Refinancing a car loan can be a smart financial move, especially if you’re struggling with high interest rates or unfavorable loan terms. However, the process might seem intimidating if you have a poor credit score. The good news is that it’s entirely possible to refinance a car loan with bad credit—you just need to know the right steps to take and what to expect. Understanding this process can help you secure better terms and lower your monthly payments, even if your credit isn’t perfect.

This guide will walk you through the essential steps to refinancing your car loan when you have bad credit. We’ll explore the reasons for refinancing, how to determine if it’s the right move for you, and what you can do to improve your chances of approval. Whether you want to reduce your interest rate, lower your monthly payments, or adjust the loan terms to fit your financial situation better, this guide will provide the tools and knowledge you need to make informed decisions.

What is a Refinance Car Loan with Bad Credit?

A refinance car loan bad credit refers to the process of replacing your existing auto loan with a new one, specifically designed for borrowers with poor credit scores, typically below 630 on the FICO scale. While refinancing can be a smart financial move, the challenge for those with bad credit is finding a lender willing to offer better loan terms. Despite the difficulties, it is possible to refinance a car loan with bad credit if you know where to look.

Some lenders specialize in working with bad-credit borrowers and have less stringent credit requirements, such as lower minimum credit scores. These lenders are more likely to approve your refinancing application, even if your credit score is below average. However, it’s important to note that these loans often come with higher interest rates, which can offset the benefits of refinancing if you’re not careful.

To determine whether refinancing is a good option for you, it’s essential to do your research. Many lenders offer pre-qualification with a soft credit check, allowing you to see estimated rates without impacting your credit score. This can help you compare offers and find a loan that provides a better interest rate or more favorable terms than your current one.

If you cannot find a lender willing to offer a lower interest rate through refinancing, sticking with your current auto loan might be wiser. Refinancing should ideally help reduce your financial burden, so if the new terms don’t offer a significant advantage, staying with your existing loan could be the better choice.

Reasons to Refinance a Car Loan When You Have Bad Credit

Refinancing a car loan can be a beneficial move, especially if you’re dealing with high interest rates or struggling to keep up with payments. Even with bad credit, refinancing can help you secure better loan terms, reduce your monthly payments, and improve your financial situation. Here are some key reasons to refinance a car loan with bad credit.

Your Dealer Marked Up the Interest Rate

If your car dealer marked up your interest rate when you initially purchased the vehicle, you could be paying more than necessary. Refinancing allows you to shop around for a lower rate, which can save you money over the life of the loan. By choosing to refinance a car loan with bad credit, you might find a lender willing to offer a rate closer to what you actually qualify for, reducing your overall cost.

Improved Credit Since Purchase

If your credit score has improved since you first took out your car loan, you may now qualify for better terms. Lenders may be more willing to offer a lower interest rate, which can make refinancing worthwhile. Even if your credit is still not perfect, you might be surprised by the savings you can achieve when you refinance a car loan with bad credit and an improved score.

Difficulty Making Payments

Struggling to make your current car loan payments is a clear sign that refinancing could help. By extending the loan term or securing a lower interest rate, refinancing can lower your monthly payments, making them more manageable. Refinancing a car loan with bad credit can provide the relief you need to avoid falling behind on payments and damaging your credit further.

General Decrease in Interest Rates

If interest rates have dropped since you took out your car loan, it may be an excellent time to refinance. Lower market rates mean you could potentially secure a better rate than what you’re currently paying, even with bad credit. By choosing to refinance a car loan with bad credit during a period of low rates, you can take advantage of the market conditions and reduce your loan costs.

Increased Vehicle Value

If your car’s value has increased, it could positively affect your refinancing options. A higher vehicle value may result in better loan terms because the lender sees less risk in the loan. Refinancing a car loan with bad credit becomes more feasible when your car is worth more than when you first purchased it, giving you more leverage in negotiations.

