An Interest Saving Balance is the part of your loan or credit balance that, It helps you avoid or minimise additional interest charges if you pay it off before the due date. Put simply, it’s the amount you must pay off in order to minimise your interest expenses.

- For beginners, consider it the amount of money you have to pay to prevent interest from accruing.

- For professionals, it’s a tool for prudent cash flow management; by concentrating on paying this balance, you can lower borrowing costs and accelerate debt repayment.

What is interest saving balance? In the simplest terms, an interest saving balance is the amount of money in your savings account that earns interest. Banks reward you for keeping your money with them by paying you a percentage of your balance. The more money you keep in your account, the more interest you earn.

What is Interest Saving Balance and How Does It Work?

Interest Saving Balance refers to the portion of your savings account that earns interest over time. Banks pay you a percentage of your balance as a reward for keeping your money with them. The amount you earn depends on the interest rate and whether it’s simple or compound interest. Understanding how interest works can help you maximize your savings and grow your wealth faster.

What does Interest Saving Balance Mean?

Understanding interest saving balance is crucial for anyone who wants to grow their savings. This concept refers to the portion of your savings account balance that earns interest. When you deposit money into a savings account, the bank pays you a small percentage of your balance as a reward for keeping your funds there.

However, not all savings accounts work the same way. Different banks offer different interest rates, and the way they calculate interest can impact your earnings significantly. Let’s break down how savings interest works.

How savings interest works

Savings interest is the money a bank pays you for keeping funds in your account. It’s calculated based on the interest rate and can be simple (earned only on your initial deposit) or compound (earned on both your deposit and previous interest). Compound interest helps your savings grow faster by reinvesting earnings over time.

Interest Is Calculated Based On Two Main Factors:

The interest rate – This is the percentage the bank pays you for keeping money in your account. A higher interest rate means more earnings.

The method of interest calculation – Interest can be simple (calculated only on your original deposit) or compound (calculated on both your deposit and previously earned interest).

For example, let’s say you deposit $1,000 in a savings account with a 5% annual interest rate:

If the bank uses simple interest, you’ll earn $50 per year (5% of $1,000).

If the bank uses compound interest, your earnings will increase over time because you’re earning interest on both your original deposit and the interest you’ve already earned.

With compound interest, in the second year, you would earn 5% not just on your original $1,000 but also on the $50 you earned in the first year. That means in the second year, you would earn $52.50 instead of just $50. Over time, this small difference adds up and helps your savings grow faster.

Preparing to Use an Interest Saving Balance

Before you start earning interest, you need the right savings account. Compare banks, check account requirements, and understand the terms to maximize your earnings. A smart setup ensures your money grows efficiently over time.

Setting Up a Savings Account

Before you can start earning interest, you need to open the right savings account. Not all savings accounts are created equal, and choosing the right one can make a big difference in how much interest you earn over time.

Here’s a step-by-step guide to setting up a savings account that will help you maximize your interest earnings.

Step 1: Compare Different Banks and Financial Institutions

Banks and credit unions offer different interest rates, account features, and benefits. Some online banks provide higher interest rates than traditional brick-and-mortar banks because they have lower operating costs. Research various options to find the best fit for your needs.

Step 2: Check Account Requirements

Some banks require a minimum deposit to open an account, while others may need you to maintain a minimum balance to qualify for interest. If you fail to meet these requirements, you could lose out on interest earnings or even incur fees.

Step 3: Understand Terms and Conditions

Always read the fine print before signing up. Some savings accounts limit the number of withdrawals per month, while others charge monthly maintenance fees if your balance drops below a certain amount. Look for an account with no hidden fees and flexible access to your money.

Step 4: Make Your Initial Deposit

The sooner you deposit money, the sooner you start earning interest. While some accounts require only a small deposit, starting with a larger amount can help your interest saving balance grow faster.

If you’re unsure which account to choose, prioritize one with high interest rates, no monthly fees, and easy withdrawal options. By selecting the right savings account, you set yourself up for long-term financial growth.

Strategies to Maximize Your Interest Saving Balance

Maximizing your interest saving balance requires smart financial strategies. Choose a high-interest savings account, avoid frequent withdrawals, and let your interest compound over time. By saving consistently and taking advantage of tiered interest rates, you can grow your money faster and reach your financial goals.

