Are you baffled because your credit score dropped for no reason? You’re not alone. This unnerving experience can be particularly disconcerting if you’ve been conscientious about your financial decisions. A sudden dip in your credit score may seem arbitrary, but it usually isn’t the result of some mysterious, unexplainable factors. Credit scores are complex calculations influenced by a multitude of elements, some of which may not be immediately obvious.

Understanding the potential reasons behind a sudden credit score drop is crucial for both your financial peace of mind and future planning. While it’s easy to feel helpless in the face of a declining score, gaining insights into the likely causes can empower you to take corrective action. Stay with us as we unravel the mystery behind those unexpected credit score changes.

What Is a Good or Bad Credit Score?

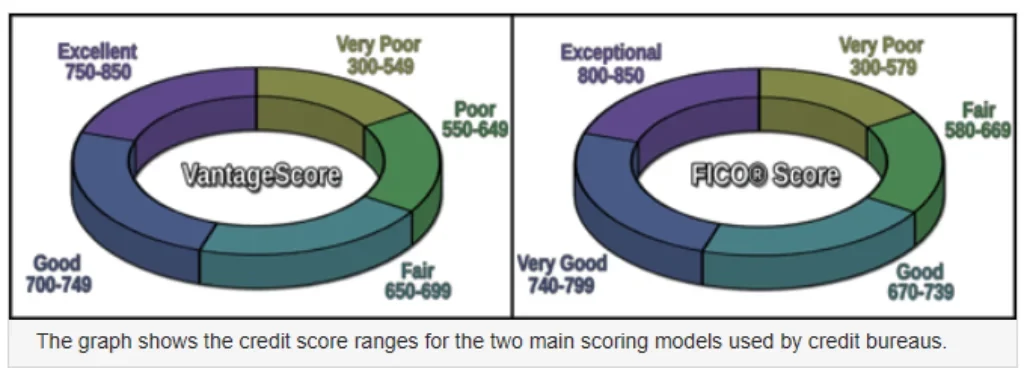

Credit scores are a numerical way to represent how likely you are to pay back debts and your creditworthiness. While these ranges vary slightly between different scoring models, they provide a general guideline. A higher credit score can unlock loan approvals, better interest rates, and more favorable financial opportunities.

Using the FICO® Score system, which has a scale from 300 to 850, a score within the 670 to 739 bracket is deemed good. Scores that exceed 739 fall into the very good category. On the flip side, scores that sit below 669 are viewed as mediocre or subpar. As of 2022, based on information from Experian, the median FICO® Score in the US stood at 714.

Utilizing the VantageScore model, which also adopts a range of 300 to 850, a score hovering between 650 and 749 is considered good. Those boasting scores above 750 are categorized as excellent. Conversely, scores falling below 650 might be considered average or even below average. According to data from 2020, the typical VantageScore in the US was reported to be in the ballpark 688.

Holding a commendable credit score is advantageous for various reasons, including the potential to spare you considerable financial strain in the long run. A robust score enhances your chances of securing diverse credit offerings at competitive interest rates. Conversely, a less-than-stellar score might hinder your ability to access specific credit facilities, or you might only secure them at steeper interest rates due to the increased perceived risk by lenders.

6 Reasons Why Your Credit Score Might Suddenly Drop

Credit scores can be perplexing. One moment, you’re enjoying the benefits of a solid score, and the next, you wonder why it suddenly dipped. While it may seem that your credit score dropped for no reason, it is integral to your financial life, affecting everything from loan approvals to interest rates. So, understanding what influences its movement is crucial. Let’s dive deep into six potential reasons your credit score might unexpectedly decline.

You Have a High Balance on Your Credit Cards

Credit Utilization Impact: Credit utilization, the ratio of your credit card balances to their limits, plays a pivotal role in credit score calculations. If this ratio increases, indicating you’re using more of your available credit, it can be perceived as a higher risk and potentially lead to a score drop.

Perception of Risk: High balances might give lenders the impression that you’re living beyond your means or relying heavily on credit. Even if you pay off your balances in full each month, the reported balance can affect your score.

Balance Diversity: It’s not just about how much you owe in total but also how that debt is distributed across your cards. Owing a significant amount on a single card as opposed to smaller amounts spread out can influence your score differently.

You Have Late or Missing Payments

Payment History: Your payment history is one of the most substantial components of your credit score. Even one late or missed payment can have a disproportionately negative impact, especially if your score was high to begin with.

Compound Effects: Multiple missed payments or consistently paying late compounds the negative effect on your score. It signals to lenders that you might be facing financial difficulties.

Severity and Frequency: A payment that’s 90 days late can hurt your score more than one that’s 30 days late. Additionally, frequent late payments on different accounts can be more damaging than the occasional oversight on a single account.

You Closed a Credit Card or Paid Off a Loan

Reduced Credit Availability: Closing a credit card reduces your available credit, which can increase your credit utilization rate, especially if you carry balances on other cards.

History Length: Long-standing accounts contribute positively to your score by demonstrating a long credit history. Closing older accounts can shorten your credit history’s average length, affecting your score.

