In modern life, money is an integral part of daily life, and developing money skills for life is essential for financial stability and success. It is important to teach kids money skills early to prepare them for a successful financial future.

With the proper guidance and knowledge, they can develop a healthy and responsible relationship with money that will help them in their future lives. As parents, educators, and guardians, it’s our responsibility to teach children the essential money skills they need to succeed.

In this article, we’ll discuss some valuable tips and tricks to help you teach money skills to kids. We’ll also highlight why money skills are essential for kids and how they can help them build a stable financial future.

Teaching Financial Literacy Today Sets Kids up for a Healthy Financial Future Tomorrow

Sadly, financial literacy doesn’t always get the attention it deserves, and it’s usually too late when it does, which is why some bad things can happen. But, as homo sapiens, we haven’t had to deal with money for even a portion of the time we’ve existed. Planning takes a bit of learning.

As you have likely figured out already, here at Educounting.com, we believe that it is essential to begin teaching financial literacy and money skills for life early so that kids can be fully prepared when they embark on their journey.

Unfortunately, most kids get more education in school about the “S” word that rhymes with Tex or Mex. But, they don’t get enough, if any, financial literacy training in their school settings. So, it is up to us as parents to make sure that they learn the lessons they need to prepare them for the future ahead.

After all, as we like to say, money makes the world go round. Let it spin!

How can we expect our children to manage money and finances as adults if we don’t show them the ropes?

Teaching financial literacy and money skills for life must be a priority from the day they are born until they leave the nest. (Even birds get to see their parents fly around with great technique before they’re kicked out.) Still, too many parents let their kids figure it out along the way, usually alone, setting them up for disaster.

This article will outline the importance of financial literacy and how we can get our kids started on the road to financial success by teaching them money skills for life.

But first, check out this video we made about introducing financial literacy to kids.

Why Does Everyone Need Money Skills for Life?

Financial problems can easily lead to stress about providing food or shelter, among other things. Although it’s a no-brainer, the importance of proper financial literacy can’t be overstated. By starting early and instilling healthy habits at a young age, we avoid ending up with financially ignorant adolescents because, by then, it can be too late.

Teenagers with no understanding of managing their finances can quickly fall into financial traps and not even realize it.

It can be challenging to undo financial mistakes, often taking years. Teaching kids about money and finances from an early age can give them information and essential money skills for life to avoid those devastating mistakes and make sound financial decisions. We have to open their eyes to have any potential to prevent them.

Money Skills for Life: 5 Reasons Why Financial Literacy is Important

Here is a list of five reasons it is essential to get a jump start on financial literacy early.

Reason #1: Financial Literacy Breeds Responsibility

Studies show that young people who do not acquire basic financial education become irresponsible adults, especially when it comes to financial management or money skills for life. Without a crash course in financial literacy, they may be unable to save and invest and are more likely to end up with terrible credit ratings, making it difficult to do things like own a home or live comfortably. We’d never want to see our children go down that path.

Adults who gained significant financial literacy at a young age, on the other hand, have the financial foundation needed to make sound financial decisions.

Childhood in a family with six children has its own set of issues. But, it’s exaggerated when you don’t have the financial strength to make things comfortable. And time is one of the most precious commodities, but it’s used up incredibly quickly. Long, long days and short, short years.

How do parents determine who’s after-school event to go to with six kids? How do you pay for all the food? Can you help anyone with homework when one parent works during the day and the other at night?

Needless to say, there wasn’t a well-defined schedule to teach my brothers and sister about how to manage money. A lot of it came from watching our parents. There was clearly a strong sense of doing what was right. Don’t overspend, and us kids would simply have to adjust and deal with it.

My mother’s father was financially minded. He did instill some solid habits in his kids that at least mom got. He liked business and managing the money. So, it was passed down.

After years of doing without, a couple of siblings went crazy when out on their own. New cars, new clothes, restaurants, drinks and lots of entertainment. But, they KNEW what the right thing to do was, because they saw it when we grew up. I can’t say all of us are on the right track, but we at least all had a chance because we had some skills.

