Structured Investment Vehicles (SIVs) emerged as innovative financial entities in the late 1980s. They offered a distinct approach to generating profits by borrowing funds on a short-term basis and investing them in long-term assets. This strategy allowed SIVs to capitalize on the spread between borrowing and lending rates, making them highly attractive to institutional investors seeking both security and yield. Initially, they gained significant traction, especially among major financial institutions, for their potential to offer steady returns with perceived stability.

However, the 2008 financial crisis highlighted vulnerabilities within the SIV model. These vehicles faced severe liquidity issues due to their reliance on short-term funding for long-term investments. Their collapse contributed to broader financial instability, leading to regulatory changes and a decline in their popularity. This guide will dive into SIVs’ history, operational structure, associated risks, and overall impact on the financial landscape.

What are Structured Investment Vehicles (SIVs)?

Structured Investment Vehicles (SIVs) are special financial entities created by banks to profit from investments in various assets. These unique vehicles operate off the bank’s balance sheet, meaning their assets and liabilities don’t appear in its official financial statements. This setup allows banks to invest in riskier assets without directly impacting their capital requirements, giving them more flexibility in managing their finances.

SIVs have several defining characteristics that make them distinct from traditional investment approaches:

Off-Balance Sheet Operation: Because SIVs are off-balance sheet, the bank’s official financial position remains unaffected. This design lets banks engage in high-yield investments with potentially higher risks, as these investments aren’t reflected in the bank’s capital obligations.

Short-Term Funding and Long-Term Investments: SIVs primarily fund themselves by borrowing on a short-term basis, often through instruments like commercial paper. They use these short-term funds to invest in longer-term assets, offering higher returns.

Maturity Transformation: SIVs engage in maturity transformation or asset-liability mismatch. This means they use short-term borrowing to finance long-term investments, profiting from the difference between the borrowing cost and the returns on long-term assets. While profitable, this practice exposes SIVs to liquidity risk if short-term funding sources dry up.

While the structure of SIVs offers certain advantages, it also introduces notable risks:

Avoidance of Capital Requirements: By keeping assets off the bank’s main balance sheet, SIVs allow banks to bypass some regulatory capital requirements. This can increase profit potential but lead to a lack of transparency, as investors may not see the full scope of a bank’s financial exposure.

Liquidity Risk: One of the biggest risks SIVs face is liquidity. If short-term funding sources, like commercial paper, become unavailable, SIVs may struggle to meet their obligations. This can lead to a forced sale of long-term assets at unfavorable prices or, worse, a financial collapse.

SIVs became widely popular in the years before the 2008 financial crisis. However, many SIVs faced severe liquidity challenges during the crisis as short-term funding dried up. Banks were then forced to return SIV assets to their balance sheets, highlighting the hidden risks associated with off-balance sheet structures.

Following the 2007-2008 financial crisis, the use of SIVs dropped significantly. The liquidity issues SIVs experienced during the crisis led to regulatory scrutiny and reforms aimed at limiting off-balance sheet activities and ensuring better investor transparency. As a result, the reliance on SIVs in financial markets has diminished.

Historical Context of Structured Investment Vehicles

The history of structured investment vehicles traces back to the 1980s when Citigroup pioneered their development. This vehicle allowed banks to leverage capital to invest in higher-return long-term assets funded by short-term debt—a strategy known as maturity transformation. This design was profitable and efficient, sparking interest from other financial institutions.

Growth and Adoption by Financial Institutions

Following Citibank’s lead, major banks and asset managers established their own SIVs. These entities sought to benefit from high returns through structured investments and off-balance sheet funding, which provided banks with more flexibility. SIVs initially focused on stable returns, but over time, they diversified into more complex portfolios.

Key Players: Large banks and specialized fund managers quickly adopted SIVs, drawn by the potential profits.

Structured Investments: The growth of SIVs included investments in various debt instruments, adding complexity.

Increased Complexity Over Time

As SIVs grew, they began including more sophisticated financial products, including mortgage-backed securities. Initially designed for stable returns, SIVs’ focus shifted to higher profits, which led to more speculative strategies and increased risk.

SIVs and the 2007-2008 Financial Crisis

The 2007-2008 financial crisis highlighted the risks of Structured Investment Vehicles, especially their dependency on short-term funding. When liquidity dried up, many SIVs faced severe challenges, forcing banks to absorb these assets back onto their balance sheets, which significantly impacted their financial health.

Liquidity Strain: Short-term funding became scarce, leading to SIV instability.

Bank Impact: Many banks were required to bring SIV assets onto their balance sheets, impacting their stability.

