As you embark on the car-buying journey, you likely spend considerable time researching the perfect vehicle. However, it’s equally important to understand the financing aspects to ensure you secure a favorable deal. If you’re considering a loan, you might have been curious about the APR and its impact on your loan costs. At some point, you may have also asked, “What is the finance charge on a car loan?”

Understanding the various terms involved in the buying and financing process allows you to make informed decisions and better manage your financial commitments. This blog will help you comprehend the full cost of a car loan, ensuring you stay within your budget and make the best financial choices.

Understanding Your Finance Charges

When it comes to financing a car, it’s essential to understand the different components that make up your finance charges. These charges determine the overall cost of your loan and can impact your budget significantly. Here are the key elements to consider:

Interest Rate

The interest rate is the amount your lender charges for your auto loan, expressed as a percentage of your loan amount or principal. This rate is crucial as it directly affects your monthly payments and the total amount you will repay over the life of the loan. A lower interest rate means lower finance charges, reducing the overall cost of borrowing.

Fees

In addition to the interest rate, various fees can contribute to your finance charges. These can include loan origination, processing, registration, and documentation fees. These separate charges are often added to the principal amount of your loan, increasing the total cost you need to repay. Understanding these fees and negotiating where possible can help minimize your overall finance charges.

Taxes

Sales tax on purchasing your car is another component that can be included in your finance charges. This tax might be incorporated into your APR or paid separately, depending on your loan agreement. Including the sales tax in your loan will increase your monthly payments and the total finance charges, so it’s important to consider how you prefer to handle this expense.

What is the Finance Charge on a Car Loan and How Does It Work?

What is the finance charge on a car loan? The finance charge encompasses several key elements, including the loan amount, interest rate, fees, and taxes. This charge includes all upfront costs to finance the vehicle and the interest paid over the loan’s term. Understanding these factors is crucial to securing the best car loan possible. Here’s how it works:

Loan Amount

The total amount you borrow significantly impacts your finance charge car loan. Larger loan amounts typically result in higher finance charges because you borrow more money. It’s important to carefully consider how much you need to borrow and try to make a larger down payment to reduce the principal amount.

Interest Rate

Your interest rate, which is influenced by your credit score, plays a crucial role in determining your finance charge. Borrowers with higher credit scores often qualify for lower interest rates, which can reduce the finance charges over the life of the loan. Conversely, those with lower credit scores may face higher rates, increasing the overall cost.

Loan Term

The length of your loan term also affects your finance charge. Shorter loan terms usually come with lower interest rates because the lender’s risk is minimized over a shorter period. Although monthly payments might be higher with shorter terms, the total finance charge is typically less than that of a longer-term loan, which accrues more interest over time.

Additional Fees and Taxes

Lenders calculate your finance charge by including various fees and taxes. These can include loan origination fees, processing fees, registration fees, documentation fees, and vehicle sales tax. These charges are often added to the principal amount, increasing the total cost of the loan.

Calculating Finance Charges on a Car Loan

To calculate the finance charge, lenders use an auto loan calculator incorporating the loan amount, interest rate, loan term, fees, and taxes to determine your Annual Percentage Rate (APR). This APR represents the total annual cost of borrowing, expressed as a percentage. If you’re unsure how to find finance charge details accurately, using online calculators can simplify the process.

Another method to estimate your finance charge is to multiply your monthly payment by the number of months in your loan term and subtract the loan principal. This will give you a rough idea of the total interest and fees you will pay over the life of the loan.

Here’s a step-by-step guide to using a simple formula to estimate these charges.

First, gather all the necessary information about the loan, including:

- The Loan Amount (Principal)

- The Monthly Installment Amount

- The Length of the Loan in Months

- Any Other Charges

Once you have this information, you can use the following finance charge formula:

Finance Charge = (Length of Loan in Months × EMI) + Other Charges – Loan Amount

Here’s how to apply this formula:

- Multiply the Length of Loan With EMI: This step gives you the total repayment amount (Interest + Principal).

- Add Any Other Charges, Commissions, Taxes, Etc.: This provides the total amount you spent in terms of the loan.

- Subtract the Principal Loan Amount to Get the Finance Charge: This gives you the extra amount you pay over the loan principal.

Example Calculation

Let’s walk through an example:

- Loan Amount: $20,000

- APR: 15%

- Length of Loan: 60 months (5 years)

- EMI: $475.80.

- Other Charges: $175.00

1. Calculate the Total Installment Payment to the Bank:

$475.80×60=$28,548.00

2. Add Other Charges:

$28,548.00 + $175.00 = $28,723.00

3. Subtract the Principal Amount to get the Auto Loan Finance Charge:

$28,723.00 – $20,000.00 = $8,723.00

Total Finance Charge =$8,723.00

This calculation helps you understand what you might pay in finance charges over the life of the loan, including the finance charge on a car loan, allowing you to budget more accurately and make informed decisions about your car purchase.