How to Increase Interest in a Savings Account

Growing your interest saving balance isn’t just about opening an account and leaving your money there. To maximize your savings, you need to be proactive and strategic.

There are several ways to increase the amount of interest you earn, from choosing high-yield savings accounts to leveraging compound interest.

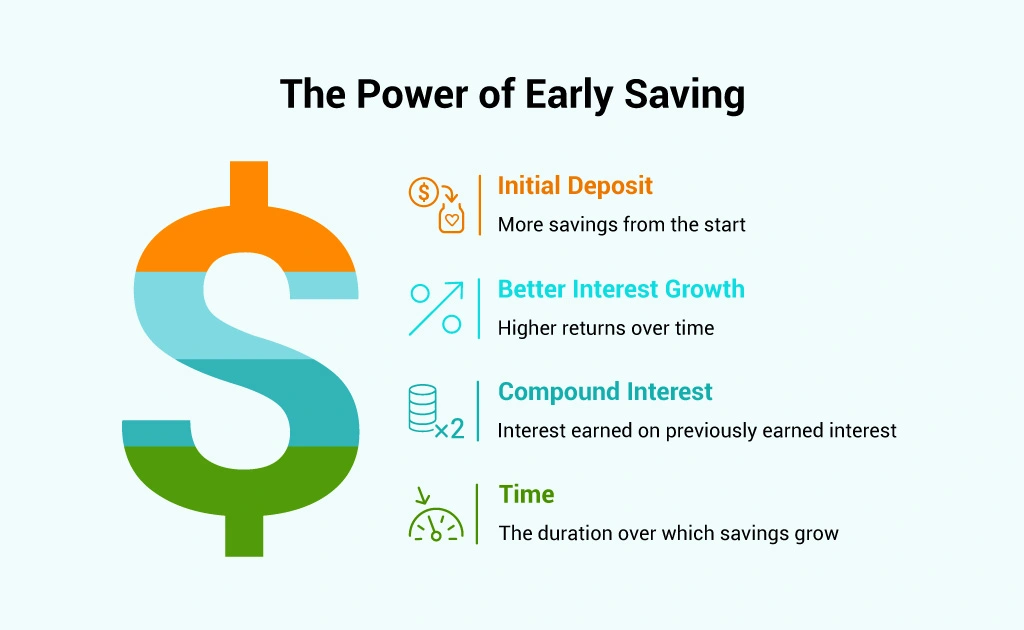

1. Start Saving as Early as Possible

The earlier you start saving, the longer your money has to grow. Even if you can only save a small amount each month, starting now will give your money more time to accumulate interest. Thanks to compound interest, your savings will grow at an increasing rate over time.

For example, if you deposit $1,000 in an account with 5% annual interest, you will earn $50 in the first year. But with compound interest, you will earn even more in the following years as the interest gets added to your balance.

2. Look for High-Interest Savings Accounts

Not all savings accounts are the same. Some banks offer higher interest rates than others, especially online banks that don’t have the same overhead costs as traditional banks. Some banks also offer promotional rates for new customers, so it’s always worth comparing different options before opening an account.

3. Avoid Frequent Withdrawals

Every time you withdraw money from your savings, you reduce your balance and the interest you could have earned. Many banks also have limits on how often you can withdraw from a savings account before they start charging fees. Keeping your balance stable helps maximize your earnings.

4. Use Automatic Transfers

Setting up an automatic transfer from your checking account to your savings account ensures that you save regularly. This method helps you build discipline in saving and keeps your balance growing consistently.

5. Take Advantage of Tiered Interest Rates

Some banks offer tiered interest rates, meaning the more you save, the higher your interest rate. For example, if one bank offers 1% interest for balances under $5,000 but 2% interest for balances over $5,000, it might be worth saving a little more to qualify for the better rate.

By following these strategies, you can ensure your interest saving balance grows efficiently, helping you reach your financial goals faster.

Step-by-Step Guide to Managing Your Interest Saving Balance

Learn how to manage your interest saving balance effectively with this step-by-step guide. From setting clear savings goals to tracking progress and maximizing interest, these simple strategies will help you grow your savings efficiently. Stay proactive and watch your money work for you!

