So… you’re thinking about how to start a hedge fund? That’s no small ambition, and honestly, welcome to the deep end. At first glance, it might seem like hedge funds are just about picking smart investments or riding the next hot stock. But in reality, starting a hedge fund is much more than that. It’s a business, one that demands structure, discipline, and a surprising amount of paperwork.

You’re not just trading anymore. You’re building. You’ll need to form legal entities, create a compliance framework, find the right partners (lawyers, auditors, administrators), and design a strategy that’s not just profitable, but clear and defendable. You’ll also need to figure out how to create hedge fund systems that can handle growth, investor reporting, and regulatory requirements. And yes, fundraising is a beast of its own. Convincing others to trust you with their capital is both an art and a process.

This guide is here to walk you through the entire hedge fund startup process. Whether you’re still brainstorming or already deep in planning mode, you’ll find practical steps and plain-English explanations to help you navigate the complexities ahead. From legal setup and operational basics to capital raising and compliance, we’ll break it all down into clear, manageable chunks.

And don’t worry, we’ll keep the jargon to a minimum. You don’t need an MBA or Wall Street resume to follow this. You just need the willingness to learn, build smart, and keep pushing forward. Let’s get started.

What is a Hedge Fund?

Let’s start with the basics, what is a hedge fund? At its core, a hedge fund is a private investment partnership. It’s typically structured as either a limited partnership (LP) or a limited liability company (LLC). In simple terms, it’s a pool of money collected from a small group of qualified investors. These investors trust the fund manager to invest that money in ways that, ideally, generate strong returns.

What makes hedge funds different is the wide range of tools they can use. They’re not limited to just buying and holding stocks or bonds. Hedge fund managers can short stocks (betting prices will fall), use leverage (borrowed money to amplify returns), trade derivatives, or pursue complex strategies like global macro or arbitrage. Some hedge funds focus on very specific niches, like distressed debt, emerging markets, or cryptocurrency.

That’s the short version of the hedge fund definition. But how does that compare to mutual funds?

Here’s the key distinction in the hedge fund vs mutual fund comparison: mutual funds are designed for the general public. They’re easy to buy into, heavily regulated, and must follow strict rules. Investors can typically buy and sell daily. Hedge funds, on the other hand, are only open to accredited investors, people who meet certain income or net worth thresholds, and they operate with much more flexibility and far fewer regulatory constraints.

Because of that, hedge funds can be more aggressive in how they invest. They aim for higher returns but also carry higher risks. And they’re not required to disclose their holdings in the same way mutual funds are, making them less transparent but more nimble.

In short, hedge funds are built for performance, not public access.

Prerequisites for Starting Your Hedge Fund

Before launching, you need to check off the essential hedge fund requirements list:

- A Verified Track Record: Start-up investors want proof, ideally 3+ years of audited or independently confirmed performance.

- Proper Structure: Set up as a Delaware LLC or LP in the U.S., or choose an offshore structure if targeting non-U.S. investors.

- A Team and Support System: Prime broker, fund administrator, auditor, compliance consultant, and legal counsel.

- Clear Compliance and governance processes to meet SEC, IRS, or CFTC regulations.

- Operational Basics: A trading system, risk analytics, accounting, reporting, and investor materials.

These hedge fund qualifications aren’t optional, they’re mission-critical. And yes, these start hedge fund requirements can feel daunting at first, but each plays a key role in building a trustworthy, investable firm.

How to Start a Hedge Fund in the U.S.