Reason #2: Financial Literacy is Empowering

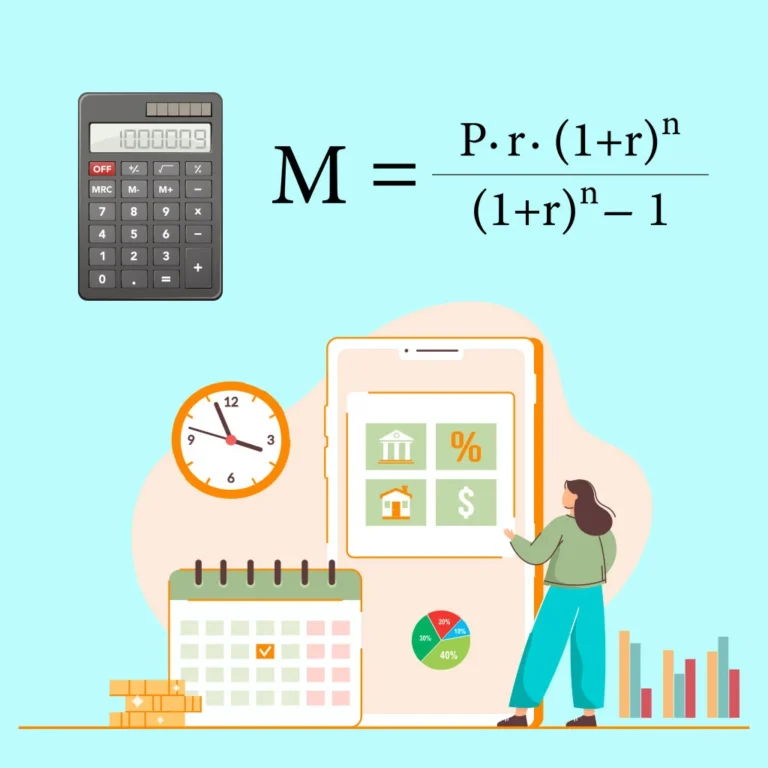

We all know the saying, “knowledge is power.” Well, that applies to financial literacy too! The more knowledge you possess, the better prepared you’ll be. Young people who lack adequate financial literacy and basic money skills for life, on the other hand, are at serious risk. For instance, paying extra interest on a home loan can easily cost hundreds of extra dollars a month. That can make the difference between retiring or not.

I love school, but I don’t remember losing money or a job because I didn’t know when the war of 1812 started. Our kids attend school and study history, math, and science to gain authority around those subjects and prepare them for adulthood. Doesn’t it make sense to prioritize financial literacy and education about money along with these other disciplines?

When young people understand money and finance, they become empowered and quickly learn the skills necessary to provide for themselves, rather than rely on us. While working in education, this stat was quoted on occasion: For those kids who didn’t meet certain developmental skills in school by the third grade, the government could calculate the number of prison cells needed approximately ten years later. Scary. If you can’t read and write, you can expect a certain percentage of those to be angry because they can’t function well in society which learns to very bad choices and actions which lead to jail.

We need to give our kids skills so they aren’t in financial jail!!! After all, isn’t that our ultimate goal as parents to protect and support our kids so they can take care of themselves and be “happy.” I’d contend that it’s hard to take care of yourself or be happy if we don’t have food, clothes, shelter, and opportunities for some wants like a vacation home which can protect us against too much sunshine or boredom, right?

Reason #3: Financial Literacy Prepares us for Emergencies

At least once in our lives, we will be confronted with an urgent problem that could end up costing a lot of money. Car repairs, medical bills, or some other type of unexpected event can leave us high and dry if we are not prepared. It happens to many of us, and medical bills are the number one reason for bankruptcy.

If our kids have been taught financial literacy and money skills for life at a young age, they have a better chance of handling the burden of an unexpected financial emergency without significant repercussions. If they were taught how to manage debt, budget, and save from an early age, they are more likely to survive the challenges that life throws their way.

Check out this video we made about the importance of an emergency fund:

Reason #4: Early Financial Education Creates Healthy Financial Habits

Without a foundation of financial literacy instilled at a young age, young adults can easily slip into bad financial habits such as living paycheck to paycheck, racking up debt, and making poor investments.

Speaking of bad financial habits, check out this podcast from Mak & G about the dangers of Black Friday.

Our financial well-being has everything to do with our habits, and, as we know, habits start early in life. Ben Franklin knew it took at least 21 days to build a habit. I’d say it’s much longer than that. But that’s why it is so important to teach kids healthy financial habits and money skills for life to set them on a path to future financial success.

