In the case of understanding credit cards, People often debate whether credit cards are good or bad. The truth is, it depends on the person and how they use their card. Credit cards can be a powerful financial tool if used responsibly. They offer convenience and can help people build their basics of credit history. However, credit cards can also lead to debt if not used carefully.

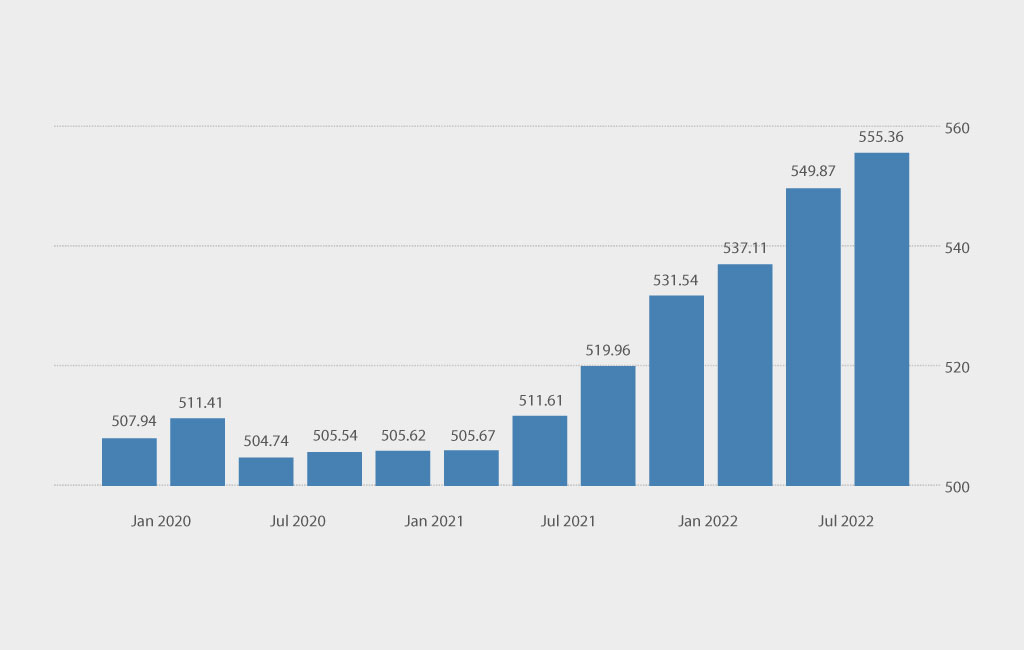

With Credit Card Accounts in the US increasing to 549.87 Million in the 2nd quarter of 2022 from 537.11 Million in the 1st quarter of 2022, you must start understanding how credit cards work and how to use your credit card to make the most of it without racking up debt. This blog post will explore the basics of understanding credit cards for beginners, including how they work and tips for using them responsibly.

What Are Credit Cards?

A credit card is a plastic card that gives the cardholder a line of credit they can use to make purchases. When the cardholder makes a purchase, they borrow money from the credit card issuer. If applicable, the cardholder will need to repay the debt, plus interest and fees.

Credit cards are issued by banks, credit unions, and other financial institutions. They can be used anywhere that accepts credit cards as payment. Credit cards offer many benefits, including convenience, fraud protection, and building a credit history. However, they also come with some risks, such as the potential for debt and high-interest rates.

Each time a person who uses credit cards pays for something, they borrow money to pay for the purchase. As the credit card holder, you are responsible for paying the money back, however, you get to choose when you pay it back. If you don’t pay it all back in the same month, you have to pay back a “minimum amount” as defined by the bank, and delaying your payment costs you extra cash in the form of interest.

Understanding Credit Cards

Before you use a credit card, it is crucial to understanding credit cards and how they work. Credit cards are a type of loan; you will need to repay the debt plus interest and fees.

How Does a Credit Card Work?

