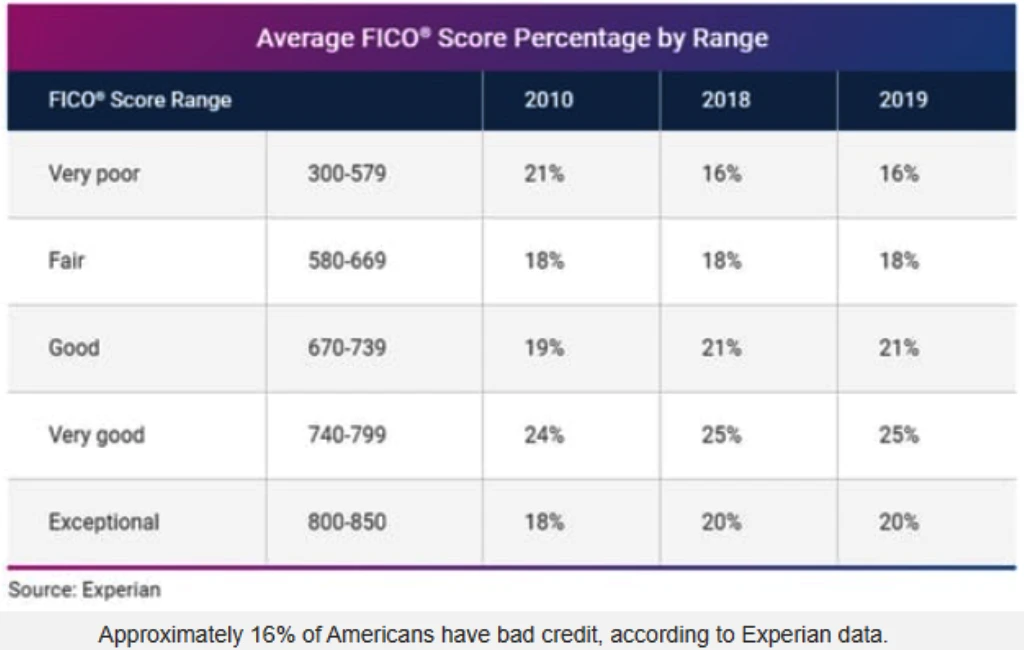

According to Experian’s Consumer Credit Review, a significant 16% of Americans find themselves grappling with a very poor credit rating, defined as a FICO score ranging between 300 and 579. Additionally, 18% are in the realm of fair credit, with scores hovering between 580 and 669. Interestingly, a mere 1.2% of the population boasts the elusive perfect FICO score of 850. These statistics set the stage for understanding the challenges many face when seeking startup business loans with less-than-ideal credit profiles.

For many, the entrepreneurial dream seems to fade away when faced with financial challenges, especially when they bear the weight of a poor credit score—however, many routes open avenues for these potential business moguls. The focus of our discussion, Startup Business Loans for Bad Credit, is one such beacon of hope.

What is Considered a Bad Credit Score?

Generally, a credit rating between 300 and 629 is deemed low based on standard benchmarks like FICO and VantageScore. Scores ranging from 630 to 689 are usually classified as average credit. While specific criteria can vary among lenders catering to small businesses, business loans for those with less-than-stellar credit often focus on individuals with FICO scores under 630.

Types of Startup Business Loans for Bad Credit

Venturing into the business realm with a less-than-stellar credit score can take time and effort. However, it’s important to remember that one’s credit history is just a single facet of their financial picture. For aspiring entrepreneurs with bad credit, numerous loan options cater specifically to their needs, ensuring they don’t remain just dreams. Let’s explore the various startup business loans available for those with imperfect credit.

Term Loans

Term loans are the most traditional type of business loans where a lender provides a lump sum of money upfront. The borrower then repays this amount, with interest, over a set period. Many alternative lenders offer term loans to businesses with bad credit, albeit sometimes at higher interest rates.

Despite the potential for higher interest rates, term loans can be advantageous because they provide a predictable repayment structure. Entrepreneurs can easily budget and plan their finances around consistent monthly payments, simplifying financial management.

Secured Loans

Secured loans require collateral, such as property, equipment, or inventory. This collateral acts as security for the lender, meaning if the borrower defaults, the lender can seize the asset to recover their funds.

For those with bad credit, secured loans can be more accessible. The collateral reduces the risk for the lender, potentially leading to better interest rates and terms. However, borrowers need to be confident in their ability to repay to avoid losing valuable assets.

Business Lines of Credit

Like a credit card, a business line of credit provides access to funds up to a set limit. Entrepreneurs can borrow as needed and only pay interest on the amount drawn. This offers flexibility, ensuring businesses have capital on hand for unforeseen expenses.

