A home equity loan can be a convenient option for homeowners aiming to extract some financial value from their property. However, acquiring one, particularly with a low credit score like 580, can be challenging. This article delves into home equity loan credit score 580, exploring what it implies, how to qualify, and some viable alternatives to consider.

What is a Bad Credit Score?

Understanding credit scores is crucial as they play a pivotal role in determining whether or not lenders deem you worthy of credit. The FICO scoring model, formulated by the Fair Isaac Corporation, classifies credit scores between 300 and 850. A score within this range represents a person’s creditworthiness, depicting the likelihood of loan repayment.

Any score between 300 and 579 is classified as poor, indicating to lenders a high risk associated with the borrower. In contrast, scores ranging from 580 to 669 are considered fair, 670 to 739 are considered good, 740 to 799 are very good, and 800 to 850 are deemed exceptional.

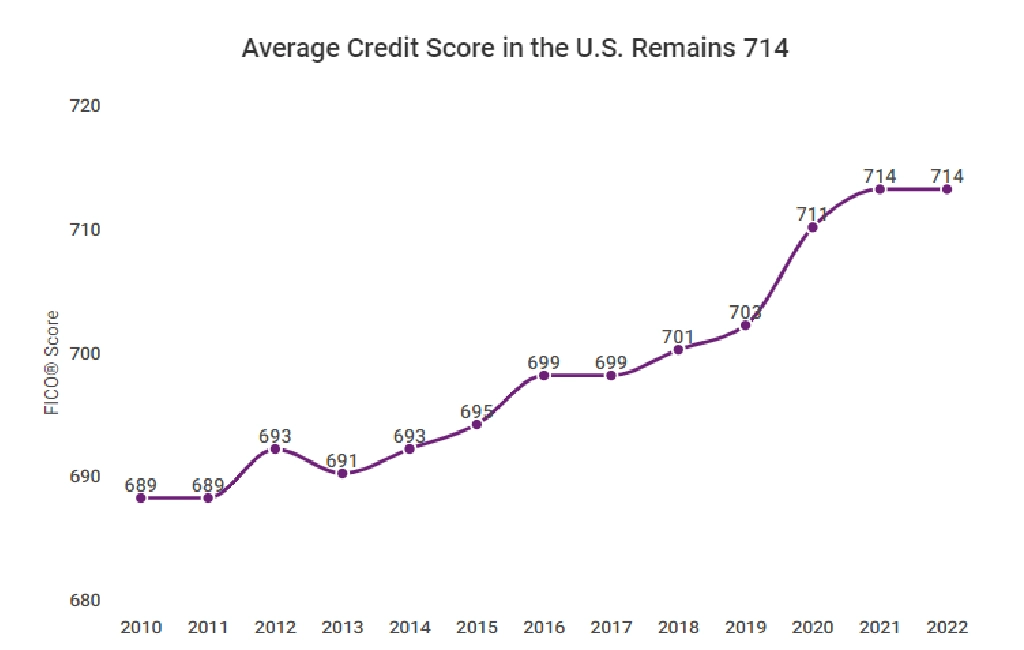

In 2022, the average FICO score was 714, falling well within the good range. Individuals possessing a credit score below 670 are significantly below this average, signaling a diminished financial standing and, hence, placed either in the poor or fair category. A score in this lower range can lead to unfavorable loan terms, higher interest rates, or even outright rejection of credit or loan applications, emphasizing the importance of maintaining a healthy credit score.

However, those with scores in the poor range are only partially full of financial options. Many lenders specialize in offering credit to individuals with lower credit scores, although it often comes with stringent conditions and higher interest rates to offset the elevated risk. Additionally, consumers can employ various strategies such as timely payment of bills, reducing outstanding debts, and maintaining a low credit utilization ratio to enhance their credit scores over time.

How Do You Qualify For a Home Equity Loan?

Navigating the qualifications for a home equity loan can be intricate, as lenders consider different factors to evaluate your eligibility. The common factors are the amount of equity you possess, your credit score, debt-to-income ratio, income stability, etc. Each of these elements plays a crucial role in the approval process, and understanding them can significantly enhance your chances of securing a home equity loan under favorable terms.

