It’s never too early to give children a crash course in finance.

We can all agree that good habits are crucial for success in life, whether they’re financial habits or other types. If we develop a bad habit, like eating a half dozen donuts every weekend, we’ll never reach our healthy weight goal, and bad habits die hard. That’s why we must help our kids develop good financial habits early on, so they can be financially healthy and prosperous later in life.

It’s hard to get our kids to embrace healthy habits, like showering or brushing their teeth, but in the end, we fight the fight because it is worth it.

As parents, we’ve heard all the excuses.

“But dad, I showered last week.”

No matter how ridiculous the excuse, we keep at it because it’s the right thing to do. At the very least, our nagging helps the house smell better, and the kids still have most of their teeth.

They may call it nagging, but we like to think of it as encouragement. We encourage healthy habits from an early age because we care.

This post will outline some of our favorite tips for parents who want their kids to develop healthy financial habits for investment. Using these suggestions, you can help your children get a head start on saving money and possibly help them to save for longer-term goals like retirement.

While it may be hard to imagine that they will ever be as “ancient” as we are but, heaven help us, they will. Just imagine what life would be like if we had started saving for retirement at their age.

Your best bet is to keep things simple, as with any habit-building technique.

We have found four sure-fire steps to help kids develop healthy financial habits:

Step 1: Lay the Groundwork with Some Financial Basics for Kids' Better Financial Habits.

The dreaded “e” word? Yuck!

It’s natural for kids to resist education, but we’re going to need to get down to brass tacks and give them a solid foundation to build these healthy financial habits.

It’s tempting to want to push our kids with adages like, “You need to save money for a rainy day,” or “Investing will help you have a more secure future.”

These kinds of comments will make you sound like an annoying parent. The truth is, like everyone else, your kids want to understand WHY it is essential to save their money, even if they give you the occasional eye roll.

Kids will probably want to know:

- Why are good financial habits important to them?

- How do you manage money today and in the future?

- Why is it important to learn about investing?

The key is to teach your kids about money in a way that they can understand and possibly find interesting.

We have a great Stocks & Bonds course that will lay down the fundamentals of several financial concepts in a fun, easily digestible way.

I want to help. If you’re one of the first 50 to contact us, I’ll send you a code for free access to the course. If free doesn’t entice you, find a cost-effective course, book, or another educational offering that works for you.

Our course covers some serious foundational material in a not-so-serious way, which is a great way to help kids develop healthy financial habits. And you might learn something too!

When you use familiar subject matter to build the basics, your kids will start to ask questions because they know enough to be dangerous! When you have open, honest conversations with them about everyday finance-related subjects (groceries, gas, spending, etc.), you will help to educate them further while making them understand that discussions about money are normal.

It’s not a one-and-done conversation that builds financial confidence, but a habit of having open and honest discussions about confident financial decisions that take the mystery out of money.

Step 2: When They Learn to Practice Patience, Kids Will Resist Impulse Buying.

These days, kids get bored quickly, and they often want to spend all of their money on everything they see on the internet RIGHT NOW.

We all know the timeless quote, “Patience is a virtue.” It has stood the test of time (since 1360, to be exact) because it is truly a universal truth.

When we get into the habit of holding off on making purchases, we give ourselves time to research and find a better deal. It also helps us come to our senses when potential “impulse buys” rear their ugly head. From an investment perspective, it’s invaluable to buy at the right price. We have Mr. Warren Buffet to thank for that nugget of wisdom.

There was a time when we paid Mak & G interest for the money they had in their bank accounts at the end of each month.

The process was simple; Whatever they each had at the end of the month, we added 10%.

Sure, a 120% annual interest rate is insane, but the bank of mom and dad always offers the best rate. Plus, there were lessons to be learned.

That reminds me of a story about Grant, who I often describe as more of a spender. It is hard to convert a spender to a saver, or vice versa. The best you can do is work with their tendencies and help them make adjustments.

Here’s how it went down:

Grant had $200 in the bank and was three days away from his scheduled “interest” payment.

We were at the Shedd Aquarium in Chicago, and he had his eye on a $35 stuffed otter at the aquarium gift shop. He’d lose $3.50 ($35 times 10%) from his upcoming interest payment if he spent the money before his interest payment.

We made a point of showing him a similar stuffed otter on Amazon that cost $20. We explained that if he waited, the interest he would earn on his $200 in savings ($200 times 10% = $20) would help him score the otter for free.

Conversely, if he bought it at the aquarium, it would cost him $18.50 ($35 – $20 = $15 plus $3.50 interest).

In the end, Grant clearly understood that he could save money without losing any interest and get himself a stuffed otter if he wanted to. So, he waited.

What do you think happened?

You guessed it, he forgot about the otter.

That was a huge lesson that we occasionally use as an example when reminding him that waiting on a purchase can change your viewpoint, and being patient can result in a reward (or, in this case, higher interest payout).

Step 3: Make Your Financial Discussions with Kids Relatable.

Nothing brings out an eye roll faster than the phrase, “When I was your age,” so I try and stay away from the know-it-all parent attitude.

If you want a healthy habit to stick, the child needs to relate.

Several years ago, I wanted to teach the kids about stocks.