Entrepreneurs especially favor business lines of credit for their adaptability. They’re ideal for covering short-term costs like payroll during slower months. Regularly drawing and repaying can improve one’s credit score over time.

Working Capital Loans

These loans finance everyday business operations, like rent or payroll. They’re typically short-term solutions to address cash flow hiccups or seasonal fluctuations.

Working capital loans can be lifesavers for startups experiencing growing pains or navigating the challenges of seasonality. They ensure operations run smoothly, even when revenues fluctuate.

Equipment Financing

Instead of paying for machinery, vehicles, or other equipment upfront, equipment financing allows businesses to spread out the cost. The purchased equipment often serves as collateral for the loan.

This type of financing can be instrumental for businesses reliant on expensive equipment. It ensures that startups can access top-tier tools without depleting their cash reserves, all while building credit as they repay the loan.

Invoice Factoring

Invoice factoring involves selling unpaid invoices to a third party (a factor) at a discount. The factor then directly collects customer payments, providing immediate liquidity to the business.

Invoice factoring can optimize cash flow for businesses with lengthy invoice cycles or clients that are slow to pay. This way, operations can handle outstanding invoices.

Merchant Cash Advances

Businesses receive a lump sum for a portion of their future credit card sales. Repayments are typically daily, based on the day’s sales.

While merchant cash advances provide quick access to capital, they can be one of the costlier financing options with higher APRs. They’re best suited for businesses with strong credit card sales and a clear plan for utilization.

How to Get a Startup Business Loan With Bad Credit

Navigating the business financing landscape with a blemished credit record can be challenging, but it is not impossible. With diligence, knowledge, and preparation, securing a business loan can be well within reach, even for those with bad credit. Here’s a step-by-step guide to help you traverse this journey successfully.

1. Evaluate Your Business Position

Before diving into the loan application process, take a moment to assess your business’s strengths and weaknesses. Besides credit, lenders often look at other factors like revenue, time in business, and your business plan.

A strong business proposal, a consistent revenue stream, or a solid growth trajectory can offset concerns about your credit score. Ensure these strengths are front and center when pitching to potential lenders.

2. Understand How Much Debt Your Business Can Afford

One of the biggest mistakes startups make is borrowing more than they can repay. Use financial projections and budgeting to ascertain how much debt your business can comfortably manage.

It’s always tempting to secure a larger sum for expansive plans, but it’s prudent to focus on sustainability. Your business’s financial health should be paramount, ensuring you can manage repayments without undue strain.

3. Compare Lenders and Offers

Beyond traditional banks, numerous lending platforms, microlenders, and alternative financial institutions cater to businesses with bad credit. It’s crucial to explore multiple avenues.

Different lenders offer varying terms, interest rates, and fees. Analyze each option meticulously to understand the total cost of the loan and ensure there are no hidden surprises.

4. Avoid Predatory Lenders

While these offers might sound tempting, they are often too good to be true. Such lenders might charge exorbitant interest rates or have unfavorable terms hidden in the fine print.

Always verify the credibility of a lender. Check for reviews, and Better Business Bureau ratings, and seek feedback from fellow entrepreneurs. Remember, a legitimate lender will usually want to assess some level of risk before approving a loan.

5. Submit Your Application with Care

Gather all the required documentation, such as business licenses, bank statements, and financial projections. Being organized and thorough can streamline the approval process and make a favorable impression on lenders.

Always be truthful in your application. If there are discrepancies or falsehoods, they’re likely to be discovered and could jeopardize your chances of approval or lead to unfavorable loan terms.

6. Work on Improving Your Credit

Securing a loan with bad credit is achievable but also indicates room for improvement. Start by regularly monitoring your credit score, paying bills on time, and managing your debt responsibly.

Consider consulting with a credit counselor or financial advisor. They can provide strategies and guidance to bolster your credit score over time, opening up more favorable loan opportunities in the future.

Where to Get a Startup Business Loan with Bad Credit

Starting a new business is challenging, particularly when grappling with a less-than-ideal credit score. The traditional route to securing funds via banks is often impossible under these circumstances. However, the rise of alternative lending sources has brought about numerous options for aspiring entrepreneurs. Let’s dive into where you can secure a startup business loan, even with bad credit.

Online Lenders

The digital age has ushered in a host of online lending platforms offering various financial solutions for businesses. Platforms like LendingClub, Kabbage, and OnDeck often cater to individuals and businesses with bad credit. Their online processes typically involve minimal paperwork and promise faster approvals. Since they sometimes bypass traditional creditworthiness assessment methods, they can be more forgiving of low credit scores.

Online lenders can be a lifesaver for many, providing flexibility and rapid access to funds. However, it’s essential to be wary of potential pitfalls. Some might charge higher interest rates or have less transparent terms to compensate for the added risk of lending to someone with bad credit. As always, thoroughly review any agreement before committing.

