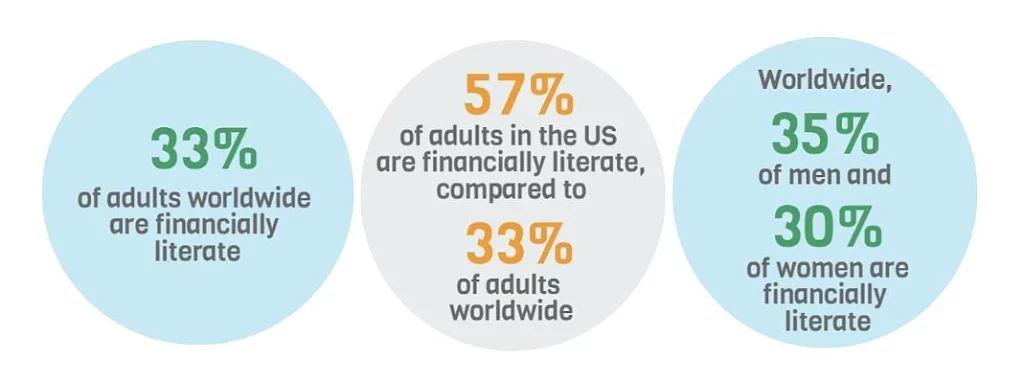

According to the Global Financial Literacy Survey conducted by Standard & Poor’s Ratings Services, only a third of adults worldwide, or 33%, demonstrate financial literacy. In the US, this figure is more encouraging at 57%. When breaking it down by gender, 35% of men exhibit financial knowledge compared to 30% of women.

The Benefits of Financial Planning cannot be overstated in the vast realm of personal finance. Financial planning is about securing a future that resonates with financial security, prosperity, and growth. This article delves deep into the importance, benefits, and steps towards effective financial planning.

What is Financial Planning?

Financial planning is the process of strategizing, implementing, and maintaining a comprehensive overview of an individual’s or organization’s monetary resources. The aim is to effectively allocate these resources to meet current needs while also ensuring future financial goals and obligations are met.

Financial planning is the systematic process of organizing and managing one’s finances to achieve immediate and long-term objectives. It goes beyond mere budgeting and involves a holistic view of an individual’s or organization’s monetary resources. Financial planning encompasses understanding one’s income, assets, expenses, and liabilities, then crafting a plan that aligns with one’s unique financial goals, whether buying a dream home, funding children’s education, or ensuring a comfortable retirement.

The process of financial planning typically begins with assessing the current financial situation, which provides a clear starting point. From there, specific goals are set, timelines are established, and strategies are developed. This might involve selecting suitable investments, setting aside emergency funds, planning for tax liabilities, or considering insurance needs. It’s not a static process but an evolving one, requiring periodic reviews and adjustments based on changing financial circumstances, economic conditions, and personal objectives.

Furthermore, effective financial planning operates under a set of guiding principles, including risk management, diversification, and discipline. While the tools and strategies employed might vary based on individual preferences and situations, the end goal remains consistent: achieving financial stability, growth, and independence. By weaving together various financial disciplines and focusing on long-term perspectives, financial planning provides a roadmap to monetary success.

What are the Key Benefits of Financial Planning?

Financial planning is more than just a tool—it’s a compass guiding individuals and families through the intricate maze of personal finance. With the myriad financial decisions one must make throughout life, having a clear and focused plan can be the difference between thriving and merely surviving. From achieving ambitious goals to ensuring stability during unforeseen events, the benefits of financial planning touch every corner of one’s financial landscape.

Achieving Financial Goals

When setting a clear path for your future, financial planning provides the most concrete roadmap. Planning brings about clarity, helping you identify exactly what you want to achieve in terms of financial milestones.

Whether purchasing a home, traveling the world, or starting a business, these dreams are made tangible through a financial plan. Furthermore, by breaking down these goals into actionable steps and setting realistic timeframes, one can better visualize and act towards these aspirations, making the journey as rewarding as the destination.

Preparation for Emergencies

Life is unpredictable. While we hope for the best, preparing for the unexpected is always wise. A sound financial plan includes an emergency fund to cover sudden and unforeseen expenses. This fund cushions against life’s unpredictabilities, ensuring that a medical emergency, job loss, or urgent home repair doesn’t derail your financial stability. Building and maintaining this safety net allows one to navigate life’s surprises with more confidence and less financial stress.

