If you’ve ever sat with your cursor hovering over the “Submit FAFSA” button, wondering how long does it take to get a student loan, you’re not alone. It’s one of those oddly simple questions that has no one-size-fits-all answer. The truth? It depends. On what kind of loan you’re applying for, how fast your school moves, and, franklyhow organized you are.

This guide peels back the curtain on the 2025 student loan process, step by step, glitch by glitch. From the first application to that satisfying notification that funds have hit your school account (or your bank), we’re diving into every corner of the journey.

Because while it’s a financial question on paper, it’s an emotional one in real life. You’re asking because you need to plan. Maybe you’re waiting on that aid to cover tuition—or your rent. Or books. Or a bus pass. So yeah, timing matters. And we’ll help you get a better handle on it.

Understanding the Student Loan Timeline

Before diving into the exact number of days or weeks it takes to get a student loan, it helps to zoom out and look at the bigger picture. Understanding student loans isn’t just about money, it’s about how the whole system functions. And that system includes schools, lenders, and a lot of forms.

The Two Types of Student Loans

First, let’s talk about types. Most loans fall into one of two buckets:

- Federal student loans, offered by the U.S. Department of Education. These start with filling out the FAFSA (Free Application for Federal Student Aid).

- Private student loans, which come from banks, credit unions, or online lenders. These skip FAFSA but still require an application, and often, a credit check.

The General Process

Application: You submit either a FAFSA (for federal loans) or a private loan form.

Review and Approval: Federal loans are mostly automatic, but private lenders look at your credit and possibly your co-signer’s.

Acceptance: You review and accept the loan terms.

School Certification: Your school confirms your enrollment and costs.

Disbursement: The funds are sent, usually directly to your school.

Expect Some Delays

Unfortunately, even if you do everything right, things don’t always move quickly. Your school’s financial aid office might be backed up. FAFSA might flag your file for extra review. Or the system could just be slow, especially during peak months or when technical updates (like 2025’s FAFSA overhaul) cause hiccups.

In short: the steps are simple, but the timing? Less predictable.

How Long Does It Take to Get a Student Loan (Federal)?

Let’s start with the federal path, the one backed by the U.S. government. If you’re wondering how student loans work through the federal system, here’s the key: everything begins with the FAFSA, short for Free Application for Federal Student Aid.

Step 1: Submitting the FAFSA

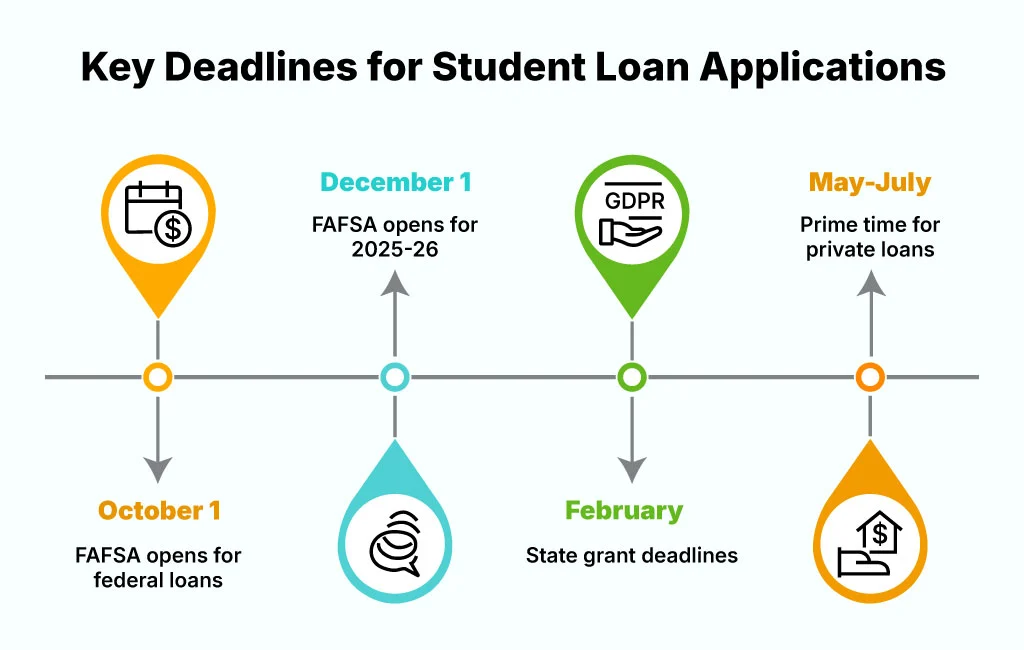

The FAFSA typically opens on October 1st each year, but in 2025, due to system upgrades, it launched in December. It collects essential details like your household income, number of dependents, and which colleges you’re applying to. Based on that info, the government calculates your financial need.