Community Development Financial Institutions (CDFIs)

CDFIs are private financial institutions delivering responsible, affordable lending to aid low-income, low-wealth, and other disadvantaged people and communities. They are often more flexible than traditional banks and are designed to support economic growth within communities, focusing less on profit and more on positive impact.

CDFIs offer a holistic approach, typically considering the borrower’s character, business idea, and community impact. They can offer loans as well as training and technical assistance. For those with bad credit, CDFIs might be an excellent avenue, as they often place less emphasis on traditional credit scores and more on the entrepreneur’s potential impact.

Microlenders

Microlenders offer small loan amounts for startups and emerging businesses. Organizations like Accion, Kiva, and the Opportunity Fund focus on underserved entrepreneurs, including those with bad credit. Their mission is to stimulate local economies by supporting small businesses, often with loans that traditional banks would deem too risky.

Microlenders often offer more than just financial support. They may provide resources, workshops, and training to help businesses succeed. While their interest rates can sometimes be higher due to the inherent risks, the added value of mentorship and education can be invaluable for a budding business.

Merchant Financing Companies

Merchant financing companies provide funds in exchange for a percentage of future credit card sales. This model is ideal for businesses with consistent credit card transactions, like retail stores or restaurants. Companies like Square Capital and PayPal Working Capital fall into this category, offering cash advances based on future sales.

Once approved, you receive a lump sum for your business needs. As sales come in, a fixed percentage is automatically deducted to repay the advance. It’s a flexible approach, as repayments fluctuate with sales volume. For those with bad credit, this model is attractive because repayments are directly tied to sales, reducing the risk for the lender.

Factors to Help You Choose a Bad Credit Business Loan

Embarking on the journey of starting a business with bad credit can feel like setting sail on choppy waters. However, with the right knowledge and preparation, you can navigate these challenges and find a loan tailored to your needs. Here are crucial factors to consider when choosing a bad credit business loan.

Interest Rates

The interest rate can heavily influence the total cost of your loan. Especially for businesses with bad credit, these rates can be significantly higher due to perceived risk. While it might be tempting to take any loan offer that comes your way, it’s essential to shop around. By comparing rates from various lenders, you can find a balance between what you can afford and what’s competitively priced in the market.

Repayment Terms

Beyond just the principal and interest, understanding the repayment structure is critical. How long do you have to repay the loan? Are there penalties for early repayment? Is the repayment schedule flexible? Choose a loan that aligns with your business’s projected cash flow, ensuring you can manage payments without crippling your operations.

Lender Credibility

In your quest for a loan, you’ll likely encounter an array of lenders, from established banks to newer online platforms. It’s paramount to verify the credibility and reputation of each potential lender. Read reviews, check their standing with the Better Business Bureau, and seek testimonials from other business owners. Remember, a trustworthy lender is as vital as favorable loan terms.

Collateral Requirements

Some bad credit business loans may be secured, meaning they require collateral. The type and value of collateral can vary widely between lenders. Before taking out a loan, understand what assets you might need to leverage- property, equipment, or inventory. The collateral serves as a safety net for the lender but poses a risk for you. If you’re unable to repay, you stand to lose that asset. Hence, always consider if you’re comfortable with what’s at stake.

Fees and Additional Costs

Beyond interest rates, loans can come with many fees and hidden costs. These might include origination fees, service charges, late payment penalties, or even fees for paying off the loan early. Always request a full disclosure of all costs associated with a loan. Knowing the full picture can prevent unpleasant surprises down the road and helps you accurately gauge the cost of borrowing.

Pros and Cons of Bad Credit Business Loans

When considering a Startup Business Loans for Bad Credit, weighing the potential benefits against the downsides is essential. This helps you make an informed decision that aligns with your business goals and financial health.

Pros

- Accessibility: These loans might be one of the few financing options for businesses with poor credit scores. Lenders are more lenient with their credit score requirements, making the loans more accessible.

- Fast Approval and Funding: Bad credit business lenders, especially online platforms, often promise quick application processes and faster approval times. This speed can be invaluable for businesses needing urgent funds.

- Flexible Terms: Some bad credit lenders offer more adaptable terms and conditions, such as variable repayment schedules, catering to businesses with fluctuating revenues.

- Credit Improvement: Successfully obtaining and repaying a bad credit loan can help improve your credit score, opening the door for better financing options in the future.

Cons

- Higher Interest Rates: Due to the perceived risk associated with lending to businesses with poor credit, interest rates tend to be significantly higher. This can greatly increase the overall cost of borrowing.

- Collateral Requirements: Many bad credit loans are secured, requiring collateral. This means assets like property or equipment might be at risk if repayments aren’t met.

