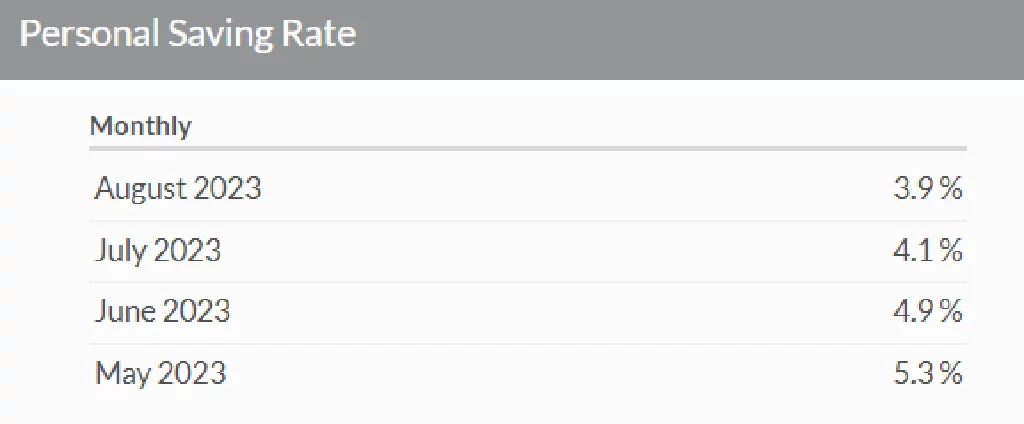

The US personal saving rate — a reflection of the percentage of our income left after taxes and spending — has steadily declined. From a high of 5.3% in May, the rate dipped to 4.9% in June, further slid to 4.1% in July and settled at a modest 3.9% by August.

In the challenging financial climate many families find themselves in today, figuring out how to save money is crucial. The need for Money Saving Tips for Families has never been more paramount. The joy of family life often comes with its fair share of expenses, and balancing these costs with the desire for leisure and memorable experiences can be daunting. Here’s a detailed guide to help you make the most of every dollar.

Money Saving Strategy for Families in 9 Easy Steps

Balancing family finances can sometimes feel like juggling on a tightrope. But, with careful planning and discipline, the task becomes more manageable. Here are nine steps to help families pave their way to financial stability.

1. Setting Financial Goals

Every financial endeavor begins with a purpose. Goals, such as purchasing a new home and setting clear and actionable financial goals, stand as the cornerstone in the journey toward financial stability. For families, these goals not only serve as a roadmap to guide their monetary decisions but also act as a motivational beacon, encouraging consistent saving and prudent spending. Whether buying a new home, saving for children’s education, or planning a vacation, having tangible objectives allows families to allocate resources effectively, ensuring that every dollar spent or saved has a purpose.

Furthermore, involving all family members in goal-setting can be immensely beneficial. It fosters a sense of collective responsibility, ensuring that everyone, from adults to young ones, understands the family’s financial priorities and works harmoniously towards them. This collective effort streamlines the financial journey and strengthens family bonds as everyone collaborates to turn financial dreams into reality.

2. Creating a Family Budget

A well-structured family budget acts as a financial compass, ensuring that every dollar is accounted for and spent judiciously. Crafting such a budget begins by documenting all income sources and then juxtaposing them with monthly and yearly expenses. This not only provides clarity on where the money is going but also reveals potential areas of excess expenditure or opportunities for savings. For families, the budget serves as a tangible reflection of their financial health, highlighting priorities and facilitating informed decision-making.

Engaging all family members in the budgeting process is pivotal. When everyone contributes their insights and understands the fiscal framework, it instills a sense of shared responsibility. This collective approach ensures that the budget isn’t just a spreadsheet of numbers but a living, adaptable tool that guides the family’s financial journey. Using technological aids, like budgeting apps, can further simplify tracking and make the process more interactive, ensuring sustained commitment from everyone involved.

3. Identifying Essential Costs

Discerning between essential and discretionary costs is paramount in the intricate dance of family finances. Essential costs are the fundamental expenditures that ensure a family’s well-being and day-to-day functioning. These include housing, utilities, basic groceries, healthcare, and essential education costs. Recognizing these primary outlays provides a clear baseline for a family’s monthly spending, ensuring that the basic needs are always met, even when financial waters get choppy.

