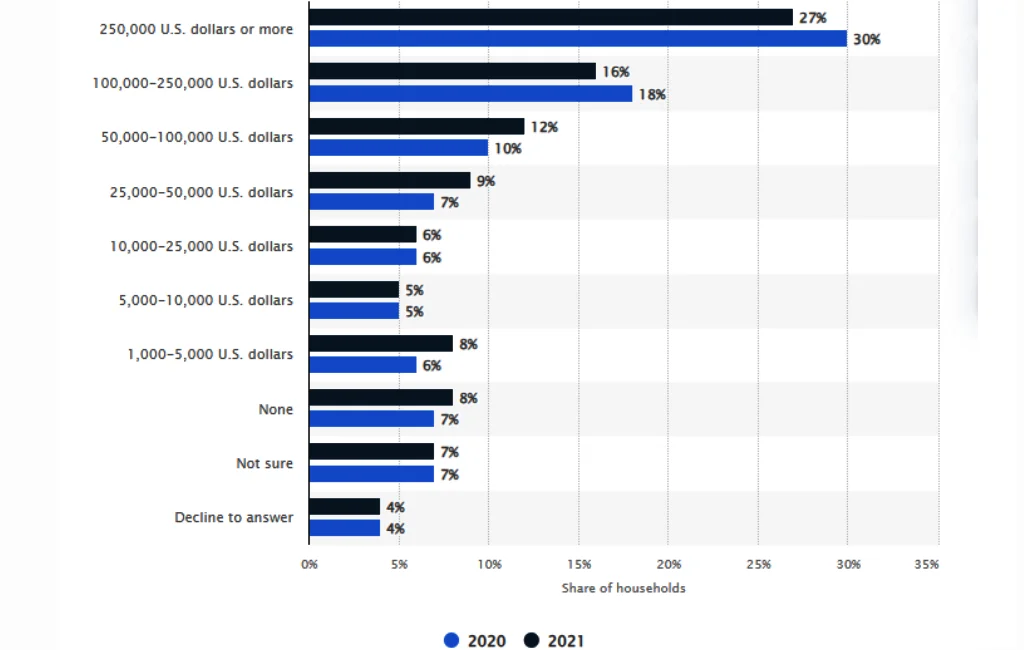

In 2021, approximately a quarter of Americans boasted household retirement savings of $250,000 or more. However, not everyone was as fortunate. An alarming 8% of individuals reported having no retirement savings whatsoever. Interestingly, that year’s overall retirement savings had decreased compared to the preceding year.

Retirement planning is an essential part of financial security, and with the evolution of executive compensations, the Supplemental Executive Retirement Plan (SERP) stands out as an attractive option. Let’s delve deep into understanding SERP and how it can ensure a secure future for executives.

What is a Supplemental Executive Retirement Plan (SERP)?

A Supplemental Executive Retirement Plan (SERP) is a non-qualified retirement plan for key company employees, typically executives and other top-ranking officials. Unlike standard retirement plans, SERPs are not available to all employees. These plans are an agreement between an employer and its key employees, wherein the employer promises to pay a defined benefit to the employee upon retirement.

Understanding the Dynamics of Supplemental Executive Retirement Plans

Supplemental Executive Retirement Plans (SERPs) cater primarily to executives, presenting them with retirement benefits that transcend what’s typically offered by standard retirement schemes. Each SERP carries its distinctive characteristics, yet there are recurring elements across various plans:

Deferred Income Opportunities: One of the cornerstones of SERPs is the ability it grants executives to put aside a slice of their salary. This deferred income remains untouched by taxes until the executive retires, allowing it to compound and grow over time.

Defined Vesting Periods: Much like their counterparts in standard retirement packages, SERPs come equipped with vesting timelines. These timelines specify the duration an executive must serve before they can claim the plan’s full advantages.

Tailor-made Benefit Structures: The flexibility of SERPs lies in the breadth of benefits they encompass. Beyond just the typical retirement payouts, SERPs can incorporate features such as benefits for survivors in the event of the executive’s demise and provisions for disability insurance, among other perks.