Smart Budget Allocation

In a world filled with endless wants and needs, it’s essential to distinguish between the two. Financial planning encourages this distinction, promoting wiser budget allocations. Through a clear overview of your income and expenses, one can better prioritize financial commitments, ensuring necessary expenses are met while also allocating funds to recreational pursuits and investments.

Over time, this smart allocation can lead to greater financial growth and freedom, emphasizing the need to consciously understand and manage one’s money.

Improved Standard of Living

Financial stability directly correlates with an improved standard of living. With a well-structured financial plan, one is less likely to fall into unmanageable debt and more likely to enjoy a comfortable lifestyle. Through wise investment decisions and effective savings strategies, one can ensure they have enough to provide for their family’s needs while also indulging in some of life’s luxuries. An improved standard of living isn’t just about financial freedom but also about the peace of mind accompanying it.

Financial Independence

The ultimate dream for many is to achieve financial independence, where assets and investments generate enough income to cover living expenses without relying on regular employment. Financial planning is the stepping stone towards this dream. By understanding where you currently stand financially, setting clear goals, and mapping out a plan to achieve these goals, you inch closer to a life where work becomes optional. This sense of independence promises a carefree retirement and offers the freedom to pursue passions, hobbies, and other life endeavors without monetary constraints.

Risk Mitigation

Every financial decision comes with inherent risks. However, effective financial planning involves understanding these risks and implementing strategies to minimize them. Whether it’s through diversifying investments, obtaining the right kind of insurance, or setting aside an emergency fund, a good financial plan always has risk mitigation at its core. This approach protects your assets from potential losses and ensures you’re better positioned to recover and adapt to any financial adversities.

Why is Personal Financial Planning Crucial?

In today’s dynamic world, ensuring financial stability and growth requires more than just earning; it demands strategic planning. Personal financial planning is the lighthouse, guiding individuals through the often turbulent waters of economic decisions and uncertainties. It not only shapes our present financial circumstances but also carves out our future financial path. Why is this meticulous planning so vital?

A Better Standard of Living

Financial planning is pivotal for elevating one’s standard of living. With a clear understanding of your income and expenses, you can allocate resources more effectively, ensuring you can afford the necessities and life’s little luxuries. It allows you to enjoy the present while laying a foundation for a prosperous future, balancing between enjoying today and preparing for tomorrow.

You're Prepared for Emergencies

Life’s unpredictable nature can throw many curveballs, from sudden medical expenses to unexpected home repairs. A sound personal financial plan includes provisions for such unexpected events. Setting aside an emergency fund and considering insurance options ensures that these unforeseen challenges don’t derail your financial stability, granting peace of mind in an ever-changing world.

You Grow Your Wealth

Financial planning isn’t just about managing expenses; it’s also about capitalizing on opportunities to grow your wealth. A well-structured financial plan can turn your savings into a growing asset pool by identifying viable investment avenues, considering tax-saving strategies, and compounding returns over time. This growth enhances financial security and opens doors to new opportunities and aspirations.

You Secure Your Retirement

One of the most critical aspects of financial planning is ensuring a comfortable and secure retirement. With rising life expectancies and the uncertainties of social security benefits, relying on external factors is risky. Personal financial planning ensures you set aside enough to maintain your desired lifestyle in the post-working years.

Understanding how much you’ll need and investing wisely will pave the way for a retirement filled with contentment and financial independence.

You Make the Most of Your Earnings

Every dollar earned holds potential; without a plan, it’s easy to let this potential slip away. Personal financial planning ensures you’re not just spending but optimizing each dollar for maximum benefit. Whether through smart spending, savvy investing, or timely debt repayments, a financial plan ensures that every earning contributes to your broader financial goals and well-being.

How to Create a Successful Financial Plan?

Crafting a successful financial plan is akin to charting a map for an expedition. While replete with challenges, this journey can lead to rewarding destinations—provided you have the right strategy in place. Whether navigating through the thickets of debt or climbing the peaks of investment returns, a well-laid plan is your compass. Here’s a step-by-step guide to creating a robust financial blueprint to set you on the path to fiscal prosperity.

Set Financial Goals

Before embarking on any journey, it’s crucial to know your destination. When it comes to finances, this translates to setting clear and attainable goals. It could be buying a home in the next five years, taking that dream vacation, or achieving early retirement. By defining these targets, you give your financial plan direction and purpose. Moreover, breaking these goals into short-term and long-term can provide a clearer roadmap, ensuring you stay motivated and on track.