Reason #5: Financial Literacy Equals Better Planning

Kids need to recognize that achieving a particular goal requires planning. Americans love the stories about successful situations that happened without effort and took almost no time. It’s nearly done by magic. Have you ever heard about someone sitting down and writing a famous song in 10 minutes? The thing we forget about is that these people had been practicing and planning for 10 or 20 years. It requires work and planning.

Kids need to know that all of their dreams, from vacations, homeownership, and starting a family to owning a Maserati or a family pet, require money. Still, we have financial obligations to pay for as well.

Maybe your child dreams of retiring at a young age. Heck, I did because work didn’t seem like fun. My dad was stressed about having his job, losing his job, finding a job, and more. Well, kids need to start investing early because the magic of compounding comes to life when you start early. Remember Warren Buffet and his compounding magic?

Financial planning allows you to achieve your goals while taking care of responsibilities. Yes, you really can have your cake and eat it too, but only if you are financially literate. NFL Players make a lot of money, but 1 out of 6 are broke several years after leaving that big paycheck. That has to be at least ten times greater than average. Kids of all backgrounds need to recognize these critical concepts early in life to succeed.

Money Skills for Life: The Benefits of Financial Literacy

There are many benefits to becoming financially literate. Here are three of the most obvious:

Benefit #1: Understanding the value of money fosters healthy financial habits.

My financially secure friends respect money, they’re usually considered a little “tight,” and even though they have enough money to buy most things they want, they don’t. When we truly understand the importance of money, we’re better positioned to manage personal finances. By recognizing the inherent value of our money, we are more likely to practice healthy financial habits, avoid wasteful spending, and see the benefits of planning, budgeting, and saving.

Benefit #2: Financial literacy helps avoid bad debt.

When you have the basic foundation for financial literacy along with money skills for life, you are less likely to find yourself in bad financial situations, such as accumulating bad debt that you cannot repay. Why? Because you understand how it happens and how crappy it is and why you need to avoid it.

Benefit #3: Financial literacy helps our money grow.

Being financially literate and having money skills for life, we are more likely to have many great tools in our toolbox to help us invest money and grow wealth. For some, it’s not about growing wealth, and that’s ok. But, wouldn’t it be nice to have enough money? Or better yet, having enough money that you make a difference at your church, the homeless shelter, for animals, climate change, or something else you care about it?

At EduCounting.com, we believe it is never too early to start teaching financial literacy. So, how does that work? How do we teach financial literacy that is not only age-appropriate but will be helpful as the child develops a healthy foundation for financial literacy that they can carry with them into adulthood? This next section will break down some of the best ways to teach financial literacy based on your child’s age.

How to Give Kids Money Skills for Life Based on Age Appropriateness

Kids learn a lot of great stuff at school, but we know that schools don’t do enough to teach our children the importance of financial literacy and money skills for life. From infancy through to adulthood, a child’s financial literacy will lead to overall financial success.

Here are some age-appropriate ways to get them on the right path:

Age 0-6 years: A child’s eyes are open to everything.

Children are just like tiny sponges at this age. They are soaking up everything and learning at lightning speed. You want to commit to helping them by putting in a little time and effort. It doesn’t always work perfectly, but it shows you care, they ARE learning, and when you continue, it WILL help. When Mak & G were younger, we talked about how much a house cost and other things like a car. I remember asking Mak about how much a car cost after having that discussion a couple of days earlier….$300,000. Ok, it was a miss, but she started to become comfortable with talking about money.

At this young age, kids are catching on to more stuff than you imagine, so it is the perfect time for you to be introducing critical concepts about money and finance that your kids will carry for a lifetime. A Cambridge University study found that kids form their financial habits around age seven. I’m not 100% sure that’s true, but they are learning a lot at an early age, and I think they continue to learn as they get older.

So how do we teach them at such a young age?

We can start by giving them a piggy bank or a jar (it should be clear so they can see their savings) and, every time they get money for a holiday or birthday, put the money in the bank.

Each time money is added, you can use it as a chance to count the money they saved.

As their money grows, they’ll respond with excitement.

You can also help them set goals using the money they save. If you set a goal when the money passes a certain line (if a clear jar), you can go for ice cream. It’s easy to visualize, which makes it easy to understand. Instead of spending money when they reached a goal, even though they were older, I’d commit to picking up Oreo’s poop on our walks if they hit a goal.