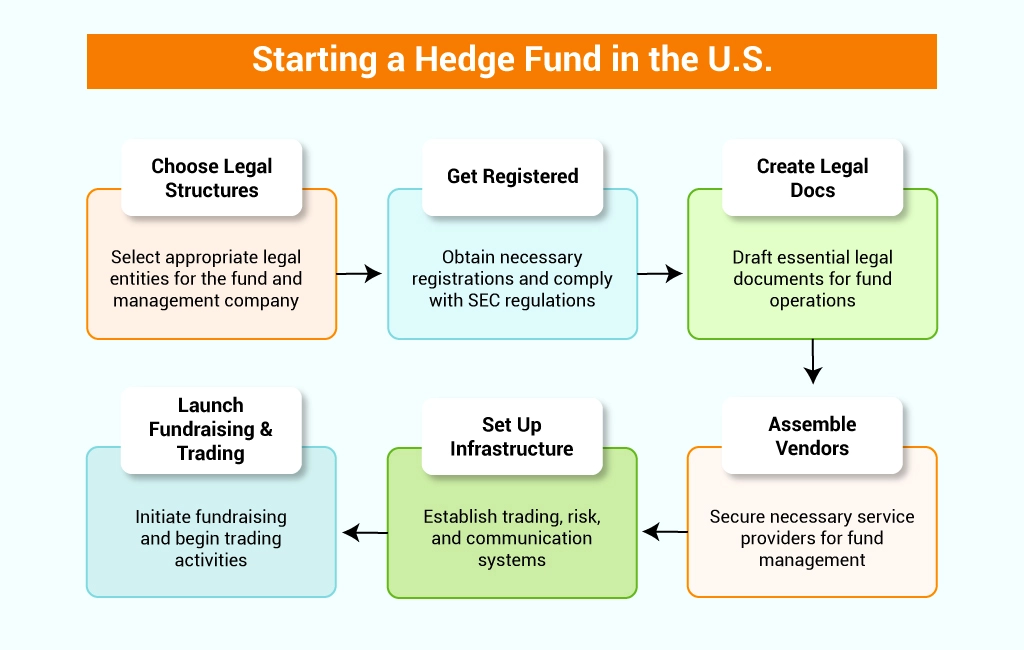

Alright—let’s talk execution. Here’s the roadmap to Start a hedge fund in America:

1. Choose Legal Structures

Form two entities: your Fund (LLC/LP) and your Management Co (GP/advisor). Most U.S. funds pick Delaware for regulatory ease.

2. Get Registered

Obtain an EIN from the IRS. If you’re raising outside family/friends, you may need to file Form D with the SEC—important to comply with offering rules.

3. Create Legal Docs

You’ll need a Private Placement Memorandum (PPM), subscription agreements, operating agreement, and compliance manual. These define your terms, disclosures, and investor protections.

4. Assemble Vendors

Secure a prime broker (remember, they often want a minimum AUM or personal capital), an administrator for NAV and statements, an auditor, and compliance counsel.

5. Set Up Infrastructure

Build trading and risk systems, accounting setup, digital presence (pitch deck, website, professional but gated), and communication tools.

6. Launch fundraising & trading

Once the legal and operational frameworks are in place, make a capital call, onboard investors, and start trading. Expect a 3–6-month lead time from idea to first trade.

That’s the practical side of Starting a hedge fund, structured, sequential, and built to withstand scrutiny.

How to Raise Money for a Hedge Fund

Now comes the most challenging, and arguably most important, part of the entire journey: hedge fund fundraising. It’s one thing to have a strong strategy on paper. It’s another to convince real people to trust you with their money. Learning how to raise capital hedge fund style takes time, skill, and persistence.

Start by seeding your fund with your own capital. Even a relatively small amount, say $100,000, signals to potential hedge fund investors that you believe in your strategy and are personally invested in the outcome. It builds early credibility.

Next, lean into your existing network. Reach out to high-net-worth individuals, former colleagues, mentors, or family offices. These groups are often more open to backing a new manager than large institutions, especially if they know you or have followed your track record.

A great pitch matters. Develop materials that clearly explain your investment strategy, risk management approach, what makes your fund unique (your “edge”), and how fees are structured. Keep it simple and honest, investors don’t need fancy language, just clarity and confidence.

