Understanding personal finance is a critical skill in our lives. Yet, many individuals find navigating through complex financial terminologies and metrics difficult. One such concept that often comes across as perplexing is the ‘proportion of loan balances to loan amounts is too high’. This is a key financial metric, especially for outstanding debts.

If not understood and managed well, the proportion of loan balances to loan amounts can significantly influence an individual’s financial health. Determining one’s creditworthiness is important for potential lenders, and credit history plays a vital role. Therefore, it’s crucial to understand what it means, its implications, and ways to manage it effectively.

What Does “Proportion of Loan Balances To Loan Amounts Is Too High” Mean?

The phrase “proportion of loan balances to loan amounts is too high” refers to a financial scenario wherein the outstanding balance of your loans, relative to the original loan amount, remains high. This typically transpires when there is a lack of significant repayments on your loans or when you’ve recently taken on new debt.

In other words, if you’ve borrowed $10,000, and after some repayments, you still owe $9,000, your proportion of loan balances to loan amounts is 90%. If your repayments were higher and you only owed $5,000, the proportion would drop to 50%. A high proportion means you still owe a significant part of your original loan, which can be a red flag for lenders.

Importance of Understanding the Proportion of Loan Balances to Loan Amounts

Understanding the proportion of your loan balances to loan amounts is crucial to managing your financial health. The statement displays the remaining balance of your initial loan. If this proportion is high, it could indicate that you are not making substantial progress toward reducing your debt. This could affect your financial plans and goals, as a high debt level can limit your ability to save, invest, or take on beneficial debt such as a mortgage.

Also, lenders consider this ratio as a significant aspect while assessing your creditworthiness. A high proportion suggests that you may have difficulty managing your current debt, which makes you a riskier borrower. Therefore, the proportion of loan balances to loan amounts is too high which could lead to higher interest rates on new loans or even loan denial. It’s important to keep this ratio as low as possible to maintain good financial health and access to credit.

Definition and Calculation of the Proportion

To clarify, the proportion of loan balances to loan amounts is a comparison between the current outstanding balance and the original amount borrowed. To calculate it, divide the current loan balance by the original loan amount and multiply the answer by 100. The result will be a percentage.

For example, if you took out a loan for $20,000 and currently owe $15,000, the calculation would be (15,000 / 20,000) * 100 = 75%. This means you still owe 75% of the original loan amount.

Disadvantages of High Loan Balances to Loan Amounts

In the world of finance, maintaining a healthy balance between loan balances and original loan amounts is of paramount importance. When the proportion of loan balances to loan amounts becomes too high, it can have serious repercussions.

High Finance Fees

Having a high loan balance compared to the loan amount can result in significant finance fees. Most of these fees consist of interest charges. Most loan interest is calculated based on the loan’s outstanding balance, meaning a higher balance results in higher interest charges.

Each payment you make on a loan is typically split between interest and principal repayment. When you have a high outstanding loan balance, a significant portion of your payment is directed toward paying off the interest rather than reducing the principal amount.

This situation can significantly increase the total cost of the loan, making the debt more expensive over time. Therefore, a high loan balance to loan amount ratio prolongs your debt repayment journey and makes it costlier.

High Risk for Default

If the loan balance is a larger percentage of the loan amount, it indicates a greater likelihood of loan default. Maintaining a high loan balance indicates that the borrower may have difficulty making sufficient payments to significantly reduce the principal. If this pattern continues, there’s an increased likelihood that the borrower may eventually fail to meet the loan obligations, resulting in a default.

Defaulting on a loan has severe consequences, including damage to the borrower’s credit score, increased interest rates, and potential legal action from the lender. If you default on a loan, it can affect your credit report for a considerable period of time, which may make it challenging for you to get credit in the future. It’s thus essential to keep the loan balances in check to mitigate the risk of default.

Bad Credit Scores

One of the most significant disadvantages of a high proportion of loan balances to loan amounts is its negative impact on your credit score. Your credit score is an essential factor lenders consider when assessing your creditworthiness. A high loan balance indicates that you may have difficulty keeping up with the loan payments, which affects your ability to borrow money in the future.

