In the ever-evolving financial landscape, individuals and families with substantial wealth face unique challenges and opportunities. High Net Worth Financial Planning is a specialized field that addresses these distinct challenges by implementing strategic planning and resource allocation tailored to those with significant assets.

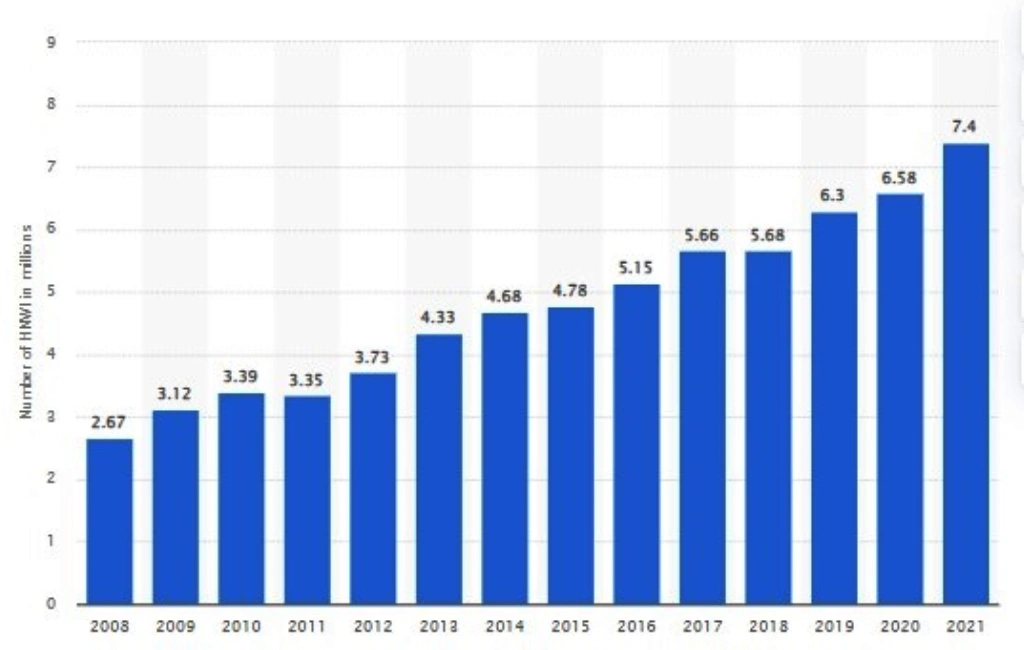

In 2021, North America was home to approximately 7.4 million individuals boasting a high net worth status. The increasing number of individuals in this category necessitates a comprehensive understanding of High Net Worth Financial Planning.

The scope of high-net-worth financial planning extends beyond traditional investment strategies. It encompasses estate planning, tax optimization, philanthropic endeavors, and legacy building. This article takes a deep dive into high-net-worth financial planning, uncovering its multifaceted advantages and outlining key strategies for individuals and families who aim not only to protect but also to grow their wealth responsibly.

What is High Net Worth Financial Planning?

High Net Worth Financial Planning (HNWFP) refers to the comprehensive financial management process tailored for individuals and families with significant wealth, generally considered to be assets exceeding $1 million. It involves the integration of all financial resources, including investments, taxes, savings potentials, and liabilities.

Unlike standard financial planning process, HNWFP often deals with more complex assets and requires a more sophisticated approach. Moreover, it is centered around long-term wealth preservation and growth, emphasizing passing wealth to future generations and making meaningful societal contributions.

High Net Worth Financial Planning Advantages

The major advantage of High Net Worth Financial Planning is that it allows individuals and families to make fully informed decisions about managing their wealth. HNWFP typically starts with a comprehensive assessment of the client’s financial situation, including an analysis of existing investments, liabilities, and risk factors.

Enhanced Investment Diversification

One of the primary benefits of HNWFP is the opportunity for enhanced investment diversification. With a larger asset base, high-net-worth individuals can access a broader range of investment vehicles. This allows them to allocate assets across different classes and geographies, mitigating risks and potentially enhancing returns.

Strategic Tax Planning

HNWFP provides avenues for strategic tax planning. By taking advantage of tax-efficient investment vehicles, deductions, and credits, high-net-worth individuals can potentially reduce their tax liability and preserve more of their wealth.