First, you must fill out an application; many are online or can be done at a bank or even over the phone. They want your name, address, social security number, and other information. Once they have that, they can access massive amounts of data and determine if you’re good at paying your bills/debt.

But, once approved for your shiny new card (which can sometimes be with your favorite professional team’s logo or a design or picture), the bank will set a credit limit.

A credit limit is the maximum amount of money you can have outstanding or borrow for purchases at any time. If it’s $500, then in your first month, you can spend $500. If you buy all your friends new running shoes, which cost $497, you only can spend THREE more dollars, and you are CUT OFF!! But if you pay off the $497 at the end of the month. Voila! You can borrow up to $500 again.

Side note: Want to hear a podcast with Mak and G on understanding credit cards, take a listen here:

The approved credit limit depends on a couple of things. Do you make a big fat salary? If yes, you’ll probably be given a higher credit limit. Do you have a lot of debt? If so, you will probably have a lower credit limit. What’s your history in paying back the money you borrowed? If you have a great credit score, you’re more likely to get a lot more. Once they calculate all of these pluses and minuses, they get to a total limit.

The major payment networks are the ones that move all the money around for a credit card. Have you ever heard of American Express, Discover, Mastercard, and Visa? These are payment networks. When you make a purchase and SWIPE your card, insert the card, or “tap it,” a bunch of electronic processes take place in the background, where the bank pays for the purchase, and you get charged! These networks’ job is to ensure that the merchant receives their money and that your bill is calculated each month correctly. Don’t worry, they are seriously good at making sure you get ALL of your charges.

You can pay a predetermined minimum amount when using a credit card receive your monthly credit card bill. Credit card companies are praying that you pay the small amount because they can then charge you LOTS of INTEREST. So, they are very interested in your payment habits. I want to help you MINIMIZE that; I highly encourage you to pay the entire credit card balance each month.

Paying the minimum amount each month is the most costly option because of interest. Paying the amount in full will always be the best move because there is no interest, and I’ll give you a couple of gold stars. In some cases a credit card company may give you a “grace” period which gives you a couple of extra days to pull your money together and avoid interest, but you will need to talk directly with customer service to request this rare option.

Credit bureaus collect HUGE amounts of data to calculate credit scores. They also will give you a credit report. Think of the report like a kid’s report card. It gives a grade for the different credit cards and other things you borrow and pay back.. If you pay your bill after the date it was due that’s NOT a passing grade. If you pay on time every month for ten years, that’s an A+.

So, where does a credit bureau get information about credit card to fill out your report card? They get it from the card issuer, who regularly reports to them. It’s kind of like Mak’s & G’s teachers. They give input that goes into their report cards. Your payment history from your credit card is a HUGE part of your credit score (35%). We all know that a person’s credit score is a number that lenders will use to assess the risk of lending money (in addition to insurance rates, getting a job, and more). To avoid any late fees or potential credit score damage, you must pay the minimum amount due each month on time or suffer some major consequences.

For more information on understanding credit cards and how credit cards work, check out these awesome videos we made to help explain credit cards when Mak & G were young:

Credit Cards vs. Debit Cards

Accountants talk about debits and credits all the time (BORING!!!). So, why shouldn’t a CREDIT card have a close relative called a DEBIT card? They act differently, just like your cousin Johnny acts differently from you. A standard debit card is linked to your bank account, just like a check. It’s like writing a check, but you use a plastic debit card instead of paper. That means that each time you use it to make a purchase, the money is automatically taken out of your bank account. You don’t have the choice of when to pay and how much. The decision is made for you.

Using a debit card, you use your money rather than borrow money from someone else and pay it back later. It’s no different than using the cash in your pocket. While some debit cards will offer rewards programs to users, they are typically not as good as those provided by credit card issuers. The main reason is that credit card companies charge the companies that accept them. So, they make some money and can pass some of the benefits on to those of us who use them. Credit cards also generally have more protection against fraud and people who want to steal your money. It’s a bit of peace of mind when you’re limited by the amount a thief can get if it’s done on a credit card.