High loan balances, especially compared to the original loan amounts, indicate high credit utilization, which can negatively affect your credit score. Creditors interpret high credit utilization as a sign of potential financial stress and a higher likelihood of default. Consequently, this can make obtaining future credit and loans more challenging. It could also lead to higher interest rates on future borrowing since lenders may view you as a higher-risk borrower.

Factors Affecting the Proportion of Loan Balance to the Loan Amount

Various factors influence the proportion of loan balance to the loan amount. Some of these include:

A New Installment Loan

When you first take out an installment loan, such as a mortgage or auto loan, the proportion of the loan balance to the loan amount will be high because you have yet to make any significant repayments. Over time, as you make regular payments and reduce the principal, this proportion should decrease.

Low Average Age of Accounts

The age of your credit accounts can affect the ratio of the loan balance to the loan amount. The average age of your accounts is calculated by dividing the total age of all of your accounts by the number of accounts. A low average age suggests that you haven’t had credit for very long and may not have established a strong repayment history, which could affect your loan balance to loan amount ratio.

Understanding the Risk Associated with a High Proportion

Understanding the risks associated with a high proportion of loan balances to loan amounts is crucial in managing your financial health. As mentioned earlier, a high proportion suggests to lenders that you may be a risky borrower, which could lead to higher interest rates or even loan denial.

Maintaining a high balance on your loans may also lead to financial stress. High loan payments can strain your monthly budget, leaving less money for savings, investments, or other expenses. In worst-case scenarios, you could end up in a cycle of debt, where you’re constantly borrowing money to repay existing loans.

Managing your loan balances carefully is essential to keep a strong financial position. Properly understanding the proportion of your loan balances to loan amounts is the first step in this process.

How To Fix the Code and Improve Your Credit Score

When you notice a high proportion of loan balances to loan amounts, it’s time to take action. Start by focusing on reducing your outstanding debt. Making additional payments, if possible, can help lower your loan balances more quickly.

In addition to reducing your debt, try to avoid taking on new debt until your existing balances are more manageable. Taking on new debt can increase your loan balances and make it harder to lower your proportions.

Remember, fixing your credit score is gradual, but you can see improvement over time by consistently working to lower your debt.

Improve the Average Age of Accounts

Improving the average age of your accounts can help reduce your proportion of loan balances to loan amounts. To increase the average age of your accounts, it’s beneficial to maintain older accounts, even if you’re not actively using them, as their age is determined by how long they’ve been open.

Additionally, try to avoid closing any accounts if possible. Closing an account can reduce the total age of your accounts and may not be worth it since the average age is made up of all of your accounts.

Pay Off Your Installment Loan

Paying off your installment loans as quickly as possible can significantly reduce your proportion of loan balances to loan amounts. Consider strategies such as making larger payments or making extra payments if your lender allows it without penalty. Paying off your loans faster will lower your proportion more quickly.

Lower Your Credit Utilization Rate

Your credit utilization rate is the amount of your available credit that you’re currently using, usually measured as a percentage. A higher utilization rate can negatively impact your loan balance to loan amount ratio, so it’s important to keep this number low. You may be able to reduce your utilization rate by requesting a credit limit increase or decreasing spending on your credit cards.

