric for comparing tax burdens across different income levels and households.

On the other hand, the marginal tax rate measures the impact of taxes on economic incentives. It affects decisions on earning more income, saving, investing, or spending. Higher marginal tax rates can discourage additional work or investment because the extra income will be taxed at a higher rate. For businesses, high marginal rates may deter expansion and hiring.

Impact on Behavior

Higher marginal tax rates can reduce the incentive to engage in more income-generating activities. For individuals, this might mean working fewer hours or opting not to take a higher-paying job. For businesses, it could mean scaling back on investments or expansion plans.

Expert Tips for Accurate Calculations

Accurate tax calculations are vital for ensuring you pay the correct amount and avoid any penalties. Here are some tips for tax calculation to help you achieve accurate results: mattis, pulvinar dapibus leo.

1. Gather Comprehensive Financial Records

The first step in accurate average tax rate calculation is gathering all relevant financial records. This includes income statements, tax returns, documentation of deductions and credits, and any other financial transactions that affect your taxable income.

Having a complete set of records ensures that you don’t overlook any income or deductions, which can significantly impact your tax rate. These expert tips for accurate calculations will help you start on the right foot when learning how to calculate average tax rate.

2. Understand Taxable Income

Clearly understanding what constitutes taxable income is crucial. Taxable income includes wages, salaries, bonuses, dividends, interest, and capital gains. It’s important to include all sources of income to get an accurate picture.

Knowing how to calculate average tax rate involves understanding the full scope of your taxable income. Following these expert tips for accurate calculations will ensure you account for all income correctly.

3. Utilize Tax Software

Using reliable tax software can simplify the calculation process and reduce errors. Tax software is designed to handle complex calculations and can automatically apply the latest tax laws and rates. This tool is especially useful for ensuring your calculations are accurate and up-to-date, making calculating your average tax rate easier.

Employing these expert tips for accurate calculations can save you time and increase precision when figuring out how to calculate average tax rate.

4. Double-check for Deductions and Credits

Deductions and credits can significantly reduce your taxable income and, consequently, your average tax rate. Ensure that you account for all eligible deductions, such as mortgage interest, medical expenses, and charitable contributions. Similarly, don’t overlook tax credits like the Earned Income Tax Credit (EITC) and the Child Tax Credit. These can provide a dollar-for-dollar reduction in your tax liability.

Implementing these expert tips for accurate calculations will maximize your tax savings and provide a clear picture of how to calculate average tax rate.

5. Stay Updated on Tax Law Changes

Tax laws change frequently, and staying informed about these changes is essential for accurate calculations. Changes in tax rates, standard deductions, and allowable credits can all affect your tax liability.

Regularly reviewing IRS updates and consulting with a tax professional can help you stay current with these changes and ensure your average tax rate calculation is correct. Adhering to these expert tips for accurate calculations will keep you compliant with current tax laws and well-informed on how to calculate average tax rate accurately.

6. Consult with a Tax Professional

Consulting with a tax professional can provide valuable insights and ensure accuracy when in doubt. Tax professionals are knowledgeable about the latest tax laws and can provide personalized advice based on your financial situation.

They can also help identify potential deductions and credits that you might have missed. Following these expert tips for accurate calculations will benefit from professional guidance and a thorough understanding of how to calculate average tax rate.

7. Review and Verify Your Calculations

Finally, always review and verify your calculations. Even if you use tax software or a professional, double-checking the numbers can help catch any errors or omissions. This step ensures that your average tax rate is accurate and that you are fully aware of your tax liability.

Implementing these expert tips for accurate calculations will provide peace of mind and financial accuracy, making it easier to understand how to calculate average tax rate.

Common Mistakes to Avoid Calculations

When calculating your tax rate, it’s essential to avoid common tax rates mistakes that can lead to inaccuracies. These mistakes include overlooking deductions, failing to report all income, and not staying informed about tax law changes.

Here are some common mistakes to avoid when figuring out how to calculate average tax rate and preparing your tax returns.

Filing Too Early

Filing your taxes too early can lead to errors if you haven’t received all necessary documents, such as W-2s or 1099s. Ensure you have all the required paperwork before you start your tax calculations to avoid having to file an amended return.

Missing or Inaccurate Social Security Numbers (SSN)

One of the most common errors is entering the wrong Social Security number. Make sure that you double-check the SSNs for yourself, your spouse, and any dependents to avoid delays in processing your return.

Misspelled Names

Names on your tax return should match the names on your Social Security cards exactly. A simple misspelling can cause your return to be rejected. Take the time to verify the spelling of all names on your return.

Entering Information Inaccurately

Inaccurate information, such as income amounts or withholding details, can lead to errors in your tax calculation. Double-check all entries against your financial documents to ensure accuracy and completeness.

Incorrect Filing Status

Choosing the wrong filing status can significantly affect your tax calculations and refund. Ensure you select the correct status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)) based on your situation.

Math Mistakes

Math errors are common and can lead to incorrect tax liabilities or refunds. Using tax software can help eliminate math mistakes, but if you are calculating by hand, double-check all your calculations to ensure accuracy.

Figuring Credits or Deductions

Miscalculating tax credits or deductions can lead to overpaying or underpaying your taxes. Be sure to follow IRS guidelines carefully when calculating any credits or deductions you are eligible for, and use reliable resources to understand how to calculate average tax rate accurately.

Incorrect Bank Account Numbers

Entering incorrect bank account numbers for direct deposit of your refund can cause significant delays. Double-check your bank account and routing numbers to ensure your refund goes to the right place.

Unsigned Forms

An unsigned tax return is considered incomplete and will not be processed by the IRS. If you are filing a paper return, ensure that all required signatures are in place before sending it off. For electronic filing, follow the steps to provide an electronic signature.

Conclusion

Understanding how to calculate average tax rate is essential for effective financial planning and ensuring compliance with tax laws. You can accurately determine your average tax rate by following the steps outlined in this guide and considering factors such as taxable income, deductions, and credits. This knowledge empowers you to make informed financial decisions, optimize your tax strategy, and avoid common pitfalls during tax season.

For more detailed insights and practical advice on managing your finances and taxes, visit our blog at EduCounting. Our comprehensive resources are designed to help you navigate the complexities of tax calculations and financial planning, providing you with the tools you need to achieve financial success.