5 Essential Reasons Why Your Business Needs Insurance

Starting and running a business is an exciting journey. Whether it’s your first time launching something or you’ve been doing this for years, there’s always that thrill of building something of your own. But let’s face it—there are risks too.

How Much is Car Insurance for Teens? What Teens Need to Know

Learning to drive is a huge milestone in a teenager’s life. It brings freedom, independence, and a whole lot of responsibility. But once you finally get that driver’s license in your hand, there’s one more thing you need to think

How to Pay No Taxes on Rental Income: Proven Strategies

Being a landlord can be a great way to build wealth, but it also comes with its fair share of challenges, especially when it comes to taxes. Many new landlords are surprised by how much of their rental income gets

What is Interest Saving Balance? From Beginner to Pro

An Interest Saving Balance is the part of your loan or credit balance that, It helps you avoid or minimise additional interest charges if you pay it off before the due date. Put simply, it’s the amount you must pay off

How Insurance Protects You from Financial Loss

Life is unpredictable. One moment, everything seems fine, then suddenly, disaster strikes. Whether it’s a house fire, a car accident, or an unexpected medical emergency, financial loss can happen in an instant. Without the right protection, you could find yourself

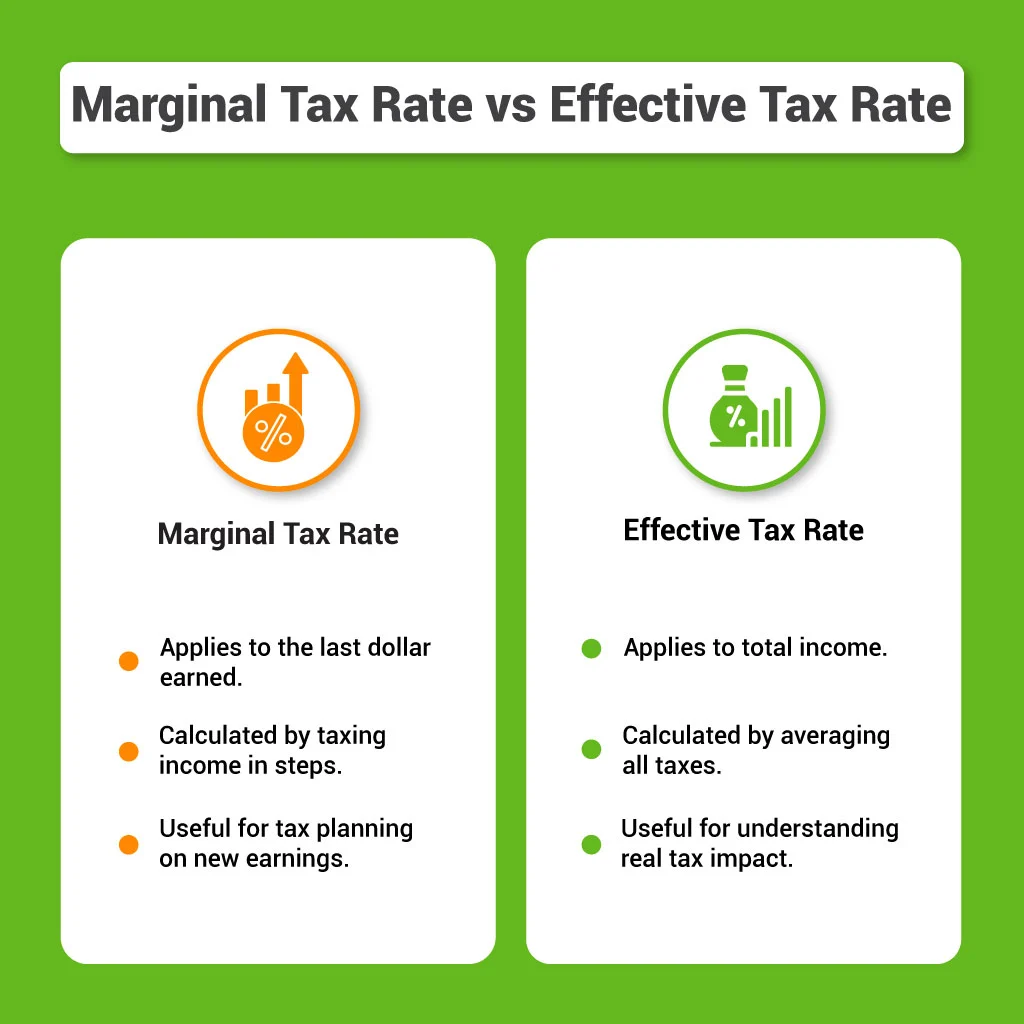

Marginal Tax Rate vs Effective Tax Rate: What Every Taxpayer Should Know

The United States operates under a progressive tax system, which splits your income into multiple tiers. Each tier, or bracket, applies a different tax rate solely to the portion of your income that lands within it. For instance, a single