In 2022, the latest Consumer Expenditure Survey data revealed that households typically brought in $94,003 pre-tax and spent about $72,967. This comprehensive study, released by the U.S. Bureau of Labor Statistics (BLS), broke down the average spending across different areas, with housing, transportation, and food emerging as the primary outlays.

The art of budgeting is as versatile as our spending habits. Adapting to various pay structures is essential in today’s increasingly flexible financial environment. One of the frequently used payment structures today is biweekly. This article breaks down the nuances of the biweekly budget planner and why it might just be the perfect fit for your financial journey.

What is a Biweekly Budget?

A biweekly budget is a financial plan tailored around a twice-a-month income schedule. Instead of mapping out monthly expenses, you align your expenses with your biweekly paycheck. If you get paid every two weeks, it makes sense to use a biweekly budget planner to manage your money effectively.

Advantages of Biweekly Budgeting

In the intricate dance of personal finance, rhythm matters. Just as we’ve seen shifts in working dynamics, with more people freelancing or joining the gig economy, how we handle our money is also transforming. Enter biweekly budgeting, an unsung hero that aligns with many modern payment schedules.

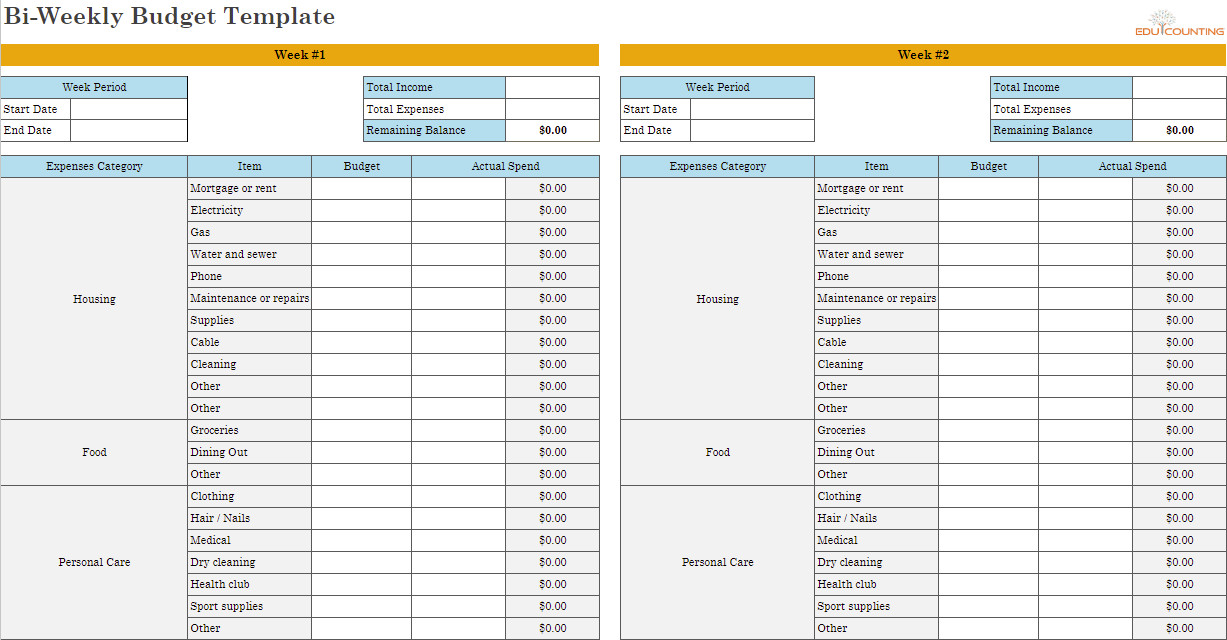

Get Your Free Biweekly Budget Planner Template

Organize your finances and take back control of your money with our Biweekly Budget Planner Template. Don’t miss this opportunity to download our free template:

1. Perfect Synchronization with Pay

One of the primary reasons to consider biweekly budgeting is its seamless alignment with a biweekly paycheck system. When your income and expenses follow the same timeline, the chances of overspending or falling short are curtailed.

2. Manageable Financial Windows

Instead of grappling with a month of expenses at once, biweekly budgeting divides the month, making it easier to track and manage. With only two weeks of expenses to account for, you get clearer insights into your spending habits and can make quicker adjustments.

3. Benefit from More Paychecks

Here’s a fun fact – when you’re on a biweekly system, you get 26 paychecks a year instead of the 24 you’d expect (or 12 if monthly). These two “extra” paychecks can be a boon when managing unexpected costs, building an emergency fund, or simply accelerating your savings goals.

4. Quicker Feedback Loop

Since you’re revisiting your budget more frequently, spotting and addressing any discrepancies or unnecessary expenditures is easier. This helps in maintaining better financial discipline.

5. Optimal Use of Extra Paychecks

With the standard monthly budgeting system, viewing any additional income as a windfall or bonus is easy. However, with a biweekly system, you’re better equipped to allocate those extra funds effectively for investments, debt reduction, or other financial priorities.

