In today’s world, financial literacy has become a necessity. One of the most fundamental concepts everyone should grasp is the difference between saving and investing. Both play vital roles in wealth accumulation, but they function quite differently. This article aims to delve into the details of these terms, highlight their similarities and differences, and provide guidance on when and how to use each method effectively.

Although saving and investing may seem like two sides of the same coin, they have distinct implications for your financial health. Understanding the distinct difference between saving and investing is crucial for anyone looking to take charge of their financial destiny.

What is Saving?

Saving is setting aside a portion of your income for future use. It usually involves putting money into safe and highly liquid avenues like savings accounts, fixed deposits, or money market accounts. The primary goal of saving is not to generate high returns but to protect your capital and keep it readily accessible.

In addition to being a fallback for unforeseen expenses, saving is often the first step toward larger financial goals. It could refer to various savings goals, such as setting aside money for unexpected expenses, funding a trip, or accumulating funds to make a down payment for a vehicle or property.

Example

You can consider saving as regularly transferring a part of your earnings or allowance to a bank savings account. For example, you plan to purchase a laptop that costs $2,000, and you have a ten-month timeline. You can accumulate the required amount by allocating $200 monthly to your savings without incurring any loan interest or credit card charges.

The Pros and Cons of Saving

When you save, your principal amount is secure, and you don’t risk losing it. Furthermore, savings accounts offer high liquidity; you can access your funds at any time without worrying about penalties or market conditions.

- Helps the user establish an emergency fund.

- Facilitates meeting immediate or short-term objectives such as purchasing daily necessities, a new gadget, or planning a holiday.

- Offers a minimal risk of loss as the FDIC insures savings deposited in banks.

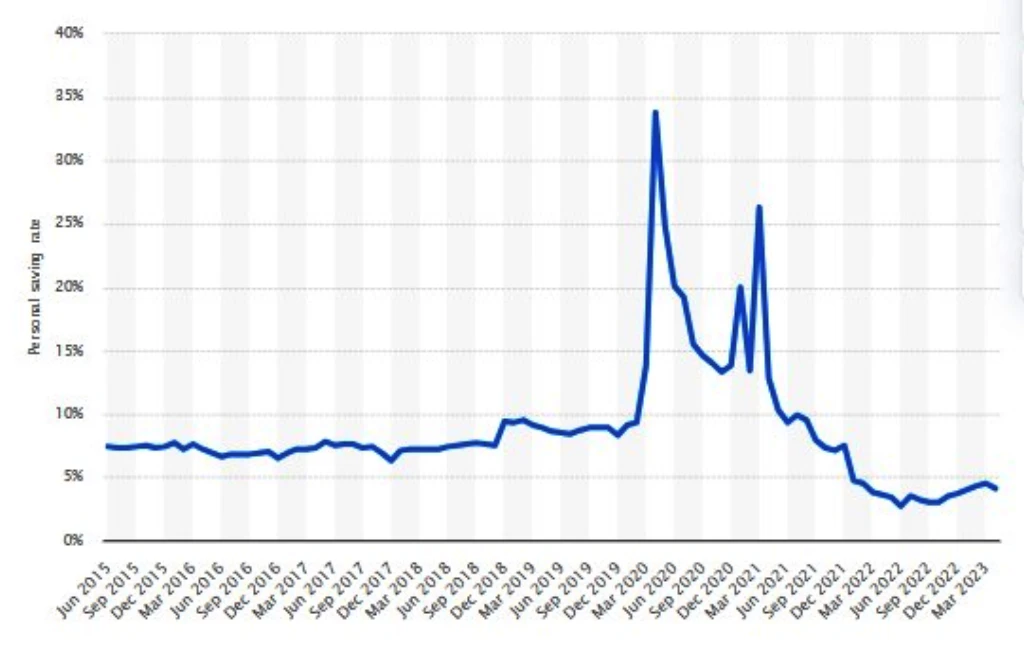

Despite its advantages, saving also comes with its drawbacks. Primarily, the returns from a savings account are minimal. In fact, the interest rate on most savings accounts is lower than the inflation rate, which means your money loses value over time. Moreover, with saving, you miss out on the opportunity to grow your money exponentially, as you might with investing.

