Real estate remains one of the most lucrative sectors for investors seeking both short-term profits and long-term wealth accumulation. Among the myriad strategies available, Passive Real Estate Investing stands out as a highly effective approach for those looking to grow their portfolios without the daily hassles of property management. This article delves into the nuances of Passive Real Estate Investment, offering insights into its benefits, risks, and strategic considerations.

Passive Real Estate Investment refers to real estate investment strategies that do not require day-to-day involvement in property management. This approach allows investors to reap the benefits of real estate ownership without engaging in the operational aspects of property management. It’s a strategy particularly appealing to individuals seeking to diversify their investment portfolios while maintaining a hands-off approach.

What is Passive Real Estate Investing?

Passive Real Estate Investing simplifies the journey into real estate markets, making it an appealing strategy for individuals who wish to benefit from the sector’s potential without the complexities and demands of direct management. This investment approach significantly lowers the barriers to entry in several key ways, making it an attractive option for a wide range of investors.

It encompasses a range of investment vehicles, including real estate investment trusts (REITs), syndications, and crowdfunding platforms. These vehicles expose investors to real estate markets without requiring direct property ownership or management. Investors can thus benefit from real estate’s potential for high returns and portfolio diversification while dedicating their time and resources elsewhere.

Passive investing allows for entry at a lower capital amount, making it feasible for individuals to “own a piece” of a real estate transaction or project without needing to finance the entire purchase or development. This democratizes access to real estate investments, traditionally seen as the preserve of the wealthier investor due to the high capital requirements of direct property ownership.

Passive investing is characterized by minimal to no involvement in the day-to-day management of the property. This means investors can benefit from the asset’s performance without the time-consuming responsibilities of property management, such as tenant relations, maintenance, and administrative tasks. This lack of direct involvement removes many operational headaches associated with real estate, making it an attractive option for those with limited time or interest in hands-on management.

Another significant feature of passive real estate investment is the reduction of personal liability. Direct real estate ownership can expose investors to various liabilities, from financial obligations to legal risks. Passive investment structures, such as REITs or real estate crowdfunding platforms, typically limit personal liability, protecting investors’ assets beyond the investment itself.

Geographic diversification is another compelling feature of this type of investment. Investors are open to properties in their immediate area but can access opportunities nationwide or internationally. This broadens the potential for diversification, allowing investors to spread risk and take advantage of growth in different markets.

However, these conveniences and the reduced barriers to entry do come with a trade-off. Passive investors may accept a lower total return than those actively managing a property. The rationale behind this is straightforward: active management involves more risk, effort, and expertise, warranting a higher reward. Passive investors, in exchange for the ease of investment and reduced personal commitment, generally yield a portion of the potential returns to those undertaking the management tasks.

What Are the Benefits of Passive Real Estate Investing?

Given the considerable capital, time, and risk involved, the traditional route of becoming a landlord or directly managing properties isn’t for everyone. This is where passive real estate investing shines, offering a way into the market without the intensive involvement of direct property management.

Portfolio Diversification

Diversification is a cornerstone of a well-rounded investment strategy, helping to mitigate risk by spreading investments across different assets. Passive investing allows you to incorporate real estate into your portfolio without purchasing property outright. By investing in various projects or real estate investment trusts (REITs), you can achieve exposure to different property types and markets, reducing the impact of volatility in any single investment on your overall portfolio.

Lower Capital Amount

One of the most appealing aspects of passive investing is the opportunity to invest at a lower capital amount. Unlike direct property investments that often require significant upfront capital for down payments and maintenance, passive investments allow you to buy into real estate projects or entities with much smaller amounts. This makes it easier for investors, even those with limited funds, to get started in real estate.

Lower Barrier to Entry

The complexities of acquiring and managing real estate can be daunting for many. Passive real estate investment lowers the barrier to entry, making it accessible to a broader audience. By eliminating the need for extensive real estate knowledge, experience, and the significant capital typically required for property investment, passive strategies open the door to the real estate market for novices and seasoned investors alike.

Less Involvement

Passive real estate investing is ideal for those who prefer a hands-off investment approach. It frees investors from the day-to-day responsibilities of property management, such as dealing with tenants, maintenance issues, and property taxes. This lack of direct involvement allows investors to reap the benefits of real estate investment without the time commitment and operational challenges, making it a perfect fit for those with busy lives or other professional focuses.