Decline and Regulatory Scrutiny Post-Crisis

After the crisis, regulatory bodies imposed tighter controls on off-balance-sheet financing and structured products. These regulations aimed to increase transparency, resulting in a decline in SIV use and a shift towards more cautious practices in structured finance.

Regulatory Changes: New rules targeted off-balance sheet financing, requiring greater transparency.

Reduced Use of SIVs: The regulatory environment led to a steep decline in SIV popularity.

Legacy and Lasting Impact

While SIVs are rare today, they underscore the importance of transparency and risk management in structured finance. Their history offers valuable lessons on balancing innovation with caution in financial markets.

Types of Structured Investment Vehicles

There are various types of structured investment vehicles within the financial market. Structured Investment Vehicles (SIVs) typically diversify their investments across a range of asset-backed securities (ABS), each providing unique cash flows and risks. Here’s a breakdown of the main asset types SIVs invest in:

1. Residential Mortgage-Backed Securities (RMBS)

SIVs invest in RMBS, which are backed by pools of residential mortgages. These investments generate steady cash flows as homeowners make their mortgage payments, offering relatively predictable returns.

2. Commercial Mortgage-Backed Securities (CMBS)

Like RMBS, CMBS is backed by commercial real estate loans. These securities provide a higher yield compared to residential-backed assets, making them attractive for SIVs seeking greater returns.

3. Collateralized Debt Obligations (CDOs)

SIVs also invest in CDOs, which are collections of corporate bonds or loans packaged into a single security. This asset class often includes different levels of risk and reward, with CDOs backed by corporate debt offering exposure to credit markets.

4. Credit Card Receivable-Backed Securities

Backed by pools of credit card receivables, these securities provide steady cash flows as borrowers make their credit card payments. This asset class offers SIVs a mix of liquidity and reliable income.

5. Auto Loan-Backed Securities

Auto loan securities, backed by car loans, deliver regular cash flows and tend to have short durations, making them useful for SIVs that need liquid assets with stable returns.

6. Student Loan-Backed Securities

Student loans provide another cash-generating option, as they come with long repayment terms and low default rates. This makes student loan-backed securities appealing for SIVs focused on longer-term assets.

Additional Investments in Short-Term Securities

In addition to ABS, SIVs may also hold short-term securities to manage liquidity effectively:

Commercial Paper: Issued by corporations and banks, commercial paper provides quick access to cash and helps SIVs meet short-term funding needs.

Medium-Term Notes: These notes offer slightly longer maturities than commercial paper but still provide the necessary liquidity to manage cash flows effectively.

The main objective in choosing these securities is to balance liquidity with stable cash flows, ensuring the SIV remains financially viable while meeting its investment goals. Each investment vehicle type has distinct characteristics, and the chosen structure impacts how assets are managed, returns are generated, and risks are distributed across investors.

How Structured Investment Vehicles Work

Understanding how structured finance works within the framework of SIVs is crucial to appreciating their function. Structured investment vehicles operate by purchasing long-term, high-quality assets like mortgage-backed securities and corporate bonds, typically funded through short-term commercial paper issuance. The income generated from these long-term assets exceeds the cost of the short-term liabilities, allowing the SIV to profit from this spread.

1. Diversification and Exposure to Multiple Asset Classes

SIVs allow investors to diversify across a variety of assets based on their risk tolerance and financial goals. They commonly invest in asset-backed securities and other structured products, such as mortgage-backed securities, credit card receivables, and corporate bonds. This approach spreads risk and provides a balanced portfolio to minimize the impact of losses from any one asset type.

2. Professional Management and Oversight

SIVs are typically managed by professional investment managers who make strategic decisions on behalf of investors. These managers analyze the market, select appropriate securities, and adjust the portfolio as needed to optimize returns. For this service, management fees and other operating expenses are charged, contributing to the costs investors bear for the benefits of expert guidance and oversight.

3. Pooling of Capital for Greater Investment Reach

By pooling capital from numerous investors, SIVs create a single, larger investment entity. This pooled structure grants access to investments that might be beyond the reach of individual retail investors, allowing them to benefit from diversified exposure and the potential for institutional-level investments.

4. Distribution of Returns Based on Investment

Investors in SIVs receive returns, such as income and capital gains, usually in proportion to their individual contributions. This income distribution varies depending on the specific securities the SIV holds and the performance of the overall investment pool.

5. Leverage for Enhanced Returns

One distinct feature of SIVs is the use of leverage to amplify returns. Leverage allows the SIV to borrow funds, enabling the purchase of additional securities and the potential for higher profits. However, leveraging investments also raises the risk of losses, which means careful due diligence is essential when considering SIVs as an investment.