What kind of aid can FAFSA unlock?

- Pell Grants (free money that doesn’t need to be repaid)

- Direct Subsidized and Unsubsidized Loans

- Federal Work-Study programs

- School-based grants and scholarships

Once submitted, your FAFSA is processed. Online submissions usually take 1–3 business days. Paper applications? Those might take 7–10 days.

Step 2: Review and Verification

Roughly one-third of applicants are flagged for verification, which means the school needs more documents, think tax returns, W-2s, or proof of citizenship. If you’re quick to respond, it might not slow things down too much. But delays here can add several weeks.

In 2025, some schools reported 4–6 week delays due to system glitches after the new FAFSA rollout, even for verified applications.

Step 3: Financial Aid Package

Once verification (if needed) is complete, your school builds your financial aid package. This includes any grants, scholarships, and the federal loan offers. During busy times, like January through March, expect this to take 2 to 4 weeks, depending on how quickly your school processes everything.

Step 4: Accept and Complete Requirements

To accept the loans, you’ll log into StudentAid.gov, complete entrance counseling, and sign your Master Promissory Note (MPN). If it’s your first loan, plan for 1–2 hours here. It’s not hard, but it’s crucial.

Step 5: Disbursement

Funds usually disburse 10 days before classes begin, but if you’re a first-year, first-time borrower, there’s a 30-day hold after classes start. That’s by design, it ensures students actually show up before funds are released.

So, what’s the total timeline?

Realistically, plan on 4 to 8 weeks from FAFSA submission to money disbursement. Quicker if everything goes smoothly. Longer if it doesn’t.

How Long Does It Take to Get a Private Student Loan?

If you’re wondering how long does student loan take when it’s private, not federal, you’re looking at a slightly different ball game. Faster, sometimes. But also more conditional.

Step-by-Step Timeline

Application: Often includes a credit check, income verification, and co-signer info.

Approval: Instant for some lenders, a few business days for others.

Certification: Your school has to confirm you’re enrolled and eligible.

Disbursement: Either to you or directly to the school.

Some lenders approve you in minutes. Others need tax returns, pay stubs, or co-signer background checks. And school certification? That can take 3–10 business days, sometimes more.

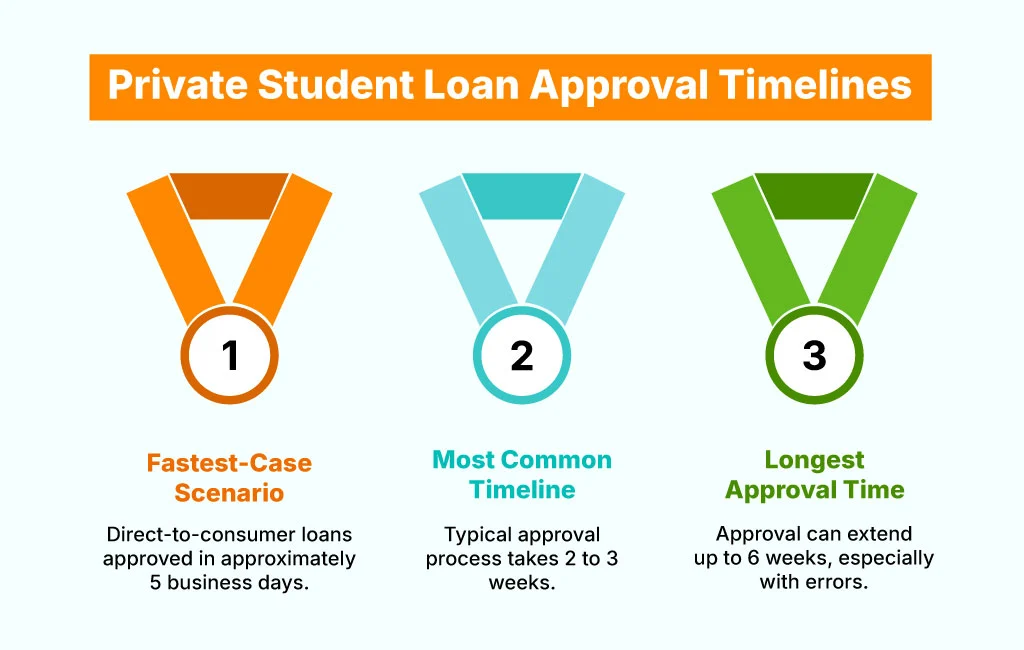

Expect:

- Fastest-case scenario: ~5 business days (direct-to-consumer loans).