Ownership and Equity

To qualify for a home equity loan, lenders typically necessitate that you own at least 15% of your home outright. This ownership or equity is calculated by evaluating the difference between your home’s current market value and the outstanding balance on your mortgage. Owning a substantial portion of your home means you have a lower loan-to-value ratio, which reduces the lender’s risk, potentially making you a more attractive candidate for loan approval.

Credit Score

A robust credit score is pivotal for securing a home equity loan. Lenders usually prefer applicants with a credit score in the mid-600s or above. A higher credit score demonstrates financial responsibility and reliability, which can increase your chances of approval and help in obtaining more favorable interest rates and loan terms.

Debt-to-Income Ratio

A lower debt-to-income (DTI) ratio is advantageous when applying for home equity financing. Lenders typically look for a DTI ratio below 43%, which indicates that a substantial portion of your income is not tied up in debt repayments. A lower DTI ratio signifies your ability to manage additional debt efficiently and indicates sound financial health, making you a preferable candidate for lenders.

Steady Income

Lenders desire applicants with a steady, reliable income, ensuring they have the financial means to repay the loan. A consistent income, regardless of the equity in your home, is critical as it represents your ability to repay the borrowed amount over time. It assures lenders that the risk associated with lending to you is minimized, impacting your eligibility positively.

How to Qualify for a Home Equity Loan with Bad Credit

Qualifying involves meeting the lender’s criteria, such as demonstrating sufficient income and proving the ability to repay the loan. Prospective borrowers with bad credit may need to seek lenders specializing in such loans or consider obtaining a co-signer to increase approval chances.

Understand the Tradeoffs

Individuals with poor credit scores often face stringent conditions when applying for home equity loans. There may be a requirement to pay higher interest rates to offset the lender’s risk, or it might be necessary to have a higher income or more substantial equity in your home.

Demonstrating additional income or presenting significant equity can act as compensating factors, balancing out the risks associated with bad credit and thus facilitating the loan approval process, albeit with less favorable terms.

Focus Your Search

Numerous lenders are in the market, but not all may be willing to work with individuals with poor credit scores. However, some major home equity lenders specialize in working with borrowers with bad credit. Focusing your search on such lenders can increase the chances of loan approval.

These lenders understand the challenges associated with bad credit and often have more flexible criteria, enabling applicants to secure a loan that suits their financial situation and needs.

Consider Alternatives

Exploring alternatives to home equity loans can also be worthwhile. Personal loans or cash-out refinances may be viable options for individuals with poor credit. These alternatives might offer more flexibility in terms of approval criteria and repayment terms.

Personal loans are generally unsecured, meaning they don’t require collateral, whereas a cash-out refinance involves refinancing your existing mortgage for a larger amount and taking the difference in cash. While these may not be the first choice for many, they can provide essential financial relief when a home equity loan is not attainable.

Home Equity Loan Requirements: Unlocking Your Home’s Value

A home equity loan can effectively access the value locked in your home, whether to manage unexpected expenses, consolidate debt, or make home improvements. However, there are specific requirements that borrowers must meet to qualify for such a loan.

Equity in Your Home

The fundamental requirement for a home equity loan is having sufficient equity in your home. Lenders typically require you to have at least 15% to 20% equity in your home, which is determined by the difference between your home’s value and your outstanding mortgage balance. The more equity you have, the more you can borrow.

Credit Score

A good credit score is usually crucial for securing a home equity loan under favorable terms. While obtaining a loan with a lower score is possible, a higher score often leads to better interest rates and terms. Some lenders specialize in working with borrowers with lower scores, but this often comes with higher interest rates to compensate for the perceived risk.

Debt-to-Income Ratio

Lenders will assess your debt-to-income (DTI) ratio, which compares your total monthly debt payments to your gross monthly income. A lower DTI ratio is preferable, with most lenders looking for a ratio under 43%. A lower ratio demonstrates to lenders that you are not overly burdened with debt and are likely to manage additional debt repayments effectively.

Steady Income and Employment

Stable income and employment are also essential. Lenders want assurance that you can meet the loan repayments. Having a stable job and a steady income stream can significantly impact your eligibility and the loan terms.