Comparing SIVs with Other Investment Options

When evaluating SIV comparison with other investment structures, it’s essential to consider aspects such as risk, returns, and regulatory differences.

Differences from Traditional Investment Funds

Structured Investment Vehicles (SIVs) differ significantly from traditional investment funds, such as mutual funds. Traditional funds gather money from investors to purchase straightforward assets like stocks and bonds, making them more accessible and transparent.

On the other hand, SIVs are designed to buy asset-backed securities and other complex financial products, requiring a higher level of financial expertise to manage and understand. This specialization makes SIVs more complex and potentially riskier than traditional investment funds, which generally offer simpler investment options for the average investor.

Comparison with Special Purpose Vehicles (SPVs)

While comparing SIV vs. SPV, though they share similarities in being structured financial products, their purposes differ. SPVs are often created to support a single project or to isolate financial risk within a corporation.

For instance, companies may use SPVs to separate specific financial activities from their main operations, thereby protecting their balance sheet from associated risks. SIVs, however, are established to profit by leveraging the difference, or spread, between short-term borrowing and long-term investments. Unlike SPVs, which focus on risk isolation, SIVs aim for profitable returns by capitalizing on asset-backed securities and structured finance.

Risk and Transparency Differences

Another key distinction between SIVs and other investment options is the level of risk and transparency involved. Traditional investment funds, such as mutual funds and ETFs, are usually more transparent and regulated, with clear information available for investors regarding portfolio composition and performance.

In contrast, SIVs involve more complex assets and higher risk, often with less transparency in their financial operations. This can make it harder for average investors to fully grasp the risks associated with SIVs compared to more conventional funds.

Appeal to Different Types of Investors

Traditional investment funds are appealing to a broad range of investors, from beginners to experienced ones, due to their simplicity and accessibility. SIVs, however, cater to institutional investors or those with an appetite for higher risk and more specialized financial instruments.

This appeal difference stems from the complexity of SIV assets and the expertise needed to manage them effectively. Investors seeking stable returns typically prefer traditional funds, while those pursuing higher, albeit riskier, returns may explore SIVs.

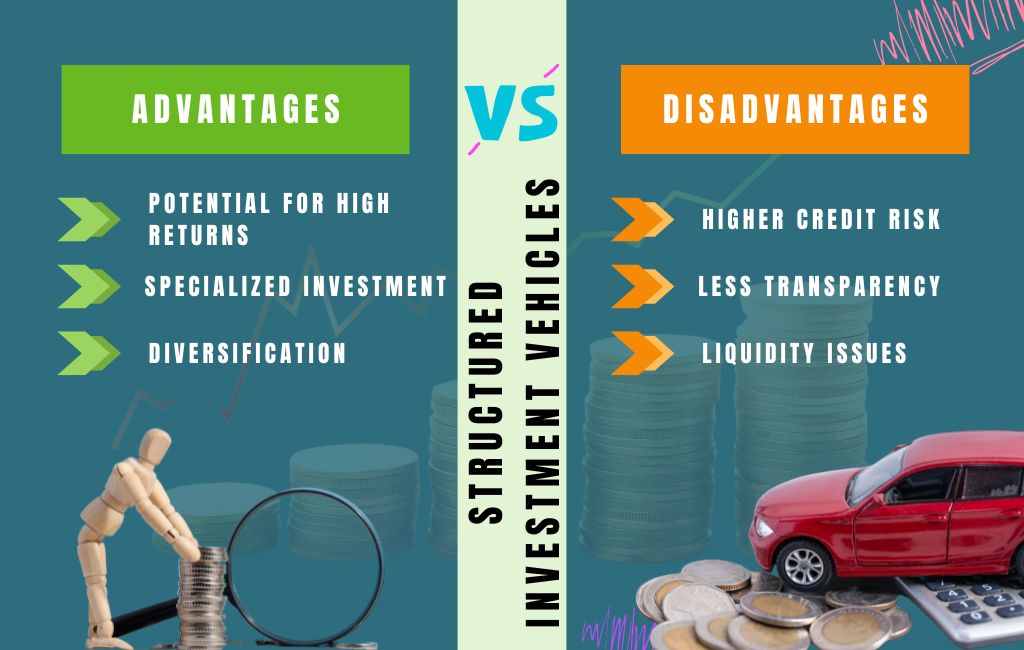

Advantages and Disadvantages of Structured Investment Vehicles

Structured Investment Vehicles (SIVs) offer a unique investment approach that appeals to certain investors due to their potential for higher returns and portfolio diversification. However, these vehicles come with substantial risks, including credit exposure, transparency issues, and liquidity challenges. Here’s a breakdown of investing in SIVs’ main advantages and disadvantages.

