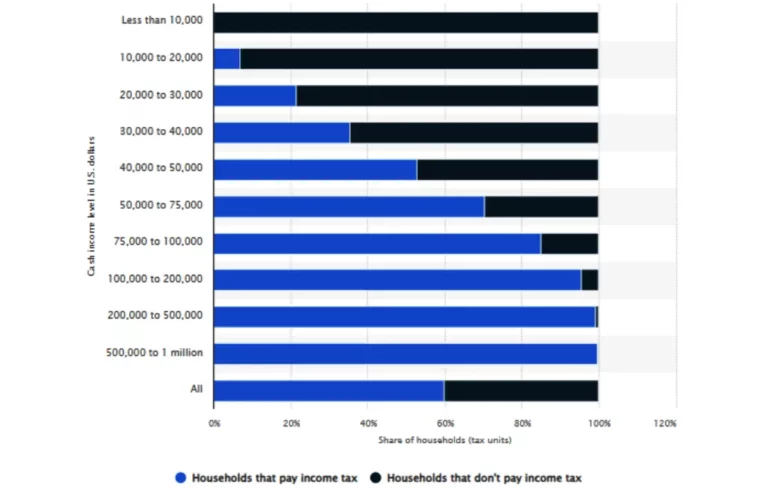

In 2022, around 59.9% of U.S. households contributed to the nation’s coffers through income tax. However, 40.1% of households had no individual income tax obligations. Delving deeper, it’s noteworthy that of households with earnings bracketed between $40,000 and $50,000, a substantial 47.1% were exempt from individual income taxes. This backdrop sets the stage for understanding the intricacies of tax nuances, such as margin interest deductions.

In the realm of investments, one query that frequently emerges is, “Is margin interest tax deductible?” This question holds importance because it can significantly influence an investor’s financial planning. As we explore this topic in depth, you’ll gain clarity on margin interest, its tax implications, and how it fits into the broader picture of investments.

What Is Margin Interest?

At its essence, margin interest is the cost one pays for borrowing money from a brokerage to invest in securities. While this may seem like any other loan, the world of securities trading has its unique nuances, making margin interest distinctive.

Essentially, when you opt to buy stocks or other securities “on margin,” you are only required to deposit a fraction of the total value. The broker lends you the remaining balance. For this service, the broker charges an interest known as margin interest.

The reason many investors choose margin is the potential for amplified returns. However, with greater potential returns come increased risks, including the interest costs and the risk of margin calls.

The Basics of Margin Interest

Borrowing on margin means you’re amplifying your buying power. By leveraging your investments, you can potentially enhance your profits. Yet, it’s a double-edged sword as the potential for higher losses also increases.

The interest you’re charged is based on the broker’s rate and the amount you’ve borrowed. This rate can fluctuate based on various market factors and the broker’s discretion.

It’s crucial to understand that while margin can augment your investment strategy, it also introduces a new level of complexity, including interest costs and maintenance requirements.

Advantages of Using Margin

Leveraging margin in investments can amplify both your gains and losses. Let’s illustrate this with a straightforward example, keeping aside transaction fees and taxes.

Imagine you invest $5,000 in cash to purchase 100 shares of a stock priced at $50 each. After a year, the stock price increases to $70 per share. Consequently, your investment value rises to $7,000. If you decide to sell, you make a profit of $2,000.

Now, consider the scenario where you incorporate margin. With your initial $5,000, you can access a total buying power of $10,000, thanks to an additional $5,000 loan as a margin by your broker. This lets you buy 200 shares of the same $50 stock.

Fast forward a year, and with the stock price at $70, the value of your shares becomes $14,000. On selling, after repaying the $5,000 margin loan and $400 as interest, you’re left with $8,600. From this, your net profit amounts to $3,600.

The Downside of Margin Use

While margin can be a powerful tool to amplify profits, it can equally amplify losses, especially when stock prices move unfavorably.