No Personal Liability

Direct property ownership can expose investors to personal liability in the event of accidents or legal disputes related to the property. Passive real estate investing, on the other hand, often involves investment structures that limit investor liability to their investment amount. This protection is a significant advantage, offering peace of mind and shielding personal assets from potential legal entanglements.

Potential Tax Advantages

Real estate investments are known for their favorable tax treatment, and passive real estate investment is no exception. Through strategies like 1031 exchanges, investors can benefit from deductions such as depreciation, mortgage interest, property tax, and deferred capital gains. These tax advantages can significantly enhance the overall return on investment, making passive real estate an even more attractive option.

Inflation Hedge

Real estate has historically been an effective hedge against inflation. As the cost of living rises, so can rent and property values, leading to higher income and capital appreciation for real estate investments. Passive real estate investment provides a way to benefit from this inflation hedging without the need to directly own or finance properties, offering protection for your investment portfolio against the eroding effects of inflation.

Risks and Challenges of Passive Real Estate Investing

While passive real estate investment offers numerous advantages, such as accessibility and reduced personal involvement, investors should be aware of the potential risks and challenges associated with this investment strategy. Understanding these can help investors make informed decisions and develop risk mitigation strategies.

Lower Profit

One of the trade-offs of passive real estate investment is the potential for lower profits compared to active investment strategies. Active investors who take a hands-on approach to property management and development can often realize higher profit margins through strategic improvements, effective management, and market timing. While benefiting from a hands-off investment, passive investors generally share a portion of the returns with management or the platform facilitating the investment, potentially lowering overall profits.

Hands-off Approach

The hands-off nature of passive real estate investing means trusting the management team or platform to make decisions that affect the investment’s performance. This reliance introduces management and performance risk; if the entity managing the investment makes poor decisions or underperforms, it can directly impact your returns. Thoroughly vetting management teams and choosing reputable platforms with a track record of success can help mitigate this risk.

Real Estate Market Fluctuations

Real estate markets fluctuate due to economic conditions, interest rates, and other factors. Passive investors, particularly those investing in properties outside their local area, may struggle to stay abreast of all the nuances affecting their investments. Remote ownership allows for a different level of control or agility in responding to market changes than direct ownership might, potentially affecting the investment’s resilience to market downturns.

Liquidity Concerns

Compared to stocks or bonds, real estate investments generally offer lower liquidity. Passive real estate investments, such as those in syndications or non-traded REITs, may come with holding periods during which your capital is locked in or offer limited opportunities for early exit. This can be a significant consideration for investors who prioritize liquidity or may need access to their capital on short notice.

Tax Implications

While passive real estate investment can offer tax advantages, it also has complex tax considerations. The investment structure, such as through a REIT or a limited partnership in syndication, can affect how returns are taxed. Additionally, passive activity loss rules and the treatment of income can vary, potentially complicating an investor’s tax situation. Consulting with a tax professional familiar with real estate investing is crucial to navigate these complexities and optimize tax outcomes.