Another widely used debit card type is the “prepaid” debit card. These cards are not linked to a bank account. Instead, the cardholder “loads” money on the debit card. The amount you can spend using the card is capped at the amount you have loaded onto it. So, if you want to give a kid an allowance, you can put their allowance on it, and they can NOT spend more than the balance on the card.

Often, prepaid debit cards charge various fees not associated with standard debit cards. As you can imagine, prepaid cards also have some limitations, particularly when compared with traditional debit cards. For instance, most prepaid-style debit cards do not allow mobile banking options or access to ATMs. Plus, you may be unable to use them everywhere you’d like.

The good news (or bad news, depending on how you look at it and how responsible or irresponsible you are) is that prepaid and traditional debit cards do not affect credit scores. That’s because it doesn’t give the credit bureaus any information on how well you pay back the money you borrow since you can only use the amount put on the card.

Types of Credit Cards

From “miles” for free flights, hotels, or travel discounts to “points,” you can turn these benefits into cash to ultra-low interest rates and cards with no annual fee. Credit card companies offer their customers many features and options in hopes of earning your business. With so many types of cards to choose from, it makes your head spin. This section will break down the types of credit cards available with a brief explanation of each one.

Rewards Cards

A rewards card is a credit card that gives “rewards” to the cardholder when they use it to make a purchase. Typically, rewards cards are given to individuals with good credit scores. These cards work best when you pay your monthly credit card bill. If you carry a balance, you can expect that the minimum interest charge could quickly negate the value of the rewards you earn.

Some of the most popular types of rewards offered by credit card companies are as follows:

Cashback Rewards. Cashback rewards cards give the cardholder “cash” each time they use the card to make a purchase. The “reward” money usually comes annually in a check, mailed directly to the cardholder, or directly deposited into their bank account. Cashback rewards may also be used to pay down the credit card balance. Me likey, likey free cash!

The airline, Hotel, and Travel Rewards. Some credit cards offer “points” or “miles” that can be exchanged for flights, hotels, and other travel discounts. Often, these rewards come with restrictions, like when you can travel. You have to be prepared to do some math, work through the fine print, and understand the number of points needed for reward travel. Some rewards may only be redeemed through airlines and hotels that partner with the card issuer, while others offer more general travel rewards that are more flexible and can be used for most travel expenses. So, be careful and choose wisely! Travel cards are good; sometimes, you can pair them with your other miles. Mak & G loved when I used our points to do the Disney cruise in Europe!!

Store Rewards. Store-branded credit cards often reward cardholders for their loyalty by offering discounts and benefits when using their card at the store or with store partners. We all like to feel special, and the Kohl’s card has been a personal favorite with special discounts, Kohl’s cash, and other benefits that make us feel like we’re saving all the time.

Low-Interest Credit Cards

While low-interest credit cards won’t give you travel rewards or cash back, they have their benefits through lower interest rates, making it affordable to carry card balances. That’s the key, you don’t get a benefit if you don’t have a balance, and we’re TRYING to avoid carrying a balance if possible.

Often, low-interest credit cards will offer 0% introductory annual percentage rates (APR) during a specific period, allowing the payoff of large purchases without paying interest. Be careful because sometimes, once you go past the introductory period and haven’t paid off the transfer, they’ll add the interest from the BEGINNING of the introductory period. It feels like a big slap in the face. But, sometimes, juggling these cards (in the short run) can be helpful if it gets you out of a bind. We’ve all been there. But, to qualify for a low-interest credit card, you generally need a good credit score.

Balance Transfer Credit Cards

Credit cards offering balance transfer programs allow you to move debt from other credit cards to take advantage of lower interest rates. These types of cards generally require good to excellent credit scores. Juggling can get confusing, and you have to be on your game. Plus, make sure you have a plan because when the music stops (the intro transfer rate is over), it can be very painful, as mentioned above, with interest back to the beginning!!