- Offers considerably lower returns.

- There might be a devaluation of funds due to inflation.

- This presents potential opportunity costs, as the money is not invested in assets that, while riskier, could provide higher returns.

What Is Investing?

Investing is the process of using your money to purchase assets that have the potential to earn a return. The primary goal of investing is to create wealth over the long term and to keep up with or outpace inflation.

Investing can also help you achieve more substantial financial goals. For instance, investing might be an effective way to save for your child’s college education or your retirement, both of which require a larger sum of money that might be difficult to achieve through saving alone.

Example

Participating in a 401(k) retirement program is a prime example of investing. It involves regularly earmarking a slice of your earnings to be invested in a broad mix of stocks, bonds, and other financial instruments, aiming to increase your savings over the years.

A 401(k) program is a kind of retirement plan that many employers provide as a perk to their staff. A percentage of your income is contributed to this plan, and in many cases, your employer pledges to match your contribution up to a specific limit. The plan administrator then invests this money in a portfolio that may include mutual funds, stocks, and bonds.

A standout feature of participating in a 401k retirement program is the tax advantages it offers. Your 401k investments grow on a tax-deferred basis, allowing your money to compound over the years and potentially offering higher returns than a conventional savings account.

Through consistent investing over time, you can reap the benefits of compounded returns and potentially amplify your retirement nest egg significantly. Furthermore, selecting a diverse array of investments that align with your risk tolerance and retirement objectives is vital, and routinely evaluating and tweaking your investments to ensure they continue to serve your financial goals effectively.

The Pros and Cons of Investing

Compared to saving, investing has the potential to offer higher returns. Investment instruments, such as stocks and bonds, are more volatile than savings accounts, but they could offer higher returns in the form of capital gains or dividends.

- Possibility of yielding higher returns compared to savings.

- Contributes towards reaching substantial long-term financial objectives.

- A variety of different assets can help to reduce the potential risks.

Investing involves risks, as the value of your investments may change unexpectedly, causing you to lose some or all of the money you’ve put in. Furthermore, investments often require a longer time horizon and may not offer the same level of liquidity as savings. You may not be able to withdraw your money without incurring fees or penalties, and in some cases, it may take some time to convert your investments back into cash.

- Potential for loss, particularly in the short term

- Necessitates perseverance and dedication

- Often demands more extended periods to yield meaningful results

How are Saving and Investing Similar?

Saving and investing are two fundamental aspects of personal finance. They both aim to help you build a secure financial future and enable you to achieve your financial goals. Both require discipline, regularity, and an understanding of your financial needs and circumstances.

Another similarity is that both can provide a form of income. Saving can earn interest, although it’s usually quite low, while investing can generate a return in the form of capital gains, dividends, or rent. Thus, both saving and investing allow your money to work for you instead of merely sitting idle.

The Common Principle Underpinning Saving and Investing

At the most fundamental level, saving and investing aim to set aside money for future use. They serve as financial tools that help us accumulate wealth over time. As Chris Hogan, a financial expert and author of ‘Retire Inspired’, puts it,

"First and foremost, both involve putting money away for future reasons."

Chris Hogan Tweet

Whether saving for a rainy day or investing for long-term growth, the essence of both activities lies in postponing immediate consumption for future financial security and prosperity.

Utilizing Financial Institutions for Saving and Investing

Another similarity between saving and investing is their reliance on financial institutions. Savers often open accounts with banks or credit unions, while investors use funds with independent brokers. Renowned online investment brokers such as Charles Schwab, Fidelity, and TD Ameritrade have made it easier for individuals to embark on their investing journeys.

The Importance of Savings for Both Savers and Investors

Both savers and investors understand savings’ critical role in a healthy financial life. For savers, the importance is clear. However, it may not be as obvious why investors typically look for higher returns and also need to prioritize saving. The answer lies in risk management.