How to Decide if Refinancing is Right for You

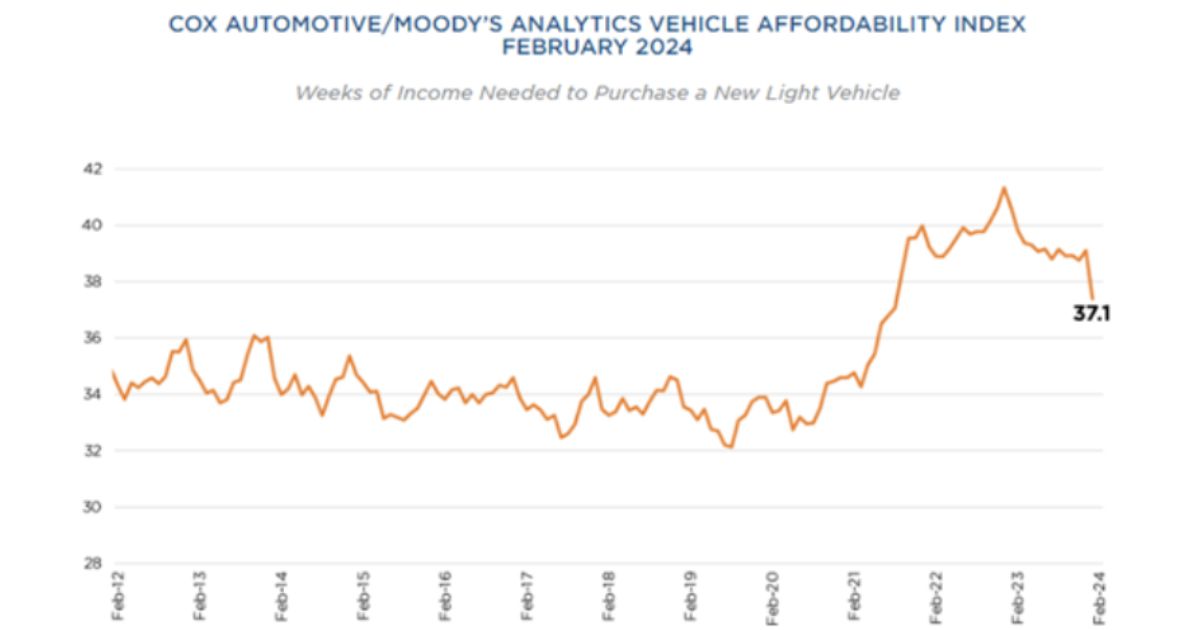

Deciding whether to refinance your car loan depends on several key factors, including the current trends in car prices and affordability. In February 2024, the typical monthly payment decreased by 0.7%, and the number of median weeks of income needed to purchase the average new vehicle dropped to 37.1 weeks from 37.4 weeks in January.

Image Courtesy: Cox Automotive/Moody’s Analytics Vehicle Affordability Index

Refinancing a car loan can be a smart financial move, but it’s important to ensure it’s the right decision for your situation. Even with bad credit, there are several factors to consider before making the move to refinance. Here’s how to determine if now is the time to refinance a car loan with bad credit.

Your Credit Scores Have Improved

Refinancing could lead to better loan terms if your credit scores have improved since you first took out your car loan. Lenders are more likely to offer lower interest rates if they see that your creditworthiness has increased, making it a good time to refinance a car loan with bad credit and secure a more favorable deal.

Your Car Has Gained Equity

If your car is now worth more than you owe on it, you have equity in the vehicle, which can make refinancing more attractive. Lenders see equity as a positive factor, which may help you qualify for better terms when you refinance a car loan with bad credit, potentially lowering your monthly payments or interest rate.

You Qualify for Lower Payments

One of the main reasons to refinance is to reduce your monthly payments, which can help ease financial strain. If you qualify for a loan with a longer term or lower interest rate, refinancing could make your payments more manageable. This is especially beneficial if you need to refinance a car loan with bad credit to improve your cash flow.

You Can Add a Cosigner

Adding a cosigner with good credit to your refinancing application can significantly improve your chances of getting approved for better terms. A cosigner provides additional security for the lender, which can lead to lower interest rates or more favorable loan conditions. If you have the option to add a cosigner, it could be the key to refinance a car loan with bad credit.

What’s the Lowest Credit Score Needed to Refinance a Car?

When it comes to refinancing a car loan, there isn’t a strict lowest credit score required. However, lenders typically consider a credit score above 700 to be ideal for securing the best interest rates. If your score falls between 660 and 700, you’re still likely to qualify for standard rates, making it more feasible to refinance a car loan with bad credit.

Refinancing is still possible for those with credit scores below 660, though it may come with higher interest rates. Lenders will assess additional factors beyond just your credit score, such as your income, employment history, and vehicle value. These factors can help strengthen your application.

How to Improve Your Credit Before Refinancing

If you’re planning to refinance your car loan but are concerned about your credit score, there are several steps you can take to improve credit score before applying. A better credit score can lead to lower interest rates and more favorable loan terms, making the refinancing process smoother and more beneficial.

Make Sure You Pay All Your Bills on Time

One of the most effective ways to improve your credit is to pay all your bills on time consistently. Payment history is a major factor in your credit score, so setting up automatic payments or reminders can help ensure you don’t miss any due dates. Timely payments demonstrate financial responsibility and positively impact your credit score.