Take the scenario where you invested $5,000 directly to purchase 100 shares of a stock at $50 each. If the stock’s price declines to $30 within a year, the total value of your shares will drop to $3,000. Should you decide to sell, you’d incur a loss of $2,000.

However, let’s delve into a scenario where you’ve leveraged margin. By borrowing another $5,000, you could buy 200 shares of the same stock, amounting to a total investment of $10,000. If the stock’s value descends to $30 within a year, your holdings would be worth $6,000. On selling those shares, after repaying the borrowed $5,000 plus $400 in interest, you’d be left with a mere $600 from your initial $5,000. This represents a staggering loss of $4,400.

How to Calculate Margin Interest?

Calculating margin interest is a straightforward process but requires awareness of certain variables. The primary factors include the borrowed amount and your broker’s established interest rate.

Here’s a simple formula for convenience: Margin Interest = Amount Borrowed x Broker’s Annual Interest Rate / 365 x Number of Days. This provides an estimate, but always confirm specifics with your brokerage as rates vary.

To stay on top of your interest payments and understand the real cost of your investments, it’s recommended to periodically calculate your margin interest, especially if you borrow frequently or in large amounts.

Tax Deductions: A General Overview

Tax deductions are a cornerstone of many tax systems around the world. They are concessions offered by tax authorities, allowing taxpayers to reduce their taxable income, leading to a potential decrease in their overall tax liability. Here’s a deeper dive into the subject.

Purpose and Function

The main objective of tax deductions is to provide relief to taxpayers for certain types of expenses, promoting specific economic or social behaviors. For instance, deductions for charitable donations can incentivize individuals and businesses to contribute more towards social causes, while mortgage interest deductions may encourage homeownership.

Broad Spectrum of Deductions

The range of allowable tax deductions is vast and varied, covering a multitude of categories. This includes everyday items, such as work-related expenses, to more specialized ones, like child adoption. For the investing community, one of the critical aspects of deductions relates to interest paid on loans taken for investment purposes, such as margin loans.

Significance for Investors

For investors, particularly those who leverage borrowed funds to amplify their investment power, the interest paid on such loans can be a substantial expense. If such interests are deductible, it can provide significant relief by reducing their taxable income, hence potentially lowering their tax liability. This can have a tangible effect on an investor’s annual financial performance, making understanding interest deductions vital.

Complexities and Nuances

However beneficial as these deductions might sound, navigating the labyrinthine tax code to determine eligibility and limitations is challenging. Different jurisdictions, and sometimes even different types of loans or investments, come with varying regulations on interest deductions. Furthermore, there may be caps or thresholds on how much interest can be deducted or specific criteria that must be met to qualify.

Deductible vs. Nondeductible Interest

In the world of taxation, interest can generally be bifurcated into two categories: deductible and nondeductible. Deductible interest, like that on some mortgages or student loans, can be subtracted from your income, reducing the amount you’re taxed on.

Margin interest often falls into the deductible category, particularly when the borrowed funds are used for investment purposes. However, there are exceptions and conditions.

It’s important to understand that not all personal interests qualify for deductions, even if it feels like an investment. Clarifying these distinctions can save you time and potential complications come tax season.

Qualified Investment Expenses

To claim a deduction on margin interest, the borrowed amount should primarily be used to purchase taxable investments. This includes avenues like stocks and bonds.

Conversely, if you’re utilizing the borrowed funds for tax-exempt investments, such as municipal bonds, the interest on the margin loan becomes nondeductible.

It’s pivotal to maintain meticulous records and ensure that the funds borrowed on margin are indeed used for qualifying investment purposes to avail of the interest deduction.

Tips for Margin Interest Tax Deductions

Navigating the world of margin interest tax deductions can be complex, but with the right strategies in place, it becomes manageable. Here are some essential tips to guide you through the intricacies and ensure you maximize your deductions while staying compliant.