- Most common: 2–3 weeks.

- Longest: Up to 6 weeks, especially if errors pop up.

Direct-to-Consumer vs. School-Certified

Direct-to-consumer loans send money straight to you, often within a week. But they’re rare, and can be risky if you overspend.

School-certified loans go through your school’s financial aid office first. That adds time but ensures you’re borrowing only what you need.

Factors That Affect Student Loan Processing Time

Let’s be honest: some delays are in your control. Others? Not so much.

You-Control Factors

- Application completeness: Double-check everything. One typo (say, a name mismatch) can trigger delays.

- Response time: If a lender or school emails you, respond fast. Like, within-the-hour fast if possible.

- Loan type: Private loans with no co-signer move faster, but that’s rare.

Outside Factors

- Verification delays: FAFSA gets flagged? You’ll wait.

- School certification lags: Some schools take 5 business days; others take 5 weeks.

- System errors: 2025 saw a number of federal delays due to updates in FAFSA systems. Some were unexpected, and frankly, frustrating.

Also worth noting: how your loans affect other areas of your life is part of the big picture. For example, if you’re hoping to buy a home someday, it’s important to understand how your student debt could impact that goal. Our guide on mortgage denied due to student loans: Common Reasons and Solutions dives into what lenders look at and how to prepare.

Remember: The student loan process isn’t just paperwork. It’s also people. Real humans, working through backlogs. Sometimes during vacation season. Sometimes underfunded. That means delays.

When Should You Apply for Student Loans?

Short answer: as early as you possibly can.

Federal Loans

- FAFSA opens October 1 (or December 1 for 2025–26).

- Some state grants have deadlines as early as February.

- Schools may run out of aid money if you wait until spring.

So aim to file before Thanksgiving if you can. Yes, really.

Private Loans

- Most experts suggest applying 60–90 days before tuition is due.

- May–July is prime time for fall semester loans.

Important Tips to Keep in Mind When Applying for Student Loans

We’ll keep this simple.

- Start early. Like, early early.

- Gather all documents before you start.

- Use the IRS Data Retrieval Tool for FAFSA, it’s faster and more accurate.

- Be consistent. Your name, date of birth, Social Security number, all must match across all forms.

- Stay in the loop. Log into portals regularly. If you spot a hold, act quickly.

- Understand your loan type. Are you borrowing subsidized, unsubsidized, PLUS, or private? Each has its own rules.

If you’re weighing loans against scholarships, make sure you know the difference in terms of cost, repayment, and long-term financial impact. The article How is a Student Loan Different From a Scholarship? Best Comparative Guide breaks it down clearly and is definitely worth a read.

And once you start borrowing, it’s smart to think about your credit. Yes, student loans can affect it, both positively and negatively. The guide how do student Loans affect credit score? gives a straightforward overview of what to expect.

How to Monitor and Check Your Student Loan Status

You shouldn’t have to wonder where your money is.

Federal Loans

- Log in to StudentAid.gov

- Check FAFSA processing, SAR, MPN status, and disbursement timing

- Email your school’s financial aid office if it’s been more than 3 weeks with no update

Private Loans

- Use your lender’s online portal

- Call them if you don’t see a status update after 5 business days

- Make sure your school has certified your enrollment

Private loans, in particular, come with more variability. If you’re wondering about their structure, the article Exploring the

Student Loan Mystery: Are Student Loans Secured or Unsecured? offers a nuanced explanation that clears up common misconceptions.

Also worth noting: Check student loan balance regularly once disbursed. Helps avoid surprises later.

And yes, can you be denied a student loan? Absolutely.

Federal? Rarely—unless you miss deadlines or have unusual citizenship/residency issues.

Private? Often—credit score, debt-to-income, or lack of a co-signer are common issues.

What Can You Do to Speed Up the Student Loan Process?