Advantages

Potential for High Returns

One of the most attractive features of SIVs is their potential for high returns. By engaging in “maturity transformation” or borrowing at lower short-term rates to invest in higher-yield, long-term assets, SIVs seek to capture the difference in interest rates for profit. This approach, though complex, offers potentially larger returns than traditional investments. For investors with a high-risk tolerance, SIVs provide an opportunity to access assets that may yield higher profits.

Specialized Investment

SIVs are specialized investment vehicles designed for investing in asset-backed securities and complex financial instruments. This specialization exposes investors to unique assets, such as commercial mortgage-backed securities, collateralized debt obligations (CDOs), and other structured finance products. Unlike traditional funds, which may hold stocks and bonds, SIVs allow investors to explore more sophisticated financial market sectors.

Diversification

Investing in SIVs allows for diversification across various asset-backed securities and debt instruments. This portfolio mix can include residential mortgages, commercial loans, auto loans, and more, spreading investment across multiple sectors. Diversification is particularly beneficial for investors looking to reduce exposure to a single market sector, as it helps balance risks across a range of investments. This diversification within SIVs can be especially appealing to institutional investors aiming to broaden their portfolio reach.

Disadvantages

Higher Credit Risk

One of the significant downsides of SIVs is their higher credit risk. Since these vehicles rely on short-term borrowing to invest in long-term assets, they are vulnerable if the value of those long-term assets declines. If market conditions deteriorate or short-term borrowing rates increase, the assets held by SIVs may lose value, leading to credit issues. This was evident during the 2008 financial crisis when SIVs struggled with loan defaults and losses on their assets.

Less Transparency

SIVs are less transparent than traditional investment funds, making it difficult for investors to fully understand the risks involved. Unlike mutual funds, which disclose their holdings and offer regular updates, SIVs often operate with minimal public disclosure due to the complexity and nature of their assets. This lack of transparency can lead to unexpected risks and makes it harder for investors to track their investments’ performance, potentially exposing them to unforeseen losses.

Liquidity Issues

Liquidity is a common challenge for SIVs. Because they invest in long-term assets while relying on short-term funding, SIVs face liquidity risks if they cannot roll over their short-term debt. This mismatch between asset and funding duration can result in a liquidity crunch if market conditions shift suddenly, leaving SIVs unable to meet their financial obligations. During financial stress, SIVs may find it challenging to sell off assets to cover short-term liabilities, adding to the risk of investment losses.

The SIV advantages and challenges underscore the importance of fully understanding these investment vehicles before committing funds.

Regulatory Environment Surrounding SIVs

The landscape of SIV regulations has evolved considerably since the 2008 financial crisis. Prior to the crisis, regulatory oversight was minimal due to these vehicles’ off-balance-sheet nature.

Early Days: Minimal Oversight and Offshore Freedom

The 2008 financial crisis highlighted the dangers posed by SIVs and similar off-balance-sheet entities, especially as they heavily relied on short-term funding to invest in long-term assets. Many SIVs could not cover their short-term obligations when the financial markets faced liquidity issues.

To address these vulnerabilities, regulators introduced new guidelines to improve transparency, risk management, and accountability within these vehicles. These regulations sought to prevent the unchecked growth and risk accumulation that had previously gone unnoticed until the crisis.

Current Compliance Standards: Safeguarding Investors and Markets

Today, SIVs must follow a much stricter regulatory framework to maintain compliance and protect investors. The focus on transparency means SIVs must now report more detailed information regarding their assets, funding structures, and risk exposure.

Enhanced oversight aims to safeguard the financial markets from potential disruptions caused by highly leveraged and under-regulated entities. This increased accountability reduces the chances of excessive risk-taking, creating a more controlled environment for both investors and market stability.

A Balanced Investment Environment

With these changes, the regulatory landscape for SIVs now emphasizes balance—allowing for innovation in structured finance while minimizing risk. Though the stricter requirements have made it more challenging for SIVs to pursue aggressive investment strategies, they have also contributed to a more resilient financial system.

This new environment aims to support structured investments with the necessary safeguards, benefiting investors and the broader economy.

The Impact of SIVs on Financial Markets

Structured investment vehicles have a significant market impact due to their ability to provide liquidity and enable funding for various assets. By aggregating high-grade assets, SIVs allow financial institutions to participate in structured finance markets without directly impacting their balance sheets.

