When learning how to invest in bonds for beginners, it’s essential to start with a fundamental understanding of what bonds are. Bonds are debt securities issued by entities such as governments, municipalities, and corporations to raise capital. When you purchase a bond, you’re lending money to the issuer in return for periodic interest payments and the repayment of the bond’s face value at maturity.

So, how do bonds work? After issuing bonds to investors, the issuer pays a fixed rate of interest, often referred to as the “coupon rate,” at predetermined intervals. This payment continues until the bond reaches its maturity date, at which point the issuer repays the principal amount to the bondholder. It’s essentially a loan where you, the investor, act as the lender.

Bond investments appeal to many because they typically offer lower risk than equities, making them a staple in diversified portfolios. Bonds provide a steady income stream through interest payments, which can be highly beneficial, especially for retirees seeking stable income.

Furthermore, certain types of bonds offer tax benefits, adding to their attractiveness. As you delve deeper into the subject of how to invest in bonds for beginners, you’ll realize that while the world of bonds might seem complex initially, with knowledge and understanding, it becomes a valuable part of your investment journey.

Types of Bonds

As an investor exploring how to invest in bonds for beginners, it’s crucial to understand the various types of bonds available in the marketplace. These bonds differ based on their issuers, characteristics, and potential returns.

Firstly, Government bonds, also known as Treasury bonds or ‘T-bonds,’ are issued by national governments. In the U.S., they are considered to be among the safest investments as the full faith and credit of the U.S. government backs them. Government bonds typically pay lower interest rates, reflecting their lower risk.

Secondly, Corporate bonds are debt securities issued by companies to raise capital for various purposes, such as business expansion or debt refinancing. These bonds generally offer higher yields than government bonds to compensate for the additional risk. The risk and return of corporate bonds can greatly vary depending on the issuing company’s financial health.

Municipal bonds, or “munis,” are issued by states, cities, or other local governmental entities to finance public projects like schools, hospitals, or infrastructure. These bonds have an added appeal for U.S. investors because the interest income is often exempt from federal and sometimes state and local taxes.

In addition to these primary bond types, there are specialized bond categories.

Zero-coupon bonds, for instance, do not offer periodic interest payments. Instead, they are issued at a discount to their face value and repay the full face value at maturity.

Another type, convertible bonds, provides an option for the bondholder to convert the bond into a predetermined number of the issuer’s shares. These bonds combine the features of bonds and stocks, offering the potential for capital appreciation if the company’s stock performs well.

Understanding Bond Terminology

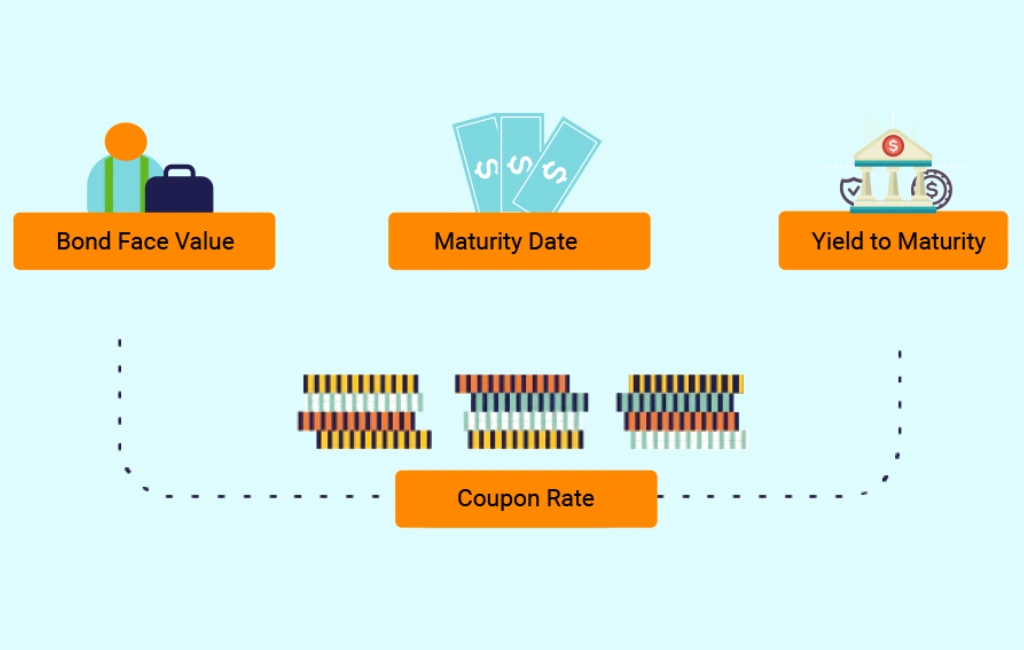

As you venture into the world of bond investments, you will come across specific jargon unique to this market. Understanding these terms is essential for making informed investment decisions. Let’s break down some of the essential bond terminologies:

Bond Face Value: This term, also known as par value or principal, refers to the amount a bond issuer promises to return to the bondholder upon the bond’s maturity. For most corporate and municipal bonds, this amount is typically $1,000, while for most government bonds, it is $10,000.

Coupon Rate: This is the annual interest rate that the bond issuer agrees to pay the bondholder. The rate gets its name from the historical practice of clipping coupons from bonds for payment. It’s a percentage of the bond’s face value. For instance, a $1,000 bond with a coupon rate of 5% implies that the bondholder would receive $50 per year.

Maturity Date: refers to the date when the bond issuer is obligated to return the bond’s face value to the bondholder. Maturity periods can range from short-term (less than three years) to long-term (30 years or more). Generally, the longer the maturity, the higher the interest rate due to the increased risk over time.

Yield to Maturity (YTM): The YTM is a measure of the total return a bondholder will receive if they hold the bond until its maturity date. It accounts for the bond’s current market price, its face value, the coupon interest rate, and the time remaining until maturity. YTM offers a comprehensive measure of a bond’s potential return, especially useful if you are buying the bond in the secondary market at a premium or discount to its face value.

Assessing Risk and Return

Investing in bonds involves a careful analysis of risks and expected returns. A critical element is understanding the inverse relationship between bond prices and interest rates. Bond prices tend to fall as interest rates rise, making existing lower-rate bonds less attractive. Conversely, bond prices usually rise when interest rates decline because existing bonds with higher rates become more desirable, increasing their market value.

Another essential factor is default risk, the risk that the bond issuer may not fulfill its obligations. Credit rating agencies help investors assess this risk by assigning ratings to bond issuers. Higher-rated bonds are considered lower-risk but offer smaller returns, while lower-rated bonds are riskier but promise higher potential returns.

Lastly, investors must consider inflation risk – the risk that inflation will surpass the return on your bond investment, effectively diminishing the purchasing power of your future interest payments and principal repayment. This risk is particularly relevant for long-term bonds due to the longer timeframe until maturity.

Steps to Start Investing in Bonds

Investing in bonds can be a worthwhile addition to a balanced financial portfolio. However, to get started, certain key steps need to be considered. Here’s a step-by-step guide on how to invest in bonds for beginners to start your bond investment journey:

1) Determine Your Investment Goals: Firstly, identify your financial objectives. Are you looking for regular income, capital preservation, or long-term growth? Your goals will guide the type of bonds that best suit your needs.

2) Assess Your Risk Tolerance: This involves understanding your ability to endure potential losses. Different types of bonds carry varying levels of risk, from relatively low-risk government bonds to higher-risk corporate bonds. Understanding your risk tolerance will help guide your investment decisions.

3) Decide on the Types of Bonds to Invest In: Once you know your goals and risk tolerance, you can decide on the types of bonds to invest in. For instance, if you’re risk-averse and looking for steady income, you might lean towards government or high-grade corporate bonds. On the other hand, if you’re willing to take on more risk for potentially higher returns, lower-grade corporate bonds could be an option.

4) Choose a Platform to Invest: Lastly, you need to select a platform for investing. This could be through an online brokerage, a robo-advisor, or directly from the government (for certain types of government bonds). Each platform has its advantages, so consider factors like fees, available resources, and user interface before choosing.

Building a Bond Portfolio

Building a successful bond portfolio is a strategic exercise that goes beyond simply purchasing a few bonds. It calls for diversification, which is achieved by holding a variety of bonds with different maturities, coupon rates, and issuers.

This strategy spreads risk across multiple market sectors and economic conditions, thereby offsetting potential losses when one bond or sector underperforms. Simultaneously, striking a balance between risk and return is paramount.

This could mean combining higher-risk, higher-yield bonds with lower-risk, lower-yield bonds to align with your investment goals and risk tolerance. For instance, a conservative investor might favor low-risk government bonds, while a more risk-tolerant investor could lean towards higher-yielding corporate bonds.