Customized Estate and Legacy Planning

Estate and legacy planning are critical components of HNWFP. With the help of an experienced financial advisor, high-net-worth individuals can develop a comprehensive plan for passing wealth to future generations and making meaningful contributions to society. Legacy planning focuses on how one’s wealth will impact future generations and the broader community.

Philanthropy and Social Impact Investing

High Net Worth Financial Planning can also empower individuals and families to make significant contributions to society through philanthropic endeavors. This can be achieved through various means, such as setting up charitable trusts or foundations, and it can serve as a way to leave a lasting societal impact.

Comprehensive Risk Management

Risk management is central to HNWFP. Individuals can better protect their assets over the long term by employing strategies that address market risks, legal liabilities, and other potential threats.

A Definite Approach to High Net Worth Financial Planning

Achieving success in high-net-worth financial planning requires a structured and systematic approach. The first step is to thoroughly analyze one’s current financial situation, including assets, liabilities, income streams, and expenditures. Establishing clear financial goals, both short-term and long-term, is paramount.

This is followed by assessing risk tolerance and crafting an investment strategy that aligns with these goals and risk profiles. Working with specialized financial advisors and experts in tax law and estate planning is advisable to construct a robust high net worth financial plan.

Financial Planning Strategies for High-Net-Worth Individuals & Families

High-net-worth individuals and families have a range of strategies to protect and grow their wealth responsibly. The strategy involves setting up a diversified portfolio with long-term investments in equities, bonds, mutual funds, ETFs, and other asset classes. It also includes assessing risk tolerance and employing strategies to minimize risks. Additionally, tax-advantaged accounts, trusts, and family limited partnerships can play significant roles in wealth preservation and transfer.

High Net Worth Financial Planning Strategies Components

High Net Worth Financial Planning is crucial to preserving and growing wealth for individuals and families with substantial assets. It encompasses a broad range of components, each vital to the overall financial strategy. Understanding these components and how they work in tandem is essential for creating a robust financial plan that aligns with your long-term goals and values.

Asset Protection

Asset protection refers to the strategies designed to safeguard one’s assets against potential risks. It involves implementing legal strategies to safeguard assets from potential liabilities and claims. This might include establishing trusts, choosing the right business structures, and properly titling assets.

Since high-net-worth individuals are often more exposed to legal risks, having a well-constructed asset protection plan ensures that your wealth is shielded from unforeseen liabilities.

Tax Planning

Efficient tax planning is indispensable in maximizing wealth preservation. Strategic tax planning involves utilizing various tax-advantaged accounts, exploiting tax credits and deductions, and structuring investments tax-efficiently. By minimizing the tax burden, a larger portion of capital remains available for investment and wealth building.

Estate Planning

Estate planning ensures that your wealth is transferred to your heirs following your wishes and most efficiently. This involves creating wills, setting up trusts, and designating beneficiaries.

Moreover, estate planning is crucial for minimizing estate taxes and avoiding the probate process, which can be lengthy and costly. You can ensure your legacy is passed on seamlessly and meaningfully through estate planning.

Investment Planning

Investment planning is about making informed decisions regarding the allocation of assets in stocks, bonds, real estate, and other investment vehicles. For high-net-worth individuals, this often includes alternative investments such as private equity, hedge funds, and tangible assets.

The objective is to create a diversified investment portfolio that aligns with your risk tolerance, time horizon, and financial goals, optimizing returns while mitigating risks.

Charitable Giving

Many high-net-worth individuals are keen on positively impacting society through charitable giving. This can be an integral part of High Net Worth Financial Planning. Whether through establishing charitable trusts, donor-advised funds, or direct donations, philanthropy can be a fulfilling way to use wealth for a greater purpose. Moreover, charitable giving can also have tax benefits.

Insurance Planning

Insurance planning is an often overlooked but vital component of High Net Worth Financial Planning. It involves assessing potential risks and ensuring that you have adequate insurance coverage. This can include life insurance, property insurance, liability insurance, and even specialized insurance for unique assets such as art collections or yachts. Proper insurance planning is essential for mitigating risks and protecting your wealth against unforeseen events.

End-of-Life Planning

End-of-life planning goes beyond estate planning and involves deciding your preferences for end-of-life care and how affairs should be handled after passing. This can include medical directives, power of attorney designations, and funeral planning. These decisions can relieve the emotional and financial burden on loved ones during a difficult time.