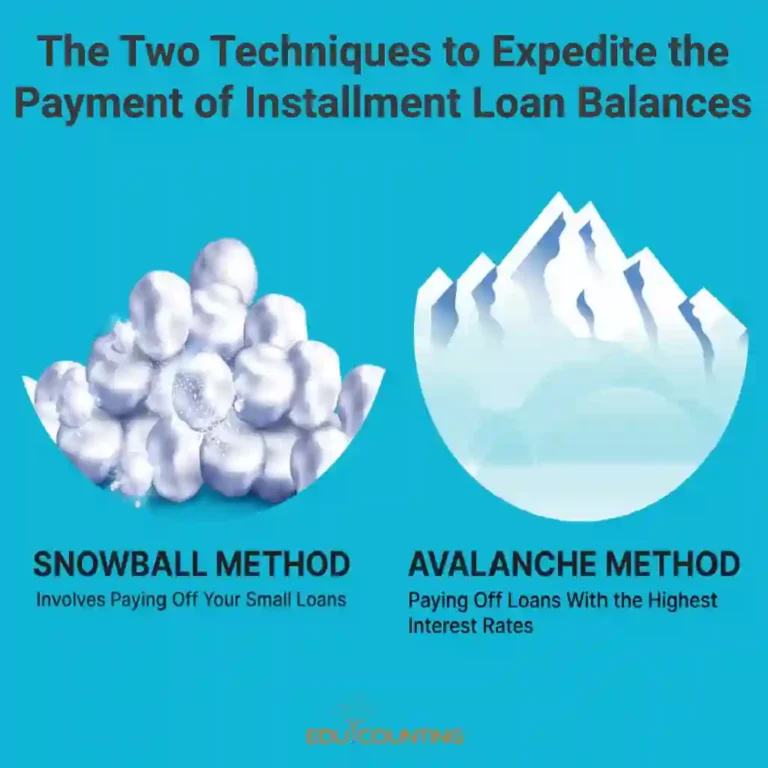

Best Ways to Payoff Balances on Installment Loans

There are multiple techniques available to expedite the payment of installment loan balances. The ‘snowball method‘ involves paying off your smallest loans first, which can provide a psychological boost and make it easier to tackle larger loans.

The ‘avalanche method’ is a strategy that suggests paying off loans with the highest interest rates first. This approach can help to minimize the amount of money spent on interest in the long term.

You can also consider refinancing your loans. Refinancing can potentially lower your interest rate, which means more of your payment goes toward the principal and less toward interest.

How To Move Your Revolving Credit Debt Onto an Installment Loan

Moving your revolving credit debt onto an installment loan, also known as debt consolidation, can be a good strategy for reducing your proportion of loan balances to loan amounts. Debt consolidation means obtaining a new loan to pay off your current debts and then making scheduled payments on the new loan.

Consolidating your debt in this way can make your payments more manageable and potentially lower your interest rate. However, it’s important to ensure you can afford the new loan payments and avoid accumulating more debt while paying off the consolidation loan.

What Are Debt Consolidation Loans?

Debt consolidation loans refer to personal loans utilized for repaying multiple debts through a single loan. The debt consolidation loan has one interest rate, often lower than the combined rates of the individual debts.

This means you’ll likely be able to save money on interest and make more substantial payments against your outstanding balances. Additionally, debt consolidation usually reduces the monthly payments you need to track and simplifies debt repayment.

What Are Credit Builder Loans?

Credit builder loans are personal loan products designed to help build or rebuild your credit score. These loans typically have lower interest rates than other financial products and can be paid back in a reasonable amount of time. When you successfully repay the loan, the creditors report it to the credit bureaus, which helps improve your credit history and score.

Frequently Asked Questions (FAQs)

What is a good proportion of loan balances to loan amounts?

A ‘good’ proportion of loan balances to loan amounts depends on various factors, including the type of loan and your overall financial situation. However, generally, a lower proportion is better, as it signifies that you have made significant progress in paying down your debt. A proportion below 30% is often considered good.

Can a high proportion of loan balances to loan amounts lead to default?

Yes, a high proportion of loan balances to loan amounts can increase the risk of default. You may have trouble making payments if you owe a large amount relative to the original loan. If the situation continues, it could eventually lead to default.

What should I do if I have a high proportion of loan balances to loan amounts?

If you have a high proportion of loan balances to loan amounts, start by creating a plan to pay down your debt. This could involve making extra payments, reducing spending in other areas to free up money for debt repayment, or seeking a debt consolidation loan. Speaking with a financial advisor or credit counselor who can help you create a personalized plan.

Can lenders refuse to lend to me if my proportion is too high?

Yes, lenders may refuse to lend to you if your proportion of loan balances to loan amounts is too high. A high balance-to-limit ratio indicates that you’re already carrying a lot of debt relative to the original loan amount, which could make it difficult for you to repay another loan.