Lastly, employing a laddering strategy is also key. You can leverage both short-term and long-term rates by purchasing bonds with staggered maturity dates. This provides a regular income and mitigates the risk associated with interest rate fluctuations, allowing you to reinvest as each bond matures at the prevailing interest rates.

How to Research and Select Bonds

Thorough research and careful selection are prerequisites for successful bond investment. Understanding bond ratings, which range from ‘AAA,’ indicating a low risk of default, to ‘D’ for bonds in default, is crucial.

These ratings, provided by agencies like Standard & Poor’s and Moody’s, help you gauge the risk versus potential returns. Furthermore, you should evaluate the financial health of the bond issuer, scrutinizing financial statements and industry news to judge the stability of your investment.

Lastly, ensure that your bond selections align with your investment goals and risk tolerance. For instance, high-grade corporate or government bonds might be fitting for those seeking regular income with low risk, while high-yield or “junk” bonds could serve those open to higher risk for larger potential returns. This targeted approach can help align your investments with your financial objectives while effectively managing risk.

Buying and Selling Bonds

When learning how to invest in bonds for beginners, understanding the buying and selling process is crucial. You can purchase bonds either directly from the issuer on the primary market, which is common for government bonds or from other investors on the secondary market. The prices of these bonds can fluctuate depending on interest rates and the issuer’s creditworthiness.

The decision to sell bonds is influenced by various factors, including changes in interest rates, changes in the issuer’s creditworthiness, or your personal financial needs. While the ideal situation is to hold a bond to its maturity, circumstances might necessitate otherwise.

It’s also essential to keep in mind that buying and selling bonds can involve transaction costs, such as broker commissions or dealer markups, which can impact your return. Always consider these costs when assessing your potential return on a bond investment.

Monitoring and Managing Bond Investments

Effectively managing and monitoring your bond investments is a vital aspect of learning how to invest in bonds for beginners. It involves regular check-ins and updates to ensure your investments align with your financial goals. Here’s what you need to consider:

Regular Review: Make it a habit to regularly review your bond portfolio to ensure it still aligns with your investment goals and risk tolerance.

Adjustments: Economic conditions, interest rates, and financial circumstances can change over time. Be ready to make adjustments to your portfolio as needed.

Remember, bond investment is a long-term commitment. Effective monitoring and management can help ensure your bond portfolio remains on track to meet your objectives.

Pros of investing in bonds

Investing in bonds offers several advantages, including income stability due to the regular interest payments they provide. They also enhance portfolio diversification as they often perform differently from other assets like stocks, which can provide a cushion against market volatility.

Moreover, bonds are generally considered lower risk compared to stocks, as bondholders are prioritized over stockholders for repayment in the event of a company’s liquidation, making them a safer investment choice.

Cons of investing in bonds

While bonds offer numerous benefits, they also come with certain downsides. Interest rate risk is a key concern, as bond prices inversely correlate with interest rates, meaning when rates rise, bond prices fall.

Reinvestment risk is another issue, as there’s a chance the interest rate may be lower when a bond matures, and you need to reinvest the principal. Finally, default risk, though often low for government and high-grade corporate bonds, is a concern as issuers may fail to fulfil their payment obligations.

Frequently Asked Questions

What is the minimum investment required for bonds?

The minimum investment required for bonds varies depending on the type of bond and where it’s purchased. For instance, U.S. Treasury bonds can be bought for a minimum of $100. Corporate and municipal bonds are often sold in minimum increments of $1,000 to $5,000.

Can bond prices go down?

Yes, bond prices can and do go down. The main reason for this is the inverse relationship between bond prices and interest rates. When interest rates rise, new bonds paying higher interest rates come onto the market, making existing bonds with lower rates less attractive, which can cause their prices to fall.

How often do bond issuers pay interest?

The frequency of interest payments depends on the bond’s terms. Most bonds pay interest semi-annually (twice a year), but some bonds may pay interest annually, quarterly, or even monthly.

Can I sell my bonds before they mature?

Yes, most bonds can be sold before they mature. Bonds are traded on the secondary market after issuance. However, it’s important to note that selling a bond before its maturity date could result in a capital gain or loss depending on the bond’s market price at the time of the sale.

Are bond investments suitable for short-term goals?

Bonds can be suitable for short-term goals, particularly if those goals align with the bond’s maturity date. However, short-term bonds typically have lower yields than long-term bonds. Also, if you may need to sell the bond before it matures, you could face interest rate risk and potentially sell the bond for less than its purchase price.