Property Value and Mortgage Balance

Lenders will also consider your property’s current market value and the remaining balance on your mortgage. These factors will help determine how much you can borrow. Typically, lenders allow you to borrow up to 85% of your home’s value minus any outstanding mortgage balance.

Pros and Cons of a Home Equity Loan with Bad Credit

Opting for a home equity loan with bad credit can be a pivotal financial decision that comes with its fair share of advantages and disadvantages. Below is an expanded analysis of the pros and cons of acquiring a home equity loan when dealing with bad credit to aid in making an informed decision.

Pros

- Access to Funds: A home equity loan can be a lifesaver, especially for those with bad credit, as it is an option that helps homeowners avail credit against the equity built up in the proposed properties. This accessibility to funds can be particularly beneficial for covering unforeseen expenses, consolidating debts, or making significant purchases or home improvements, thereby offering a degree of financial flexibility and relief.

- Fixed Interest Rates: One of the appealing aspects of home equity loans is the provision of fixed interest rates, ensuring stability and predictability in repayment. This is especially advantageous for budgeting and financial planning, as borrowers are not subjected to fluctuating interest rates that can affect the amount to be repaid monthly.

- Potential Tax Deductions: Interest paid on home equity loans has the potential to be tax-deductible Personal loans, especially if the funds are used for home improvement purposes. This deduction can reduce taxable income and potentially lead to a smaller tax obligation, which can significantly benefit borrowers, enhancing the overall appeal of home equity loans.

Cons

- Higher Interest Rates: While home equity loans can offer financial relief, having a poor credit score usually means dealing with higher interest rates. These elevated rates are due to lenders perceiving borrowers with bad credit as high risk. Consequently, borrowers end up paying more over the life of the loan, making it imperative to consider the long-term implications and affordability.

- Risk of Foreclosure: Taking out a home equity loan implies using your home as collateral, meaning failure to meet the repayment terms can result in foreclosure and the loss of your home. This risk is especially pronounced for those with bad credit, who may have less favorable loan terms and higher interest rates, potentially making repayment more challenging.

- Stricter Terms: Poor credit scores often lead to stricter loan terms, reflecting the increased risk perceived by the lenders. Borrowers may navigate limited loan amounts, shorter repayment periods, and additional loan stipulations, which can significantly impact the loan’s utility and manageability. Understanding and evaluating the loan terms is crucial to ascertain their alignment with one’s financial capacity and goals.

How to Get a Home Equity Loan Credit Score 580: A Step-by-Step Guide

Securing a home equity loan with a credit score 580 can be challenging but possible. Here are six crucial steps that can increase your chances of approval:

Step 1: Gather Details on Your Existing Mortgage

Begin by collecting all pertinent information regarding your existing mortgage, such as the remaining balance, interest rate, and payment history. A clear understanding of your current mortgage will help determine how much equity you have in your home, which is crucial for a home equity loan application.

Step 2: Estimate Your Home's Current Value

Having a current and accurate estimate of your home’s value is vital. You can use online home valuation tools or consult with a real estate professional to get an approximate value. Keep in mind that lenders will typically send an appraiser to determine your home’s exact value before approving the loan, but having an initial estimate can guide your expectations and calculations.

Step 3: Determine Your Potential Borrowing Amount

Once you have the estimated value of your home and the details of your existing mortgage, you can determine your potential borrowing amount. Generally, lenders allow you to borrow up to 85% of your home’s value minus any outstanding mortgage balance. For instance, if your home is worth $200,000 and you owe $100,000 on your mortgage, you might be able to borrow up to $70,000.

Step 4: Prepare Letters Explaining Your Credit Issues in Advance

Given your credit score 580, it is advisable to prepare explanatory letters addressing any credit issues or discrepancies in advance. Clearly and concisely explain any late payments, defaults, or other negative marks on your credit report. Providing context can help lenders understand the circumstances surrounding your credit history and may impact their decision-making positively.

Step 5: Apply to Three to Five Home Equity Lenders

Don’t limit your application to just one lender. Apply to at least three to five home equity lenders to explore your options and increase your chances of approval. Different lenders have varying criteria and may offer different loan terms, so shopping around can help you find the most favorable deal. Consider lenders that specialize in working with borrowers with low credit scores.

