Savings and emergency funds often intersect in personal finance, yet they serve distinct purposes. This article delves into the nuanced differences between savings vs. emergency funds, shedding light on their unique roles in financial planning. By understanding these distinctions, individuals can better strategize their financial futures, ensuring they are prepared for expected and unexpected financial needs.

Financial security is a cornerstone of peace of mind, and two of its main pillars are savings and emergency funds. While they might seem similar at first glance, their roles and the strategies surrounding their use are markedly different. This exploration aims to demystify these concepts, clarifying how each should be approached within the context of effective financial management.

What Are Emergency Funds?

Emergency funds are financial safety nets designed to cover unexpected expenses or financial downturns without impacting your regular income or savings. These include sudden medical bills, urgent car repairs, or job loss.

The primary purpose of an emergency fund is to ensure financial stability during unforeseen circumstances, preventing the need to incur debt. Financial advisors typically recommend that an emergency fund cover three to six months’ worth of living expenses. However, the ideal size can vary based on personal circumstances and risk tolerance.

An emergency fund is essentially a financial safety net designed to cover significant, unforeseen expenses. This fund is crucial for dealing with emergencies outside regular monthly expenditures, such as unexpected medical costs or major car repairs.

The ideal size of an emergency fund is not set in stone, but it’s widely advised to have enough to cover three to six months’ worth of living expenses. Such a cushion can be invaluable in situations requiring substantial outlays, like appliance replacements or periods of unemployment.

Advantages:

- Financial Prudence: Establishing an emergency fund is a financially savvy strategy compared to using credit cards for emergency expenses, which can lead to accruing interest on outstanding balances.

- Cost-Efficiency: Typically, no fees are associated with accessing your emergency fund, and the balance may earn interest over time. This starkly contrasts with borrowing funds, which often incur additional costs.

- Peace of Mind: The assurance of having an emergency fund cannot be overstated. It alleviates the stress of unexpected financial burdens, such as significant home repairs.

- Savings Incentive: Regular contributions to your emergency fund from your income can curb unnecessary spending, promoting healthier financial habits.

- Safety Net: Funds kept in a checking or savings account designated as an emergency fund are usually insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC), adding an extra layer of security.

Disadvantages:

- Lower Returns: Funds parked in a savings account for emergencies typically yield lower returns than investments, meaning the growth potential is limited.

- Opportunity Cost: There might be more efficient uses of resources than allocating money towards an emergency fund, especially for those grappling with high-interest debt. Repaying debt may offer a better financial return than setting aside money for unforeseen expenses.

What Are Savings Accounts?

Savings accounts, on the other hand, are designed for accumulating wealth over time and are geared towards specific financial goals or general wealth accumulation. These goals can range from purchasing a home or car to planning for retirement or a vacation. Savings are usually built up through consistent deposits and benefit from interest over time, making them a fundamental component of long-term financial planning.

A savings account is a basic banking service that lets individuals deposit funds securely. These accounts typically offer modest interest rates and are often free to open and maintain, providing easy access to your funds as needed. Importantly, savings accounts are insured by the FDIC up to $250,000, offering protection against bank failures.

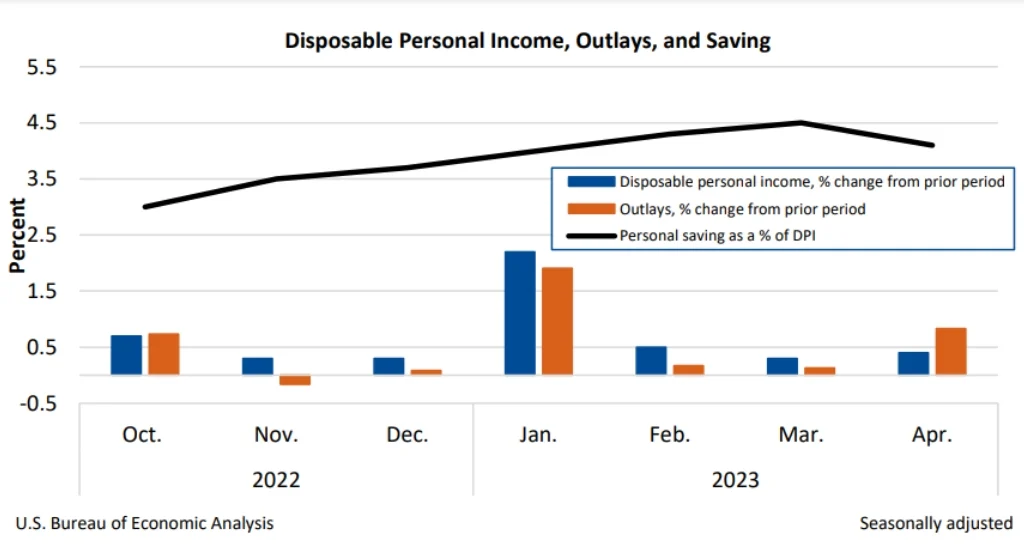

In April 2023, according to the Bureau of Economic Analysis, personal savings in the United States reached $802.1 billion. This figure reflects the personal saving rate, which measures personal savings as a percentage of disposable personal income, standing at 4.1%. This data underscores the importance of financial prudence among Americans, highlighting a collective effort to allocate a portion of their income towards savings amidst the broader financial landscape.