Credit Mix: Credit scoring models often consider the variety of credit types you have. Closing a unique type of credit (like a store card) can decrease your credit mix, potentially impacting your score.

You Paid Off an Installment Loan

Change in Credit Mix: Scoring models often favor a balance of various credit types. By paying off an installment loan, like an auto loan, you’re altering that balance, which can lead to a score change.

Short-Term Drop: Even though it’s beneficial to pay off debt, your score might experience a temporary dip before it starts to rise, reflecting the positive change in your financial situation.

Loss of Positive Information: Regular, on-time loan payments positively affect your score. You lose those positive marks once a loan is paid off and eventually drops off your report.

Applied for a Mortgage, Loan, or New Credit Card

Hard Inquiries: When lenders check your credit as part of the application process, it results in a hard inquiry. While one inquiry might have a minor effect, multiple inquiries in a short span can reduce your score.

New Credit Risks: Opening several new credit accounts in a short time frame can signal higher risk to lenders, especially if you have a short credit history.

Average Age Impact: New credit accounts lower the average age of your credit history, which can influence your score.

You’re the Victim of Identity Theft

Fraudulent Accounts: If someone opens accounts in your name without your knowledge, these accounts (and their balances) can dramatically and suddenly affect your credit score.

Unauthorized Charges: Unauthorized charges can lead to missed payments if they are noticed and paid. This can have a cascading negative effect on your score.

Resolution and Recovery: While credit bureaus and institutions often have processes to help victims of identity theft, resolving the situation can take time. It’s crucial to monitor your credit report regularly and report discrepancies immediately.

Ways to Improve Your Credit Scores

Your credit score is more than just a number; it reflects your financial health, and it’s not possible that your credit score dropped for no reason. A high credit score can open doors to better interest rates, loan approvals, and even job opportunities in some cases.

Conversely, a low score can limit your financial freedom. Whether you’re aiming to reach the pinnacle of creditworthiness or simply looking to give your score a healthy boost, there are several strategies you can employ.

Pay Your Bills on Time

One of the most influential factors in your credit score is your payment history, making up a substantial portion of the score’s calculation. Consistent paying your bills on time demonstrates to lenders that you’re reliable and less risky. Overdue payments, especially those over 30 days late, can significantly affect your credit score.

Consider setting up automatic payments or reminders to ensure punctuality. With most online banking systems, you can schedule payments in advance, ensuring they’re always on time. If manual payments are more your style, setting reminders on your phone or calendar can help you stay on top of due dates.

Minimize Overall Debt

High balances, especially relative to your credit limit, can signal to potential lenders that you’re over-reliant on credit. Reducing the amount you owe, particularly on revolving accounts like credit cards, can positively impact your credit score by lowering your credit utilization rate.

Tackling debt requires a strategic approach. Focus on paying off high-interest debt first, or consider consolidating your debt through a balance transfer or personal loan. Whichever method you choose, the key is persistence and a commitment to living within your means.

Monitor Your Credit Regularly

Regularly reviewing your credit report can help you catch and correct inaccuracies or discrepancies affecting your score. Remember, errors, no matter how minor, can have an outsized impact on your creditworthiness.

If you find errors on your report, promptly dispute them with the credit bureau. This process can take some time, but it’s crucial to ensure your score accurately reflects your financial habits. Moreover, regular monitoring can also help you detect signs of identity theft or fraud early on.

Avoid Applying for Unnecessary Credit Cards

Whenever you apply for a credit card or loan, the lender conducts a ‘hard inquiry’ on your credit report. While a single inquiry might have a minor effect, several in a short time can signal to lenders that you might be at a higher risk, thereby reducing your score.

It might be tempting to apply for every appealing credit card offer, especially those promising lucrative sign-up bonuses or rewards. However, evaluating the necessity and long-term value of a new credit account versus the temporary ding on your credit score is essential.

Practice Responsible Spending Habits

One of the foundational steps to improving your credit score is to live within your means. By creating and sticking to a budget, you can ensure you’re not spending more than you earn, reducing the need to rely on credit.

Continually educate yourself about personal finance and credit management. Understanding the implications of your spending and borrowing habits can help you make more informed decisions, setting you on a path to a healthier financial future.

Final Word

Experiencing a situation where your credit score dropped for no reason can indeed be disconcerting. It feels like a shadow lurking in your financial background, making you question all your previous monetary decisions.

However, understanding potential underlying causes and cultivating healthy financial practices can steer you towards re-establishing and sustaining a robust credit reputation. Consistent oversight and immediate remedial steps are your allies against enduring financial mishaps.

To further navigate the maze of financial literacy, Educounting offers comprehensive resources and tools. Understanding financial terms and concepts can often be overwhelming, but Educounting is designed to simplify and demystify the process. By leveraging its courses and expert insights, individuals can not only comprehend the intricacies of their credit score but also gain a holistic understanding of personal finance. Educounting by your side makes you one step closer to making empowered financial decisions.