Having better money habits can have a huge impact on your financial well-being and overall quality of life. Whether you’re looking to get out of debt, save for a big purchase, or simply feel more financially secure, developing smart money habits is key. But how do you go about building these habits? It can seem overwhelming, especially if you’re not sure where to start.

In this article, we’ll explore 10 better money habits that can change your life. From creating a budget and investing in your financial education, to cutting costs and planning for the future, we’ll cover a range of strategies for improving your financial situation. By incorporating these habits into your daily routine, you can take control of your finances and set yourself up for long-term financial success. So if you’re ready to develop good money habits and take charge of your financial future, keep reading.

1. Make a budget and stick to it

One of the most important better money habits you can develop is creating a budget and sticking to it. A budget is a plan that outlines your income and expenses, and helps you make informed financial decisions. By tracking your spending and setting financial goals, you can take control of your finances and make sure your money is being used in a way that aligns with your values and priorities.

2. Save money automatically

Saving money automatically is a smart money habit that can help you reach your financial goals faster. By setting up automatic transfers from your checking account to a savings account, you can easily build up your savings without having to think about it. You can schedule the transfers to occur on a regular basis, such as weekly or monthly, or you can set them up to occur whenever you get paid.

Automatic savings can be especially useful for meeting short-term goals, such as saving for a down payment on a house or a big purchase. You can also use automatic savings to build up an emergency fund, which can help you weather unexpected expenses or financial setbacks. Learning how to get in the habit of saving money automatically, you can make progress towards your financial goals without having to make a conscious effort to save. This can be a great way to build good money habits and ensure that you’re always saving something, even if you’re not able to save as much as you’d like.

3. Pay off debt and avoid taking on more

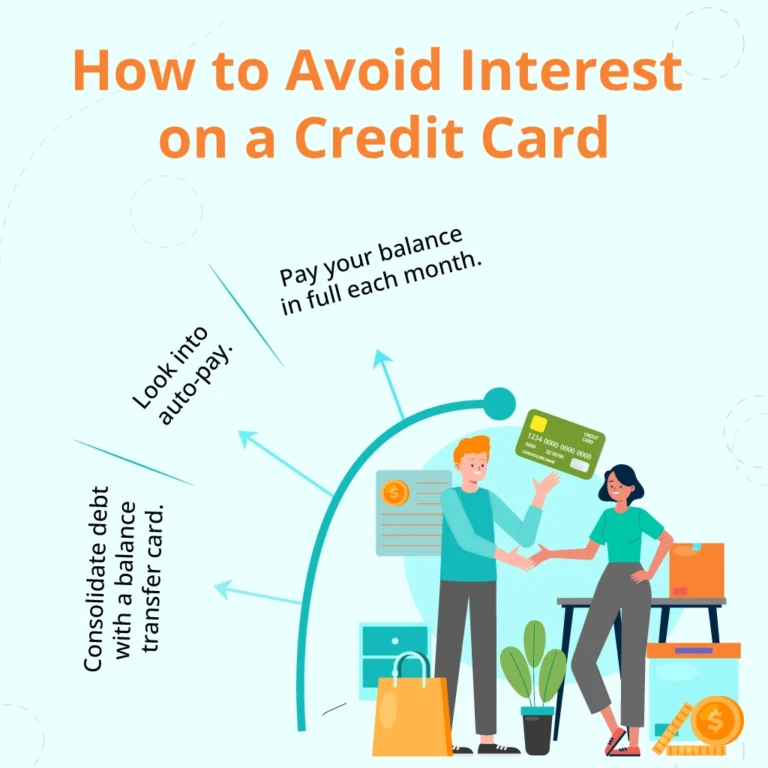

Paying off debt and avoiding taking on more is an important better money habit to develop. High levels of debt can be financially debilitating and can make it difficult to meet your other financial goals. It can also have a negative impact on your credit, which can make it harder to get approved for loans and credit cards, and can result in higher interest rates.

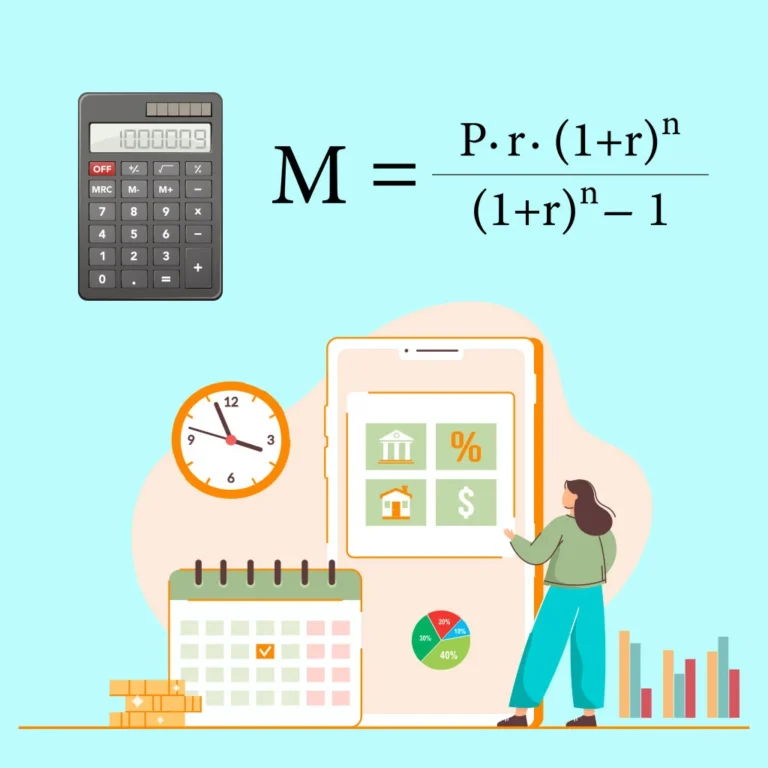

One strategy for paying off debt is to focus on the debts with the highest interest rates first. By paying off these debts first, you can save money on interest in the long run. You can also consider consolidating your debts into one loan with a lower interest rate, which can make it easier to manage your payments and pay off your debts faster.