Address Any Past-Due Debts

If you have any past-due debts, getting current on them should be a top priority. Delinquent accounts can significantly damage your credit, so bringing them up to date is important. Contact your creditors to discuss payment plans or negotiate settlements, and make consistent payments to show you’re working to resolve your debts.

Lower Your Credit Card Balances

Reducing your credit card balances to 30 percent or less of your credit limit is another effective strategy to enhance your credit profile. High credit card balances increase your credit utilization ratio, which can negatively affect your score. Paying down these balances will lower your utilization rate and help improve your overall credit health.

Keep Your Old Credit Accounts Open

Continuing with your credit accounts open can be positive for your credit score. The length of your credit history is an important factor in determining your score, so even if you’re not using these accounts regularly, keeping them open can help maintain a longer credit history. Just ensure there are no annual fees associated with these accounts.

Limit Applications for New Credit

While building your credit, it is wise to limit new credit applications. Each application can lead to a hard inquiry on your credit report, which can temporarily lower your score. Focus on managing your existing credit accounts responsibly and only open new ones if absolutely necessary to maintain a strong credit profile.

How to Refinance a Car Loan with Bad Credit: Easy Steps

Refinancing a car loan can be an effective way to reduce your monthly payments, lower your interest rate, or adjust the terms of your loan to better suit your financial situation. However, the process can be more challenging if you have bad credit. Fortunately, with the right approach and careful planning, it’s possible to refinance a car loan with bad credit successfully. Below, we outline the essential steps to guide you through this process.

Review Your Financial Situation

Before starting the refinancing process, it’s crucial to conduct a thorough financial situation review. Assess your current income, expenses, and debts to understand how much you can pay monthly. This review will help you determine whether refinancing makes sense for your situation and what terms would be most beneficial for you. Understanding your financial standing will also help you decide what loan terms to look for and how much you can reasonably expect to save through refinancing.

Check Your Credit Score

Your credit score plays a significant role in the refinancing process. Even with bad credit, knowing your current score is essential, as it will impact the interest rates and loan terms you’re offered. Obtain a copy of your credit report from one of the major credit bureaus and review it carefully. If you spot any errors, dispute them to improve your score before applying. While your score may not be perfect, having an accurate picture of your credit will help you manage expectations and focus on lenders willing to work with bad credit.

Look for Lenders

Finding the right lender is a critical step when you need to refinance a car loan with bad credit. Some lenders specialize in working with individuals who have poor credit, offering more flexible terms than traditional banks. Research and find a lender that offers refinancing options for bad credit, and compare their rates, fees, and customer reviews. Don’t settle for the first offer you receive—shopping around can help you find the best deal available.

Prequalify for Refinancing

Once you’ve identified potential lenders, it’s wise to prequalify for car refinance. Prequalification allows you to see the estimated loan terms you might qualify for without affecting your credit score. During this step, the lender will perform a soft credit check, which provides you with a rate estimate. Prequalification helps you compare offers and choose the best refinancing option without committing to a particular lender.

Collect Required Documents

After prequalifying, you’ll need to gather the necessary documents to move forward with the refinancing application. Typically, you’ll need proof of income (such as pay stubs or tax returns), your current loan details, proof of insurance, and identification. Having these documents ready in advance will streamline the application process and ensure that everything goes smoothly.

Submit Your Application

Once you have reviewed your options and gathered the necessary documents, it’s time to submit your application. Ensure that all the information you provide is accurate and complete. After submission, the lender will review your application and may conduct a hard credit inquiry, which could slightly impact your credit score. If approved, you’ll receive the new loan terms, and the lender will pay off your existing loan, leaving you to start making payments on the refinanced loan.

