In the diverse landscape of investment, two heavyweight contenders often come into focus: Hedge Funds and Private Equity. Both offer unique strategies, risks, and performance potential, but they cater to different investor needs and operate under distinct models. Understanding the nuances of Hedge Fund vs. Private Equity is crucial for any investor or financial enthusiast aiming to navigate the complex world of finance.

While they may look similar on the surface, with their hefty minimum investments, fancy limited partnership structures, and how they pay their top brass through fees and a cut of the profits, there’s much more to these investment giants than meets the eye. It’s not just about where the money’s going, but how it’s being put to work, the risks that come with it, and the kind of returns it’s bringing back. So, buckle up and get ready for an enlightening ride through the dynamic and sometimes dizzying world of hedge funds and private equity.

Hedge Fund Vs. Private Equity Fund: What's the Difference?

Hedge funds and private equity funds differ primarily in their investment focus and strategies. Private equity firms concentrate on investing in private companies, often acquiring significant or controlling stakes. Their returns are typically realized by enhancing the company’s performance and profitability, often through operational improvements or strategic guidance. This approach involves a long-term investment horizon, where the fund actively participates in the management and growth of the company, ultimately seeking profit through methods like selling the company or taking it public.

In contrast, hedge funds employ more diverse investment tactics, focusing on short-term market movements and opportunities. They invest in various securities, including stocks, bonds, options, and futures. Hedge funds use advanced strategies such as leveraging (borrowing capital to amplify returns) and hedging (using techniques to offset potential losses in one investment by gains in another). This approach allows hedge funds to aim for high returns regardless of market direction, often adjusting their strategies to adapt to changing market conditions.

What is a Hedge Fund?

A Hedge Fund is a pooled investment fund that employs different strategies to earn active returns for its investors. It operates more flexibly than traditional investment funds and often uses leverage and derivatives to amplify returns. Hedge Funds are known for their aggressive investment strategies and higher risk tolerance, targeting absolute returns.

A hedge fund is an investment fund that pools capital from accredited investors or those approved by the U.S. Securities and Exchange Commission (SEC). These investors are often required to commit substantial amounts of money to participate. Managed by professional portfolio managers, these funds aim to generate significant returns for their investors through various investment strategies.

One of the hallmark strategies of hedge funds is the practice of “hedging” their investments. This involves making investments in such a way that potential losses in one position are offset by gains in another, similar to hedging a bet. Additionally, hedge funds frequently employ leveraging, a technique where the fund borrows money to invest, aiming to amplify returns. This strategy can also involve selling securities to repurchase them at a lower price, thereby profiting from the difference.

Another distinct feature of hedge funds is their liquidity. Unlike private equity firms, known for their long-term investments and extended periods before investors can realize returns, hedge funds typically offer more flexibility. Investors in hedge funds can usually make investments and withdrawals on a more regular basis, allowing for greater liquidity in their investment strategies.

What is a Private Equity Fund?

Private Equity Funds are investment vehicles that accumulate capital to invest in private companies. They typically involve a longer investment horizon than Hedge Funds, focusing on value creation over several years. Private Equity Funds often engage in buyouts, venture capital, and distressed investments, aiming to enhance the value of their holdings before exiting at a profit.

A Private Equity (PE) Fund is an investment vehicle that focuses on acquiring stakes in privately held companies not listed on public stock exchanges. Investments made by PE funds are characteristically long-term, often meaning that investors may need to realize returns for several years.

A common strategy employed by many private equity firms is the buy-out approach. In this approach, the firm either purchases a company outright or acquires a significant share, often enough to hold a majority stake. Gaining this level of control enables the private equity firm to influence or directly manage the company’s decision-making processes. This control is typically used to restructure the company and improve its profitability, thereby enhancing the value of the firm’s investment.

The capital for private equity investments is usually raised from a variety of sources, including private investors, high-net-worth individuals, and, similar to hedge funds, endowments. Additionally, private equity firms often draw investment capital from less traditional sources like pension funds. This diverse funding base allows PE funds to engage in substantial, transformative investments in their chosen companies, aiming for significant returns upon exit, such as through a sale or public offering.

Types of Roles in Hedge Funds

Hedge Funds boast diverse roles, including portfolio managers, traders, analysts, risk managers, and marketers. Each role is pivotal in navigating the complex and fast-paced environment, ensuring the fund’s strategy is effectively implemented, and its risk is meticulously managed.

- Quantitative Analysts: Quantitative analysts in hedge funds use complex mathematical and statistical models to identify investment opportunities and manage risk. They play a critical role in developing algorithmic trading strategies and optimizing portfolio performance.