The overarching appeal of SERPs hinges on their capacity to fill gaps. SERPs come in as a supplementary boon for executives who’ve reached the contribution ceiling on standard retirement plans like 401ks. By introducing SERPs, corporations can bolster the retirement savings of their top-tier personnel, ensuring a more comfortable and secure post-career phase for them.

Advantages of a SERP

A SERP is more than just a financial tool—it’s a dynamic asset that, when harnessed correctly, can secure both immediate and future financial needs. Whether strategizing for a strong retirement or safeguarding your present, SERPs offer a robust foundation for all your financial endeavors.

The Game Changer for Retirement Planning

Unlike other retirement plans, SERPs stand out with their unlimited contribution potential. Imagine a benefit that could compound into millions over time. SERPs act as a turbo booster for high earners who’ve capped their 401k contributions, potentially allowing for earlier retirements.

Benefits Beyond Retirement: One of the big concerns for early retirees is health insurance before qualifying for Medicare. A SERP can be that cushion, providing a steady cash flow to cover health-related expenses in the interim.

Leveraging SERP for Pre-Retirement Goals

A SERP isn’t just about retirement. With the right provisions, you can tap into its funds for significant milestones before hanging up your work boots.

Educational Milestones: Ever worried about those rising college tuition fees? With in-service distributions, SERPs can be your financial ally in ensuring quality education without debt.

Dream Projects: Been eyeing that vacation home? Dreaming of that grand European tour? Your SERP could be the key to unlocking these dreams.

Crafting a Personalized Financial Blueprint with SERPs

The versatility of SERPs lies in their distribution flexibility. You don’t have to commit all funds for post-retirement. Strategize and allocate portions for imminent financial needs, be it your child’s college or that anniversary getaway.

Negotiating Your Unique SERP: The Power Move for Executives

For those in the C-suite, a SERP isn’t just a retirement tool; it’s a strategic asset.

The Golden Parachute: Often spoken about in hushed boardroom corners, the ‘golden parachute‘ isn’t a myth. Top-tier executives, including CEOs, CFOs, and COOs, can negotiate a SERP tailored to their unique needs, providing a safety net if the corporate relationship sours.

Disadvantages of a SERP

While the Supplemental Executive Retirement Plan (SERP) offers numerous benefits, particularly for high-ranking executives, it’s essential to approach it with a well-rounded perspective. Like all financial tools, SERPs come with their own set of drawbacks. Here’s a closer look at some of the potential disadvantages of adopting a SERP:

Security Concerns

Compared to traditional retirement plans such as the 401(k), the funds within a SERP are less secure. This means:

Bankruptcy Vulnerability: If a company faces financial collapse or goes bankrupt, the funds promised under a SERP could be jeopardized. In such scenarios, executives might find themselves in a challenging position, with their anticipated retirement benefits at risk.

The Financial Burden on Employers

SERPs, by design, are meant to offer substantial benefits to a company’s top-tier employees. However, this generosity comes at a price:

Sole Funding Responsibility: Employers shoulder the entire responsibility of funding the SERP. Depending on the size of the executive package and the company’s financial health, this can be a hefty commitment and might strain the company’s resources over time.

Navigating Tax Complexity

One of the appealing aspects of a SERP is the deferred compensation it offers. But this feature comes with its own set of challenges:

Tax Implications: While deferring compensation allows executives to postpone taxes until benefits are received, improper management can lead to significant tax consequences. If not strategically planned, executives might find themselves with a larger-than-expected tax bill, eroding the benefits they initially aimed for with the SERP.

Company Benefits with SERPs

Supplemental executive retirement plans (SERPs) that utilize life insurance as a funding mechanism offer numerous benefits to companies. Below are some key advantages explained under specific subheadings:

Ease of Implementation

SERPs are known for their simplicity when it comes to setting them up. A company can avoid seeking approval from the Internal Revenue Service (IRS), which avoids the potential delays and red tape often associated with tax-related matters. Additionally, their administration is straightforward, ensuring minimal additional burden on company resources.

Selective Reward System

One of the highlights of SERPs is the company’s discretion in deciding which executives will benefit from these plans. This means companies can strategically use SERPs to reward and retain top-performing or essential executives, ensuring they have a tailored mechanism to incentivize key personnel.

