In the world of finance, making smart investment choices can pave the way to financial success. In this blog, we’ll unravel money market funds’ mysteries, offering a straightforward guide to their mechanisms and investment strategies.

Imagine finance as a giant puzzle, and each piece represents a way to grow your money. To solve this puzzle successfully, it’s crucial to make informed decisions about where to invest your hard-earned cash. That’s where money market funds come into play—a safe and accessible option for both beginners and seasoned investors alike.

Now, you might be wondering, “How do money market funds work?” That’s exactly what we’ll explore together. Think of this as your roadmap to understanding the inner workings of these funds and discovering how they can be a valuable addition to your investment portfolio.

So, let’s embark on this journey together, demystifying the complexities of money market funds and empowering you to make confident investment choices. Get ready to uncover the secrets behind financial success!

What Are Money Market Funds? Navigating the Safe Path

Money Market Funds, often called MMFs, are like financial superheroes – they keep your money safe and ready for action. Think of them as a special savings account where your dollars can earn a bit more muscle. These funds are designed to be safe and low-risk, making them a smart choice for folks who want their money to grow without taking big risks.

So, what sets Money Market Funds apart from the investing crowd? While stocks and bonds are like thrill-seeking roller coasters, MMFs are more like a calm Ferris wheel ride. They invest in short-term, super-safe stuff like government bonds and top-notch loans, making them steady and dependable.

Investing in Money Market Funds is like having a financial sidekick that helps your money grow steadily without wild ups and downs. It’s a friendly and secure way to make your money work for you.

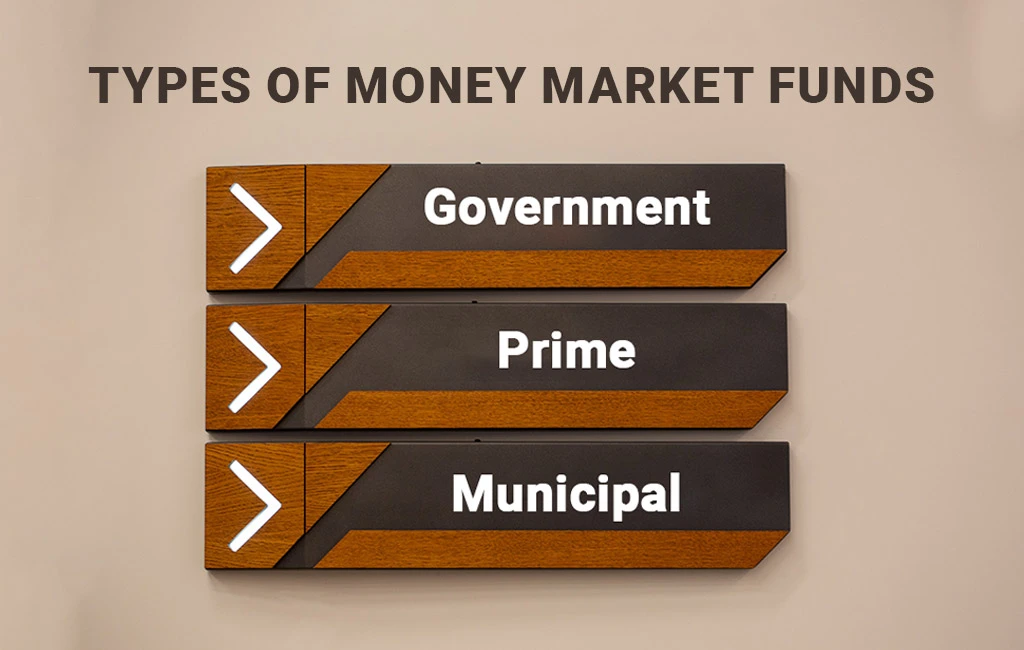

Types: Government, Prime, and Municipal Money Market Funds

Money market funds come in three distinct types, each playing a unique role in the financial arena: Government, Prime, and Municipal Money Market Funds. Think of them as specialized squads with specific strengths tailored to different needs.

First up, we have Government Money Market Funds. These are like the stalwart defenders of your financial castle, investing primarily in government-issued securities. They offer stability and low risk, making them a reliable choice for risk-averse investors.

Next, meet Prime Money Market Funds—the versatile all-rounders. These funds cast a wider net by investing in a variety of short-term, high-quality instruments from different sectors. They balance risk and return, providing a middle ground suitable for many investors.

Lastly, there are Municipal Money Market Funds—the local heroes. These funds focus on short-term debt securities issued by municipalities. They’re like the neighborhood champions, offering tax benefits for certain investors while supporting community projects.