Step 6: Submit Your Documents and Finalize Your Home Equity Loan

Once you’ve identified potential lenders, submit all the required documents, such as proof of income, proof of homeownership, and any additional paperwork they request. After submission, stay proactive in communicating with the lenders and be prepared to provide any additional information or documentation required. Once approved, review the loan terms carefully before finalizing and accepting the loan.

Home Equity Loan Alternatives

Home equity loans can be a great solution for many homeowners, but they might only fit some. Several alternatives exist that might better suit one’s needs and circumstances.

1. Cash-Out Refinance

A cash-out refinance allows homeowners to refinance their existing mortgage for more than they currently owe and receive the difference in cash. This option can be advantageous for those looking to secure lower interest rates or adjust their mortgage terms while also accessing needed funds.

However, it’s crucial to consider the costs involved in refinancing, such as closing costs, and to assess whether the new loan terms and the amount received justify those costs.

2. Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is another popular alternative, functioning as a revolving credit line secured against your home’s equity. HELOCs offer flexibility, allowing you to draw funds as needed up to a certain limit and typically featuring a variable interest rate. Interest is only charged on the amount you borrow.

However, fluctuating interest rates can be a downside, potentially affecting your repayments, and there is a risk of overspending due to the revolving nature of the credit.

3. Personal Loan

Personal loans can also be a viable alternative, offering a fixed amount paid back in installments over a set period. These loans can be used for various purposes, and their unsecured nature means you don’t risk losing your home if you default.

However, personal loans usually come with higher interest rates, especially for those with lower credit scores, and the loan amounts might not be as substantial as those offered by home equity products.

4. Shared Appreciation Mortgage

A shared appreciation mortgage is a less common but innovative alternative where a third party provides funds in exchange for a share of the future increase in your home’s value. This option can be beneficial for those unwilling or unable to take on more debt, as there are no monthly payments.

However, it could be costly in the long run, especially if your property significantly appreciates, and options may be limited as not many providers offer this product.

Frequently Asked Questions

What is the Lowest Credit Score to Get a Home Equity Loan?

The minimum credit score to qualify for a home equity loan varies by lender, but it typically ranges from 620 to 680. However, some lenders may offer loans to individuals with scores below this range, such as a credit score 580, though these may come with higher interest rates and more stringent terms due to the increased risk to lenders.

Do People Get Denied Home Equity Loans?

Yes, people can and do get denied home equity loans. Lenders assess several factors, such as credit score, debt-to-income ratio, loan-to-value ratio, and overall financial stability. If the potential borrower fails to meet the lender’s criteria in these areas, their application may be denied. Additionally, a lack of sufficient equity in the home or a decline in the property’s value can also result in loan denial.

Why is It So Hard to Get a Home Equity Loan?

Obtaining a home equity loan can take time due to stringent qualification criteria. Lenders assess various factors, including, but not limited to, credit score, income stability, and home equity. The economic environment can also impact the availability of these loans, with lenders tightening requirements during economic downturns. Furthermore, fluctuations in property values can influence the amount of equity available to borrow against, making it harder for homeowners to qualify.

How Long Does It Take a Bank to Approve a Home Equity Loan?

The approval time for a home equity loan can vary widely depending on the lender and the applicant’s individual circumstances, but it generally takes anywhere from two to four weeks. The process involves property appraisal, title search, and a thorough review of the applicant’s financial situation, including credit score, income, and debt levels. Any discrepancies or issues arising during this process can further delay approval times.

Final Words

Home equity loan credit score 580 can be challenging but is possible with diligent preparation and exploration of various lending options. By understanding your financial stance, evaluating your property accurately, and presenting a strong case to lenders, you can navigate the hurdles of low credit scores and access the financial resources you need. Additionally, exploring alternative lending options can provide added avenues for those struggling with traditional home equity loans.

At EduCounting, we are dedicated to arming you with extensive financial literacy and essential tools for proficient money management, allowing you to make informed and robust decisions on your financial journey. Explore our guide now and step confidently on your path to financial prosperity!