However, in the bustling rhythm of modern life, it’s easy for non-essential expenses to masquerade as necessities. This is where periodic financial reviews come into play. By routinely assessing the family’s spending patterns, one can differentiate the true essentials from the desirable but non-critical expenses. This clarity streamlines budgeting and opens up avenues for potential savings, allowing families to redirect funds towards bigger goals or financial cushions for the future.

4. Saving on Transportation

Transportation, often one of the largest expenditure categories for families, offers ample opportunities for savings with a bit of forethought and strategy. For many, vehicles are essential for daily commuting, school runs, and errands, but the associated costs – fuel, maintenance, insurance, and possible loan payments – can quickly add up. Families can make significant strides in reducing these costs by evaluating the true necessity of multiple vehicles, considering more fuel-efficient models, or even leveraging public transportation options.

Carpooling is an eco-friendly and wallet-friendly alternative, especially for families with overlapping routes for work, school, or activities. Not only does this reduce the individual fuel and wear-and-tear costs, but it also fosters community bonding. Additionally, instilling the habit of clubbing errands together or planning routes efficiently can further cut down unnecessary travel, leading to noticeable savings. In urban settings, embracing walking or cycling for shorter distances offers the dual benefits of savings and health, making it a win-win choice.

5. Grocery Shopping and Meal Planning

For many families, grocery shopping constitutes a significant chunk of their monthly expenses, but it’s also an area ripe with opportunities for savings. Smart shopping strategies, such as buying in bulk, leveraging discounts and sales, or even venturing into local farmer’s markets, can lead to substantial reductions in the grocery bill. Being prepared with a detailed list before stepping into the store curtails impulse purchases and ensures that families buy just what they need, reducing waste and unnecessary expenditure.

Meal planning further amplifies the savings derived from mindful grocery shopping. By charting meals for the week or month, families can buy ingredients in precise quantities, optimize the use of leftovers, and resist the pricey allure of last-minute takeouts or dine-outs. A well-planned meal schedule not only alleviates the daily stress of the proverbial “What’s for dinner?” question but also ensures a healthier and more diverse diet, as families can strategically incorporate a variety of nutrients into their meals.

6. Embracing Hand-Me-Downs

In an era dominated by fast fashion and the allure of the ‘new’, the tradition of hand-me-downs might seem outdated. However, hand-me-downs are a goldmine for families keen on trimming expenses without compromising on quality. These pre-loved items, be they clothing, toys, or even furniture, come without the hefty price tags but often with a quality that stands the test of time. Especially in households with multiple children, circulating clothes or toys from an older sibling to a younger one ensures maximum utility from each item without the incessant need to purchase new ones.

But the charm of hand-me-downs isn’t restricted to intra-family exchanges. Thrift stores, community swaps, and online platforms dedicated to second-hand goods have made accessing quality items at a fraction of their original cost easier than ever. Beyond the obvious savings, embracing this culture fosters a sense of sustainability, teaching children the value of reusing and recycling, invaluable lessons in today’s increasingly eco-conscious world.

7. Budget-Friendly Vacations

Vacations, while a source of relaxation and cherished family memories, can often strain the family coffers. However, with astute planning and a dash of creativity, it’s entirely possible to have memorable getaways without breaking the bank. Off-peak travel, for instance, offers the dual advantages of fewer crowds and significantly discounted rates. Staying in vacation rentals or hostels instead of upscale hotels or even camping can provide authentic experiences while drastically reducing accommodation costs. Additionally, preparing some meals during the trip rather than dining out for every meal can lead to considerable savings.

Moreover, vacationing doesn’t always necessitate long-distance travel. Exploring local attractions, indulging in staycations, or even planning road trips to nearby landmarks can be equally refreshing. Such vacations often provide deeper insights into one’s own region and eliminate hefty flight costs. Also, using reward points, travel deals, or last-minute offers can make even distant travel more affordable. The essence of a vacation lies in the experiences and bonding it fosters, not in the lavishness of the destination. With the right approach, families can balance wanderlust and budget constraints.

8. Low-Cost Family Activities

Engaging in family activities doesn’t always necessitate extravagant outings or expensive tickets to attractions. Quite often, the most cherished memories are forged from simple, low-cost endeavors that prioritize togetherness and creativity. A family picnic in a local park, an afternoon of board games, DIY craft sessions, or even movie marathons at home with homemade popcorn can provide hours of entertainment without a hefty price tag. These activities foster bonding and emphasize the value of simplicity and making the most of what one has.