Consider offering early-bird incentives to sweeten the deal. That could mean reduced fees, a share of GP ownership, or preferred liquidity terms for those who commit early.

And be realistic about timing. Many emerging managers take six months to a year (or more) to raise meaningful capital. Some turn to placement agents, who can help connect you with potential investors in exchange for a cut of fees or carry.

Ultimately, successful hedge fund fundraising is about relationships and trust. You’re not just asking for money—you’re asking someone to believe in you, your judgment, and your ability to manage risk. Done right, fundraising becomes the fuel that transforms your fund from plan to performance.

How Much Does It Cost to Start a Hedge Fund?

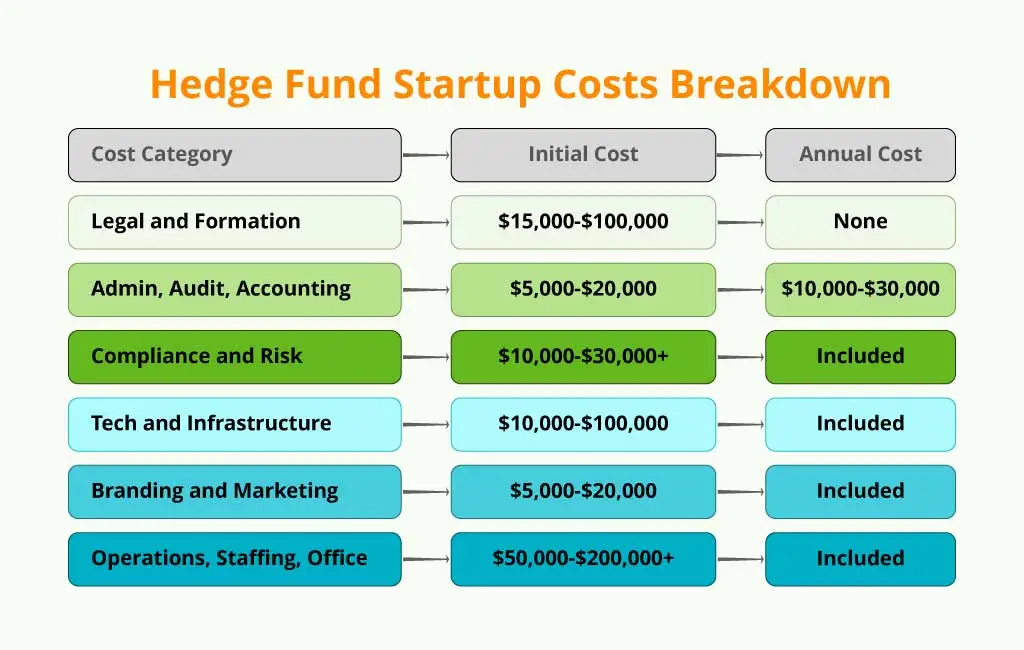

Alright, let’s talk numbers, because hedge fund startup costs, the cost to start hedge fund, and ongoing hedge fund expenses are very real, and often underestimated by first-time founders. Starting a hedge fund isn’t just about having a good strategy, it’s about building an entire infrastructure that can pass legal, investor, and regulatory scrutiny.

Here’s a more detailed breakdown of the typical costs:

- Legal and Entity Formation ($15,000–$100,000): This includes setting up your fund and management company, drafting offering documents like the Private Placement Memorandum (PPM), partnership agreements, and other required compliance materials. The cost depends heavily on the complexity of your structure and the reputation of your legal team.

- Administration, Audit, and Accounting ($5,000–$20,000 to Start; $10,000–$30,000 Annually): Your fund administrator handles daily operations like calculating Net Asset Value (NAV) and investor statements. Add in a third-party auditor and a tax accountant, and the numbers grow quickly.

- Compliance and Risk Systems ($10,000–$30,000+): These tools ensure you follow all regulatory obligations. This includes monitoring trades, tracking conflicts of interest, and updating internal policies.