Average Finance Charges for Car Loans

The main component of finance charges for most auto loans is the interest rate. This interest rate is primarily influenced by two factors:

- Borrower’s Credit Score: Individuals with higher credit scores are typically offered lower interest rates. Lenders view them as lower risk, resulting in more favorable loan terms.

- Condition of the Car (New or Used): Loans for used cars generally come with higher interest rates compared to new cars. This is because used cars have depreciated in value, posing a higher risk to the lender.

For borrowers with excellent credit, the average Annual Percentage Rate (APR) for a new car loan is approximately 3%, while for a used car, it’s around 4%. Conversely, those with poor credit might face an average APR of about 15% for new car loans and around 21% for used car loans.

Keep in mind that these are average rates, and your actual interest rate will depend on your specific financial situation and credit profile. When you apply for a car loan, you’ll receive a specific interest rate. However, these figures can help you estimate what is the finance charge on a car loan.

Is It Possible to Avoid Finance Charges on a Car Loan?

No, it is not possible to avoid finance charges on a car loan completely. However, you can reduce them by improving your credit score, opting for a shorter loan term, making a larger down payment, or negotiating a lower interest rate.

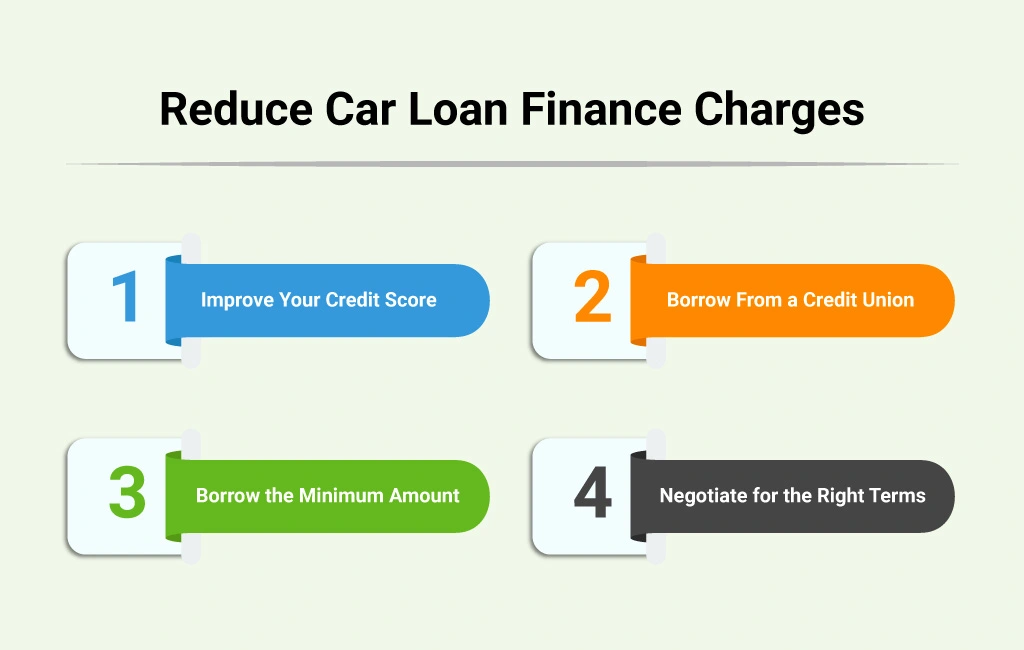

The Best Way to Reduce Finance Charges

The most effective way to reduce finance charges on a car loan is to negotiate better loan terms. Here are some tips to help you achieve this:

Improve Your Credit Score

Knowing your credit score is essential as it directly influences the interest rate you receive on a car loan. Higher credit scores typically qualify for lower interest rates, which can significantly reduce your finance charges. Regularly check your credit report and take steps to improve your score by paying off debts and correcting any errors.

Borrow From a Credit Union

Credit unions often offer lower interest rates on auto loans than traditional banks. They are member-owned, which allows them to pass on savings to their members. If you qualify for membership, consider borrowing from a credit union to take advantage of these lower rates.

Borrow the Minimum Amount

Only borrow what you need to finance the car. A larger loan amount means higher finance charges. Making a larger down payment can reduce the loan principal, resulting in lower overall interest payments and finance charges.

Negotiate for the Right Terms

Selecting the appropriate loan term is crucial for managing finance costs. While longer terms may lower your monthly payments, they often result in higher total interest payments over the life of the loan. Opt for the shortest term you can comfortably afford to minimize finance charges.

Final Words

So, what is the finance charge on a car loan, and how does it work? By being aware of how finance charges are calculated and taking steps to minimize them, you can save money and make more informed financial decisions. Always compare loan offers, improve your credit score, and consider making a larger down payment to reduce the overall cost of your car loan.

For more valuable insights on managing your finances, understanding loans, and making informed financial decisions, be sure to visit our blog at EduCounting. Our comprehensive articles cover a wide range of topics designed to help you stay informed and make smart financial choices.