Non-Critical Components of a Financial Plan

In addition to the core components, high-net-worth individuals may also consider incorporating several non-critical but potentially beneficial elements into their financial plan:

Concierge Services: This includes travel arrangements, lifestyle management, and other personal services.

Luxury Asset Acquisition and Management: Assistance in acquiring and managing luxury assets such as yachts, art collections, and real estate in exclusive locations.

Family Governance and Education: Establishing a family governance structure and educating future generations on wealth management principles.

Tips for High Net Worth Financial Planning

High Net Worth Financial Planning is a nuanced process tailored for individuals and families with substantial assets. Navigating the multifaceted realm of investments, taxes, estate planning, and risk management requires a well-thought-out approach.

Whether you have recently entered the realm of high net worth or are a seasoned wealth holder, employing effective strategies is paramount to safeguarding and growing your wealth.

Commence Planning Early

The adage “time is money” holds particularly true regarding wealth management. The sooner you commence your high net worth financial planning, the more time your investments have to grow through the power of compounding.

Early planning also provides a wider window for implementing tax strategies, setting up estate planning structures, and adapting to changes in the financial landscape. The combination of early and consistent investments, coupled with strategic financial planning, can profoundly impact wealth accumulation and preservation.

Engage with Specialized Advisors

When dealing with significant wealth, the stakes are high, and the complexity is amplified. Engaging with specialized financial advisors who have expertise in high-net-worth financial planning is crucial.

These professionals possess the know-how to advise on intricate tax issues, estate planning, alternative investments, and risk management strategies pertinent to high-net-worth individuals.

Moreover, a team of advisors, including accountants, lawyers, and financial planners, can provide a holistic view of your financial health and devise strategies aligning with your objectives.

Continuously Monitor and Reevaluate

The financial landscape is not static; markets fluctuate, laws change, and personal circumstances evolve. Consequently, high net worth financial planning is not a “set and forget” process. It is vital to continuously monitor your investments, tax strategies, and estate plans.

Regularly reevaluating your financial plan ensures that it remains aligned with your goals and adapts to changes in your personal life and the wider financial environment. Periodic reviews with your financial advisors can aid in making timely adjustments that reflect current realities.

Make Informed Investment Decisions

High-net-worth individuals often have access to a plethora of investment opportunities. While this is advantageous, it can also be overwhelming. Making informed investment decisions is essential. Before committing capital, conduct thorough research or consult with experts to assess an investment’s risks and potential returns.

Ensure that your investments are congruent with your risk tolerance and long-term objectives. Diversification is also key – avoid putting all your eggs in one basket.

Maintain Liquidity

In the pursuit of investment returns, it’s easy to overlook the importance of liquidity. Having readily accessible funds is vital for both opportunities and emergencies. Whether it’s an attractive investment opportunity that requires quick capital or an unexpected personal emergency, maintaining a certain level of liquidity ensures that you can respond effectively without prematurely liquidating investments at an inopportune time.

FAQs

How is net worth related to financial planning?

Net worth, defined as the total assets minus total liabilities, is a snapshot of one’s financial health. High net worth financial planning is about effectively managing and growing this net worth through investments, tax planning, estate planning, and other strategies.

What is considered a high net worth individual investment?

High net worth individual investments typically refer to investment vehicles and opportunities geared towards individuals with substantial assets. These can include private equity, hedge funds, real estate portfolios, and more exclusive investment opportunities that require higher capital.

What is considered a large net worth?

While definitions can vary, generally, an individual is considered to have a high net worth if they have investable assets of $1 million or more, excluding the value of their primary residence.

How do you build a high net worth?

Building a high net worth involves a combination of saving, investing wisely, minimizing tax liabilities, making smart financial decisions, and often involves entrepreneurship or a high-paying career.

Final Words

High Net Worth Financial Planning is an intricate process that demands a comprehensive and customized approach. Individuals and families can effectively manage, protect, and grow their wealth through careful planning, wise investment, and diligent monitoring.

In an ever-changing financial environment, having a solid high net worth financial planning strategy is paramount for wealth preservation and legacy building. Seeking the expertise of specialized financial advisors can provide invaluable insights and guidance in navigating the complex landscape of high-net-worth financial management.

At EduCounting, we are passionate about helping young people attain financial literacy and money management skills. We provide educational resources and tools to help you take control of your finances and make informed decisions about your money. Join the course to become a master of money management.