When it comes to investing, various strategies can be employed, each with its own strengths, weaknesses, and appropriate scenarios. Two of the most common investing styles are “Income Investing” and “Growth Investing.” While both approaches aim to generate wealth over time, they do so in distinct ways, appealing to different investor preferences and risk tolerance. This article will delve into “Income vs. Growth Investing” shedding light on their key differences, the factors to consider, and their associated risks and rewards.

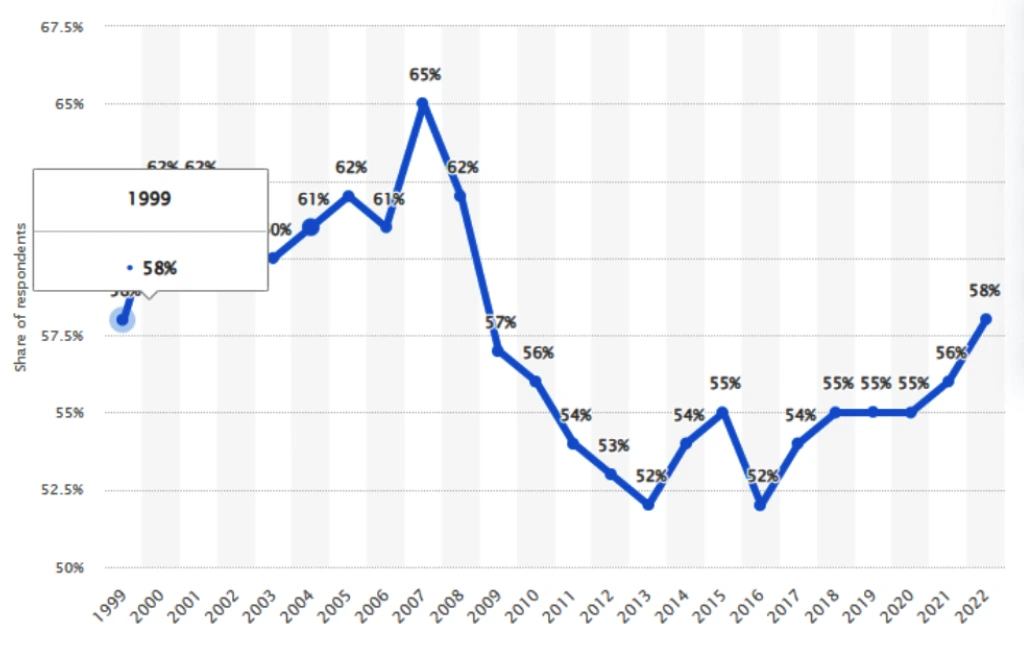

The world of investing is no longer exclusive to the financial elite. In 2022, 58 percent of adults in the United States actively shaped their financial futures through stock market investments. Though this figure falls short of the pre-Great Recession peak of 65 percent in 2007, it showcases the steady persistence of investor participation in the marketplace. This prevalence of investment culture sets the stage for an important dialogue that affects every investor—understanding the differences between income and growth investing.

Concept of Income Investing

Income investing is a strategy focusing on building a portfolio of assets that generate a steady and reliable income stream. This is often achieved through investments in bonds, dividend-paying stocks, real estate investment trusts (REITs), and other income-yielding assets. The primary goal of income investors is to seek regular cash flow, making this a suitable strategy for retirees or individuals seeking a steady income.

Concept of Growth Investing

In contrast, growth investing concentrates on investing in companies or assets with above-average growth potential. These are usually businesses in the stages of expansion or industries poised for rapid growth. The goal here isn’t to receive immediate cash flow but to see the assets appreciate over the long term. This strategy is typically favored by investors willing to take on greater risk for potentially higher returns and have a longer investment horizon.

Key Differences Between Income and Growth Investing

Income and growth investing differ primarily in goals, risk tolerance, and time horizons. Income investors prioritize regular and reliable cash flows. They are typically more risk-averse, while growth investors seek capital appreciation and are willing to take on more risk for potentially high returns.

The type of assets involved also differs. Income investing leans towards dividend-paying stocks, bonds, and REITs, while growth investing often involves investing in tech startups, biotech firms, or emerging market companies.

Factors to Consider in Income Investing

When considering income investing, it’s important to evaluate the reliability and sustainability of the income source. Look for companies with stable earnings and a history of paying dividends or bonds with high credit ratings. The yield of the income-generating asset is another critical factor, as it directly impacts the cash flow you can expect.

Yield

The yield is one of the most essential factors in income investing. It represents an investment’s annual income as a percentage of its current market price. However, a higher yield isn’t always better. A high yield often indicates a higher risk or the market’s lack of confidence in the sustainability of the dividend or interest payments.

Consistency of Income

Not all income-generating investments are created equal. Some pay out regularly, while others might do so less consistently. Therefore, you need to evaluate whether the income from the investment aligns with your cash flow needs. If you require regular income, opt for investments like bonds, which provide a fixed interest payment, or stocks of companies with a history of consistent dividends.

Stability of the Underlying Asset

The underlying asset’s stability directly influences your income stream’s security. Stable assets like blue-chip stocks or government bonds are more likely to provide consistent income. On the other hand, investments with volatile prices may see fluctuations in income and even possible capital losses.

Risk of Default

The risk of default refers to the risk that a company or government issuing a bond will not be able to pay the interest or repay the principal on its debt. Income investors must assess this risk before investing, as it can result in a loss of both income and the invested capital.