Credit Cards for Those with Average to Bad Credit Scores

There are limited options for individuals with average to bad credit scores. These cards rarely offer rewards, and the interest rates are much higher than other cards. Ok, let’s be honest; the rate can be SKY HIGH!! Using these types of credit cards can help you improve your credit score to qualify for better credit card options in the future. So, there is a benefit, but not as apparent as other rewards programs.

If you have average credit, the credit card company may not charge annual fees or offer certain rewards only for a fee. The best option for those with bad credit is what is known as a “secured” card. The idea is that a credit card company doesn’t want the risk of lending money if they don’t have something they can access to repay an outstanding loan if the cardholder doesn’t pay.

So, the card owner will generally have to pay a set fee as a security deposit which is returned once the cardholder closes the credit card account or upgrades to an unsecured credit card. That’s only if you close it in good standing and don’t owe them anything. Over time, the secured card offers a less expensive option for those with bad credit because unsecured cards usually charge insanely high-interest rates.

Student Credit Cards

College students are not automatically qualified to receive a credit card (which is a good thing). Federal law prohibits credit card companies from issuing cards to anyone under 21 without proof of regular income or co-signer. A co-signer is someone willing to use their credit score to help an applicant boost theirs (for instance, I’ve co-signed for Mak & G to get a credit card). In situations where none of this is an option for a college student, secured credit cards allow them to establish a credit history.

The Costs Associated with Credit Card Use

Aside from the annual fee, credit card companies generate revenue in several ways. Understanding credit cards often come at a price, but if you play your cards right, you can avoid many costs when you use them responsibly.

The following section lists some of the most common costs associated with credit card use.

Interest Payments

Different credit cards have different APRs or interest rates. These rates will also differ depending on how you use the card. In other words, credit cards often have different rates for cash advances, balance transfers, and purchases. You will not accrue interest if you pay your credit card balance in full each month. It also depends on your credit score. The lower the score, the higher the rate. You have to treat it with care; if you do, it will take care of you in the long run when you need it.

Annual Fees

Generally, I say, “Heck no to annual fees!”. But, sometimes, it does make sense, depending on your needs. Credit card companies will sometimes charge you an annual fee for using their card. Annual fees can range from $25 to more than $200. The sales pitch is easy. With the fee, you get EXTRA rewards. These are supposed to offset the cost. I have one card like this. It didn’t charge fees when I used it overseas, gave me extra points, some insurance benefits, and a good cashback rate. Every year, I run some calculations and see whether it is worth it. So far, so good. However, you should not have to pay annual fees in most cases, especially if you have good credit.

Late Fees

Late payment fees will vary, and federal laws limit the amount companies can charge. However, these fees can add up, and if you can’t afford to pay your credit card payments on time, you probably shouldn’t be using the card. Being late to a family recital may be good if you don’t want to go, but being late paying a credit card is NEVER a good idea.

Transfer Fees

A credit card’s average balance transfer charge is between 3% and 5% of your transfer amount. Certain credit cards will waive that fee if you transfer debt from another card within a particular promotional period. You have to make sure this makes sense because a one-time fee in this range makes me cringe just writing about it.

Fees for Foreign Transactions

Credit cards will typically charge between 1% and 3% of any transaction made with merchants outside of the U.S. If you like to travel, this can really add up, look around for a card that doesn’t charge for this. I did, and it was really helpful when on that wonderful European cruise with Mickey and the kids.

Benefits of Using Credit Cards

No one should be racking up mounds of bad debt. Bad debt is usually money that’s owed for stuff that was a “want.” It doesn’t provide any future benefit, or wasn’t something needed, like surgery. However, there is good debt, which creates wealth. Buying a business with debt can produce income, or purchasing an asset that becomes more valuable (like a house) is good.

If you have problems differentiating between wants and needs, then debit cards can be great! By the way, a video game system is a want and not a need, even though it provides future benefits to you as a parent (Grant leaves us in peace for hours at a time :)).