Understanding SIV market impact requires a balanced view of their benefits and potential risks in the context of broader economic trends.

Enhancing Market Liquidity and Expanding Credit

SIVs contributed to market liquidity by increasing the availability of funds for short-term loans, which helped expand credit in various sectors. By borrowing funds through instruments like commercial paper and reinvesting in long-term, higher-yield assets, SIVs allowed investors to benefit from credit spreads.

This practice helped make credit accessible, supporting broader market growth. However, this liquidity was often fragile, as it relied heavily on the stability of short-term funding.

SIVs in Maturity Transformation and Arbitrage

One key function of SIVs was engaging in maturity transformation—using short-term borrowing to fund long-term investments. This approach created arbitrage opportunities for SIVs, as they capitalized on the difference in interest rates between short- and long-term debt. Although this allowed for profitable returns, it also introduced liquidity risks if funding sources became limited, revealing a weakness in the SIV structure.

Systemic Risks and SIVs in the Shadow Banking System

Operating within the shadow banking system, SIVs posed unique risks to the broader financial markets. As off-balance-sheet entities, they bypassed traditional banking regulations, allowing them to take on higher risks with limited oversight.

While this enabled flexibility and creativity in their investment strategies, it also made SIVs vulnerable to sudden changes in market conditions, increasing systemic risks. When liquidity dried up, SIVs struggled, affecting the interconnected financial system.

Lessons from the Subprime Mortgage Crisis

During the subprime mortgage crisis, SIVs held substantial investments in mortgage-backed securities, quickly losing value as the housing market collapsed. Unable to secure short-term funding, many SIVs faced severe liquidity crises, forcing their sponsoring banks to absorb these losses. This crisis highlighted the risks associated with off-balance-sheet entities and led to stricter regulations to improve transparency and oversight for SIVs and similar financial vehicles.

Innovations and Future Trends in Structured Investment Vehicles

The world of SIV innovations continues to evolve, with new trends shaping the future of structured finance. Key trends include the integration of technology, such as blockchain, to enhance transparency and streamline asset management. Additionally, environmentally focused SIVs are emerging, which pool assets tied to green initiatives, providing investors with sustainable investment opportunities.

The Rise of Responsible Investment in SIVs

Today, SIVs are moving toward responsible investment approaches. Key trends include collateralized loan obligations and integrating ESG (environmental, social, and governance) factors into investment strategies. These approaches address modern concerns, allowing SIVs to balance financial performance with ethical considerations.

By focusing on safer, conservative assets and improving transparency, SIVs aim to meet higher regulatory standards while providing value. Niche asset classes also offer SIVs a specialized role in financial markets, appealing to investors seeking alternatives beyond traditional investments.

Adapting SIVs for Niche Markets

SIVs still hold unique advantages, such as efficient risk transfer and diversification through nontraditional assets. As securitization evolves, SIVs can play a key role by bundling niche assets that larger institutions often overlook.

This strategy aligns with investor needs for tailored products and adds flexibility in a competitive market. By providing options that cater to specific investment goals, SIVs help diversify investment portfolios and address gaps in asset-backed finance.

Integrating ESG and Advanced Analytics

One of the latest innovations for SIVs is integrating ESG principles. SIVs can now structure deals that prioritize environmental or social outcomes, aligning investments with the values of modern investors. By selecting assets based on ESG criteria, SIVs help create products that serve ethical and financial objectives.

Advanced analytics, including AI and big data, also enhance SIV operations. These tools allow for improved cash flow analysis and better asset pool optimization, making SIVs more precise and efficient.

SIVs and the Future of Structured Finance

The future of SIVs depends on balancing innovation with careful oversight. Stricter regulations following the 2008 crisis make it essential for SIVs to prioritize transparency and manage risk responsibly.

With the right approach, SIVs can continue contributing to asset-backed finance by offering sustainable, specialized investment options. Focusing on conservative structures, responsible asset selection, and advanced technology will help SIVs build trust, making them a valuable part of modern financial markets.

Final Words

Structured Investment Vehicles (SIVs) offer investors a unique opportunity to benefit from structured finance while navigating high-quality assets in the financial markets. Investors can make informed decisions with the right understanding of how SIVs work, their benefits, risks, and evolving regulatory requirements. Although the 2008 financial crisis deeply impacted SIVs, recent innovations and future trends promise to reshape this investment avenue, potentially bringing a resurgence in the market.

Exploring Structured Investment Vehicles (SIVs) can offer exciting opportunities and valuable insights for those interested in the evolving world of structured finance.