This guide breaks down the intricacies of each money market fund type, making complex concepts easy to grasp. Consider it your map for navigating the diverse landscape of financial options, empowering you to make well-informed investment decisions.

How Do Money Market Funds Work?

Money market funds work by pooling money from multiple investors to invest in short-term, low-risk financial instruments. These funds aim to provide a safe and liquid option for investors while generating a modest level of income.

Here’s a step-by-step breakdown of how money market funds operate:

- Investor Contributions: Individuals invest their money into a money market fund, becoming shareholders. The fund aggregates these investments to create a larger pool of capital.

- Fund Manager’s Role: A professional fund manager oversees the money market fund. Their responsibility is to invest the pooled funds in a diversified portfolio of short-term securities, such as Treasury bills, certificates of deposit, and commercial paper.

- Income Generation: The fund earns interest income from the securities it holds. This income is generated from the interest payments on the underlying investments.

- Distribution of Returns: Periodically, the money market fund distributes the earned income among its shareholders. This distribution is typically in the form of dividends.

- Stability and Safety: Money market funds prioritize stability and safety by investing in low-risk instruments with short maturities. This approach helps minimize the impact of market fluctuations.

- Liquidity: Money market funds offer high liquidity, allowing investors to buy or sell shares at the current net asset value (NAV). This liquidity makes them suitable for short-term cash management needs.

- NAV Maintenance: The net asset value (NAV) of the money market fund is calculated by dividing the total value of its assets by the number of shares outstanding. The NAV aims to remain constant at $1 per share, reflecting the stability of the fund.

Overall, money market funds provide a straightforward and accessible way for investors to earn a reasonable return on their cash while maintaining a high level of safety and liquidity.

Are Money Market Funds Safe?

Safety first, right? Discover why money market funds are considered a safe bet among investments. We’ll spill the beans on regulations and the magic of diversification, the safety nets that make these funds as secure as Fort Knox. It’s like having a financial guardian angel watching over your money.

Money market funds aren’t just another jargon-filled financial concept. With this easy-to-follow guide, you’ll unravel the mechanisms behind them and gain insights into smart investment strategies.

Pros of Money Market Funds:

- Safety: Money market funds invest in low-risk, short-term securities, providing a relatively safe investment option compared to riskier assets.

- Liquidity: These funds offer high liquidity, allowing investors to easily buy or sell shares, making them suitable for short-term cash needs.

- Stability: The focus on low-risk instruments and short maturities helps maintain a stable net asset value (NAV), usually around $1 per share.

- Income Generation: Money market funds provide a source of income through interest earned on the underlying securities, offering a modest return on investment.

- Diversification: Funds often diversify their investments across various issuers and instruments, reducing the impact of a default by any single issuer.

- Professional Management: Fund managers handle investment decisions, leveraging their expertise to navigate the money market and optimize returns for investors.

Cons of Money Market Funds:

- Low Returns: While money market funds offer stability, they typically provide lower returns compared to riskier investments like stocks. This may not keep pace with inflation over the long term.

- Interest Rate Risk: Changes in interest rates can impact the returns of money market funds. When rates are low, returns may be modest, and when rates rise, the existing securities may decline in value.

- Not FDIC Insured: Unlike bank savings accounts, money market funds are not insured by the Federal Deposit Insurance Corporation (FDIC), which means there is a slight element of risk involved.

- Market Fluctuations: While money market funds aim to maintain a stable NAV, there is still a possibility of slight fluctuations due to changes in market conditions.

- Fees: Some money market funds may have management fees or other expenses that can reduce overall returns for investors.

- Tax Considerations: Depending on the type of money market fund, investors may be subject to taxes on their earnings. Municipal money market funds, however, may offer tax advantages.

Investors should carefully consider their financial goals and risk tolerance before choosing money market funds as an investment option. While they provide safety and liquidity, the trade-off is often lower returns compared to riskier investments.

Is a Money Market Account the Same as a Money Market Fund?

No, a Money Market Account and a Money Market Fund are not the same, but they share similarities. A Money Market Account is like a savings account offered by banks, letting you earn interest on your deposits. It’s safe and insured by the government.

On the other hand, a Money Market Fund is an investment option, usually managed by financial companies. It pools money from many investors to buy short-term, low-risk securities like government bonds and certificates of deposit. While both aim for stability, Money Market Funds can have slightly higher returns, but they are not guaranteed.

A Money Market Account is a safe savings option in a bank, while a Money Market Fund is an investment choice with a bit more risk, potentially offering slightly higher returns. It’s essential to understand your goals and risk tolerance when deciding between them.