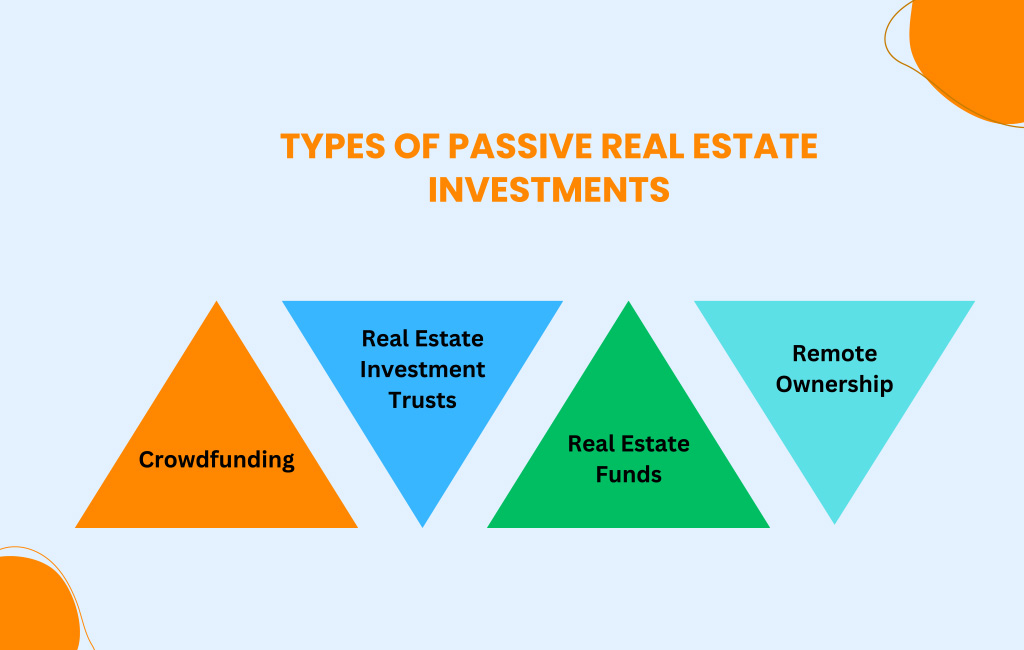

Types of Passive Real Estate Investments

The passive route presents an appealing alternative for those looking to bypass the intensive management and capital requirements traditionally associated with real estate investments. Passive real estate investments offer a spectrum of opportunities that cater to varying investor preferences, risk tolerances, and financial objectives.

1. Crowdfunding

Crowdfunding has revolutionized how individuals can invest in real estate by pooling together small amounts of capital from many investors to finance real estate projects or purchases. This approach lowers the entry barrier, making it accessible for investors with limited capital. Through real estate crowdfunding platforms, investors can choose specific projects to fund, ranging from commercial properties to residential developments, enjoying the benefits of real estate investment, including potential returns and diversification, without significant upfront capital or direct management responsibilities.

2. Real Estate Investment Trusts

Real Estate Investment Trusts (REITs) offer a straightforward way for investors to gain exposure to real estate markets without owning physical properties. REITs own, operate, or finance income-producing real estate across various property sectors. These trusts are traded on major stock exchanges, providing liquidity and accessibility similar to stocks. By investing in REITs, individuals can benefit from dividends generated from the trust’s real estate holdings, making it an attractive option for income-seeking investors.

3. Real Estate Funds

Real estate funds are mutual funds or exchange-traded funds (ETFs) that invest primarily in REITs and real estate companies. These funds offer diversification within the real estate sector, spreading investment across multiple properties, geographic areas, and real estate types. Investors in real estate funds benefit from professional management, which selects and oversees the fund’s holdings, offering a hands-off investment approach while capitalizing on the expertise of real estate professionals.

4. Remote Ownership

For those who prefer more direct investment in physical properties but still wish to maintain a passive role, remote ownership using a property manager is an effective strategy. In this model, investors own individual properties and hire professional property managers to handle all aspects of day-to-day management, from tenant interactions to maintenance. This approach allows investors to enjoy the benefits of owning real estate, such as potential appreciation and rental income, while delegating operational responsibilities to experienced professionals.

Factors to Consider in Passive Real Estate Investing

Passive real estate investing offers a gateway to the benefits of property investment without the necessity of hands-on management. However, its ease of entry doesn’t imply a hands-off approach to decision-making. Several critical factors must be carefully considered to navigate this terrain effectively and maximize potential returns.

Property Type

The type of property you invest in can significantly impact your investment’s performance. Different property types, such as residential, commercial, industrial, or retail, come with their own set of demand dynamics, risk profiles, and income potentials. For instance, residential properties might offer more stability in income through rental payments, whereas commercial properties could provide higher returns but with potentially higher vacancy risks. Understanding the characteristics and market demands of different property types will help you align your investment with your financial goals and risk tolerance.

Market Conditions

A complex interplay of local and national economic indicators influences real estate markets, including employment rates, population growth, and consumer spending habits. Market conditions can significantly affect property values, rental income potential, and investment climate. Investing in areas with strong economic growth, job creation, and infrastructure development can lead to more favorable investment outcomes. Conversely, stagnant or declining markets pose higher risks. Keeping a pulse on market trends and economic forecasts can guide investment decisions toward more promising markets.