- Financial Analysts: Financial analysts in hedge funds conduct detailed market research and financial analysis to inform investment decisions. They assess the financial health of potential investment targets and provide insights into market trends and economic conditions.

- Investment and Portfolio Managers: Investment and portfolio managers make final investment decisions and manage the hedge fund’s overall portfolio. They strategize asset allocation, monitor investment performance, and adjust strategies to align with the fund’s objectives.

- Accountants: Accountants in hedge funds manage financial records, ensure compliance with financial regulations, and prepare financial statements. They are vital in reporting the fund’s financial status to stakeholders and regulatory bodies.

- Risk Managers: Risk managers in hedge funds identify, assess, and mitigate financial risks associated with the fund’s investment activities. They develop risk management frameworks and policies to safeguard the fund’s assets and ensure long-term stability.

- Securities Traders: Securities traders in hedge funds execute buy and sell orders in the financial markets, actively managing trades to capitalize on market movements. They are essential to implement the fund’s investment strategies and achieve desired financial outcomes.

Types of Roles in Private Equity Funds

In Private Equity Funds, roles include deal-makers or partners, who identify and negotiate investment opportunities; operations specialists, who work on improving the performance of portfolio companies; and fund managers, who oversee the overall portfolio and investor relations.

- Financial Analysts: In private equity funds, financial analysts perform in-depth financial analysis and valuation of potential investment targets, assessing their viability and profitability. They are crucial in guiding investment decisions by analyzing market trends, financial statements, and economic indicators.

- Quantitative Analysts: Quantitative analysts in private equity funds use mathematical and statistical techniques to model and predict financial outcomes. Their role involves analyzing data to support investment strategies and decision-making processes, particularly in areas like market trends and risk assessment.

- Investment Managers: Investment managers in private equity are responsible for identifying, evaluating, and executing investment opportunities. They oversee the entire investment lifecycle, from initial screening to deal closure, and subsequently manage the portfolio companies to drive value creation.

- Venture Capitalists: As a specialized role within private equity, venture capitalists focus on investing in startups and early-stage companies. They not only provide capital but also strategic guidance to help these companies grow, with the aim of earning substantial returns through eventual exits.

- Accountants: Accountants in private equity funds manage the financial reporting, budgeting, and compliance aspects. They are vital in maintaining accurate financial records, ensuring the fund adheres to regulatory standards, and providing financial insights to stakeholders.

- Business Analysts: Business analysts in private equity funds play a key role in evaluating the operational aspects of potential and existing investments. They analyze business processes, market conditions, and competitive landscapes to inform investment decisions and portfolio company growth and improvement strategies.