I was armed with graphs about standard deviations and volatility when I realized there was no way they would relate. So, I asked myself, what interests them?

They were young at the time, and I knew they were into puppies and video games and enjoyed trips to McDonald’s and Target.

When I asked them about their favorite companies, they looked at me like I had ten heads. When I asked them what they wanted to do that day and mentioned going to McDonald’s and Target, I knew that this would be the springboard that could lead us to discuss making investments in companies they loved. We came up with quite a few, including Activision Blizzard, Disney, McDonald’s, and Target.

I asked how a company (and an investment in that company) may be affected by world events and the economy.

COVID offers a perfect example, as it affected BEACH companies (Bookings, Entertainment, Airlines, Cruises, and Hotels). Fewer people were going on cruises, taking flights, attending concerts, or staying in hotels, which would harm those companies.

That conversation helped plant the seed on how investments in companies can be affected by real-world events. Making the subject material relevant helped create interest and build a habit of evaluating their investments.

For more great financial advice, visit our podcast:

Step 4: Kids Need Tangible Examples, So Show Them the Money!

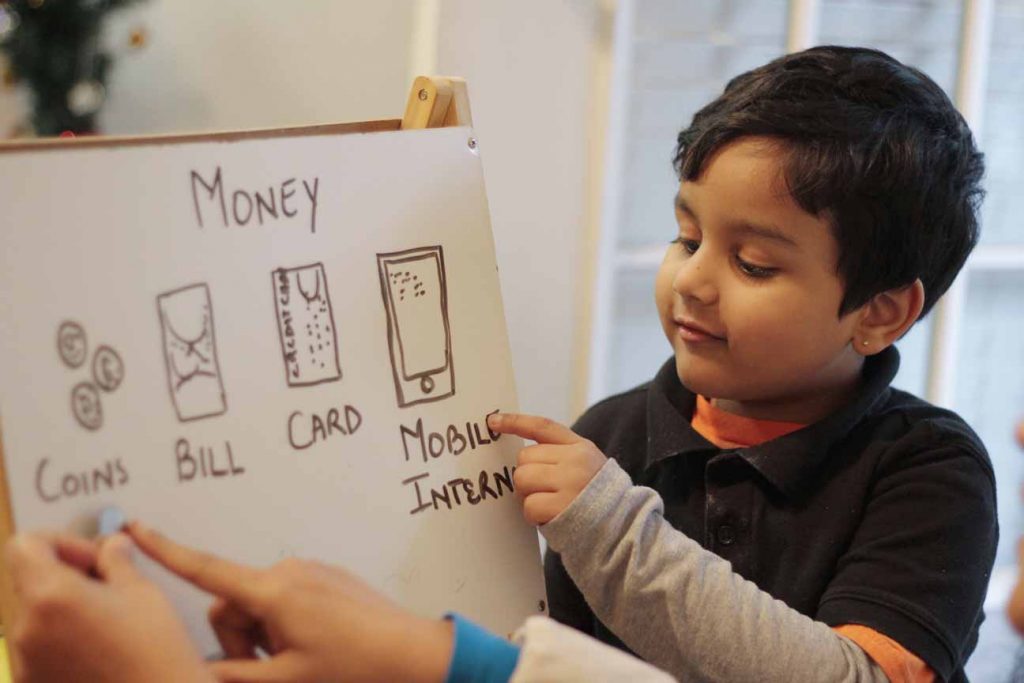

Theoretical education can be helpful when teaching adults, but when teaching kids about money, a theory isn’t all that effective. Children need something tangible. They need things that they can see or touch. That’s why you need to show them the money.

We paid our kids a monthly interest rate based on their end-of-the-month savings balance, as I mentioned earlier. Things got real for them when they saw an extra $20, $30, or even $40 go into their account.

Investing is about growth. Buying something now, with the anticipation it will increase in value. I was pretty amazed at how quickly the kids could wrap their heads around the concept. Why wouldn’t they? Save money, wait, and watch it grow. It’s pretty simple.

That reminds me of a story about Makenna and her stock investments.

While looking at her statement, she noticed an increase in her investment account’s “cash” balance. It jumped from $3 the previous month to $50 in the current month. Although she knew how many shares of stock she had in each company and knew that it made her a company owner, she was trying to understand why her cash balance had jumped so high.

I told her that, sometimes, companies give you money because they want to give back to the owners.

Getting money for literally doing nothing was not only new to her, but it was also SUPER cool.

I almost teared up when she asked if she could invest that cash balance in more stock for future dividends.

She had grasped the concept of compounding!

For more information on the benefits of teaching kids about investing, check out our blog about the reason to start saving and investing early.

On the other hand, Grant didn’t like the whole “interest” payment concept because Mak had twice as much saved and got twice as much interest. That led us to a discussion about what is fair. He quickly learned one of the most important lessons of all: When you save more, you have more to invest, and, naturally, you earn more. It’s not really about being fair.

It was a win, win, win, win!

It is never too early to teach kids about money management.

Taking an active role in working with your kids on healthy money concepts, no matter how small, will yield positive results.

Get help, read, share it with your kids.

Sometimes it will be tough to grab their attention. But, just like teaching your kids about the importance of daily hygiene, I GUARANTEE that you will never regret teaching them about healthy financial habits.