Investing for Future Aspirations and Security

Lastly, both saving and investing revolve around planning for the future. Savings provide a safety net for unplanned expenses or short-term goals, while investing allows money to grow over the long term to achieve larger future goals and aspirations. Hogan elaborates, “Investing is money that you’re planning to leave alone to allow it to grow for your dreams and future.”

The Difference Between Saving and Investing

Despite the many similarities between saving and investing, there are some key distinctions. The main difference lies in their respective objectives: while saving is focused on preserving capital in the short-term, investing is associated with reaching long-term goals. Savings are generally liquid and easily accessible, but they may not be able to keep up with inflation over the long term.

Term & Period

When it comes to the term and period, saving and investing have different implications. Saving is usually meant for short-term goals or needs. It’s the money you might need to access within a few months or a few years. Investing, in contrast, is typically done with a long-term perspective. It’s meant for money you won’t need for many years, often for goals at least five years away.

The reason for this difference is primarily because the market goes through fluctuations. It takes time for investments to endure the inevitable rise and fall of the market and produce substantial profits. Savings, on the other hand, are more stable but provide limited growth.

Fund Access

Investing your funds is easier when you save compared to when you invest. Savings are highly liquid, meaning you can access them anytime, making them suitable for emergencies or unexpected expenses. You can take out money from a savings account without facing any fees and receive immediate access to the funds.

Investments, on the other hand, have lower liquidity. Depending on the type of investment, it might take days or even weeks to sell your assets and access your funds. Some investments, like certain retirement accounts, also have penalties for early withdrawal, making them less suitable for unexpected costs.

Risk Assessment

Regarding risk, saving and investing occupy opposite ends of the spectrum. Saving is generally low-risk. The amount you put in a savings account is insured up to a certain limit, and the value of your savings doesn’t decrease.

Investing, by contrast, is high-risk. The value of investments can fluctuate based on a wide range of factors, including market conditions, economic indicators, and company performance. This means that while you have the potential to earn a substantial return on your investment, you also risk losing some or all of your initial investment.

Earning Potential

While saving is a secure way to store your money, it doesn’t provide substantial growth. Interest rates on savings accounts are often minimal, barely keeping up with inflation. This means that the real value of your savings might even decrease over time when you account for inflation.

On the other hand, investing offers the potential for much higher returns. While it does come with a higher risk, investing in the stock market or real estate, for example, has the potential to provide substantial growth over time. The potential returns from investing are generally much higher than the interest earned from a savings account.

When to Save and When to Invest

The decision of whether to save or invest often comes down to your financial goals, your timeline, and your risk tolerance. As a rule of thumb, short-term goals that require a guaranteed amount of money are usually better suited for saving. This might include an emergency fund or saving for a vacation or a new car.

Long-term goals, especially those that can tolerate some level of risk, are usually better suited for investing. This might include saving for retirement or building wealth over time. It’s crucial to have a diversified financial plan that includes saving and investing to ensure you’re prepared for the short-term while working towards your long-term goals.

So Which is Better – Saving or Investing?

The question of whether saving or investing is better doesn’t have a straightforward answer. The right choice depends on your individual circumstances, financial goals, and risk tolerance.

If you are saving for a short-term goal or need your money to remain accessible and safe, saving is likely the better choice. However, if you’re aiming for a long-term goal, you’re willing to take on some risk, and you won’t need your funds immediately, investing could provide a more significant financial benefit.

But remember, it’s not always a choice between one or the other. A well-rounded financial plan should incorporate both saving and investing. It’s about balancing the need for immediate accessibility and safety (saving) with the potential for long-term growth (investing).

Conclusion

The difference between saving and investing is crucial to understand for anyone aiming to build a secure financial future. Saving provides safety and accessibility, making it an excellent tool for managing short-term needs and preparing for unforeseen expenses. On the other hand, despite its risks, investing provides the opportunity for long-term growth and wealth accumulation.

It’s important to understand that saving and investing are not mutually exclusive but complementary strategies in effective financial planning. Your financial goals, risk tolerance, and timeline will determine the right mix of saving and investing for you. Ultimately, by understanding the difference between these two crucial financial practices, you’ll be better equipped to make informed decisions and chart a course toward financial stability and success.