Money Market Funds Vs. Mutual Funds:

1. Investment Objectives:

- Money Market Funds: These funds focus on short-term, low-risk securities such as Treasury bills and commercial paper. They aim to provide stability, liquidity, and modest returns.

- Mutual Funds: Mutual funds can have various investment objectives, including stocks, bonds, or a mix of both. They come in different types, such as equity funds, bond funds, or balanced funds, catering to different risk profiles.

2. Risk and Return:

- Money Market Funds: These funds are designed to be low-risk, offering stable but relatively lower returns compared to other investments. They are suitable for conservative investors.

- Mutual Funds: The risk and return profile of mutual funds can vary widely based on their underlying assets. Equity funds may offer higher returns but come with higher volatility, while bond funds provide income with less risk compared to stocks.

3. Asset Classes:

- Money Market Funds: Primarily invest in short-term debt securities with high credit quality, emphasizing capital preservation and liquidity.

- Mutual Funds: Can invest in a diverse range of asset classes, including stocks, bonds, and money market instruments, allowing for a broader investment approach.

4. Return Structure:

- Money Market Funds: Generate returns through interest payments on the short-term securities they hold. Returns are typically distributed to investors in the form of dividends.

- Mutual Funds: Returns come from capital appreciation (increase in the fund’s share price) and income generated by the underlying assets. Dividends and capital gains may be distributed to investors.

5. Diversification:

- Money Market Funds: Offer diversification by investing in a variety of short-term instruments, but the scope is limited to low-risk securities.

- Mutual Funds: Provide broader diversification by investing across different sectors, industries, and geographic regions, potentially reducing overall portfolio risk.

6. Investor Suitability:

- Money Market Funds: Suited for investors seeking stability, preservation of capital, and easy access to funds. Common for short-term cash management needs.

- Mutual Funds: Cater to a range of investors with different risk appetites and investment goals. Suitable for those looking for long-term capital appreciation or income generation.

While money market funds and mutual funds share some similarities, their key differences lie in their investment objectives, risk profiles, and the types of assets they hold. Money market funds are a subset of mutual funds, each serving distinct purposes in the broader investment landscape.

How Does a Money Market Fund Compare to a Bank Deposit?

Have you ever wondered about the differences between stashing your cash in a money market fund or a traditional bank deposit? Let’s break it down in plain English.

Returns:

Money market funds and bank deposits are like two different flavors of ice cream. Money market funds offer a chance for slightly higher returns, like getting a scoop of double chocolate fudge instead of plain vanilla. However, bank deposits, the vanilla option, are safer but might not give you as much in return.

Accessibility:

Think of your money as a car. With a money market fund, your cash has a GPS, and you can access it more easily. Bank deposits are like parking your money in a garage – safe and sound, but it takes a bit longer to pull it out.

Risk:

Money market funds and bank deposits both keep your money from falling, but just like a seesaw, the seesaw tilts a bit more with a money market fund. Bank deposits, on the other hand, keep things more level but with fewer thrills.

In a nutshell, it’s about the flavor you prefer, the ease of reaching your cash, and how much excitement you want on your financial seesaw. So, which financial treat suits your taste?

Final Words

In wrapping up, consider giving money market funds a chance in your investment journey—they’re like a safe and cozy corner for your money to grow. So, how do money market funds work? These funds are beginner-friendly, offering stability and a steady income through low-risk investments. Think of it like planting seeds in a well-protected garden; your money grows with care and safety.

If you’ve got more questions or thoughts buzzing around your mind like curious bees, don’t hesitate to ask! Finance might seem like a big, complex forest, but we’re here to help you navigate it. Whether it’s about money market funds or anything else finance-related, let’s keep the conversation going.

FAQs

How do money market funds make money?

Money market funds make money primarily through interest earned on short-term, low-risk investments like Treasury bills and certificates of deposit. These funds pool money from many investors, and the interest generated is then distributed among them. The interest rates, set by market conditions, play a crucial role in determining the overall returns.

Do money market funds pay daily?

No, money market funds typically don’t pay daily. Instead, they distribute returns periodically, usually monthly or quarterly. This ensures a smooth flow of income for investors without daily fluctuations. The payout frequency provides a steady stream of earnings while maintaining the stability of the fund.

What is an example of a money market fund?

An example of a money market fund is the Vanguard Prime Money Market Fund. It invests in short-term, high-quality securities, aiming to preserve the invested capital and provide modest returns. Investors appreciate its stability and liquidity, making it a popular choice.

What is another name for a money market fund?

Money market funds are also known as “money market mutual funds” or simply “money funds.” These terms are used interchangeably in the financial world. They refer to funds that invest in short-term, low-risk instruments, offering a safe and accessible option for investors.