Best Way to Grow Savings

Simply depositing money into a savings account isn’t enough to grow your wealth efficiently. You need to actively manage your interest saving balance to ensure you’re making the most of your savings

Here’s a step-by-step guide to keep your savings on the right track:

First, set clear savings goals. Decide how much you want to save and set a deadline. Whether it’s for an emergency fund, a vacation, or a big purchase, having a target will keep you motivated.

Next, track your progress. Use a budgeting app or a simple notebook to monitor how much you’re saving each month. This helps you stay on course and adjust if needed.

It’s also important to review interest rates regularly. Some banks offer better rates than others, so keep an eye out for opportunities to switch to an account that will help your money grow faster.

Another key step is to reinvest your interest. Instead of withdrawing the interest your account earns, leave it there so it can compound and increase your savings over time.

Finally, adjust your savings plan as your income grows. If you get a raise, bonus, or unexpected income, consider putting a portion into your savings. The more you save now, the more interest you’ll earn in the long run.

Benefits and Drawbacks of Interest Saving Balance

An interest saving balance helps your money grow safely by earning interest over time, offering security and easy access to funds. However, it typically provides lower returns compared to investments and may lose value due to inflation. Understanding these pros and cons can help you make smarter financial decisions.

Benefits of a Savings Account

While an interest saving balance is a great way to grow your money safely, it’s important to understand both the benefits and drawbacks before committing to a savings strategy.

Guaranteed Growth: Unlike investments, where the value of your money can fluctuate, a savings account ensures steady growth. Your money earns interest over time, which means you’ll always end up with more than you started with.

Security: Most banks offer insurance on deposits, protecting your money even if the bank faces financial difficulties. This makes a savings account a safe place to store your funds.

Easy Access: You can withdraw money whenever you need it, although some savings accounts limit the number of withdrawals per month. This flexibility makes savings accounts a good option for emergency funds or short-term financial goals.

Drawbacks of a Savings Account

Understanding these factors will help you make informed decisions about your savings strategy. While savings accounts are beneficial, they also come with a few downsides:

Lower Returns Compared to Investments – Savings accounts typically have lower interest rates than other investment options like stocks, bonds, or mutual funds. While they provide security, they may not help you build wealth quickly.

Inflation Risk – If inflation rises faster than the interest rate on your savings account, the purchasing power of your money decreases. In simple terms, even though your savings grow, they may not be able to buy as much in the future.

To balance safety and growth, many people use savings accounts for emergency funds while investing extra money in higher-return options like stocks or real estate.

Common Mistakes to Avoid With Interest Saving Balance

Avoid common mistakes that can slow down your savings growth, such as choosing a low-interest account, making frequent withdrawals, or ignoring hidden fees. Keeping your interest in the account and leveraging compound interest can significantly boost your balance over time. Smart saving habits will help you maximize your earnings effortlessly.

Savings Account Mistakes

Many people unknowingly make mistakes that slow down their financial growth. Avoiding these common errors can help you make the most of your interest saving balance.

Choosing an Account With a Low Interest Rate

Not all savings accounts offer the same interest rates. If you deposit your money into an account with a very low interest rate, your savings won’t grow as much as they could in a high-interest account. Always compare different banks before opening an account.

Making Frequent Withdrawals

Each time you withdraw money from your savings, your balance decreases, which means you’ll earn less interest. If your goal is to maximize interest earnings, avoid unnecessary withdrawals.

Ignoring Account Fees

Some banks charge maintenance fees that can eat into your savings. For example, if you’re earning $10 per month in interest but paying $5 in fees, half of your earnings are lost. Always read the terms before opening an account.

Not Considering Compound Interest

The key to growing your savings is letting interest compound over time. If you withdraw your interest earnings instead of leaving them in the account, you miss out on the snowball effect that compound interest provides.

By choosing a high-interest account, keeping withdrawals minimal, and taking advantage of compound interest, you can ensure your savings grow effectively over time.

Conclusion

Understanding what is interest saving balance and how it works is crucial for anyone who wants to grow their savings. Simply putting money in a bank account isn’t enough, you need to choose the right account, take advantage of compound interest, and use smart saving strategies to maximize your earnings.

By following the tips in this guide, you can take control of your savings and build a stronger financial future. The earlier you start, the more benefits you’ll reap in the long run. Start saving today and watch your money grow over time.