Student’s loan forgiveness in the USA is an important issue that affects thousands of students across the country. With rising college tuition costs, many students cannot pay off their student loans and are looking for options to alleviate their debt burden. But student loan forgiveness depends mainly on one factor – who are the students taking the loan from?

One option is federal loans – government-backed loans with low-interest rates and flexible repayment terms. Another alternative is a private student loan, which is not government-backed; therefore, interest rates are higher than federal loans.

The new law passed by the Biden administration allows student loan borrowers to receive full or partial forgiveness. Now the question is, does the new law apply only to federal student loans, or does it include private student loans? Let’s explore the meaning, possibilities, and alternatives to private student loan forgiveness.

Private Student Loans vs. Federal Students Loan

To start with, federal student loans are funded by the federal government and offer various benefits, such as fixed interest rates, income-driven repayment plans, and loan forgiveness programs. They also do not require collateral or a good credit score to qualify.

On the contrary, private student loans are non-federal educational financing options offered through banks, credit unions, or other financial institutions. The terms and conditions vary from lender to lender but generally require excellent credit scores to qualify for lower interest rates and more favorable repayment terms.

In short, private student loans are offered by banks, credit unions, or other lenders, while federally funded student loans are provided directly by the U.S. Department of Education.

Federal student loan borrowers benefit from repayment plans tailored to their income level, including income-based repayment options and loan forgiveness provisions in certain situations. Borrowers who qualify may also be able to take advantage of Subsidized Stafford Loans, which allow them to defer all interest payments until after graduation.

As for private student loan borrowers, various programs are available through the government, private companies, and nonprofit organizations designed to help private borrowers reduce or ease their student loans. But the case could be better for private student loans so far forgiveness involves. Unlike its federal counterpart, private student loan borrowed from and offered by private profit-making companies and money unions are no way to be forgiven.

To cite an exception, many lenders have offered private student loan forgiveness covid programs to help ease the burden. The coronavirus pandemic caused a financial crisis for millions of Americans, including those with student loan debt. So, this has been a lifeline for borrowers of both private student loans and others struggling to keep up with their payments amid economic turmoil.

What is President Biden's Take on Students Loan Forgiveness?

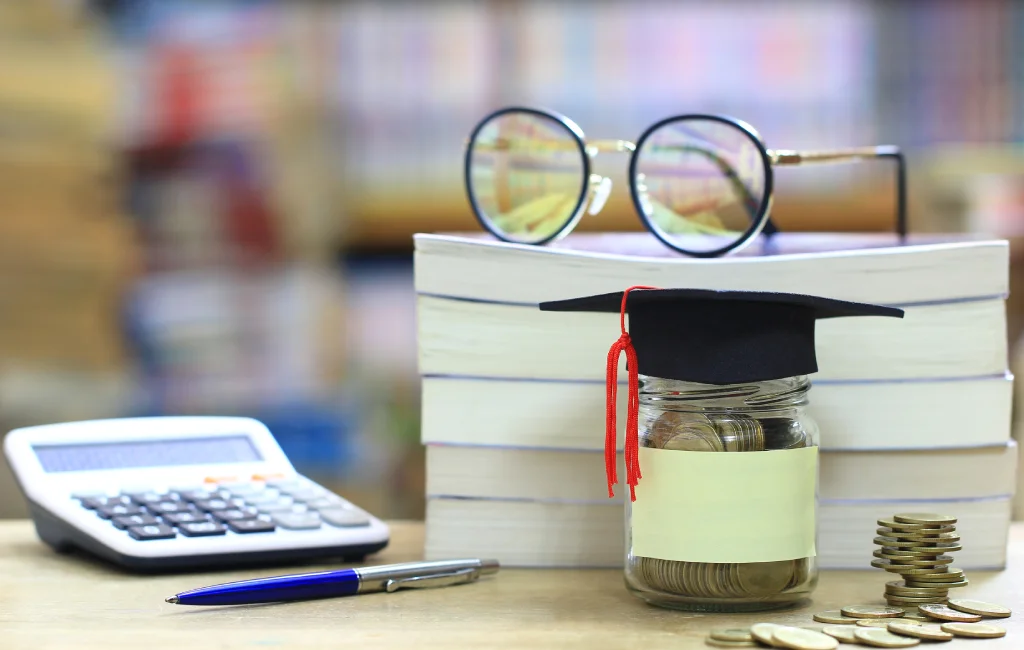

When President Biden took office in 2021, student loan debt was at an all-time high. As of January 2021, the total outstanding student loan debt in the U.S. exceeded $1.7 trillion, with more than 44 million borrowers struggling to pay off their loans.

President Joe Biden has made clear his stance on student loan debt. He believes that students should not be burdened by large amounts of loan debt and wants to make it easier for those needing help with college tuition.

In line with this idea, “Public Service Loan Forgiveness” was created to help those who work in public service fields such as teaching, law enforcement, and health services by reducing or eliminating some of their debts.

But will President Biden’s stance extend Private Student Loans forgiveness? The blunt truth is a clear no, as Biden student loan forgiveness did not address private student loans – taken chiefly from non-government profit-making sources.

How to Ease the Burden of Your Private Student Loans

If you’re struggling to pay off your private student loans, don’t despair. As a smart way out, you can use a few strategies to get rid of your loans and gain some financial freedom. Here is why private student borrowers should put an end to their futile effort to discover student loan forgiveness and try the following options.