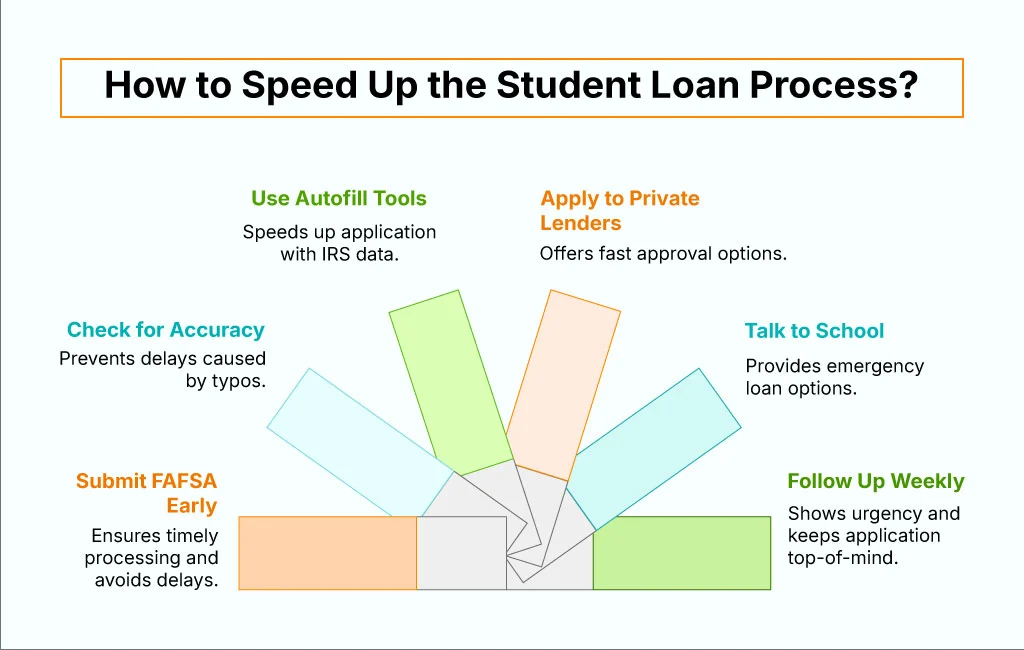

- Submit FAFSA early—October 1 (or ASAP if late open like 2025).

- Check for accuracy—typos cause 90% of delays.

- Use autofill tools—IRS data retrieval speeds things up.

- Apply to private lenders with fast-track options—some promise approval in 2–3 business days.

- Talk to your school—some offer “emergency loans” while aid is pending.

- Follow up weekly—checking in shows urgency and keeps your app top-of-mind.

Another thing to keep in mind: forgiveness options. While federal loans offer several programs, private loans don’t always play by the same rules. If you’ve heard about private loan forgiveness, be sure to read private student loan forgiveness: What Does It Mean? before counting on it.

If you’re wondering how to pay student loans fast, that’s a whole other topic—but applying early and borrowing smart is step one.

Final Thoughts

So, how long does it take to get a student loan in 2025? Anywhere from 5 days to 8 weeks, depending on the type, the timing, and, let’s be real, whether the system cooperates.

The trick isn’t just in knowing the steps. It’s in anticipating the slow parts. FAFSA delays. Missing tax documents. A financial aid office that takes the weekend off. Or longer. That’s life.

But if you start early, check in often, and keep your paperwork clean, you’ll be fine. Or well, probably. Because in this process, a little uncertainty is part of the ride.

Frequently Asked Questions (FAQs)

How Much Money Does FAFSA Give?

Depends on your Expected Family Contribution (EFC), enrollment status, and school costs.

- Max Pell Grant: ~$7,395 (2024–25)

- Direct Loans: ~$5,500 to $12,500/year for undergrads

- Plus Loans: Up to cost of attendance

How Fast Can I Get Student Loan Money?

- Federal: 4–8 weeks after FAFSA

- Private: As little as 5 business days (rare) to 6 weeks

Will I Get Denied for Student Loans?

- Federal: Not usually. But missed deadlines or incorrect info can block you.

- Private: Yes, often. Especially without income, credit, or a co-signer.

Also helpful:

- Mortgage Denied Due to Student Loans: Common Reasons and Solutions

- How is a Student Loan Different From a Scholarship? Best Comparative Guide