Investment Strategy

Your investment strategy should reflect your financial objectives, investment horizon, and risk appetite. Passive real estate investing can range from short-term speculative investments to long-term income-generating strategies. Some investors prefer the liquidity and diversity of REITs, while others may opt for the tangible asset ownership offered by crowdfunding projects or remote property ownership. Deciding on an investment strategy that complements your overall investment portfolio and financial goals is crucial for achieving the desired outcomes.

Conducting Due Diligence

Due diligence is paramount in passive real estate investment. This process involves thoroughly vetting the investment opportunity, understanding the terms and conditions, assessing the track record and reputation of the management team or investment platform, and evaluating the financial health of the investment. For crowdfunding and REITs, it’s important to review past performance, management fees, and the legal structure of the investment. Assessing the property’s condition, location, and potential for appreciation or rental income is essential for remote ownership. Comprehensive due diligence can mitigate risks and uncover valuable investment opportunities.

Cons of Passive Real Estate Investing

While passive real estate investment offers a streamlined path into the real estate market, it has drawbacks. Understanding these challenges is crucial for investors to navigate the landscape effectively and make informed decisions.

Limited Control

One of the most significant trade-offs in passive real estate investing is relinquishing control over investment decisions. When you invest in a REIT, a real estate fund, or through crowdfunding platforms, you’re essentially putting your capital into the hands of those managing these entities. While this can free you from the day-to-day hassles of property management, it also means you have little to no say in the operational decisions, from the choice of tenants to the timing of property sales.

This hands-off approach requires trust in the management’s decision-making processes and strategies. Investors must do their due diligence before committing their funds but must also reconcile with the fact that their influence on individual investment outcomes will be minimal. This dynamic can lead to situations where decisions made by the management team may not always align with every investor’s personal or financial goals, highlighting the importance of selecting the right investment vehicles and management teams from the outset.

Dependence on Management

The success of passive real estate investments heavily relies on the expertise, integrity, and performance of the management team or the platform. This dependence creates a dynamic where the investor’s returns are closely tied to the decision-making and operational efficiency of those managing the investment. Selecting the right managers or platforms becomes crucial, as their ability to navigate market fluctuations, manage properties effectively, and identify lucrative investment opportunities directly impacts the profitability of your investment.

The risk associated with this dependence on management underscores the necessity for thorough vetting processes and ongoing monitoring. Investors should look for entities with a proven track record, transparent communication practices, and strategies that align with their investment goals. However, even with diligent selection, the inherent risks of mismanagement or underperformance remain, potentially affecting the expected returns on your investment.

Complexity and Fees

Passive real estate investments, particularly those structured as syndications, funds, or through crowdfunding platforms, can be complex and laden with additional costs. The intricacies of these investment vehicles often involve layers of fees, including management, performance, and transactional fees, which can significantly impact the net returns. Understanding these structures and their associated costs requires financial literacy and due diligence, which may be daunting for some investors.

The complexity of these investments can make it challenging to assess the true value and risks associated with each opportunity. Investors need to navigate through the fine print, understand the fee structures, and evaluate the long-term implications of these costs on their investment returns. This complexity not only demands a higher level of engagement and education on the part of the investor but also emphasizes the need for transparency and clarity from those managing the investment vehicles.

Final Words

Passive Real Estate Investing offers a viable pathway to wealth accumulation for those looking to invest in real estate without the burdens of direct property management. Investors can make informed decisions aligning with their financial goals by understanding passive real estate investments’ benefits, risks, and strategic considerations.

For more insights and guidance on passive real estate investment and other financial empowerment topics, follow our blog at EduCounting. Stay ahead with expert advice, market trends, and strategic tips to navigate the complex world of investments and secure your financial future.

FAQs

Is passive investing a good idea?

Yes, passive investing can be a good idea for those seeking exposure to real estate markets without the complexities of direct ownership. It allows for diversification and potential income generation with a hands-off approach.

Are passive funds safe?

While no investment is entirely risk-free, passive funds can offer a safer alternative to direct investing, especially when managed by experienced and reputable firms. However, investors should conduct thorough due diligence.

Is passive investing low or high risk?

The risk level of passive investing depends on the specific investment vehicle and market conditions. Generally, it offers a moderate risk level, combining the potential for high returns with the benefits of diversification and professional management.