Track Your Money

To control your finances, you first need to understand them. This involves tracking every dollar that comes in and goes out. Fortunately, with modern apps and tools, this process has become more manageable than ever. You gain insights into your spending habits by closely monitoring your income, expenses, and savings. This allows you to identify wasteful expenditures and reallocate funds to more critical areas, laying the foundation for financial discipline.

Budget for Emergencies

Life is unpredictable. Sudden medical expenses, job losses, or car repairs can upset your financial equilibrium. Hence, setting aside an emergency fund is paramount. This fund should ideally cover 3-6 months of your living expenses. Doing so ensures that unexpected financial shocks don’t push you into debt or force you to dip into your long-term savings, maintaining your financial security.

Tackle High-Interest Debt

High-interest debt, like credit card balances, can significantly drain your resources. These debts can compound over time, making them harder to pay off. Prioritizing their repayment can free up more money for savings and investments. Focusing on these debts first and then moving to lower-interest ones can reduce your financial liabilities faster and more efficiently.

Plan for Retirement

Retirement might seem distant, but planning for it early can make a world of difference. By starting to save and invest for retirement in your 20s or 30s, you harness the power of compound interest, letting your money grow over decades. Consider tools like IRAs or 401(k)s that offer tax advantages and ensure your golden years are comfortable and secure.

Optimize Your Finances with Tax Planning

Taxes, while unavoidable, can be managed with effective planning. You can minimize tax liability by understanding deductions, credits, and tax-advantaged accounts. This doesn’t just mean saving money during tax season and optimizing your investments and income sources to be tax-efficient year-round.

Invest in Building Your Future Goals

With your goals set and emergency funds in place, it’s time to focus on growing your wealth. This involves investing in avenues aligned with your risk tolerance and time horizons. Diversifying your stocks, bonds, or real estate investments can help maximize returns while mitigating risks, ensuring that you’re steadily moving closer to your financial aspirations.

Grow Your Financial Well-Being

Financial well-being isn’t just about numbers in a bank account. It’s about balancing living comfortably now and planning for the future. As you progress on your financial journey, consistently reassess and adjust your plan. Attend financial workshops, read books, or consult with professionals. Continuously educating yourself can ensure you’re making informed decisions that enhance your financial health.

Estate Planning: Protect Your Financial Well-Being

Your financial plan should focus on something other than your lifetime. Estate planning ensures that your assets are distributed according to your wishes after your demise. This involves creating wills, and trusts and considering life insurance policies. By organizing these aspects, you protect your financial legacy and alleviate potential burdens on your loved ones, ensuring your hard-earned wealth continues to benefit those you care about.

FAQs

What is the main goal of financial planning?

The main goal of financial planning is to align one’s financial resources and decisions with their short and long-term objectives, ensuring sustainable financial growth and stability throughout life’s various phases.

What is the most important step in financial planning?

The most crucial step in financial planning is setting clear, realistic goals. This provides direction and purpose, making it easier to develop strategies and allocate resources effectively towards achieving these objectives.

Can I do financial planning on my own?

Yes, with the right resources and tools, you can undertake financial planning on your own. However, consulting with a financial advisor or planner can provide expert insights and strategies, especially for complex financial scenarios.

What is the 50-30-20 rule?

Created by father-daughter duo Senator Elizabeth Warren and Amelia Warren Tyagi, this rule is detailed in “All Your Worth: The Ultimate Lifetime Money Plan.” The 50-30-20 approach is valued for its simplicity and adaptability, allowing individuals to gauge and adjust their spending habits quickly.

- 50% to Needs: These are essential expenditures like housing (rent or mortgage), utilities, groceries, health insurance, and transportation.

- 30% to Wants: These encompass discretionary expenses such as dining out, entertainment, shopping for non-essentials, vacations, and other leisure activities.

- 20% to Savings and Debt Repayment: This includes contributions to savings accounts, retirement funds, and the payment of debts beyond minimum required amounts.

Final Words

The vast benefits of financial planning underscore its importance in achieving a prosperous and secure future. With a clear plan, one is better equipped to face financial challenges and make the most of opportunities, leading to growth, security, and peace of mind.

For those seeking guidance on this journey, EduCounting offers invaluable assistance. Through our meticulously curated blogs and courses, we shed light on critical financial topics, strategies, and best practices. Whether you’re a novice starting your financial journey or someone looking to refine their financial acumen, EduCounting is a reliable companion, empowering you to forge a path towards financial success.