6. Enhanced Savings Opportunities

If you set aside a fixed percentage or amount for savings with every paycheck, a biweekly system can noticeably enhance your savings. This is because, as mentioned earlier, you’re technically receiving more paychecks for a year.

7. Flexibility

A biweekly system introduces a degree of flexibility that a monthly system might lack. For instance, if a large, unplanned expense comes up in the month’s first half, you can adjust your spending for the second half, ensuring that your budget remains balanced.

Steps to Create a Biweekly Budget

The changing dynamics of the modern world mean that traditional monthly budgeting might not always be the best fit for everyone. Especially for those who receive paychecks biweekly, aligning their budget with this payment schedule can prove beneficial. Dive in as we explore the steps to craft a perfect biweekly budget, ensuring your financial plan meshes seamlessly with your income flow.

Create a List of Your Income and Expenses

Before diving into budgeting, you must comprehensively grasp your total income. This includes your primary paycheck and any other ancillary sources of income, such as freelance gigs, rentals, or dividends. A clear picture ensures you’re not shortchanging yourself or overlooking potential resources.

The next crucial step is listing out all your fixed and predictable expenses. This includes rent, utilities, subscriptions, loans, and other recurring costs. Organizing these expenditures will offer a tangible foundation for your biweekly budget, ensuring that you prioritize essential payments.

Factor in Variable Expenses

Unlike fixed expenses, variable expenses can be unpredictable. These include categories like groceries, dining out, entertainment, or shopping. Although they might fluctuate, reviewing past months can provide a reasonable estimate. It’s essential to account for these to avoid overspending.

Given the unpredictable nature of variable expenses, it’s prudent to create a buffer. This buffer is a financial cushion, ensuring that you won’t derail your entire budget even if you exceed your estimated spending in one category. It provides flexibility, ensuring you don’t stress over minor overruns.

Monitor Your Budget Regularly

With a biweekly budget, regular check-ins are imperative. This doesn’t mean obsessing over every penny, but a quick review every pay period can be enlightening. It helps you identify discrepancies, adjust for the next cycle, and ensure you’re on track with your financial goals.

A biweekly system’s beauty is its agility. If you notice that you need to consistently spend more in one category, or perhaps you’ve over-budgeted for another, it’s easy to recalibrate. These periodic adjustments ensure that your budget remains relevant and effective.

Set Savings Goals

Before diving into the ‘how,’ it’s essential to understand the ‘why.’ Whether building an emergency fund, saving for a vacation, or a significant future investment like a house, having a clear savings goal can be incredibly motivating. It provides direction and purpose to your financial journey.

One of the perks of a biweekly budget is the additional paychecks you receive over a year (26 instead of 24). This presents an opportunity to boost your savings. Decide on a fixed amount or percentage from each paycheck to divert into savings. With consistency, you’ll be amazed at how swiftly your savings grow.

How to Budget for Non-Monthly Expenses

One of the most common pitfalls people need to work on is the oversight of non-monthly expenses. These are the expenditures that don’t occur on a regular monthly basis but might pop up quarterly, bi-annually, or annually. Think of costs like car insurance, annual subscriptions, property taxes, or yearly dental check-ups. Because they aren’t part of our routine monthly bills, they can often catch us off guard if not adequately planned.

Addressing these sporadic expenses becomes essential when operating on a biweekly budget planner. Begin by listing out all such expected non-monthly costs for the year. Once you have this list, divide each expense by 26 (the number of biweekly pay periods per year). This will give you the amount to set aside from each paycheck to cover these costs seamlessly. For instance, if you have an annual subscription of $260, you’d set aside $10 from each biweekly paycheck. When the bill comes due, you’ll have the required amount saved, ensuring these irregular expenses don’t disrupt your financial flow.

Advantages of a Biweekly Budget over a Monthly Budget

Budgeting is a cornerstone of good financial health, and your chosen method can significantly impact your financial progress and awareness. While monthly budgeting has traditionally been the norm, there’s a growing preference for biweekly budgeting, particularly among those who receive paychecks every two weeks.

- Alignment with Pay Cycle: For those who receive their wages biweekly, setting up a biweekly budget ensures that their expenses are aligned with their income. This synchronization reduces the risk of overspending in the first half of the month and then scrambling to cover bills in the latter half.

- Enhanced Cash Flow Management: With a biweekly budget, expenses are broken down into smaller chunks. This segmentation can make large, intimidating costs more manageable, as you can allocate funds from two pay periods to cover them.

- More Frequent Financial Check-ins: The biweekly system prompts you to review your finances regularly. This frequent engagement increases financial awareness, allowing quicker course corrections if you drift off track.

- Opportunity for Extra Payments: There are 26 biweekly periods in a year, leading to an “extra” month’s worth of paychecks. This can be advantageous for paying off debts faster or boosting savings, as you essentially get two additional paychecks a year compared to 12 monthly payments.

- Flexibility with Variable Expenses: Adjusting for unforeseen or variable expenses is easier because you’re budgeting for a shorter period. If an unexpected cost arises in the first half of the month, you can make adjustments in the second half, ensuring you stay within budget.