Debt Snowball Technique

The Debt Snowball Method is an increasingly popular alternative to private student loan forgiveness. It’s a strategy that focuses on paying off debt from the smallest balance to the most significant, regardless of the interest rate attached. It can be an effective way to reduce or eliminate your loan debt over time.

The goal with this method is first to pay off small balances with lower interest rates quickly and then move up the ladder as more debts are paid off.

Borrowers stay motivated by seeing quick results while they work towards eliminating larger loans and higher-interest debts. Furthermore, this method requires no additional money from outside sources – loan service relief programs or government assistance. Consequently, anyone with access to even a tiny income stream can use this method for their benefit.

Make Use of Student Loan Payoff Calculator

Student loan payoff calculator allows borrowers to estimate the amount of time it will take them to pay off their loans in full, track their payments and determine ways to reduce interest costs. With this tool, students can better understand the long-term financial implications of their loan debt. Thus, they can make decisions that best suit their individual needs.

The calculator helps individuals plan for repayment by estimating the total cost of paying off the loan over time, including interest accrued and principal payments. On its top, borrowers can customize payment plans by setting different goals, such as reducing monthly payments or shortening repayment terms.

Watch out for Private student loan refinance

Refinancing your student loans can be a great alternative to private loan forgiveness for many borrowers. It allows you to choose a new lender and negotiate better terms on your existing loans, such as lower interest rates and more flexible repayment plans.

For those with good credit, this can be an effective way to save money over the life of the loan and reduce monthly payments. But before committing to any agreement with any of multiple refinancing offers, borrowers should use a student loan payoff calculator or speak with experts to determine their best options for managing their debt load. To play safe, understanding how it works and the pros and cons associated with this approach is crucial.

Advice with your lender

If you are struggling to make payments on your private student loan, it is essential to talk with your lender about the options that may help you ease the burden.

Talking with your lender about repayment and understanding your loan type and associated terms is crucial. Your lender should provide information on how to reduce or modify payments and any other potential sources of assistance, such as income-driven repayment plans or deferment options.

Review the information from your credit report and know how much you owe each month so that you can discuss ways to streamline payments and potentially lower interest rates.

Pausing federal student loan payment

Pausing payments for federal student loans offer an excellent opportunity for those struggling to pay off their debt. This pause in payment can help borrowers get ahead of their debt without being overwhelmed by mounting interest rates. By pausing payments, borrowers can reallocate the money they were spending on loan repayments towards repaying the private student loan.

You may find a suitable option, including forgiveness, to tackle the federal loan, but the private student loan would no longer be excused.

How do we get rid of the private student loan burden?

The burden of private student loans can be daunting for many college students, as they struggle with mounting debt and increasing interest rates. But there are ways to manage. Here are some tips on how to get rid of the private student loan burden and reclaim your financial freedom:

Students Loan assistance programs

Fortunately, there are several loan payment assistance programs available to help college graduates manage their student loan debt. One of the best ways to get assistance with student loan payments is through government-sponsored programs such as forbearance and deferment. However, they are meant for federal student loan.

As for private student loan assistance, private lenders may offer refinancing options for those struggling with high-interest rates or extended repayment terms on existing student loans.

Leftover 529 funds opportunity

529 funds are becoming increasingly popular to save for a child’s future education expenses. However, many parents may not realize that these funds can be used in other ways, such as repaying up to 10 thousand dollars of qualified education loans.

When the 529 account is no longer needed for its original purpose, the funds can be withdrawn tax-free and transferred to an eligible student loan lender. This transfer will count toward the principal balance on loan and reduce the total amount owed by up to 10 thousand dollars.

The transfer must be approved by both the lender and 529 plan administrators. Not to skip in excitement, it must follow IRS guidelines in order to ensure that it’s done properly and with minimal tax implications.

Loan forgiveness for disability and death

In the event of disability, some lenders offer total and permanent disability (TPD) discharge, which allows borrowers to have their remaining loans forgiven. This option is often difficult to qualify for due to rigorous requirements such as proof of medical records or Social Security Administration certification. To come to death, some lenders provide partial or complete loan forgiveness if a borrower dies before paying off their debt.

When a loan guarantor passes away or becomes permanently disabled, the family may be eligible for loan cancellation or discharge due to their inability to pay. This type of loan cancellation usually applies only to federally guaranteed student loans; however, other types of financial aid may also provide relief in certain circumstances. The process involved depends on the type and source of the debt as well as the specific situation at hand.

File chapter 7 or 13 for discharge in bankruptcy

When someone is overwhelmed by debt and can no longer keep up with payments, filing for bankruptcy may be their last resort. When it comes to filing for bankruptcy, the two most common chapters are Chapter 7 and Chapter 13.

The process usually takes three to six months from start to finish and allows debtors to walk away from their obligations without having to pay anything back. In some cases, creditors may even agree to accept less than what they are owed in the form of a structured settlement agreement with the debtor.

So, Can Private Students Loan Be Forgiven?

Private student loans are a popular form of financing for college education, but there are fewer options for having them forgiven than federal government loans repayment plans.

To be eligible for federal student loan forgiveness application, applicants must have made 120 payments on an income-driven repayment plan over 10 years. You have to work full-time in one of the designated public service positions as per PSLF or Navient student loan forgiveness requirement.

However, it is still possible to reduce or eliminate your private student loan debt in certain circumstances. Besides working in certain jobs that qualify for loan forgiveness, teaching in an underserved area or working for a nonprofit organization may earn you loan forgiveness.

As suggested earlier, you may also be able to apply to have some of your private student loans discharged if you become permanently disabled or die. Moreover, bankruptcy can provide private student loans forgiveness under certain conditions.