Outdoor activities, like hiking, cycling, or visits to public beaches and lakes, are often free or come with minimal costs. Yet, they offer the dual benefits of recreation and physical fitness. Similarly, many communities host free events, workshops, or festivals that families can partake in. Libraries, too, are a treasure trove of free resources and often organize storytelling sessions or workshops for children. By staying informed about local happenings and being open to home-based fun, families can ensure many joyful experiences without stretching their budget.

9. Creating Homegrown Magic

The concept of ‘homegrown magic’ revolves around the idea that families needn’t look far or spend much to create magical moments; often, they can be cultivated right in the comfort of one’s home. Growing a family garden, for instance, can be a transformative experience. Planting seeds, nurturing them, and watching them bloom or yield produce teaches patience and responsibility and provides a sense of accomplishment and wonder. Furthermore, the produce from such gardens can supplement family meals, adding a touch of freshness without the associated costs of store-bought goods.

Inside the house, families can curate magic through traditions and rituals. Be it weekly family cookouts, where each member contributes a dish, storytelling nights where generations share tales, or even DIY home improvement projects undertaken collectively, such activities cultivate warmth, bonding, and a unique family identity. These moments, rooted in love, effort, and collaboration, often outshine the allure of store-bought entertainment or external experiences, proving that magic can be homegrown.

FAQs

A. Why is it important for families to set financial goals?

Setting financial goals is paramount for families because it provides direction and purpose to their spending and saving behaviors. Having clear objectives, families can prioritize their expenses, make informed decisions, and work collectively towards a shared vision. Moreover, these goals offer motivation, ensuring long-term financial habits are sustained and eventual financial security is achieved.

B. What's the best approach to creating a family budget that everyone can stick to?

The best approach to crafting a family budget is to make it a collaborative effort. Start by gathering all members and discussing monthly incomes, regular expenses, and financial aspirations. Utilizing budgeting apps or tools can streamline the process. Regularly revisiting and updating the budget ensures it remains relevant. The key is open communication, ensuring all members understand and feel a part of the financial journey, thereby increasing adherence.

C. How can we differentiate between essential and non-essential expenses when budgeting?

Essential expenses are the non-negotiable costs that maintain a family’s basic quality of life, such as housing, utilities, groceries, and healthcare. Non-essential expenses, on the other hand, pertain to discretionary spending on luxuries or comforts that aren’t fundamental to survival or basic well-being, like dining out, entertainment, or high-end brands. To differentiate, list out all expenses, categorize them, and then prioritize based on immediate need, value, and impact on overall well-being.

D. Are there effective strategies for saving money on transportation costs, especially with a family?

Yes, there are several strategies. Consider carpooling, which reduces individual costs and environmental impact. Maintaining vehicles properly can save on repair expenses in the long run. Using public transportation or cycling, when feasible, can also curtail costs. If multiple family vehicles are owned, evaluating the necessity of each and potentially downsizing can offer substantial savings. Lastly, planning errands and trips efficiently to minimize unnecessary travel can help reduce fuel and maintenance costs

E. How can families still enjoy vacations while staying on a budget?

Budget-friendly vacations are entirely achievable with a bit of planning and flexibility. Families can opt for off-peak travel times, often with discounted rates. Exploring local attractions or nearby destinations reduces transportation costs. Camping or renting vacation homes with kitchen facilities can minimize dining-out expenses. Additionally, researching free or low-cost activities at the destination ensures entertainment without a hefty price tag. Planning ahead, being flexible, and prioritizing experiences over extravagance are key.

Final Words

Navigating the financial landscape as a family might seem daunting, but with the right strategies in place, it’s entirely possible to make the most of every dollar. The journey towards a robust financial future is paved with intentional choices, whether in daily expenses, vacations, or home-based activities. By embracing the “Money Saving Tips for Families” outlined in this blog, households can maintain a healthy balance between enjoyment and savings and lay the foundation for a future replete with financial security and cherished memories. Remember, with creativity and planning, every family can transform their budget and cultivate a life rich in experiences without financial strain.

EduCounting is a beacon of support and knowledge on this financial journey. With our carefully crafted blogs and comprehensive courses, we illuminate the essentials of financial literacy, tactics, and optimal approaches. Whether at the beginning of your fiscal adventure or fine-tuning your monetary expertise, EduCounting remains a steadfast ally, equipping you to chart a course toward financial prosperity.