One issue with a debit card is that it won’t help you to establish any credit history or build a good credit score. There are times in your life when you may need to borrow money. So, it may not be your best option. Understanding credit cards, without a bit of guidance, can be dangerous, just like fire. But there are several other benefits, depending on your chosen card.

These benefits include:

The sign-on bonuses

When offered, sign-up bonuses can help you squirrel away some money for a rainy day fund (from cashback sign-up bonuses) or start you saving for your next vacation (in the case of extra miles or travel point bonuses).

The rewards

Over time, you are rewarded for the money spent using the credit card. Who doesn’t like to get rewarded? Some cards can even get you VIP access to events!

The 'only' payment option

Sometimes, there is no other way to get what you need without a credit card. Have you ever tried to rent a car? How about a rental moving truck? Sometimes you need to hold a reservation, like a hotel room. Or, the only way to pay is with a card online. Sometimes, you get cut off from access without it.

The ability to build your credit

Establishing a record of on-time payments will make it easier to borrow money at a lower interest rate down the road. That can be especially useful when purchasing a new car or a home.

Keep track of your spending

Tracking your spending can be tough. How do you know if you’re within your budget if you aren’t tracking? Learning and understanding credit cards can help organize your spending quickly. Downloads can be organized on a spreadsheet and quickly OPEN YOUR EYES to where all the money is going.

Reducing your costs

This is strange, for sure. However, sometimes it’s cheaper with a credit card. When living in Illinois I had a “transponder” for the toll roads. To obtain the transponder, you were required to have a credit card. Paying tolls via the transponder was ½ the price than if paying with cash. Did you hear that? Half the price. Yes, half!

The introductory APR offers

As I mentioned, if you are lucky enough to get a credit card with a 0% APR for an initial period, you will avoid interest charges on any purchase or balance transfer. Sometimes, that’s a huge win.

The flexibility

While you should pay your credit card in full at the end of each billing cycle, one benefit of credit card use is the ability to pay off items over time. That helps if you must make a significant purchase or pay for some financial emergency. We’ve all been there. Thank goodness kids only need braces once (I hope!???).

The Downside of Using Credit Cards

There are some downsides to using a credit card that you should be aware of.

High rate of interest

This is the number one reason to be careful with understanding credit cards. The interest rate will eat you if you don’t pay your balance in full each month. However, if you pay your outstanding bills on time, you will avoid paying any interest.

The late payment fee

This is an avoidable fee. Paying your bill on time will help you avoid this one. Worth repeating: Pay your bill on time!

Purchase power

Using a credit card makes it easy to justify purchases you can’t afford. This is the number one reason people get into debt trouble. Use & understanding credit cards wisely. Don’t let plastic rule your life.

The points and miles game

Getting caught up in collecting points and miles can be all too easy. However, if you don’t use them, they are worthless.

Final Words: Understanding Credit Cards and Using them Wisely

The benefits can outweigh the costs of using credit cards if you use them wisely. You get to keep your sanity because you’re not carrying a checkbook or cash. That’s a pain. Plus, with COVID, do you want to be touching money?

Here are a few good credit card habits that you should internalize:

- Always pay your credit card bill in full and on time each month.

- Always keep your credit card balance at or below 30% of the card’s credit limit.

- Wait for six months or more before applying for a new credit card. Nobody likes a waffler.

- Perform a weekly review of your account (which you can do online) to track your spending and avoid fraudulent charges. You’d be surprised what you might find.

- Credit cards without an annual fee that you use should remain open to maintain a good credit score. Sounds strange, but true. You still need to watch your statements, though.

- Using credit cards responsibly can quickly and efficiently establish good credit.

If you are a responsible human being, give yourself some credit. See what I did there? 🙂 If not, take it slow and build good habits before taking on too much. If you work it right, you’ll get the rewards. The extra perks, insight into your spending, and access to affordable money when you need to borrow it without any hassle down the road.