- Technology and Infrastructure ($10,000–$100,000): This ranges from trading software to cybersecurity, CRM systems, and data subscriptions. The more complex your strategy, the more robust your tech stack needs to be.

- Branding and Marketing Materials ($5,000–$20,000): First impressions matter. You’ll need a pitch deck, website, investor fact sheets, and other materials that present your fund as professional and credible.

- Operations, Staffing, and Office Space ($50,000–$200,000+): Even a lean operation needs someone managing operations, compliance, or investor relations. Add office rent, insurance, travel, and other business expenses.

Most hedge fund startup costs land between $200,000 and $300,000 for a lean setup, with annual expenses running between $150,000 and $500,000. Larger funds, or those launching with institutional expectations, often spend millions upfront and run seven-figure annual budgets.

Bottom line: starting a hedge fund isn’t cheap. It’s a business, not a side hustle.

Key Business Benefits of Starting a Hedge Fund

Starting a hedge fund is no small task, but for many, the rewards are worth the effort. The biggest benefit? Autonomy. You’re in control. You decide what to trade, how to structure your portfolio, and which markets to focus on. No investment committee to answer to, no rigid mandates, just your vision, your strategy.

Then there’s the earning potential. With performance-based fees (typically 20% of profits), your income isn’t capped like it would be in a salaried role. As your assets under management grow, so does your share of the upside.

You’re also building something of your own. Whether it’s your name on the door or a brand that stands for something specific, like innovation, discipline, or a unique market edge, you’re creating a legacy.

And let’s not forget strategic flexibility. Want to shift from long/short equities to macro or crypto? You can. Want to scale into private credit or add an ESG overlay? Totally your call.

Yes, it comes with stress: compliance, investor relations, performance pressure. But for people who value independence, creativity, and the chance to build real wealth on their own terms, few paths offer more opportunity than running a hedge fund.

Common Hedge Fund Startup Mistakes to Avoid

Starting a hedge fund isn’t just about having a smart strategy, it’s about building something stable, legal, and credible. And yet, many promising funds fall apart early on. Why? Because they overlook the basics. Below are the most common hedge fund mistakes founders make, especially in areas tied to hedge fund compliance and operational structure.

Underestimating compliance is probably the number one misstep. Regulations aren’t suggestions—they’re legal requirements. If your policies are weak or nonexistent, you risk audits, fines, and a ruined reputation.

Using unverified track records is another killer. Saying you performed well in a personal account isn’t enough. Investors want audited, independently confirmed performance data.

Rushing legal documents, or using generic templates, can create vague terms, unclear fee structures, or worse, conflicts between the manager and investors.

Launching too quickly without your operations, service providers, or strategy fully nailed down leads to broken processes and disappointed investors.

Strategy hopping is another red flag. Constantly chasing what’s trendy signals that your fund lacks discipline.

Partnering with weak vendors, like an inexperienced administrator or auditor, can damage credibility with allocators.

Pitching the wrong investor audience, like approaching institutions before you’re ready, wastes time and burns bridges.

Sloppy presentation materials can tank interest before the first meeting even begins.

Understaffing core roles, such as operations or compliance, might save costs upfront, but it signals instability to investors.

Many hedge fund failures can be traced to one or more of these issues. Some collapsed under fraud; others simply ignored the foundational work needed to survive. The key takeaway? Performance matters, but without structure, clarity, and strong compliance, even the best investment ideas will fail to take root.

Conclusion

If you’re serious about how to start a hedge fund, this guide gives you a clear, honest foundation. From setting up your structure to launching and managing capital, you’ve got a map. Yes, it’s expensive, regulated, and rugged. But if you’ve got conviction, a real strategy, credible track record, and discipline, it’s possible. This isn’t just about trading, it’s building a firm.

Want more? I can create real-term examples: a sample PPM outline, pitch deck structure, compliance checklist, or vendor recommendation list. Just point me to the next section, and let’s build it together.