Hedge Fund Vs. Private Equity Fund: Key Differences

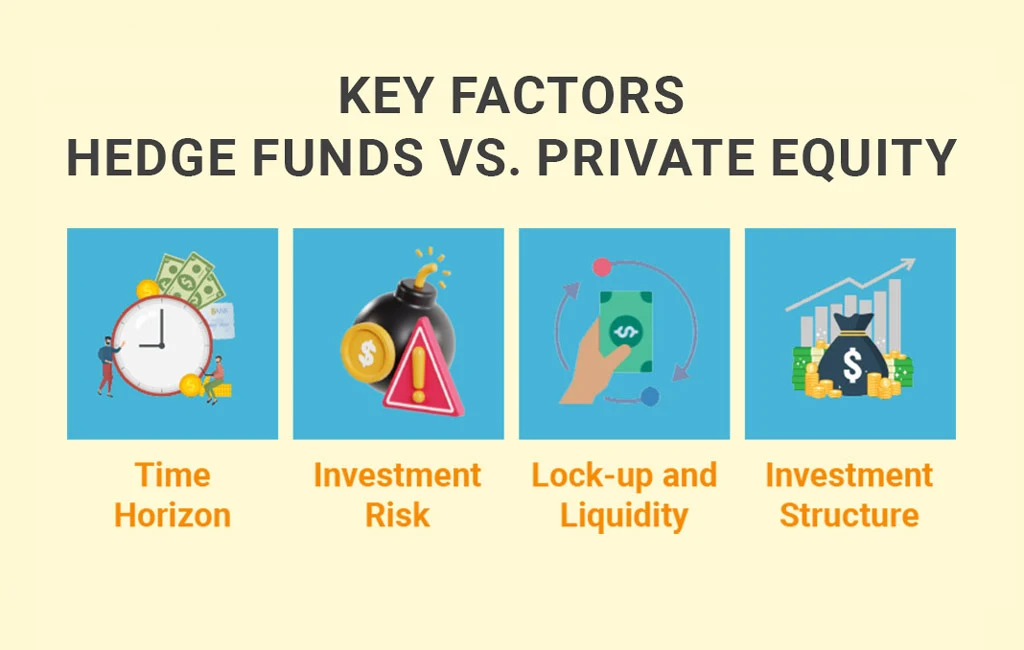

Investing in the financial markets can be a labyrinth of choices and strategies, and understanding the nuances of different investment vehicles is crucial. Among these, Hedge Funds and Private Equity Funds stand out for their unique approaches to investing. Both have distinct characteristics, and comparing them requires a deep dive into aspects like time horizon, investment risk, lock-up periods, and investment structure.

1. Time Horizon

Hedge Funds typically operate with shorter time horizons. Their investments are often geared towards quick, significant returns, capitalizing on market fluctuations and opportunities. This approach allows investors in Hedge Funds to potentially see returns in a shorter time frame, aligning with strategies that adapt to immediate market trends and changes.

In contrast, Private Equity Funds are known for their long-term investment approach. Investments in private companies or startups are made with an eye on long-term growth and profitability. This means investors in Private Equity Funds may not see returns for several years, as the focus is on the gradual appreciation of the investment through business growth and development.

2. Investment Risk

The risk profile of Hedge Funds tends to be higher due to their aggressive investment strategies. Utilizing techniques such as leveraging and short-selling, Hedge Funds aim for high returns, exposing them to significant market volatility and the potential for substantial losses.

Private Equity Funds, while still carrying investment risks, often have a lower risk profile than Hedge Funds. Their long-term, hands-on approach to managing portfolio companies allows for more controlled risk management, focusing on steady growth over time rather than immediate market gains.

3. Lock-up and Liquidity

Hedge Funds usually have shorter lock-up periods, meaning investors can withdraw their capital after a relatively brief period. This aspect provides a level of liquidity that can appeal to investors who desire more flexibility in accessing their funds.

On the other hand, Private Equity Funds typically have longer lock-up periods. Investors’ capital is tied up for several years, reflecting the long-term nature of the investments. This means liquidity is lower, and investors must be prepared for a longer commitment without access to their capital.

4. Investment Structure

The structure of Hedge Funds is primarily designed for trading in liquid assets. They invest in various financial instruments, from stocks and bonds to derivatives, allowing for diverse and flexible investment strategies.

The investment structure of Private Equity Funds is markedly different. These funds focus on direct investments in private companies or buyouts, requiring a hands-on approach to management and restructuring. This structure is geared towards creating value in the companies they invest in, often involving significant transformation or growth strategies.

Final Words

Understanding the distinction between Hedge Fund vs. Private Equity is essential for anyone involved in finance. Each offers distinct opportunities and risks, catering to different investor profiles and objectives. As the financial landscape continues to evolve, these investment vehicles will remain pivotal in shaping the future of finance.

If you’re eager to deepen your financial knowledge and stay ahead in the ever-changing world of finance, be sure to visit EduCounting. Our blog is packed with insightful articles and expert analyses that demystify complex financial concepts, making them accessible to everyone. Join us at EduCounting and empower yourself with the financial wisdom to navigate this exciting, dynamic field.

FAQs

What is the difference between a hedge fund and a VC?

A hedge fund typically invests in a wide range of financial instruments including stocks, bonds, and derivatives, often employing aggressive strategies such as leveraging and short-selling for short-term gains. In contrast, Venture Capital (VC) is a subset of private equity, focusing on investing in startups and early-stage companies, offering long-term growth potential in exchange for higher risk and illiquidity.

Which fund has the lowest risk?

Generally, private equity funds are considered to have a lower risk profile compared to hedge funds. This is because private equity involves long-term investments in companies with a hands-on approach to management and growth, as opposed to the high-leverage, market-dependent strategies often used by hedge funds that can lead to higher volatility and risk.

Which fund gives the highest return?

The potential for the highest return can vary depending on market conditions and the specific strategies of the fund. Historically, hedge funds have the potential to yield high returns in a short period due to their aggressive investment strategies. However, private equity funds can also provide substantial returns over a longer period, especially in successful buyouts or growth equity investments.

Can hedge funds do private equity?

Yes, some hedge funds engage in private equity-style investments. These hedge funds may allocate a portion of their portfolio to direct investments in private companies, leveraging their expertise and capital. However, this is not typically the primary focus of hedge funds, and their approach to these investments may differ from traditional private equity firms.