How to Improve Approval Chances for a Refinancing Application

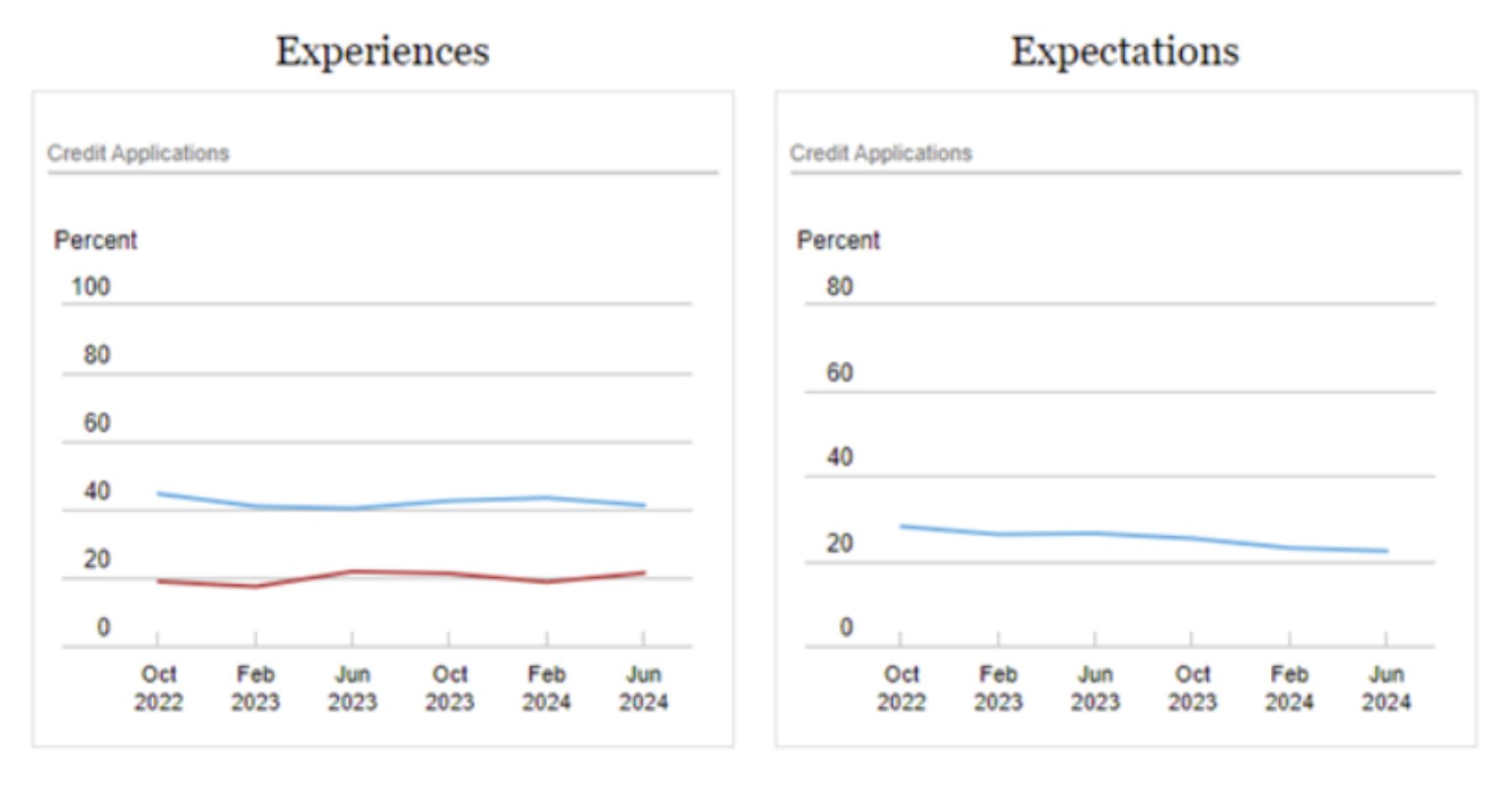

Recent statistics indicate that the rate at which people applied for any form of credit over the past year decreased to 41.2% in June 2024, from 43.4% in February 2024. Simultaneously, the rejection rate for credit applications increased, reaching 21.4% in June 2024, compared to 18.7% in February 2024.

Image Courtesy: www.newyorkfed.org

This increase in rejections was seen across all age and credit score groups, highlighting the need for a strategic approach to improve your chances of approval. Understanding the current lending environment and taking proactive steps can significantly enhance your likelihood of getting your refinancing application approved.

- Increase Your Income: If possible, take on additional work or find ways to boost your income before applying. Higher income can make you a more attractive candidate to lenders.

- Make a Larger Down Payment: If you can afford it, making a larger down payment on your refinance can reduce the loan amount and increase your chances of approval.

- Consider a Cosigner: If your credit score is very low, consider asking a friend or family member with better credit to cosign the loan. This can improve your chances of approval and help you secure better terms.

- Shop Around: Don’t settle for the first offer you receive. Shop around and compare offers from multiple lenders to find the best deal.

What to Do if Your Refinancing Application is Denied

If your refinancing application is denied, don’t panic. There are steps you can take:

- Ask for Feedback: Contact the lender and ask why your application was denied. This feedback can help you address specific issues before reapplying.

- Improve Your Credit Score: Focus on improving your credit score by paying down debt, correcting errors on your credit report, and making timely payments.

- Consider a Different Lender: Some lenders may be more willing to work with bad credit borrowers than others. Consider applying with a different lender who specializes in bad credit refinancing.

