Saving and investing money at an early age is one of the best things you can do for your future. When you start saving and investing early, you allow your money to grow exponentially (that means A LOT!!) over time. Even a small amount of money saved now can turn into a large sum down the road, but you don’t need to take my word for it. Take, for example, one of the most significant and well-known investors of all time, Warren Buffett.

This article will teach you about saving and investing money, as well as what the Warren Buffett story can teach us about financial growth and financing decisions.

Who is Warren Buffett?

Warren Edward Buffett is an incredibly wealthy and influential business person, investor in business, and philanthropist. He is currently the chairman and CEO of a company called Berkshire Hathaway and is said to be worth more than $100 billion. At 91 years old, Warren Buffett is living proof that starting early, and living a long life, can REALLY increase your wealth.

You probably think that you could never be like Warren Buffett. Maybe you think he had more advantages than you, which made his extreme wealth possible, but the truth is, he’s not much different than you and me (but he started early and got help from his dad).

Here are a few facts about Warren Buffett to show you just what I mean:

- Warren Buffett ACCIDENTALLY bought Berkshire Hathaway, a company worth more than $245.5 billion.

- Warren Buffett started saving and investing money at age 11.

- Berkshire Hathaway Berkshire Hathaway Berkshire Hathaway Berkshire Hathaway (including some big ones).

- Warren Buffett is the biggest shareholder of Coca-Cola and drinks a lot of the bubbly concoction.

The Accidental Business Owner

In 1965, Warren Buffett bought some stock shares of a struggling company, Berkshire Hathaway, as a business investment. After a while, the owners wanted to buy them back and, when they offered a price, he accepted. The only problem is that the price had been reduced when the purchase agreement got to him, and that got Warren a little miffed.

So, Warren Buffett decided not to sell back his shares and instead bought more. By becoming the principal investor in the company, he gained complete control and turned it into the thriving business it is today.

Early Saving and Investing As a Path to Wealth

Wondering How to set your child up for financial success? Warren Buffett was just 11 years old when he began saving and investing. His dad owned a brokerage company, which undoubtedly shaped his understanding of the power of saving and investing at an early age.

That is further proof that learning financial management strategies at an early age increases a child’s chances for future financial success. When you get into the game faster, you can learn, make mistakes, adjust, and make better decisions.

Even Warren Buffett Makes (Expensive) Mistakes

Speaking of learning, Warren Buffet has made several sizeable mistakes in his lifetime. He often refers to two companies he invested in, Dexter Shoes and U.S. Air, that weren’t all they were cracked up to be.

First, Dexter’s competitive advantage went away soon after buying the shoemaker in 1993, and the company collapsed, costing Warren Buffett about $8 billion. After purchasing USAir for $358 million in 1989, it quickly became apparent that the airline wouldn’t grow the way he had expected, and he often called the purchase a big mistake. A decade later, Warren Buffett admitted that the company had made enough of a turnaround to recoup the purchase price. However, it was still a costly endeavor and not one of the investor’s best financial decisions.

Sure, these lessons were costly, but they were also valuable and continued to drive Warren Buffett’s investing moving forward.

Warren Buffett Loves Coca-Cola

In 2015, Warren Buffett told Fortune Magazine that he was “one-quarter Coca-Cola,” and that’s not just because his company, Berkshire Hathaway, is one of the company’s most significant shareholders. He admits to drinking five cans of the stuff daily.

Although I threw this one in just for fun, there is a lesson to be learned here.

Warren Buffett figured out a long time ago that if you can sell something that costs a couple of pennies to make (like Coca-Cola) for 50 or 100 times more, your profit margin (how much you make on each sale) would make a pretty good business!

How Warren Buffett's Wealth Grew Over Time

The key to this story is that Warren was born in 1930 and is now worth more than $100 billion.

While that figure continues to change, here are a couple of figures that I found interesting:

- Warren Buffett didn’t hit $1 billion until he was 50.

- Warren Buffett didn’t hit $3 billion until he was 60.

- More than 99% of his wealth occurred after he was 50.

- That’s more than 80 years of compounding and investing under his belt.

These facts about Warren Buffett are real-world examples of how anyone can be financially successful if they start early and learn to employ healthy financial strategies. They also help to illustrate the crazy power of compounding.

What is Compounding?

In the simplest terms, compounding adds to your investment, not by adding more money but by reinvesting your growth. You see, investments generate growth, and when that growth is used to create additional growth, that’s compounding.

For example, using dividends from stock investments to buy more stock will ultimately bring more dividends, which you can, in turn, use to buy more stock. Over time, your money continues to grow. Another example of increasing your financial growth is compounding your bank account interest. If you have an account that gains interest off your principal balance, that balance will continue to grow, which will create more interest, continue to grow your balance, and so on.

Does it sound like I’m talking in circles?

Well, I am because that is precisely how compounding works. Investments feed on income and growth, and, over time, this is how we can successfully build wealth, just like our friend Warren Buffett did. Once he got things going, his finances took on a life of their own.