When it comes to avoiding taking on more debt, it’s important to be mindful of your spending and only take on debt when it’s necessary. For example, buying a home can be a good investment, but it’s not always the right choice for everyone. Before taking on a mortgage, ask yourself “is buying a home right for you?” Consider whether you’re financially prepared to make the monthly payments and handle the other costs associated with homeownership. If you’re not ready to buy a home, consider saving up for a down payment and working on having healthy credit before taking on a mortgage. By being mindful of your debt and only taking on what you can handle, you can develop better money habits and improve your financial well-being.

The secret to a successful financial life is having better money habits, which can increase your savings and financial security.

4. Invest in your financial education

Investing in your financial education is a smart money habit that can pay off in the long run. By learning about personal finance, you can better understand how to manage your money and make informed financial decisions. This can include learning about budgeting, saving, investing, and debt management, as well as understanding the financial products and services available to you.

There are many ways to invest in your financial education, including reading personal finance books, taking online courses, or working with a financial planner. By investing in your financial knowledge, you can set yourself up for long-term financial success and make the most of your money.

5. Set financial goals and track your progress

Setting financial goals and tracking your progress is important for developing better money habits. By setting specific, measurable, attainable, relevant, and time-bound (SMART) goals, you can have a clear roadmap for achieving your financial objectives. This can include goals related to saving, paying off debt, or investing.

Tracking your progress can help you stay motivated and on track. You can use tools such as a budgeting app or spreadsheet to track your spending and see how you’re progressing towards your goals. By regularly reviewing your progress, you can make adjustments as needed and stay focused on achieving your financial objectives.

6. Practice mindful spending

Practicing mindful spending is an important step in making better money habits. This involves being more intentional and conscious about your spending habits, rather than just making purchases impulsively or without thought. By taking the time to consider your financial goals and values, you can make more informed decisions about how to use your money.

One way to practice mindful spending is to create a spending plan or budget that outlines your income and expenses. This can help you see where your money is going and make adjustments as needed. You can also consider setting limits for yourself, such as only allowing yourself to make one big purchase per month or setting a certain amount of money aside for impulse buys. By being more mindful of your spending, you can take control of your finances and make sure your money is being used in a way that aligns with your values and priorities.

7. Cut costs and increase income

Cutting costs and increasing income are important strategies for developing better money habits. By reducing your expenses, you can free up more money to save or invest, and by increasing your income, you can have more financial resources to work with.

To cut costs, you can start by looking for ways to save on your regular expenses, such as by shopping around for the best deals on insurance or negotiating lower rates on your bills. You can also consider cutting back on unnecessary expenses, such as dining out or subscription services you don’t use regularly.

Increasing your income can involve finding ways to earn more money, such as by taking on additional work or starting a side hustle. You can also consider negotiating for a raise or looking for ways to increase your earning potential, such as by investing in your education or learning new skills. By cutting costs and increasing income, you can take control of your finances and develop good money habits that will set you up for long-term financial success.

8. Protect your assets with insurance

Protecting your assets with insurance is an important better money habit to develop. Insurance can help protect you and your family against unexpected financial losses due to events such as accidents, natural disasters, or illness. By having insurance, you can safeguard your assets and financial well-being, and have peace of mind knowing that you and your loved ones are protected.

There are many types of insurance to consider, including health insurance, life insurance, car insurance, and home insurance. It’s important to carefully consider your needs and choose the coverage that’s right for you. You may also want to work with a financial planner or insurance broker to help you determine the best coverage for your needs. By protecting your assets with insurance, you can develop better money habits and ensure that you and your loved ones are financially prepared for the unexpected.

9. Plan for the future with retirement saving

Planning for the future with retirement savings is an important better money habit to develop. By saving for retirement, you can ensure that you have financial resources to fall back on when you’re no longer working. This can help you maintain your standard of living and avoid financial struggles in your golden years.

To get in the habit of saving for retirement, you can start by setting financial goals and tracking your progress. You can also consider setting up automatic transfers from your checking account to a retirement account, such as a 401(k) or IRA. This can make it easier to save without having to think about it.

If you’re wondering how to break the habit of spending money, you may want to consider implementing a budget or setting limits for yourself. By being more mindful of your spending and setting aside money for your future, you can develop good money habits and take control of your financial future.

10. Donate to causes you care about

Donating to causes you care about can be a rewarding better money habit to develop. By supporting organizations that align with your values and beliefs, you can make a positive impact in the world and feel good about the way you’re using your money.

There are many ways to donate to causes you care about, including giving money directly to organizations, participating in charitable events, or purchasing products that support a specific cause. You can also consider setting aside a certain amount of money each month to donate, or making charitable giving a part of your financial goals. By donating to causes you care about, you can make a difference and feel good about the way you’re using your money.

In summary, learning how to develop good money habits can have a huge impact on your financial well-being and overall quality of life. By incorporating best money habits and strategies such as creating a budget, saving money automatically, paying off debt, investing in your financial education, setting financial goals, practicing mindful spending, cutting costs and increasing income, protecting your assets with insurance, planning for the future with retirement savings, and donating to causes you care about, you can take control of your finances and set yourself up for long-term financial success. By building these habits into your daily routine, you can make the most of your money and feel confident in your financial future.