- Retirement Savings: These are funds set aside to support financial stability and comfort in retirement, helping ensure a secure and independent lifestyle after leaving the workforce. Consistent contributions can compound over time, significantly increasing the fund’s value by retirement.

- College Savings: Savings are dedicated to covering educational expenses, enabling students to focus on studies without significant financial debt. Investing in a college savings plan early can take advantage of growth opportunities, making higher education more accessible.

- Cash Cushion: A reserve of funds designed to cover unexpected short-term financial needs, providing a safety net in case of sudden expenses. This fund acts as a buffer, preventing the need to dip into other savings or incur debt.

- Rainy Day Savings: Funds specifically saved to handle unforeseen financial emergencies, ensuring that unexpected costs don’t derail your financial stability. This fund allows for peace of mind, knowing you’re prepared for life’s uncertainties.

- Medical Savings: Allocated for healthcare expenses not covered by insurance, these savings can mitigate the financial impact of medical emergencies or ongoing healthcare needs. It’s an essential part of a comprehensive financial plan addressing the increasing cost of healthcare.

- Personal Savings: Funds saved for personal goals or desires, such as a dream vacation, a new car, or home renovations, offering the freedom to achieve personal aspirations without financial strain. Regularly setting aside a small portion of income can turn these dreams into reality without impacting financial health.

Advantages:

- Goal Segregation: Savings accounts enable you to distinguish between funds for immediate use and those earmarked for long-term objectives, like vacations or education, potentially earning more interest than typical checking accounts.

- Automated Savings: Banks often support automatic transfers to savings accounts, simplifying the process of saving by automatically allocating funds from checking accounts, thereby eliminating the need to manually transfer money.

- Accessibility: Among the various savings options, savings accounts offer superior liquidity, allowing for easy withdrawal of funds without the restrictions associated with Certificates of Deposit (CDs) or investment accounts.

Disadvantages:

- Withdrawal Restrictions: Many banks impose limits on the number of withdrawals or transfers from savings accounts each month, possibly coupled with minimum balance requirements to dodge fees.

- Limited Spending Tools: Unlike checking accounts, savings accounts do not come with debit cards or checks, restricting direct spending from the account.

- Lower Yield: While safer, savings accounts generally offer lower interest rates compared to other savings instruments like money market accounts or CDs, which could lead to missed opportunities for higher returns on your savings.

Emergency Funds vs. Savings Accounts: Key Differences

When it comes to managing personal finances, understanding the distinction between emergency funds and savings accounts is crucial. While both play vital roles in financial security, their purposes, accessibility, and strategies for use vary significantly.

Purpose

Emergency funds and savings accounts serve two distinct objectives. An emergency fund is specifically designed as a financial safety net to cover unforeseen expenses, such as medical emergencies, sudden job loss, or urgent home repairs. Its primary role is to provide security and prevent debt during unexpected financial crises.

On the other hand, a savings account is intended for planned expenses or long-term financial goals, such as purchasing a home, funding education, or preparing for retirement. It’s about building wealth over time and ensuring funds are available for future needs.

Liquidity

Liquidity refers to how quickly and easily assets can be converted into cash without losing value. This is where emergency funds and savings accounts diverge significantly. Emergency funds must be highly liquid, allowing immediate access to cash without penalties or delays. It’s essential for covering urgent financial needs.

Savings accounts, while also liquid, are generally used for less immediate needs. The emphasis is on gradual accumulation and earning interest rather than instant access for emergencies.

Funding and Usage

The approach to funding and utilizing these accounts further highlights their differences. Emergency funds should be established and built up as a priority, with contributions made until sufficient to cover several months’ worth of living expenses. Once the target is achieved, the focus shifts to maintenance rather than continuous growth.

Conversely, savings accounts are meant for steady, ongoing contributions to achieve specific financial goals over time. The usage of these funds is planned and deliberate, aligning with personal or family milestones rather than unexpected emergencies.

Final Words

Understanding the distinction between savings and emergency funds is crucial for sound financial planning. While both serve to secure your financial well-being, they do so in different ways and for different reasons. By allocating your resources appropriately between these two financial tools, you can ensure that you are well-prepared for both the expected and unexpected turns your financial journey may take.

Understanding the nuances of Savings vs. Emergency Funds can be a game-changer in navigating the complexities of personal finance. For more insights and guidance on managing your finances effectively, we invite you to explore our wide range of blogs at EduCounting. Whether you’re looking to build your emergency fund, optimize your savings strategy, or seek financial education, our resources are designed to empower you toward financial literacy and independence.

FAQs

Should I invest or save for an emergency fund?

It’s advisable to save for an emergency fund rather than invest, as the primary goal is liquidity and capital preservation, not growth. Investments can fluctuate in value, which could be better for funds you may need to access quickly in an emergency.

What is the 50-30-20 budget rule?

The 50-30-20 budget rule is a guideline for managing your finances by allocating 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment. This rule can help ensure you save consistently, including building an emergency fund.

Why is saving safer than investing?

Saving is considered safer than investing because it exposes your money to less risk. Savings accounts typically offer a fixed interest rate, ensuring your balance grows steadily over time, whereas investments can decrease in value depending on market conditions.

What is the ideal emergency fund?

The ideal emergency fund varies by individual circumstances but generally should cover three to six months of living expenses. This amount provides a cushion to cover unforeseen expenses or loss of income without derailing your financial stability.