- Reapply Later: If your credit score or financial situation has significantly improved, consider reapplying after a few months.

What to Do If You Can’t Refinance with Bad Credit

- Negotiate with Your Current Lender: Sometimes, your current lender may be willing to modify your loan terms if you’re struggling to make payments. This could involve extending the loan term or reducing the interest rate.

- Sell the Car: If you cannot afford the payments, selling the car and using the proceeds to pay off the loan might be the best option. This can prevent further damage to your credit.

- Look for Financial Assistance: Some non-profit organizations offer financial counseling and assistance to those struggling with debt. They can help you explore other options and create a plan to manage your finances.

Challenges of Refinancing with Bad Credit

Refinancing with bad credit presents several challenges:

- High-Interest Rates: One of the biggest challenges of refinancing a car with bad credit is that lenders may offer higher interest rates, which could negate the benefits of refinancing.

- Limited Lender Options: Not all lenders are willing to work with borrowers who have bad credit, so your options may be limited.

- Stricter Terms: Lenders may impose stricter terms, such as shorter loan periods or higher fees, making it harder to find favorable refinancing options.

- Risk of Rejection: Your refinancing application may always be denied, especially if your credit score is very low.

Benefits and Drawbacks of Refinancing a Car Loan with Bad Credit

Refinancing a car loan with bad credit has its refinance car benefits and drawbacks:

Benefits:

Lower Monthly Payments: Refinancing can lower your monthly payments by extending the loan term, providing immediate financial relief.

Opportunity to Improve Credit: Making consistent payments on a refinanced loan can help rebuild your credit over time.

Better Loan Terms: If you qualify, you might secure better loan terms than your original loan, even with bad credit.

Drawbacks:

Higher Interest Rates: Refinancing with bad credit often comes with higher interest rates, which can increase the overall cost of the loan.

Extended Loan Term: While lowering monthly payments, extending the loan term means you’ll be paying off the car for a longer period, possibly paying more in interest over time.

Refinancing Fees: The fees associated with refinancing, such as application fees and title transfer fees, can add to the cost of refinancing.

Tips for Successfully Refinancing Your Car Loan

Here are some car refinance tips to help you successfully refinance your car loan with bad credit:

Check Your Credit Report: Before applying, check your credit report for errors and dispute any inaccuracies. This can help improve your credit score and refinancing options.

Prequalify with Multiple Lenders: Prequalifying with multiple lenders allows you to compare offers without affecting your credit score, helping you find the best deal.

Negotiate Terms: Don’t be afraid to negotiate with lenders. You may be able to secure better terms by discussing your options and demonstrating your commitment to making payments.

Consider a Cosigner: If your credit is very poor, having a cosigner with good credit can improve your chances of approval and help you get better loan terms.

Be Prepared to Walk Away: If the refinance terms are favorable, be prepared to walk away and explore other options. It’s better to wait and improve your credit score than to accept unfavorable terms.

Alternatives to Car Loan Refinancing

If refinancing isn’t the right option for you, consider these alternative car loan solutions:

Loan Modification: Request a loan modification from your current lender to reduce your payments without refinancing. This option may allow you to adjust the terms of your loan, such as extending the repayment period or lowering the interest rate, making your payments more manageable.

Trade-In Your Vehicle: Consider trading your current vehicle for a less expensive one with lower payments. Trading in your car can help you reduce your debt burden and potentially get into a vehicle that better fits your current financial situation.

Personal Loan: If you qualify, a personal loan with a lower interest rate could be used to pay off your car loan. This approach could simplify your debt management by consolidating your car loan into a single payment with potentially better terms.

Lease Buyout: If you’re currently leasing, you might be able to buy out your lease at a lower interest rate than refinancing. A lease buyout could save you money in the long run, especially if the vehicle’s residual value is less than its market value.

How to Find the Best Lenders

Finding the best lenders is key to getting favorable refinancing terms. Here’s how:

Research Online: Look for lenders that specialize in bad credit refinancing. Read reviews and check ratings to ensure they are reputable.

Compare Offers: Don’t settle for the first offer. Compare rates, terms, and fees from multiple lenders to find the best deal.

Consult with a Financial Advisor: A financial advisor can provide personalized recommendations based on your credit situation and financial goals.

Check for Hidden Fees: Some lenders may advertise low rates but charge high fees. Make sure to read the fine print and understand all associated costs.

Conclusion

Refinancing a car loan with bad credit may seem challenging, but it’s possible with the right approach and preparation. By understanding how to refinance a car loan with bad credit, reviewing your financial situation, improving your credit score, and carefully selecting a lender, you can find a refinancing option that works for you.