Company Control and Ownership

The company not only controls the overall plan but also owns the life insurance policy linked to the SERP. This ownership gives companies a degree of flexibility and autonomy in managing the policy and associated benefits. Furthermore, as the policy cash value grows, the company can report this growth as book income, enhancing its financial statements.

Tax-Deferred Growth

The cash value that accumulates within the life insurance policy benefits from tax deferment. As the funds grow, they are not immediately subject to tax, allowing for more significant accumulation over time. This tax-deferred growth can potentially result in a larger benefit for the executive in the future and a greater asset for the company in the interim.

Tax Deductions for the Company

Once the time comes for the company to distribute the supplemental income benefits to the designated key employee, there’s another fiscal advantage. The amounts paid out to the executive can be written off as a business expense, providing the company with a valuable tax deduction.

Cost Recovery

A strategically designed life insurance policy can be structured so the company can recover the costs associated with the plan. This feature ensures that while companies provide additional benefits to their executives, they are not unduly burdened financially in the long run.

Executive Benefits with SERPs

Customization to Individual Needs

Every executive has unique financial goals, retirement objectives, and familial considerations. SERPs offer the flexibility to be tailored specifically to align with the individual needs of the key executive. This means that the plan can be adjusted in terms of payouts, durations, and other key parameters to ensure it’s a perfect fit for the executive’s personal and financial aspirations.

Tax-Efficient Accumulation

One of the most compelling features of SERPs is the ability to accumulate supplemental retirement income without immediately incurring taxes. Instead of being taxed upon contribution, the funds grow tax-deferred within the life insurance policy. This allows for potentially more significant growth, as the money that would otherwise be used for tax payments remains invested, providing the executive with a heftier retirement sum in the long run.

Protection in the Event of Death

Life is unpredictable, and a life insurance policy’s inherent nature ensures a safety net for the executive’s beneficiaries. Should the unfortunate event of the executive’s death occur before the full realization of the plan’s benefits, the life insurance policy kicks in. Depending on the agreement’s terms, the policy’s death benefits can be used to fund the SERP’s commitments. A lump sum may also be provided to the executive’s beneficiary, offering financial support during a potentially challenging time.

Taxation

When employers contribute to a Supplemental Executive Retirement Plan (SERP) on behalf of their executives, the financial landscape shifts in a specific way. These contributions are counted as part of the executive’s income for the purposes of the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA) in the year the contributions vest. Essentially, once these funds are irrevocably committed to the executive, they are recognized for these specific tax considerations.

However, when it comes to income taxes, SERPs offer a distinct advantage: the tax obligation on these contributions is postponed until the executive starts to draw from the plan. The manner of withdrawal from the SERP determines the taxation approach. If the executive opts for a one-time lump sum payout, the entire amount becomes taxable in that year. Conversely, choosing to spread the payouts across several years also distributes the tax liability, allowing executives to face a potentially more manageable tax situation annually.

Final Words

The Supplemental Executive Retirement Plan (SERP) is a potent tool in executive compensation. With tailored benefits and a focus on top-tier talent, SERPs hold a unique position in retirement planning, ensuring a secure future for those participating.

At EduCounting, our mission is to empower the youth with essential financial literacy and adept money management capabilities. We offer a plethora of educational resources and tools designed to equip you with the confidence to navigate your financial journey. Enroll in the course and pave your way to becoming a money management maestro.

FAQ

Is SERP better than 401k?

It’s not necessarily a matter of one being better than the other. A SERP provides substantial benefits to executives that often exceed those from a 401(k). However, 401(k) plans offer more security since they’re qualified retirement plans.

How is a SERP paid out?

Depending on the agreement, SERPs can be paid out as a lump sum or annuities over a specified duration post-retirement.

What happens to my SERP if I quit?

The answer depends on the vesting schedule agreed upon. If an executive quits before they’re fully vested, they may forfeit some or all of their SERP benefits.

What is the typical SERP plan?

SERP plans can vary widely based on employer and executive needs. Typically, they promise a certain benefit amount upon retirement, which may be a percentage of the executive’s final salary or a specific dollar amount.