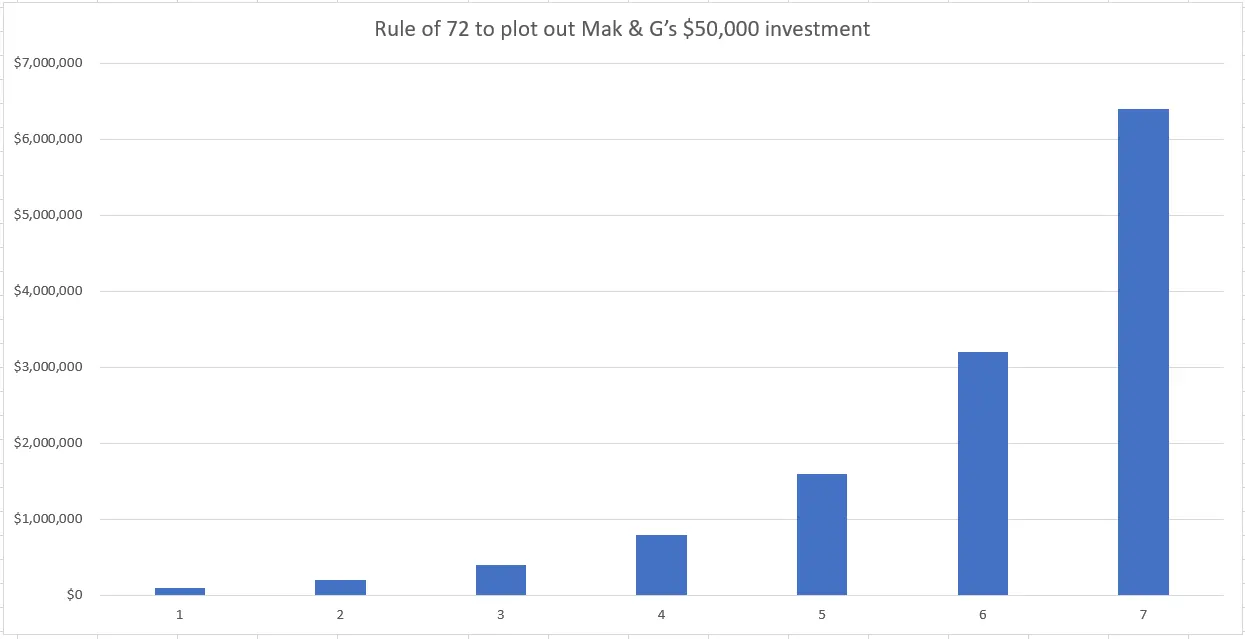

Imagine if Mak & G each had $50,000 right now. With around 49 or so years until they retire, by re-investing their earnings and growth on that amount, they’ll each have over $6 million when they retire (see below).

Of course, they can’t touch that money at all. Mak & G need to let that money sit there and grow as they live their lives. It’s fantastic when you think about it and easy to calculate when you apply what’s known as “The Rule of 72.”

The Rule of 72

The Rule of 72 is a simple calculation you can use to figure out how many years it will take for you to double your investment.

To make it simple, let’s say you are gaining interest or growth in the stock market of 10%.

Take the number 72 and divide the growth by 10.

72 ÷ 10 (interest or growth each year) = 7.2 years to double

Using this example, it would take 7.2 years to double an investment from $100 to $200. It can be ANY amount of investment. That’s what’s so special about the “Rule of 72”.

To make it simple, let’s round down to seven years, instead of 7.2.

If you maintain that 10% return each year for 49 years, which would take Mak & G into their 60’s when they might want to retire, you can figure out the total nest egg they’ve built.

If we use 49 years of compounding, and their investment doubles every seven years, that means the investment will double SEVEN different times.

49 total years ÷ 7 (time to double) = 7 times it will double

That’s some serious growth!

Let’s use the Rule of 72 to plot out Mak & G’s $50,000 investment:

- 1st 7-year period doubles to $100,000 ($50,000 times 2)

- 2nd 7-year period doubles to $200,000 ($100,000 times 2)

- 3rd 7-year period doubles to $400,000 ($200,000 times 2)

- 4th 7-year period doubles to $800,000 ($400,000 times 2)

- 5th 7-year period doubles to $1,600,000 ($800,000 times 2)

- 6th 7-year period doubles to $3,200,000 ($1,600,000 times 2)

- 7th 7-year period doubles to $6,400,000 ($3,200,000 times 2)

In 49 years, that $50,000 will have grown to $6.4 million by the time they retire.

Click the video below to watch an excellent video about “The Rule of 72” :

Need More Proof?

I don’t think there is ANY stronger argument for starting to save and invest your money as early as possible than what I have outlined here in this post.

When it comes to saving and investing, time is your friend. Welcome it with open arms, treat it with respect, let it do its job, and it will.

Thank you, Mr. Compounding!