- Motivational Boost: Achieving budgeting milestones every two weeks can be psychologically rewarding. These frequent “wins” can motivate you and make you more committed to your financial goals.

- Smoothing Out Irregular Expenses: Biweekly budgeting can make it easier to plan for non-monthly expenses. By setting aside a portion from each paycheck, you’re continually preparing for quarterly or annual bills, making them less disruptive when they come due.

Biweekly Budget planner Tips

Transitioning to a biweekly budget or fine-tuning your existing one? Here are some tips to ensure you get the most out of your biweekly budgeting:

- Prioritize Essentials First: Always allocate funds for essential expenses like rent, utilities, groceries, and insurance before considering discretionary spending. This ensures you’re covering necessities with every paycheck.

- Use the Two “Extra” Paychecks Wisely: Remember that with biweekly budgeting, you’ll receive two additional paychecks in the year. Plan ahead for these bonuses. Consider using them for debt reduction, adding to your emergency fund, or making a significant one-time purchase without affecting your standard biweekly allocations.

- Embrace Technology: Utilize budgeting apps and software that allow you to input income and track expenses on a biweekly schedule. Many of these tools offer insights, reminders, and predictive analytics to keep you on track.

- Allocate for Non-Monthly Expenses: Don’t get caught off guard by quarterly or annual bills. Divide the annual or quarterly amount by 26, and set aside this smaller amount from each paycheck to ensure you’re ready when the bill comes.

- Adjust as You Go: One of the benefits of biweekly budgeting is the frequent check-ins. Use these opportunities to adjust your budget based on recent spending patterns or upcoming known expenses.

- Maintain an Emergency Buffer: Always have a small buffer in your budget for unexpected expenses. This can prevent unplanned costs from derailing your budget.

- Align Bill Due Dates: If possible, adjust the due dates of your bills to better align with your biweekly pay cycle. This can ensure smoother cash flow management.

- Stay Consistent: Even if you don’t spend the entire allocated amount in one category during a pay period, resist the urge to splurge. Instead, roll it over to the next period or funnel it into savings.

- Automate Savings: Set up automatic transfers to your savings or investment accounts so a portion of your paycheck is saved or invested without you even thinking about it.

- Seek Regular Feedback: Discuss finances with trusted friends, family, or financial advisors. They might offer insights or tips that you have not considered.

- Review and Reflect: Every few months, take a moment to review your budget comprehensively. Are there areas where you consistently overspend? Or perhaps there are allocations you no longer need? Adjusting your budget to fit your current reality is essential.

Final Words:

Leveraging a biweekly budget planner can streamline your financial journey, making budgeting more intuitive and in sync with your income. You can navigate the biweekly landscape like a pro with consistency, organization, and a keen eye on savings.

Mastering the art of biweekly budgeting can significantly enhance your financial prowess. EduCounting serves as an essential guide in this endeavor. Our thoughtfully designed blogs and courses provide clarity on imperative financial subjects, techniques, and recommended practices.

Frequently Asked Question (FAQ)

How do I create a budget with biweekly paychecks?

Start clearly understanding your biweekly income, including any additional earnings outside your main paycheck. List out all fixed expenses, such as rent, loan payments, and utilities. Next, factor in variable expenses, like groceries, entertainment, and dining out. Remember to allocate funds for non-monthly expenses by dividing the total by 26 (number of biweekly periods in a year) and setting this amount aside from each paycheck. Finally, decide on savings goals and set aside a specific amount or percentage of each paycheck toward these.

How much of my biweekly paycheck should I save?

Financial experts often recommend the 50/30/20 rule. This means 50% of your income should go to necessities, 30% to discretionary expenses, and 20% to savings. However, the amount you should save from your biweekly paycheck depends on your financial goals, obligations, and comfort level. Prioritizing an emergency fund, long-term savings, and retirement contributions is essential.

Is it easier to budget if you get paid weekly or biweekly?

The ease of budgeting largely depends on individual preferences and financial habits. With weekly pay, you receive smaller amounts more frequently, which might be easier for managing immediate expenses. On the other hand, biweekly budgeting often aligns better with monthly bills and offers the advantage of two “extra” paychecks a year. It can be helpful for those who prefer a slightly longer financial overview. The key is consistency in tracking expenses and regular check-ins.

What are the disadvantages of getting paid biweekly?

While advantageous in many respects, the biweekly budgeting system comes with its set of challenges. The initial setup can be time-consuming, demanding meticulous planning and reconfiguring your financial framework. Moreover, to ensure smooth cash flow, there might be a need to reschedule certain bill payments to align better with the biweekly income cycle. Additionally, the allure of the occasional third paycheck in some months poses a potential pitfall; if not budgeted or utilized prudently, it can lead to unintended spending instead of bolstering savings or addressing financial priorities.

Why is biweekly cheaper than monthly?

The perception that biweekly is “cheaper” than monthly often arises in the context of loan repayments, especially mortgages. By making biweekly payments, you make an extra full payment each year, which reduces the loan’s principal faster. This leads to a reduction in the total interest paid over the life of the loan. It doesn’t necessarily make individual payments cheaper, but it can make the overall loan cost less over time due to the reduced interest.