During this early stage in their development, you will want to teach the importance of patience when saving money. It’s not natural for a kid, who’s used to screaming and getting fed immediately. Remember, children at this young age have a very short span of attention, so be sure to keep the goals short-term and very simple.

Age 7-13 years: All eyes are on the parents.

Don’t fool yourself. During these transitional years, your kids pay attention to everything you are doing. That means that they are also paying close attention to your spending habits. They see right through you, so you might want to think again if you haven’t been working on those bad habits.

Don’t fool yourself. During these transitional years, your kids pay attention to everything you are doing. That means that they are also paying close attention to your spending habits. They see right through you, so you might want to think again if you haven’t been working on those bad habits.

At this age, values and habits are born from the behavior they witness from their parents. What your children see you do will have a far more significant impact on what you say to them. Of course, you must walk the talk because if your kids can SEE you behave the same way you TELL them to act, the message will be even stronger and more likely to stick. They often times see me research purchases to find the best deal, which is one small action that means something.

With this particular age group, you’ll want to teach the differences between their wants and needs, ultimately preparing them to earn, save, and spend wisely. I know you’ll be shocked, but it tends to happen often that Mak & G “confuse” a want and a need. By showing them how to weigh decisions and understand consequences, they will obtain the saving and budgeting techniques necessary for a healthy financial future. It’s not too late, and having some time set aside is helpful….

It is a great age for them to learn important lessons like reading receipts, calculating sales tax, and calculating percentages to determine discounts and tips. Understanding these concepts is vital for saving money to pay for higher ticket items. It is also a great age to help kids properly budget, an idea that they can quickly grasp if you teach them the right way.

Age 14-18: All eyes are on a child’s future.

During our children’s transition into adulthood, we should prepare them to leave the nest and enter the real world. At this point, they should have life skills and financial literacy that will help them achieve success.

- Involve them in the family budget to help them create their own (and flex that muscle!!). Almost half of all Americans live beyond their financial means. By involving your teen in your family’s budget and by helping them develop a budget of their own, you will teach them valuable financial skills. They will learn how to have a deeper appreciation for the money they have as well as how it’s earned.

- Introduce them to savings accounts. By now, your child should have their own savings account (should they have a prepaid credit card, too?). But this is the age where they can get involved in their own money, practice the skills you taught them, and start making their own personal financial decisions. Getting these practices in place now will help them to avoid feeling overwhelming responsibilities once they are on their own. Check out this video we made about the 5 different types of savings accounts for the benefit of kids:

- Use the purchase of their first vehicle as a learning lesson. I’m always on the fence when talking about purchasing a car for your kids. Part of me says it’s a luxury they may not need, and the other part says it will make MY life easier. Either way, if you are going to be a part of purchasing their first vehicle, use it as an opportunity to sit them down and teach them how loans and credit work. It will help your kids be on the right track as they enter college. It also helps explain the dangers of debt and the best ways to build a solid, good credit history.

- Speaking of college, you should be having that discussion as well. Kids need to understand student loans because paying for college is an integral part of their decision-making process. The average student debt per borrower in the United States is nearly $28,000. But, I know a lot of students with none and a friend that actually had almost $400,000. Young people must understand what student debt means to them now and in the future. And, it REALLY helps to have them understand interest. My friend with the massive debt is brilliant, but didn’t realize he had most of his debt which had double-digit interest that he was paying on for years!!! With a couple phone calls, and some work, we cut his interest down over $1,000 per month!!

Money Skills for Life: Financial Literacy is Necessary for Survival

It may seem like an extreme statement, but I believe it’s true. In terms of money skills for life, financial literacy can mean the difference between life and death in some cases. I mean it. Better health insurance, better food, better education, and many other “betters.” Unless you’re living off the grid (which means you’re not reading this), you’re going to need money and know-how to handle it. It’s just a fact of life. If you don’t, you’re simply at a disadvantage. Hunting was a required skill hundreds of years ago, but things change.

When you have financial literacy and a good understanding of economic concepts, you can negotiate and comprehend the financial world in which you live. You can better manage financial emergencies and risks while avoiding devastating financial traps.

When we arm our kids with a foundation of financial literacy, we give them a real fighting chance at a successful future, and at a minimum options.

As we’ve said before, to teach financial literacy, you must be financially literate yourself. And, don’t worry, you can always learn the basics no matter your age, and do it together with your kids!

Our course makes financial literacy easy to learn and fun for all ages. So, consider giving it a try today!