- Other Fees and Costs: Lenders catering to businesses with bad credit might include various hidden fees or complex terms that can be costly. It’s essential to read the fine print.

- Potential for Debt Traps: Given the high costs and fees, some businesses may find themselves in a cycle of debt, borrowing more to cover existing loans.

Alternative Startup Funding for Bad Credit Borrowers

Entrepreneurs with less-than-stellar credit need not lose hope; numerous alternative financing routes can be explored. If traditional business loans are out of reach, here are some alternatives that bad-credit borrowers might consider.

Personal Business Loans

Personal loans can be used for a variety of purposes, including business-related expenses. They’re based on the borrower’s personal credit history rather than the business’s credit. If you have a decent personal credit score or a strong relationship with a bank, you might secure a personal loan more easily than a business loan. However, remember that you’ll be personally responsible for repaying the loan, which might put your personal assets at risk.

Business Credit Cards

Business credit cards can provide immediate access to a line of credit. While some card issuers might still require a credit check, others might have more lenient criteria or offer secured credit cards. By regularly using and promptly repaying the card balance, you can gradually build or repair your business credit score.

Bootstrap

Bootstrapping involves funding your business using your savings and reinvesting profits back into the business. It’s a risk-free way of avoiding debt and retaining full control over your business. However, growth can be slower since you rely on generating and reinvesting profits.

Crowdfunding

Platforms like Kickstarter and Indiegogo allow entrepreneurs to raise capital by pre-selling products or offering rewards to backers. This method doesn’t require a credit check, and success hinges on the appeal of your business idea or product. But delivering on promises to backers is essential, or you risk damaging your business’s reputation.

Venture Capital

Venture capitalists (VCs) are professional groups that manage pooled funds from many investors to invest in startups. Pitching to VCs can result in significant funding for businesses with high growth potential. In exchange, VCs often require equity in the company. While credit scores might not be a primary concern, VCs are selective, and competition is stiff.

Small Business Grants

Certain government programs, non-profits, and corporations offer grants to small businesses. These funds can be paid, making them an attractive option. However, they’re often tied to specific industries or causes and can be competitive. It’s crucial to understand the grant’s criteria and purpose before applying.

Selling Equity

Another route is to sell shares of your business to investors. You can raise capital without debt by selling a stake in your company. This method dilutes ownership, and decisions might need to be shared with equity holders, but it’s a way to secure funds without focusing on credit scores.

Startup Business Loans for Bad Credit FAQs

Can I get easy approval for a startup business loan if I have bad credit?

While obtaining approval for a startup business loan with bad credit is more challenging, some lenders cater specifically to bad credit borrowers. However, due to the perceived risk, these loans often come with higher interest rates and less favorable terms.

Can I get a startup business loan with no credit check?

Yes, certain lenders and financial products, such as merchant cash advances or crowdfunding platforms, might not require a credit check. However, they might evaluate other aspects of your business or offer terms reflecting the higher risk of not checking credit.

Which loan company is best for bad credit business loans?

The “best” loan company can vary based on individual business needs and circumstances. Online lenders like OnDeck, Kabbage, or Fundbox cater to businesses with less-than-perfect credit, but it’s crucial to research and compare options to determine the best fit.

How can I start a small business with no money and bad credit?

Starting a business under these conditions is challenging but feasible. Consider bootstrapping, crowdfunding, or seeking small business grants. Also, leveraging your skills to provide a service that requires minimal upfront investment can be a good starting point.

Can I get credit for my business with bad credit?

Yes, even with bad personal credit, there are avenues to secure business credit, such as business credit cards, vendor trade lines, or secured business loans. Over time, responsible management can help improve your business credit profile.

Can I get startup business loans with no revenue?

Obtaining a loan with revenue is easy but possible. Lenders will look at other factors like business potential, collateral, or personal guarantees. Some lenders, like microlenders or certain online platforms, might be more open to granting loans to startups without revenue, albeit often at higher interest rates.

Final Words

Navigating the world of entrepreneurship can be daunting, especially when faced with credit challenges. However, as we’ve explored, various avenues can empower business owners to secure the funding they need, even with less-than-perfect credit histories. While the journey to obtaining Startup Business Loans for Bad Credit may require more diligence and creativity, it’s a testament to the resilience and resourcefulness of entrepreneurs. Armed with the right knowledge and tools, there’s no financial obstacle too great to overcome in pursuing business success.

As we wrap up our deep dive into Startup Business Loans for Bad Credit, we at EduCounting remain committed to guiding entrepreneurs through the intricacies of business financing. Our mission is to empower you with the knowledge and strategies to navigate the challenges of obtaining funding, especially when faced with credit obstacles. We invite you to explore our comprehensive resources and further your understanding of this vital area of business management.