Inflation Rate

Inflation can significantly impact income investing. If the yield on an investment is lower than the inflation rate, the investor loses purchasing power. Therefore, it is important to consider the inflation rate when choosing an income-generating investment.

Factors to Consider in Growth Investing

In growth investing, the emphasis is on the company’s potential for expansion. Investors should look at the industry’s growth rate, competitive position, and projected earnings growth. However, keep in mind that higher potential returns come with increased risk.

Potential for Capital Appreciation

The heart of growth investing is betting on capital appreciation. Investors should consider if the company or industry has the potential for significant growth in the future. Look for disruptive technologies, innovative business models, or expanding markets that could fuel this growth.

Company's Financial Health

To sustain growth, a company needs to be financially healthy. Reviewing a company’s balance sheet, cash flow statement and income statement can provide insights into its financial condition. Look for companies with low debt, consistent earnings growth, and a positive cash flow.

Market Trends and Industry Growth Prospects

Understanding market trends and the potential for industry growth is a key part of growth investing. Researching industry reports, staying updated with market news, and understanding economic trends can help you identify potential growth industries.

Valuation Metrics

While growth investors may be more tolerant of high valuation metrics, understanding these metrics remains essential. Tools like price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price/earnings-to-growth (PEG) ratios can help assess if a stock is overvalued or undervalued. However, keep in mind that growth stocks typically have high P/E ratios, and these tools should be one part of a broader analysis.

Risk Tolerance

Growth investing can offer high returns, but it also comes with increased risk. Growth stocks are often more volatile than income stocks, and their success is tied to the company’s continued growth—which isn’t guaranteed. Assess your risk tolerance before investing in growth stocks, and ensure that it aligns with your overall investment strategy.

Comparing Risk and Return in Income vs. Growth Investing

In general, income investing is seen as a lower risk, with the trade-off of potentially lower returns. On the other hand, growth investing carries higher risk, given the unpredictability of future earnings and market volatility, but it offers the potential for higher returns.

Income Investing: Risk and Return

Income investments are often considered safer than growth investments. This is because they generally involve more mature companies with a stable history of generating profits and paying dividends or bonds where the interest payment and principal repayment are contractually guaranteed.

The returns from income investments are usually in regular dividends or interest payments, providing a steady income stream. However, while these investments are less risky, their potential for high returns is also limited.

The major risks associated with income investing include default risk (for bonds) and dividend-cutting risk (for stocks). Inflation is another risk, as it can erode the purchasing power of the fixed income generated by these investments.

Growth Investing: Risk and Return

Growth investing can deliver higher returns as you invest in companies expecting above-average growth. These investments, however, come with higher risk.

The primary risk with growth investing lies in the company’s ability to meet growth expectations. Growth companies are typically less established, operate in competitive markets, and often do not pay dividends, relying instead on reinvesting profits back into the business. If the company’s growth plans don’t materialize as expected, this can lead to significant stock price declines.

Growth stocks are also generally more sensitive to market fluctuations, which adds to their risk. They often have higher valuation ratios, and any negative news can lead to significant price volatility.

The Balance Between Risk and Return

The decision to focus on income or growth investing depends on your goals, risk tolerance, and investment horizon. If you have a lower risk tolerance or need regular income, income investing may suit you. However, if you’re willing to take on more risk in exchange for potentially higher returns and have a longer investment horizon, growth investing might be your choice.

It’s also possible to blend the two strategies, investing part of your portfolio for income and part for growth. This approach can balance risk and return, providing both current income and potential capital appreciation.

Can You Invest for Growth and Income?

Yes, blending both strategies to achieve a balanced portfolio is possible. Many investors choose a mix of income and growth assets based on their financial goals, risk tolerance, and investment horizon. This approach can provide regular income while still allowing for capital appreciation.

Should You Invest for Growth or Income?

The choice between income and growth investing depends on your individual circumstances and goals. If you require a steady cash flow, income investing might be the way to go. Growth investing could be a better fit if you’re aiming for potentially higher returns and can tolerate more risk.

FAQs

A. How do I determine if income or growth investing is right for me?

Consider your financial goals, risk tolerance, and investment horizon. Income investing might be suitable if you require a regular income stream and have a low-risk tolerance. Growth investing could be a better choice if you can withstand higher risk and aim for high returns.

B. Are there any tax advantages to income or growth investing?

Yes, both strategies have potential tax advantages. Some dividends and interest payments may qualify for a lower tax rate for income investing. You may benefit from long-term capital gains taxes for growth investing, often lower than regular income tax rates.

C. How can I manage risk in income and growth investing?

Diversification is a key strategy to manage income and growth investing risk. By spreading your investments across different assets, sectors, and geographic locations, you can reduce the potential of a significant financial loss.

D. Why should I invest in income stocks?

Income stocks can provide a steady stream of income and add stability to your portfolio. They can be particularly beneficial during volatile or bearish market conditions, as they tend to be less volatile than growth stocks.

Final Words

Understanding the difference between “Income vs. Growth Investing” can guide you in making informed decisions that align with your financial objectives. Remember, depending on your specific needs and goals, a balanced approach that incorporates both strategies might also be possible. When choosing your investment strategy, consider your risk tolerance, financial goals, and investment horizon.

As we conclude our exploration into the differences between Income and Growth Investing, we at EduCounting reaffirm our dedication to empowering young individuals with financial literacy and effective money management skills. We aim to equip you with the necessary resources and tools to gain control over your financial destiny and make well-informed decisions about your investments. We invite you to enroll in our course and embark on your journey to mastering money management. With EduCounting by your side, financial literacy is no longer a distant goal but an achievable reality.