- Meticulous Documentation: Being diligent with your record-keeping is crucial. Ensure that you have a clear log of all transactions related to margin trading. Itemize your interest expenses and other related costs. Organized records can be invaluable during an audit or when seeking clarifications.

- Seek Expert Advice: The realm of taxation, especially with specialized areas like margin interest, can be intricate. Engaging with a tax advisor or consultant can offer insights into the nuances of deductions and help you navigate potential pitfalls.

- Investment Strategy Over Deductions: While the allure of tax deductions can be tempting, it’s essential to remember that the potential return on investment, risk factors, and your financial goals should drive your core investment strategy. Tax benefits are secondary and should be seen as a bonus rather than a primary driver.

- Stay Updated: Tax codes and regulations can evolve over time. Deduction rates, eligible amounts, or the very nature of allowable deductions might change. Regularly reviewing tax laws or maintaining an open line of communication with a tax consultant can ensure you’re always in the loop.

- Understand Limitations: While margin interest might be deductible, there could be ceilings on the amount or stipulations based on your income level. Familiarize yourself with these caps to avoid misconceptions and miscalculations.

- Diversify and Balance: Solely relying on margin loans for investments can lead to significant risks. Diversifying your investment strategies with a mix of margin and non-margin investments can offer a balanced portfolio, ensuring that potential tax benefits don’t come at the expense of financial stability.

- Review Margin Agreements: Your brokerage firm will provide a margin agreement detailing the loan terms. It’s beneficial to periodically review this agreement, especially the interest rates and terms, as they can impact the amount of interest you can claim.

Potential Limitations and Phase-Outs

Margin interest deductibility isn’t always unlimited. The extent of your net investment income can often cap it. If your interest exceeds this income, you won’t be able to deduct the excess in that fiscal year.

However, the silver lining is that the non-deducted portion can be carried forward and potentially applied in subsequent years, given you have adequate net investment income.

Awareness of these limitations and potential phase-outs is crucial. It ensures you aren’t caught off guard and helps in efficient tax planning.

State-specific Considerations

Federal tax guidelines serve as a foundation, but remember, each state might have its intricacies regarding tax deductions. These can diverge substantially from federal rules.

Understanding these nuances becomes even more essential for investors operating in multiple states or those residing in states with unique tax landscapes.

As always, seeking advice from local tax professionals can be invaluable when navigating the complexities of tax laws.

FAQs

Can individuals claim margin interest as a tax deduction?

Yes, individuals can typically claim margin interest as a tax deduction, provided it’s associated with investment activities and they itemize their deductions on their tax returns.

What types of accounts qualify for margin interest deductions?

Margin interest deductions primarily apply to investment accounts where borrowed funds are used to purchase securities. However, specifics can vary, so it’s essential to consult tax regulations or professionals to confirm eligibility.

What happens if I use the margin loan for personal expenses?

If you use a margin loan for personal expenses, the interest on that portion of the loan generally isn’t deductible. Only the interest on funds used for investment purposes typically qualifies for a tax deduction.

Are there any risks associated with claiming margin interest deductions?

Yes, there are risks. Claiming inaccurate or unjustified deductions can lead to penalties or audits. Additionally, over-reliance on deductions can complicate financial planning if tax laws change or if the interest exceeds investment income.

How does the IRS verify margin interest deduction claims?

The IRS can verify margin interest deductions through a combination of reported interest expenses by brokerage firms, individual tax return reviews, and, in some cases, audits. Proper documentation and record-keeping by the taxpayer are crucial to validate claims.

Final Words

Navigating the question, “Is margin interest tax deductible?” requires a blend of investment and tax knowledge. While the possibility exists to reduce taxable income through such deductions, it’s essential to approach the matter with thorough understanding and caution. Whether you’re an avid investor or just starting, always keep abreast of tax laws, and when in doubt, consult professionals to ensure you’re on the right track.

Our mission at EduCounting is to empower young adults with robust financial literacy and the tools for effective money management. We wish you success and sound decision-making as you navigate your financial path. Stay informed and prosper!